Author: Denis Avetisyan

New research reveals how automated deleveraging mechanisms in perpetual futures markets can lead to unexpected instability and proposes smoother approaches to mitigate risk.

This paper analyzes autodeleveraging as an online decision problem, focusing on regret minimization and convexity within market microstructure.

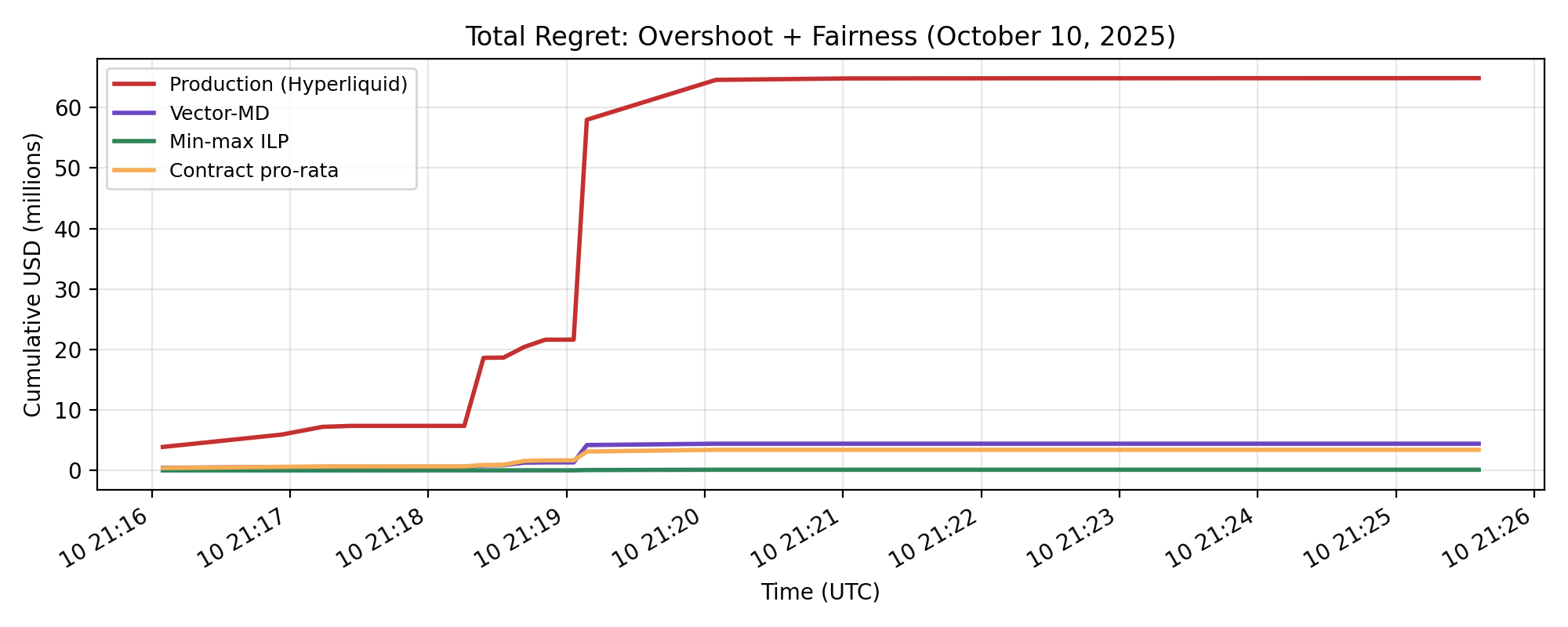

Despite the increasing scale of perpetual futures markets, the automated loss socialization mechanism known as autodeleveraging (ADL) remains largely unstudied as a sequential decision problem. This paper, ‘Autodeleveraging as Online Learning’, formalizes ADL as an online learning problem on a PNL-haircut domain, revealing that current queue-based implementations can exhibit significant instability and regret. Through this framework, we demonstrate that optimized algorithms can substantially reduce overshoot-by up to \$51.7M in a recent market stress episode-and improve solvency recovery. Can these findings inspire more robust and efficient ADL mechanisms for live perpetuals exchanges, ultimately enhancing market stability and minimizing trader losses?

