One does rather tire of the current fuss over artificial intelligence stocks. A little dip, a spot of bother, and everyone throws out the perfectly good baby with the decidedly unhygienic bathwater. Honestly, the market’s dramatics are becoming frightfully predictable.

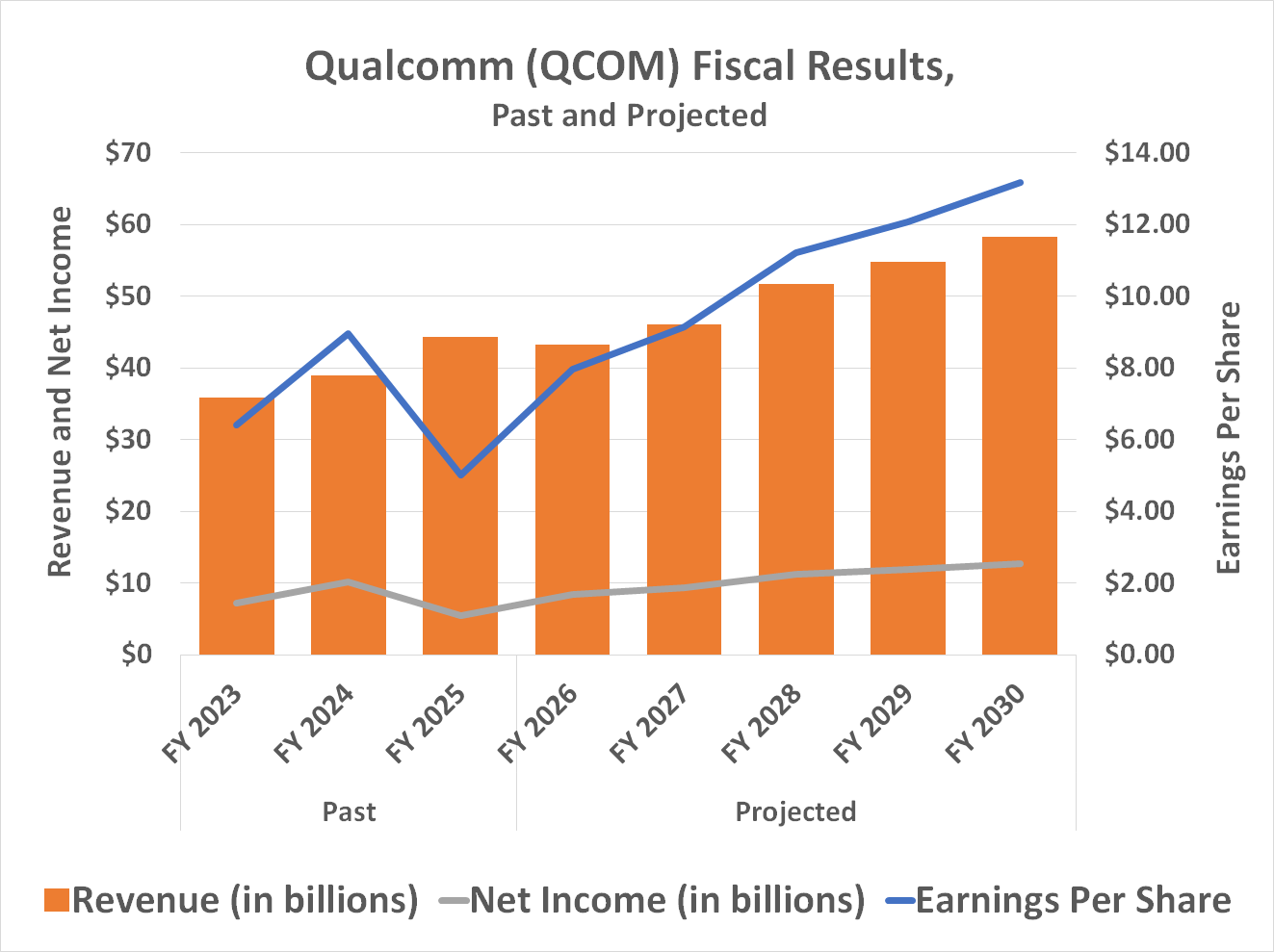

Qualcomm, you see, has been momentarily overlooked, and that, my dears, presents a perfectly amusing opportunity. It’s trading at a discount – a full 23% off its January peak, if you please – which, for a company poised on the brink of… well, let’s call it “advancement,” is rather silly.

Yes, Qualcomm

Naturally, the quarterly results weren’t exactly a triumph. Sales up a mere 5%? Management sounding slightly… subdued? One could hardly call it a roaring success. The market, predictably, has chosen to focus on this rather dreary state of affairs. They’re looking at the present, as usual, and utterly failing to consider the future. A most tiresome habit.

The current shortage of memory chips is, of course, a nuisance. Qualcomm has been rather hampered by it. But honestly, one would think they’d have anticipated such a thing. Still, it’s not as though the company is entirely idle. Quite the contrary, actually.

The real story, you see, isn’t about the present difficulties, but about where Qualcomm is positioning itself. Smartphones are so… last season. The clever chaps at Qualcomm have been quietly infiltrating the laptop, wearable, and – most importantly – the automotive markets. Soon, their processors will be doing more than just playing music. They’ll be driving the cars, darling. Or at least, assisting. One mustn’t be overly dramatic.

As Mr. Amon, Qualcomm’s CEO, so elegantly put it to The Wall Street Journal, 2026 will be the year the potential of “edge computing” truly blossoms. And who, pray tell, is perfectly positioned to capitalize on that blossoming? Qualcomm, naturally. He’s a biased source, of course, but one suspects he’s also rather astute.

The current obsession with massive data centers is, frankly, a bit provincial. As those centers reach their limits, the world will realize that a great deal of processing can – and should – be done elsewhere. On the edge, as Mr. Amon so charmingly puts it. And Qualcomm’s processors are perfectly suited to that task.

By 2027, one anticipates their chips will be gracing even the most sophisticated data centers. Their power efficiency and memory bandwidth are, shall we say, rather compelling. The industry will have no choice but to consider them. And after that? Robotics. Humanoid robots, even. The possibilities are… diverting.

Always Pricing in the Future

The memory shortage remains a bother, naturally. But the market, being the fickle beast that it is, tends to anticipate these things. Investors will sense the easing of the supply issues long before there’s any concrete evidence of it. Analysts, naturally, are already whispering about it.

The truly amusing thing is that most of the bad news is likely already priced into the stock. None of the potential upside, naturally. That’s how the market works, darling. It’s rarely logical, but it’s always entertaining.

So, if one has a spare thousand dollars, and a modicum of patience, Qualcomm presents a perfectly acceptable opportunity. A little dip, a spot of bother, and a potentially rather handsome return. One can hardly ask for more, can one?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- The Best Single-Player Games Released in 2025

2026-02-18 16:22