One does rather tire of these market corrections, don’t you agree? Spotify, that purveyor of modern melodies and, increasingly, spoken-word diversions, has experienced a bit of a tumble – a forty percent decline, if you’re keeping score. Perfectly dreadful, naturally, but one suspects a touch of overreaction. Last year, you see, was rather good to them – a record haul of users, revenue, and, dare I say, actual profit. It led to a bit of exuberance, a soaring share price, and, inevitably, a subsequent adjustment. The usual tiresome story.

They’re throwing money – substantial sums, I’m told – at all sorts of technological fripperies, most notably this ‘artificial intelligence’ business. And podcasts, of course. And audiobooks. One wonders if they’ll end up simply being a digital variety show, but one supposes variety is the spice of life, and, more importantly, revenue streams. The question, naturally, is whether this little setback presents an opportunity for the discerning investor. Or is it time to simply abandon ship?

Leading the Band (and the Tech)

Spotify, it seems, controls a rather impressive slice of the music streaming pie – around 31.7 percent, if my calculations are correct. Tencent Music trails behind, a distant second at 14.4 percent. The catalogues are much the same on all these platforms, naturally. The competition, therefore, comes down to pricing, new features, and, of course, the aforementioned diversification into podcasts and audiobooks. Spotify, rather cleverly, positions itself as the technological leader. They churned out over fifty new features last year alone, a truly impressive feat of digital tinkering.

Their ‘Prompted Playlist’ tool, powered by this AI business, is particularly amusing. One can simply tell the machine what one wants to hear, setting boundaries and preferences. Rather like a particularly obedient butler, really. The idea, of course, is to keep one glued to the platform for longer, thereby benefiting the artists and, naturally, Spotify itself. A perfectly sensible arrangement, all things considered.

And the podcasts! They’ve been rather successful with video podcasts, rewarding creators with generous incentives. Over half a million have been added, and consumption has soared ninety percent. A rather clever move, boosting engagement and providing a distraction from, say, the rather gloomy state of the world.

Profits, at Last

By the end of last year, Spotify had amassed 751 million monthly active users – an eleven percent increase. 476 million are free, sustained by advertising (a rather meagre source of income, I’m told), and 290 million are paying subscribers, enjoying an ad-free existence. Naturally, the company is rather keen to convert as many of the free users as possible.

Like most tech companies, Spotify spent its early years losing money with admirable abandon. But they’ve finally decided to focus on profits, trimming operating expenses by a modest two percent last year. A sensible decision, wouldn’t you agree? The result? A ninety-four percent increase in annual net income, reaching a record $2.6 billion. One can’t argue with that, can one?

Valuation and the Long View

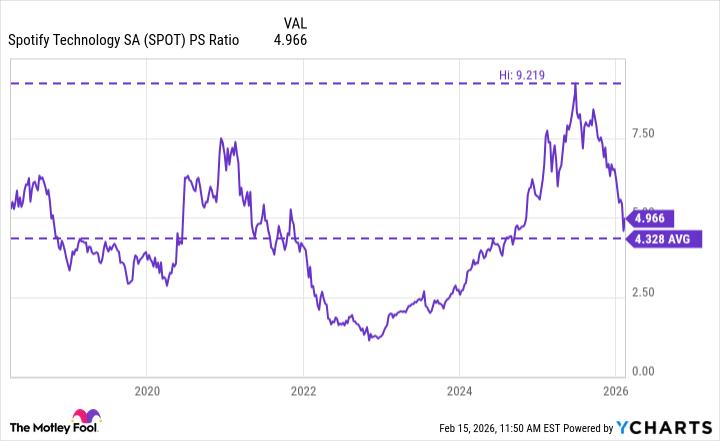

At its peak, Spotify’s price-to-sales ratio reached a rather alarming 9.2 – more than double its average since its public debut in 2018. However, the recent decline has brought it down to 4.9 – still a touch higher than the long-term average, but considerably more reasonable.

Currently, the stock trades at a price-to-earnings ratio of 36.7, a premium to the Nasdaq-100’s 31.7. But given Spotify’s potential, one could argue it’s not excessively expensive. The co-CEO, Alex Norström, believes that Spotify Premium subscribers could climb to ten or even fifteen percent of the world’s population. If he’s right – and one should always be skeptical of CEOs, naturally – the stock could be a bargain at its current price.

Therefore, this little dip might present a buying opportunity for investors with a long-term outlook – five years or more, preferably. One shouldn’t expect overnight riches, of course. But a little patience, combined with a touch of optimism, might just be rewarded. After all, a little musical diversion is always a good thing, even in these trying times.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Where to Change Hair Color in Where Winds Meet

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-02-18 20:15