Navigating the Inherent Risks of Perpetual Futures Markets

Perpetual futures exchanges represent a significant evolution in derivative trading, yet their very structure introduces a unique systemic risk: trader insolvency. Unlike traditional futures contracts with predetermined expiry dates, perpetual futures allow positions to remain open indefinitely, amplifying the potential for substantial losses. As traders accumulate leveraged positions, even relatively small adverse price movements can rapidly erode their equity, potentially leading to forced liquidation. This isn’t merely an isolated issue; a cascade of liquidations can create significant price impact, further exacerbating losses for other traders and, critically, threatening the stability of the entire exchange. Effectively managing this insolvency risk requires a proactive and dynamic approach to collateralization and loss redistribution, as standard risk mitigation techniques often prove inadequate in the face of highly volatile market conditions and the inherent leverage characteristic of these innovative financial instruments.

A significant vulnerability within perpetual futures exchanges arises when a trader’s equity diminishes, triggering liquidation events that can profoundly impact market stability. These liquidations aren’t isolated incidents; as positions are forcibly closed, they generate substantial selling pressure, potentially driving down asset prices and initiating a cycle of further liquidations. This phenomenon, known as cascading failure, occurs because subsequent liquidations are triggered by the price drops caused by earlier ones, creating a self-reinforcing downturn. Consequently, exchanges must implement robust risk mitigation strategies – including mechanisms like insurance funds, dynamic circuit breakers, and tiered margin requirements – to absorb losses, prevent runaway price impacts, and maintain the integrity of the market even during periods of extreme volatility. Without such safeguards, a single large insolvency event has the potential to destabilize the entire exchange, jeopardizing the funds of all participants.

Conventional risk management protocols, designed for established financial instruments, frequently falter when confronted with the amplified volatility characteristic of perpetual futures contracts. These systems often rely on reactive measures, such as margin calls and forced liquidations, which can inadvertently increase market stress during downturns. The speed and scale of price movements in these markets can overwhelm static risk limits, triggering a cascade of liquidations that further depresses asset values. Consequently, exchanges are increasingly exploring proactive loss redistribution mechanisms – including insurance funds and dynamic circuit breakers – designed to absorb initial shocks and prevent localized insolvency from escalating into systemic risk. These strategies aim to shift the burden of loss away from individual traders and distribute it across the broader participant base, bolstering market resilience and fostering a more stable trading environment.

