Now, it appears we’ve entered an age where folks are determined to trade in their trusty horses – or, as they’re called nowadays, automobiles powered by good old gasoline – for contraptions run by electricity. A curious notion, to be sure. The newspapers, and those chaps with their stock tickers, have been all abuzz about these ‘electric vehicles’ for a spell. Though, if I may say so, the buzz has been a bit…strained of late. Seems the public isn’t quite rushing to embrace this newfangled technology with the fervor predicted. Cox Automotive, those diligent counters of carriages, report a decent showing in sales last year, mind you, some 1.3 million of these electric buggies sold. But the pace, well, it’s slowed to a trot, not a gallop.

The government, in its infinite wisdom, offered a bit of a sweetener – a tax break to encourage these purchases. But like most good things, it came to an end in October of last year. And wouldn’t you know it, sales took a tumble. A rather substantial tumble, in fact – down nearly half in a single quarter. Seems folks aren’t so eager to spend their hard-earned dollars on something when the government stops lending a hand. By the year’s end, these electric contraptions accounted for only 7.8% of all vehicles sold – a slight dip from the year before. A fella could almost hear the gears grinding on Wall Street.

Now, I’ve always been one to admire a good gamble, but even I must admit, investing in these electric ventures feels a bit like betting on a three-legged horse. Take Rivian, for instance. A company that aims to build fancy carriages – SUVs and trucks, they call ’em – for those with a bit of extra coin. They’re a small player in a market dominated by the likes of Tesla – a company that’s managed to convince a good many folks that the future is now. Rivian’s stock, however, has taken a beating. Lost a good 86% of its value since it first appeared on the market back in 2021. A rather alarming figure, wouldn’t you agree?

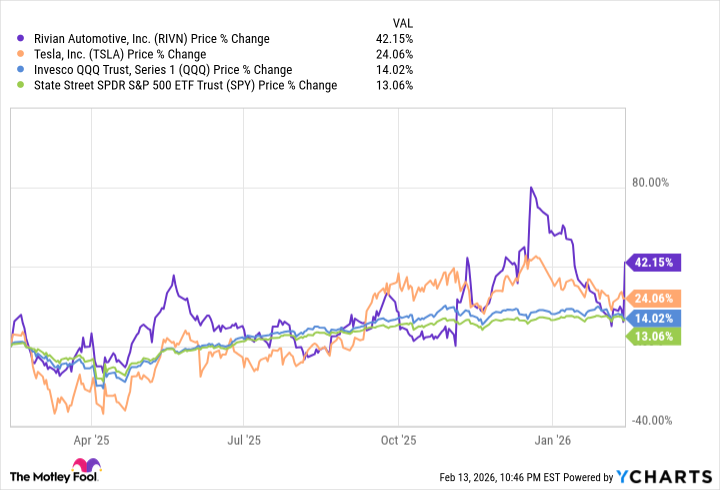

But here’s the curious part. Despite all this, Rivian’s share price has been showing a bit of pluck. Outperforming Tesla, the Nasdaq-100, and even the venerable S&P 500 over the past year. A bit like a scrawny underdog winning a prize fight. And their recent earnings report gave the stock a further boost. Shares jumped a good 26% after the announcement. Seems some folks still believe in the prospect of an electric recovery, and Rivian, for the moment, is their chosen steed.

A Forecast of Deliveries

Rivian is forecasting a rather ambitious increase in deliveries for the coming year – somewhere between 62,000 and 67,000 vehicles. That would represent a jump of nearly 60% from the 42,247 they delivered last year. A bold claim, to be sure, and one that will require a good deal of luck and skillful management. They also report a decent increase in revenue and a substantial improvement in their gross profits. Though, their automotive revenue did dip a bit. But they’ve found a surprising source of income – software and services, thanks to a partnership with Volkswagen. A curious alliance, to be sure, but one that seems to be paying off.

A Carriage for the Common Man?

Now, Rivian’s current offerings aren’t exactly cheap. Their R1T truck and R1S SUV start at around $73,000 and $77,000 respectively. Prices that would make a railroad baron blush. But they’re planning to launch a more affordable model, the R2, next month. They’re promising over 650 horsepower and a range of over 300 miles. And early reviews are reportedly quite positive. A carriage for the common man, perhaps? Or at least, for those with a slightly less bulging pocketbook.

Of course, Rivian still faces significant risks. The cost of doing business is high, and they’re forecasting a loss of nearly $2 billion this year. But they may have finally turned a corner. Especially if the R2 lives up to the hype. It’s a gamble, to be sure, but one that could pay off handsomely. If you’re looking to invest in a high-potential electric vehicle company with a compelling story, Rivian might just be worth a closer look. Though, I always say, a man is best served by a diversified portfolio. Don’t put all your eggs in one electric basket, no matter how shiny it may be.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- The Best Single-Player Games Released in 2025

2026-02-18 15:52