Right. So, commodities. Honestly, it’s all a bit… much. One minute it’s silver, the next it’s something else. Apparently, even relatively small shifts in supply and demand can send prices soaring. It’s like everyone suddenly decides they need a shiny thing. And silver, it turns out, has been having a moment. A rather prolonged moment, actually. I’ve been watching the charts (too much, probably) and it seems this isn’t just about jewellery and fancy silverware, which, let’s be honest, feels a bit… 19th century. It’s more complicated than that. It’s about data centres. And Nvidia. Which, of course, adds another layer of… everything.

The Silver Situation (a quick inventory)

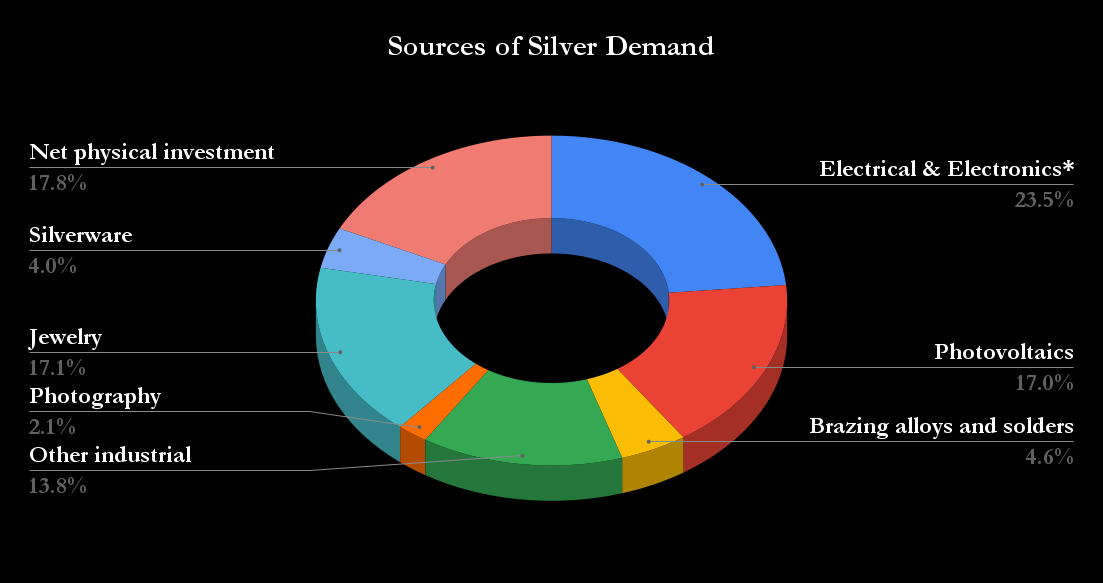

Apparently, industrial demand – particularly from those solar panel things (photovoltaic cells, they’re called) – is the really important bit. Who knew? Here’s a breakdown, in case you’re keeping score (I am. I have a spreadsheet. It’s colour-coded):

The Silver Institute (they exist! I checked) is predicting a slight dip in demand next year, which feels… sensible. Supply is supposed to increase, which usually means prices go down. But, and this is the crucial bit, they still think there won’t be enough silver to go around. Which, logically, is… bullish. Or something. I’m still trying to decode all the financial jargon.

Nvidia & the Inevitable Need for Shiny Metal

Okay, so Nvidia. The tech company. Apparently, they’re building these new data centres. 800V high-voltage direct current data centres. Honestly, it sounds like something out of a science fiction film. But apparently, it’s real. And it needs silver. Lots of it. It’s all about efficiency and lower maintenance costs, and silver, it turns out, conducts heat better than copper at high voltages. Who knew metal had preferences? It’s like choosing between cashmere and polyester.

Data centres already use silver, but these new ones are going to be even more… silver-intensive. And given that everyone is desperate for artificial intelligence (AI) – seriously, it’s everywhere – the demand for silver in these data centres is likely to be, as the economists say, “price-inelastic.” Which means that even if the price of silver goes up, people will still buy it. Because AI. It’s a bit terrifying, actually. It’s like everyone is addicted to something, and silver is the enabler.

Where does this leave us? (A personal inventory)

Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24. And yet, I persist. It’s important to be balanced, apparently. Investment (people actually buying silver) plays a huge role. It grew last year, while demand for jewellery and silverware flatlined. People are clearly hedging their bets. Or just really like shiny things. Who am I to judge?

So, there’s likely to be a correction in silver prices. It’s happening now, actually. But the fundamentals – solar panels, electric cars, and now, these AI-powered data centres – are still positive. And with Nvidia driving demand for silver in these new data centres, I’m inclined to buy the dip. It feels… risky. But also, potentially, rewarding. Or at least, a distraction from the general chaos of everything.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- The Best Single-Player Games Released in 2025

2026-02-18 07:12