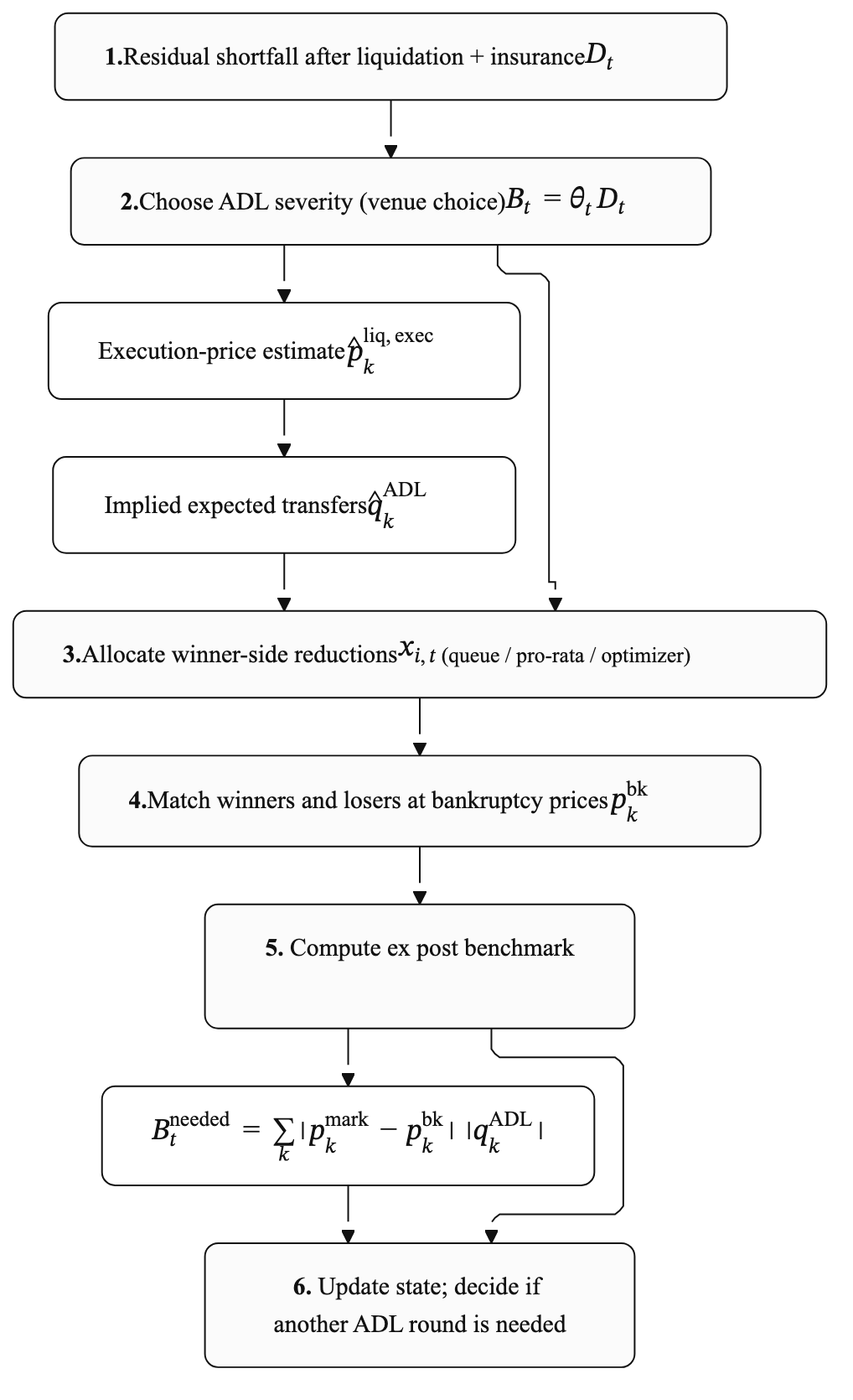

Introducing Automated Redistribution of Loss as a Proactive Safeguard

Autodeleveraging (ADL) is a risk management mechanism designed to automatically redistribute funds within a trading system to address account insolvency. When an account’s equity falls below a required maintenance margin, ADL initiates a transfer of funds from profitable, solvent accounts to cover the losses. This process is executed programmatically, without requiring manual intervention, and operates continuously to maintain system stability. The transferred funds are sourced proportionally from accounts exceeding specified profit thresholds, effectively subsidizing losing positions and preventing immediate liquidation events. This automated redistribution aims to minimize cascading liquidations and associated market impact during periods of high volatility.

Immediate liquidation of insolvent positions, particularly during periods of high volatility, can exacerbate price impact and contribute to systemic risk within a trading system. By minimizing the frequency of these forced liquidations, autodeleveraging aims to maintain market stability. Frequent, large-scale liquidations can create a cascading effect, driving prices further against leveraged positions and potentially triggering additional liquidations. Reducing reliance on immediate liquidation allows the system to absorb losses more gradually, lessening the disruptive impact on asset prices and overall market health. This proactive mitigation of liquidation events contributes to a more resilient and predictable trading environment.

