The air is thick with delusion, folks. The market, bless its naive heart, is STILL clinging to this fantasy of a couple of measly rate cuts this year. Two! As if the Federal Reserve operates on a rational schedule, guided by something other than pure, unadulterated panic. They’re staring into the void, and whistling a happy tune. The numbers, the so-called “data,” are just ghosts in the machine, whispering sweet nothings to the sleepwalkers.

But there’s a rumble on the horizon. A whisper of something… different. David Einhorn, a man who understands the sickness of this system, is betting BIG on a different scenario. He’s saying Warsh, the new Fed chair, is going to unleash a torrent of cuts, a desperate attempt to prop up this crumbling edifice. “Substantially more than two,” he says. Substantially. The man has a sense of the DRAMA.

Don’t Underestimate the New Incoming Fed Chair, Kevin Warsh

Warsh. The name itself sounds like a threat. A cold, calculating operative dispatched to clean up the mess. For months, the sharks were circling, worried Trump would install a puppet, a grinning idiot who’d happily sign whatever madness was put in front of him. The precious metals crowd – the gold bugs, the silver zealots – they were hoarding their trinkets, bracing for the apocalypse. But Trump, in a moment of almost unsettling clarity, tapped Warsh. A Wall Street veteran, a Druckenmiller protégé, a veteran of the Fed’s inner sanctum. A man who’s seen the beast up close.

Einhorn thinks Warsh will prioritize stimulus, even if the economy is “running hot.” Running hot? It’s a raging inferno, my friends, and Warsh is about to throw gasoline on the flames. He’s betting on “productivity,” that mythical unicorn that’s supposed to magically solve all our problems. As if a few extra widgets are going to offset the tidal wave of debt and delusion. He’s loading up on gold and SOFR futures. A man who speaks the language of risk. A man who understands.

But here’s the kicker. Warsh used to be a hawk. A staunch inflation fighter. A man who worried about the price of everything. The numbers are… deceptive. Unemployment is down, sure, but that’s just a statistical illusion. The devil, as they say, is in the details, and the details are screaming.

Can Warsh be a Hawk and Please Trump at the Same Time?

It’s a tightrope walk over a pit of vipers. Trump wants low rates. He wants everything NOW. He doesn’t care about long-term consequences. He only cares about the next headline, the next rally, the next ego boost. Warsh knows this. He’s walking into a minefield, and he’s carrying a very fragile peace offering.

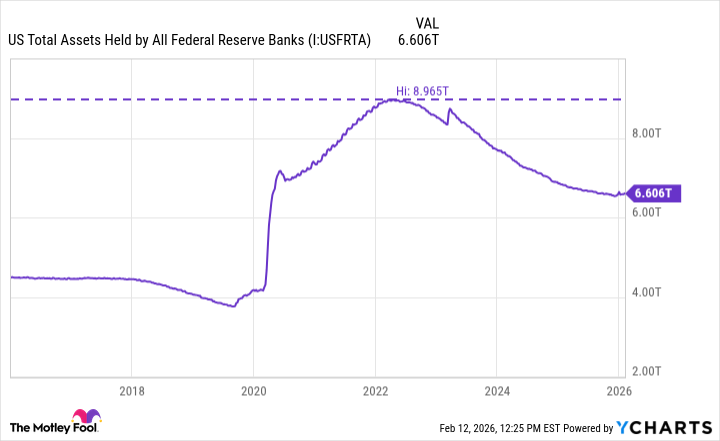

But here’s the twist. Warsh, along with that shadowy figure Scott Bessent, wants to shrink the Fed’s balance sheet. They want to unwind the madness of quantitative easing. They want to drain the swamp. It’s a brilliant, dangerous gambit. Lower rates and a smaller balance sheet? It’s like trying to steer a battleship with a rowboat.

Quantitative tightening (QT) is a beast. It can suck the life out of the economy faster than a vampire at a blood drive. The Fed tried it in 2019, and it almost triggered a meltdown. They had to inject capital just to keep the system from collapsing. They stopped QT recently because things got… hairy.

Forget about interest rates. It’s the balance sheet, folks. That’s where the real power lies. It’s the hidden lever, the secret weapon. Keep your eyes on that monster. It’s the key to everything. This isn’t about economics anymore. It’s about control. It’s about survival. And in this game, there are no rules. Just predators and prey.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- The Best Single-Player Games Released in 2025

2026-02-18 16:33