The banks had a run. A decent little surge while the tech kids were busy chasing rainbows and artificial dreams. Money has a way of looking for a quiet corner when the noise gets too loud. It flowed into financials, the sector everyone thought had already seen its best days. A classic case of everyone looking the same direction when the smart money was already gone.

But even within that little rally, things got messy. The small and mid-sized banks outpaced the big boys. The giants, the ones supposedly too big to fail, lagged. The iShares U.S. Financials ETF (IYF +0.77%) tells the story – down 3% this year, despite the broader sector showing some life. It’s like watching a heavyweight boxer slow down in the later rounds.

So, the question is, are the financials still a value play heading into 2026? It’s a question that smells of desperation, frankly. Like asking if a chipped glass is still worth drinking from.

A History of Disappointment

The banks have been tagged as “value” stocks since the last big mess. Since 2008, really. But “value” is a word people use when they’re trying to justify a lack of growth. The sector has consistently underperformed. The Silicon Valley Bank thing in ’23 gave the big boys a temporary edge. Fear is a powerful motivator. Money rushed into the names everyone thought were safe. Like running into a burning building because it’s slightly less flammable than the one next door.

They also got a boost from the usual suspects – market rotation, a slightly steeper yield curve, and a little help from the politicians who always seem to know which way the wind is blowing. Berkshire Hathaway, JPMorgan Chase, Bank of America, Goldman Sachs, and Wells Fargo – they account for a hefty 35% of the IYF. A little too much concentration for my taste. It’s like putting all your eggs in a basket made of hope.

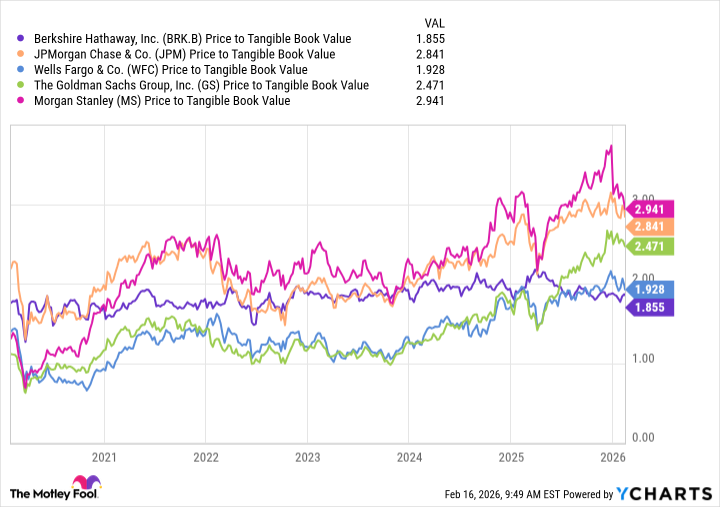

Here’s where we get down to brass tacks – valuations. Price-to-tangible-book-value. It’s a way of figuring out what you’re actually getting for your money. A glimpse under the hood, so to speak.

There was a recent pullback, sure. But “cheap” is relative. Morgan Stanley and Goldman Sachs benefited from the IPO boom, naturally. Easy money. But the party doesn’t last forever. It rarely does.

Lower interest rates help, of course. Makes the yield curve steeper, which is good for banks. They borrow short, lend long. It’s a simple equation. But it relies on things staying…stable. And stability is a rare commodity these days.

Credit quality has held up, surprisingly. Some folks think the good times will roll on. Others are bracing for a fall. I tend to listen to the ones who expect trouble. They usually have a better grasp of reality.

Is this a good time to buy banks? Depends who you ask. Some see a new cycle starting. A rerating. Others see a top. A chance to cash out. I’m leaning towards the latter, at least for the big names in the IYF. They’re not screaming buys. Not yet. They’re more like… tired horses.

There’s still opportunity in the small- to mid-cap space. They’ve done well recently, but there are pockets of value to be found. You just have to dig a little deeper. Look past the headlines. Find the companies that are actually building something. It’s harder work, but the rewards are usually greater.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-19 01:43