Effective autodeleveraging (ADL) necessitates a nuanced loss allocation strategy. Simply redistributing funds randomly is insufficient; the system must prioritize minimizing disruption to profitable traders while ensuring complete coverage of insolvent accounts. This involves calculating the proportional contribution from winning accounts based on factors such as profit size, risk exposure, and overall portfolio health. Algorithms determine the optimal redistribution amount for each solvent trader, balancing the need to cover losses with the preservation of their capital and ongoing trading activity. A fair and effective allocation minimizes negative impacts on successful traders, maintains market stability, and ensures the continued operation of the system during periods of high volatility or concentrated losses.

Refining ADL Allocation: Methodologies and Strategies

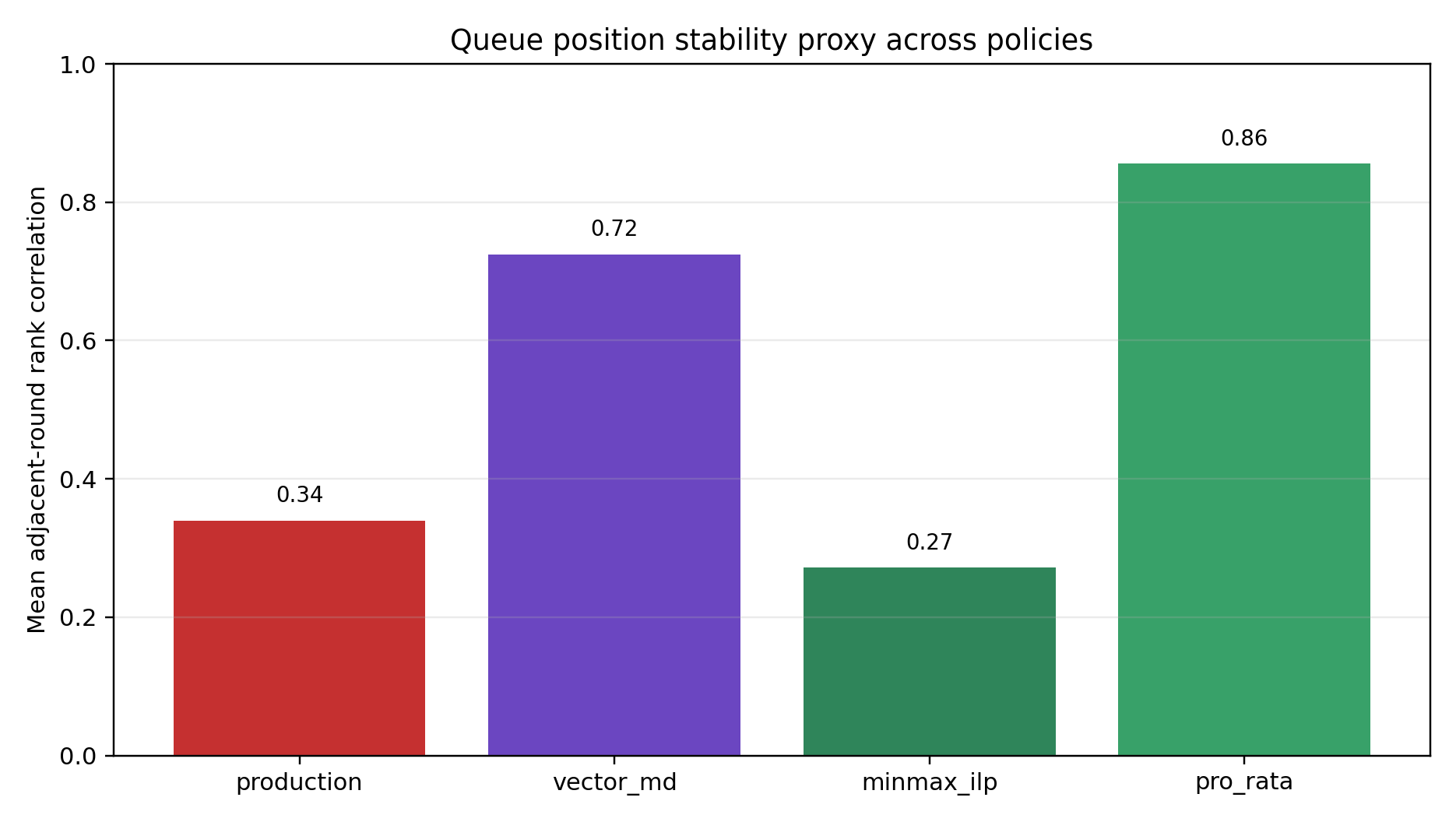

Allocation strategies for Automated Drawdown Losses (ADL) vary in complexity. Pro-Rata Allocation distributes loss amounts based on each account’s percentage of positive Profit and Loss (PNL); an account contributing 20% of total positive PNL would absorb 20% of the ADL. Conversely, the Queue Mechanism ranks accounts based on performance, typically prioritizing those with the highest recent winning streaks or overall PNL. Under this system, accounts are assigned a queue position, and losses are applied sequentially, starting with the lowest-ranked account. The Queue Mechanism introduces a degree of non-proportionality, potentially shielding high-performing accounts at the expense of those with lower rankings, and requires a defined ranking methodology to ensure fairness and transparency.

Integer Linear Programming (ILP) provides a mathematically rigorous approach to Automated Discretionary Logic (ADL) allocation by formulating the distribution problem as an optimization task. The objective function in an ILP model for ADL typically minimizes the total cost associated with transferring funds from solvent to insolvent accounts, considering factors such as transfer fees and potential slippage. Constraints are defined to ensure all insolvent accounts are fully covered, solvent accounts do not exceed their available balance, and allocations adhere to predefined risk parameters. The resulting solution, derived through solving the linear program, identifies the least-costly distribution of funds while satisfying all defined constraints, thereby reducing the financial burden on solvent accounts compared to simpler allocation methods.

