The ascent of Micron Technology, a name that once whispered of modest memory, has lately become a rather insistent shout. A 250% surge since September – a numerical flourish, wouldn’t you agree? – has propelled its market capitalization beyond the $460 billion mark. A tidy sum, certainly, and one that prompts the inevitable, slightly breathless question: is a trillion-dollar valuation within reach? A mere doubling of the current share price, a feat of arithmetic simplicity, would seemingly accomplish the trick. But simplicity, dear reader, is rarely a reliable guide in the labyrinthine world of finance.

Stock prices, after all, are not reflections of present reality, but shimmering projections of future possibilities – often wildly optimistic, occasionally prescient. To assess whether Micron can truly join the trillion-dollar club, we must dissect the forces driving its current elevation, and, more crucially, determine if those forces possess the stamina for a prolonged climb. The market, you see, is a fickle mistress, easily seduced by novelty, but equally prone to capricious withdrawal of favor.

What’s Behind the Glimmer?

Micron has, quite elegantly, positioned itself as a principal beneficiary of the insatiable appetite for high-bandwidth memory (HBM). These diminutive chips, nestled alongside graphics processing units (GPUs) and AI accelerators, are the very sinews of artificial intelligence training and inference. As the demand for computational power from AI developers intensifies – a demand that feels, at times, less like a need and more like a fever dream – hyperscalers have, predictably, expanded their chip budgets. This, in turn, has created a virtuous (or perhaps vicious, depending on one’s perspective) cycle of demand for Micron’s HBM.

The industry, however, finds itself in the grip of a DRAM shortage – a rather pedestrian term for a rather significant bottleneck. These DRAM chips, the foundational building blocks of HBM, are also essential components in more mundane devices – personal computers, smartphones, the very tools that allow us to obsess over stock prices. The resulting scarcity has allowed Micron to command increasingly premium prices. In the first quarter, the average selling price for DRAM chips increased by a substantial 20%, and gross margins expanded from a respectable 46% to a rather dazzling 57%. Earnings per share, consequently, leaped by a robust 167% to $4.78, while operating cash flow swelled to $8.4 billion. A pleasing spectacle, wouldn’t you agree?

Management anticipates even greater prosperity in 2026, projecting gross margins to reach 68% and earnings per share to climb to $8.42. They also suggest that the supply of memory chips will remain constrained beyond the calendar year. This news, predictably, ignited another surge in Micron’s share price, prompting analysts to revise their earnings forecasts upward. Wall Street now anticipates Micron generating $33.73 per share in 2026 and $43.54 in 2027. Such optimistic projections are, of course, subject to the inherent uncertainties of forecasting the future – a task akin to predicting the trajectory of a hummingbird.

The Illusion of Permanence?

Micron currently trades at approximately 12.2 times analysts’ 2026 earnings expectations and 9.4 times 2027 expectations. Superficially cheap, perhaps, when compared to other AI semiconductor stocks. However, Micron’s business lacks the distinctive, almost baroque, differentiation of its more high-end competitors. Memory chips, alas, are largely commodities. And Micron faces stiff competition from Korean giants SK Hynix and Samsung – neither of whom are content to observe Micron’s ascent with placid indifference.

While all three companies have adopted a cautious stance regarding the duration of elevated demand, they are all actively investing in production capacity. Micron itself plans to spend a staggering $20 billion in capital expenditures for fiscal 2026. This familiar cycle – expansion, scarcity, oversupply – has played out repeatedly in the industry, creating peaks and valleys in Micron’s earnings. The temptation to expand capacity, to meet current demand, is often irresistible. But the inevitable consequence is an oversupply when demand cools, leading to a painful decline in earnings. The cyclical nature of the industry, therefore, explains why Micron’s current earnings are not valued as highly as those of companies with more predictable revenue streams.

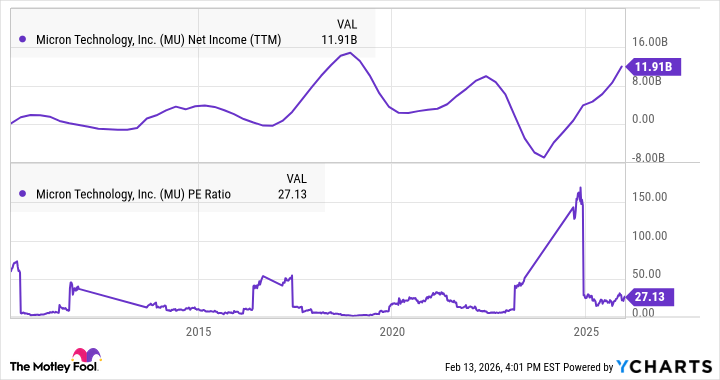

Interestingly, Micron’s current earnings multiple is considerably higher than it has been during previous earnings peaks over the past 15 years. In those instances, the trailing price-to-earnings ratio (P/E) hovered between 3 and 6. Currently, at 9.4 times 2027 earnings, investors are implicitly expecting the pricing tailwinds supporting Micron’s current earnings boost to persist well beyond fiscal 2027. While the fervor surrounding AI demand is undeniably strong, historical demand cycles suggest that Micron’s earnings are unlikely to sustain such elevated levels indefinitely.

Even if this demand cycle extends to the end of the decade, the stock price, at best, appears fairly valued. To reach a $1 trillion valuation, Micron would require an extraordinary outperformance of management guidance and analyst expectations – fueled by an acceleration in demand from its hyperscaler customers. A tall order, wouldn’t you say? A shimmering mirage on the horizon, perhaps. And, like all mirages, best admired from a safe distance.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- The Best Single-Player Games Released in 2025

2026-02-18 16:02