Right, let’s talk about leveraged ETFs. Or, as I like to call them, spectacularly efficient ways to lose money. Honestly, it’s almost… artistic. It’s like watching a beautifully engineered disaster unfold. You go to a casino, they offer you double the fun, double the pain. Sounds familiar? It should. Because that’s precisely what these things are.

The Math They Don’t Want You To Notice

They call it “volatility decay.” Sounds…technical. Boring, even. Which is, of course, the point. They want you to glaze over. I call it a slow bleed. A drip, drip, drip of your capital into the pockets of people who understand exactly what they’re doing. And you? You’re just… hoping. It’s pathetic, really. But I get it. Hope is a powerful drug.

Let’s play a little game. Day one, the S&P 500 throws a tantrum and drops 10%. Your 2x leveraged ETF? It faceplants 20%. Ouch. You’re already feeling a little sick. But hey, it can recover, right? Day two, the S&P decides to be nice and jumps 11.1%. Your ETF? A glorious 22.2% bounce! You’re back in the game! Except…you’re not. You’re still down around 2.2%. See, the market is playing chess, and you’re trying to win at checkers. It’s not going to end well.

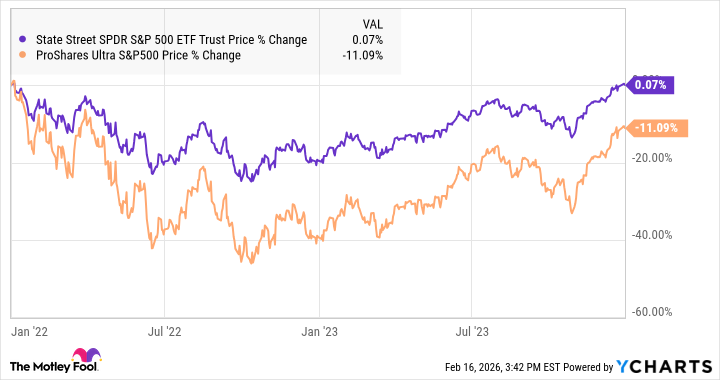

Take 2022, for instance. A truly dreadful year, thanks to inflation and general chaos. The S&P 500 lost almost 20%. The ProShares Ultra fund? A breathtaking 39.3% drop. Then, 2023 happened, and the market decided to be all forgiving and jumped 46.4%. Fantastic! Except the leveraged fund only managed a measly 24.3% recovery. Leaving you staring at a gap that feels… personally insulting.

The Good Times Are Just a Tease

Look, in a straight-up bull market, these things look brilliant. Like you’ve cracked the code. Like you’re a financial genius. It’s a delusion, obviously. Markets don’t move in straight lines. They hiccup, they correct, they overreact to tweets from people who probably shouldn’t have access to a Twitter account. And every little wiggle, every tiny tremor, chips away at your leveraged position. It’s like trying to build a sandcastle during a hurricane.

Honestly, the fund companies are practically admitting it. Read the fine print. They’re designed for day traders, for short-term tactical moves. Hours, maybe days. Not years. They’re specialized tools, not long-term investments. It’s like selling a scalpel to someone and suggesting they use it for gardening. It’s… irresponsible. But profitable for them, naturally.

Boring old index funds? They won’t make you feel like a Wall Street titan. They won’t give you that fleeting rush of adrenaline. But they also won’t leave you weeping into your coffee after a particularly choppy quarter. And sometimes, that’s a perfectly acceptable trade-off. It’s about survival, darling. And in the world of finance, boring is underrated. Trust me.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

2026-02-18 16:52