Automated Downward Leg (ADL) implementation necessitates market impact assessment to mitigate adverse price movements during allocation. The Linear Impact Model is frequently utilized for this purpose, estimating price change as a linear function of order size: \Delta P = k \cdot V , where \Delta P represents the predicted price impact, V is the volume traded, and k is the impact coefficient reflecting market depth and liquidity. Accurate estimation of k is crucial, often derived from historical data or order book analysis. By integrating these predictions into the allocation algorithm, ADL systems can strategically pace out trades, minimizing price slippage and reducing the overall cost of execution. Furthermore, more complex models may account for order book imbalances and prevailing market volatility to refine impact predictions.

Evaluating the Performance and Stability of ADL Systems

A core challenge in automated delegation of limit orders (ADL) lies in the potential for queue instability, a phenomenon where even minor fluctuations in incoming order flow can trigger disproportionately large shifts in allocation strategies. This sensitivity arises from the sequential nature of many ADL algorithms, where each order impacts the subsequent queue and, consequently, the overall execution. Recognizing this instability is paramount for designing robust ADL systems; algorithms that fail to account for it risk exacerbating market impact and incurring significant losses. Consequently, developers prioritize strategies that dampen these cascading effects, ensuring a more predictable and stable allocation process, even under volatile market conditions. Mitigating queue instability not only enhances the efficiency of ADL but also safeguards against unintended consequences and maintains the integrity of trading operations.

Evaluating the effectiveness of any automated delegation learning (ADL) system necessitates quantifiable metrics that move beyond simple profit calculations. Static and dynamic regret serve as crucial benchmarks, meticulously measuring the cumulative loss incurred by an ADL strategy when compared to a theoretical optimal approach or a consistently adaptive alternative. Static regret assesses performance against a fixed, best-in-hindsight strategy, while dynamic regret offers a more realistic evaluation by comparing against strategies that also evolve over time. These regret metrics don’t simply indicate whether a system is profitable, but how much potential value is lost due to the chosen delegation approach – providing a granular understanding of performance deficiencies and informing iterative improvements to ADL design. By quantifying these losses, researchers and developers gain a clearer picture of an ADL system’s efficiency and its proximity to ideal resource allocation, facilitating more robust and effective trading strategies.

