The past six months have proven a trying period for those invested in the affairs of Netflix. As of this present writing, the company’s shares have experienced a decline of some forty-three percent from their former, elevated position. A circumstance, it must be confessed, which has stirred a considerable degree of agitation amongst the more excitable members of the investing public.

The source of this disquiet appears to lie in speculation concerning a potential acquisition – namely, the considerable assets of Warner Bros. Discovery. One observes, with a degree of amusement, the prevailing panic regarding the financing of such a venture, and the integration of its contents. It is a truth universally acknowledged that a company in possession of ample fortune must be in want of further expansion, though whether such ventures are always conducted with the requisite prudence remains a matter for consideration.

Beyond Mere Numbers: A More Discerning View of Netflix

The majority of investors, it seems, fixate upon the simple tally of subscribers. At the close of the last quarter, Netflix boasted three hundred and twenty-five million paid memberships – a respectable increase from the preceding year. While a growing number is undoubtedly pleasing, to rely solely upon such a metric is to demonstrate a lamentable lack of perspicacity.

Over the past two years, Netflix has quietly introduced certain operational refinements which, it appears, have gone largely unnoticed. One must commend their subtle approach; a discreet improvement is always preferable to ostentatious display. The advertising segment, in particular, has flourished, growing by a factor of two and a half since last year, and generating a considerable $1.5 billion in sales. In a mere three years, they have cultivated a revenue stream of no small consequence, complementing their established subscription service.

This, one might observe, offers a degree of insulation against the inevitable fluctuations in subscriber retention, whilst simultaneously affording those of more discerning taste the option of maintaining a premium experience, free from the intrusion of advertisements. A most agreeable arrangement for all parties, provided it is managed with suitable delicacy.

The combination of recurring revenue and a healthy margin on advertising is, naturally, expanding Netflix’s profitability. Management anticipates an operating margin of 31.5% for the coming year, a welcome improvement over the previous figure. Such gains, one hopes, will translate into increased resources for the creation of new content, thereby ensuring a continued supply of entertainments for their clientele.

A Prudent Investment, or a Speculative Venture?

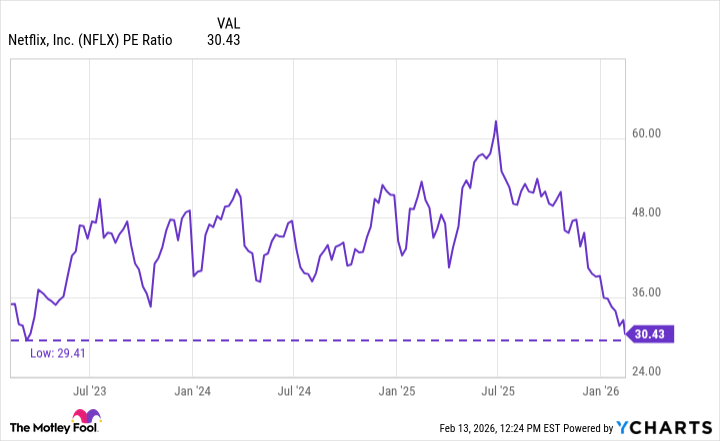

The recent decline in share price has brought Netflix to its lowest valuation in three years, based upon prevailing price-to-earnings multiples. The question now becomes: is this a judicious moment to acquire shares at a reduced price, or are we witnessing the emergence of a value trap? One must confess to a certain skepticism regarding hasty decisions, particularly in matters of finance.

Given the company’s continued growth in subscribers, the expanding advertising segment, and their demonstrated ability to maintain positive economic returns on these endeavours, one perceives little reason to anticipate a significant decline in revenue or earnings. The consensus prediction amongst analysts suggests a potential increase of forty-four percent from current levels – a most encouraging prospect, if one may be permitted a degree of optimism.

The present downturn, it seems, is largely attributable to the uncertainties surrounding the Warner Bros. acquisition. However, if one adopts a broader perspective, Netflix has consistently demonstrated its capacity to navigate the complexities of the media landscape, with or without such additions. For these reasons, one concludes that the present moment offers a favourable opportunity to acquire shares at a rare discount. A prudent course, indeed, for those of a discerning disposition.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Where to Change Hair Color in Where Winds Meet

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-02-18 21:02