They call it the ‘Total Market.’ A quaint euphemism for a meticulously constructed pyramid scheme, if you ask me. Thirty-four hundred and ninety-eight companies listed on these American exchanges, a teeming anthill of ambition and delusion. But look closer. Sixty-five firms—just sixty-five—hoard seventy percent of the value. A concentration of wealth so obscene, even Behemoth would blush. And within that gilded cage, a handful of names chime with particular insistence: Nvidia, Apple, Microsoft, Alphabet. The usual suspects. They’ve convinced the masses that progress is measured in quarterly earnings, and the masses, predictably, have obliged.

These four, these titans of silicon and algorithms, represent nearly fifteen trillion dollars of perceived worth. A sum that could, with a modicum of sense, alleviate a great deal of suffering. Instead, it fuels the relentless pursuit of… what, exactly? More efficient advertising? More convincing simulations of reality? It’s enough to make one long for the simple days of alchemy.

Enter the Vanguard Mega Cap Growth ETF. A fund, ostensibly designed to ‘track’ this concentrated madness. A clever device, really. It allows the sheep to participate in the fleecing without the inconvenience of actually choosing which shears to offer. It’s a comforting illusion of diversification, built on a foundation of spectacular, and increasingly fragile, hubris.

America’s Best Growth Stocks Packed Into One ETF (Or, A Carefully Constructed Bubble)

Artificial Intelligence. The current obsession. They claim it will revolutionize everything. Boost productivity. Unlock new revenue streams. I suspect it will mostly unlock new ways to manipulate desires and exacerbate inequalities. But the market, as always, cares little for such philosophical musings. Nvidia, with its gleaming GPUs, is hailed as the messiah of this new age. Apple, stuffing AI into every overpriced gadget, is the eager acolyte. Microsoft, ever the pragmatist, is simply trying to sell shovels in the digital gold rush. And Alphabet, well, Alphabet is already so vast, so all-knowing, it hardly needs AI to tighten its grip on the world’s information.

- Nvidia’s GPUs are, admittedly, impressive. The digital equivalent of a finely crafted torture device. Perfect for rendering fantasies and extracting data.

- Apple’s devices, brimming with ‘intelligence,’ will undoubtedly tell you what to think, what to buy, and what to believe. A modern panopticon, conveniently packaged in rose gold.

- Microsoft’s Copilot, an AI assistant embedded in everything, will ensure that no task is completed without a subtle nudge towards a Microsoft product.

- Alphabet’s Google Search, now infused with AI, will curate your reality with unnerving precision. A benevolent dictator of information, if such a thing is possible.

As of January, these four accounted for 45.3% of the Vanguard ETF’s holdings. A precarious concentration. It’s like building a house of cards on the back of a single, rather agitated, rhinoceros.

| Stock | Vanguard ETF Portfolio Weighting |

|---|---|

| 1. Nvidia | 13.51% |

| 2. Apple | 11.71% |

| 3. Alphabet | 10.48% |

| 4. Microsoft | 9.60% |

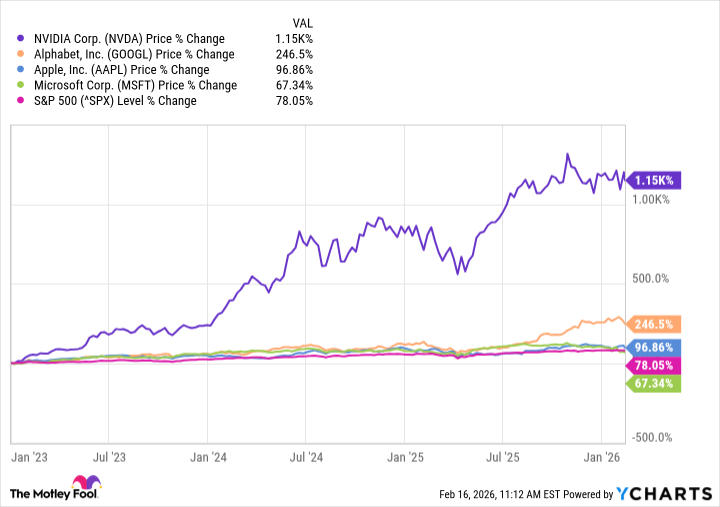

The S&P 500 has climbed a respectable 78% since this AI frenzy began. Nvidia, however, has rocketed a staggering 1,150%. A parabolic ascent. A clear sign that reason has abandoned the building. The other three haven’t fared badly either, though Microsoft lags, a temporary lull before the inevitable surge. I suspect the inevitable will arrive sooner than most anticipate.

Meta, Amazon, Tesla, Broadcom, Palantir… the usual suspects continue to populate this digital menagerie. Each vying for a piece of the AI pie, each convinced of its own unique destiny.

The Vanguard ETF Can Supercharge a Diversified Portfolio (Or, A Calculated Gamble)

A 13.6% compound annual return since 2007. 18.8% over the last decade. Impressive numbers, certainly. But remember, past performance is no guarantee of future results. Especially when the foundation is built on hype and speculation. This ETF is not a safe haven. It’s a high-wire act. A thrilling, potentially lucrative, but ultimately precarious endeavor.

Don’t park all your money here. That would be… unwise. Instead, consider it a small, carefully calculated gamble. A way to participate in the madness without risking everything. A dash of spice in an otherwise bland portfolio.

Ten years ago, ten thousand dollars in the Vanguard Total World Stock ETF would have yielded $33,349 today. Not bad. But split that investment – $5,000 in the diversified ETF, $5,000 in the Vanguard Mega Cap Growth ETF – and you’d be sitting on $44,672. A substantial difference. A testament to the power of concentrated risk. Or, perhaps, a cautionary tale about the allure of easy money.

It allows you to benefit from the potential growth of Nvidia, Apple, Microsoft, and Alphabet, while mitigating the risk with a degree of diversification. A delicate balance. A tightrope walk over the abyss. And as anyone who has ever stared into the abyss knows, the abyss tends to stare back.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

2026-02-19 09:42