The concept of a ‘Bankruptcy Price’ represents a critical benchmark in automated delegation of liquidity (ADL) systems, defining the point at which a trader’s position would be fully eroded, resulting in zero equity. This threshold isn’t merely a theoretical calculation; it directly informs when ADL intervention is necessary to prevent detrimental outcomes for individual traders. A trader approaching their Bankruptcy Price signals an urgent need for reallocation of liquidity, potentially preventing cascading failures within the system. Understanding and actively monitoring this price allows for proactive risk management, protecting traders from complete loss and fostering a more stable, resilient ADL environment. The sensitivity of the Bankruptcy Price to market fluctuations, and its interplay with various ADL policies, is therefore a crucial factor in evaluating the overall effectiveness and safety of any delegation strategy.

Research detailed in this paper indicates a substantial performance advantage for allocation policies prioritizing smoothness. Specifically, the pro-rata policy – designed to minimize abrupt shifts in resource distribution – achieved a Cumulative Objective Value of $3.40 million. This figure represents the total value generated by the allocation strategy, demonstrating its effectiveness in maximizing overall benefit. The study highlights that smoother policies not only minimize tracking errors – the deviation from an ideal allocation – but also enhance fairness by reducing disparities in resource distribution among participants. These findings suggest that a focus on stability and gradual adjustments is crucial for optimizing allocation outcomes and achieving both economic efficiency and equitable distribution.

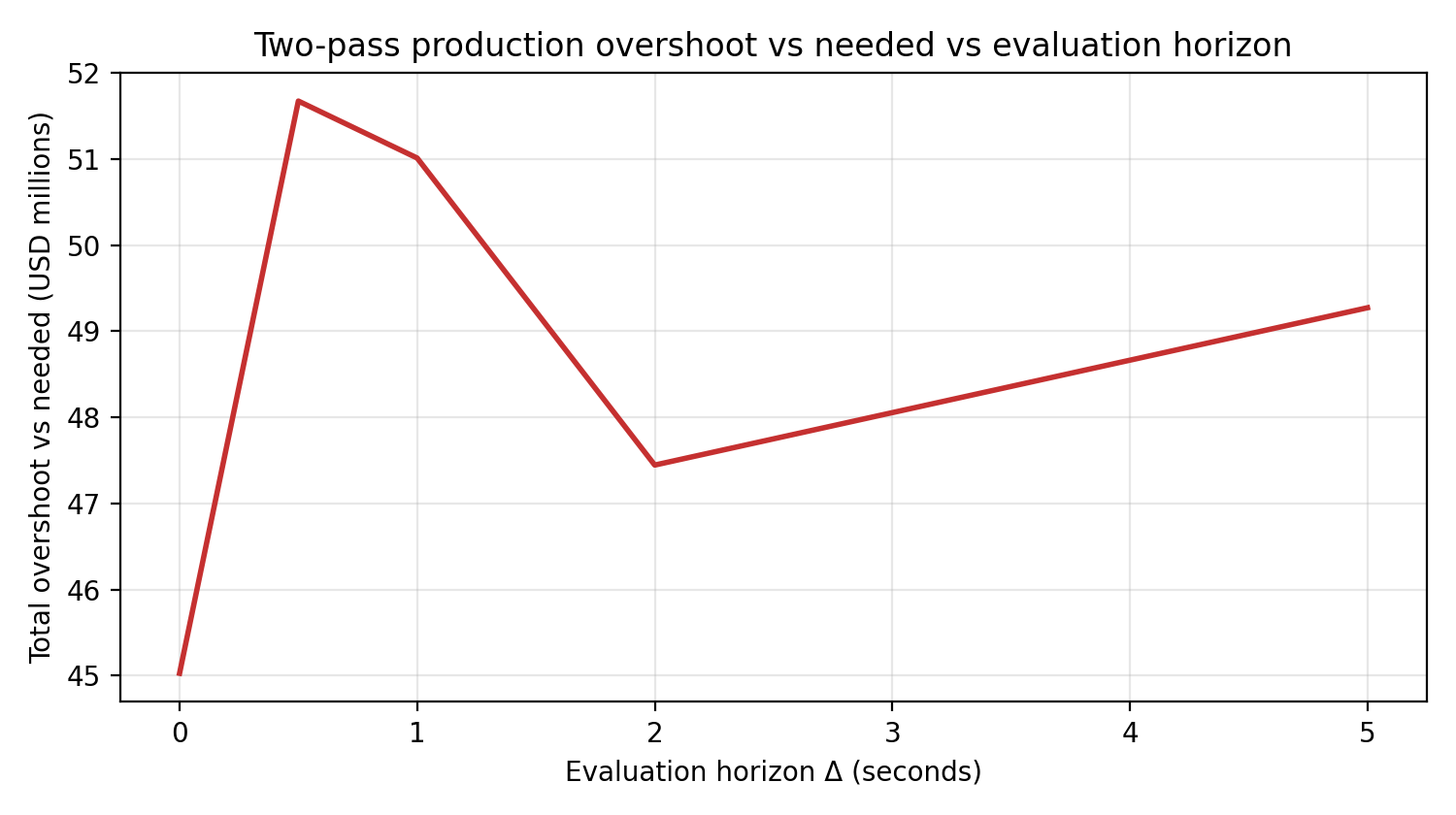

Analysis reveals a clear performance disparity between allocation policies, with queue-based systems demonstrably exhibiting higher regret – a measure of cumulative loss compared to ideal strategies – due to inherent structural instability. This instability translates to amplified sensitivity to even minor input changes, leading to significant shifts in resource allocation and ultimately, reduced overall performance. Conversely, smoother allocation policies consistently achieve lower regret, indicating greater robustness and predictability. The extent of potential overshoot – the degree to which allocations deviate from optimal levels – has been quantified, ranging from $45.0M to $51.7M across various policies and forecasting horizons, underscoring the financial implications of selecting a stable, smoothed approach to resource distribution.

The study of autodeleveraging mechanisms reveals a fascinating interplay between system structure and emergent behavior. Just as a complex organism responds to stimuli, these markets demonstrate how seemingly small adjustments – the queue-based ADL – can propagate instability. This echoes Grace Hopper’s observation: “It’s easier to ask forgiveness than it is to get permission.” The researchers, by proposing smoother alternatives, aren’t simply fixing a broken part, but rather redesigning the systemic response to minimize regret and improve risk management, akin to re-architecting a biological system for greater resilience and predictable function. Understanding the convexity of these markets is crucial, as even slight miscalculations can have exponential consequences, demanding a holistic, structurally-sound approach.

What’s Next?

The framing of autodeleveraging as an online learning problem exposes a fundamental tension: the pursuit of immediate regret minimization, while seemingly rational, can engender systemic instability. The queue-based mechanisms, so prevalent in practice, appear particularly susceptible to this, resembling less a carefully calibrated instrument and more a Rube Goldberg device primed for unintended consequences. Further work must move beyond simply smoothing the observable outputs and address the underlying convexity-or lack thereof-in the decision space itself. Is true stability even achievable within these markets, or are we merely shifting the risk, not reducing it?

A critical, and largely unexplored, avenue lies in the interaction between these automated agents and the human participants who still exert influence. The assumptions of purely rational actors, even within a constrained algorithmic framework, rarely hold. Behavioral biases, herding effects, and the simple unpredictability of human intervention introduce noise that any robust system must account for. A deeper understanding of this interplay-modeling the market not as a collection of algorithms but as a complex adaptive system-is paramount.

Ultimately, the elegance of a market lies not in its complexity, but in its ability to allocate resources efficiently and withstand shocks. The pursuit of ever-finer algorithmic control risks obscuring this fundamental principle. Good architecture is invisible until it breaks, and only then is the true cost of decisions visible.

Original article: https://arxiv.org/pdf/2602.15182.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

2026-02-18 16:09