Celebrity insurance isn’t just about health or life; it often covers valuable physical attributes essential to their careers. Because a star’s income relies on things like their voice or legs, they need significant financial protection. Lloyd’s of London often provides this specialized, and costly, coverage. These policies are essentially a business move to protect against potential earnings loss due to injury or the natural effects of aging on a performer’s career.

Mariah Carey

I was amazed to read that Mariah Carey supposedly insured her legs for a billion dollars! It all started when she did that Gillette campaign, “Legs of a Goddess,” and they wanted to protect her image while she was promoting the brand around the world. And it doesn’t stop there – I also heard she has a $35 million policy on her voice, which makes total sense considering it’s how she earns a living. It really shows how valuable she is as one of the biggest-selling female artists ever. Apparently, this kind of extreme insurance is pretty common for performers whose careers depend on their looks or talents.

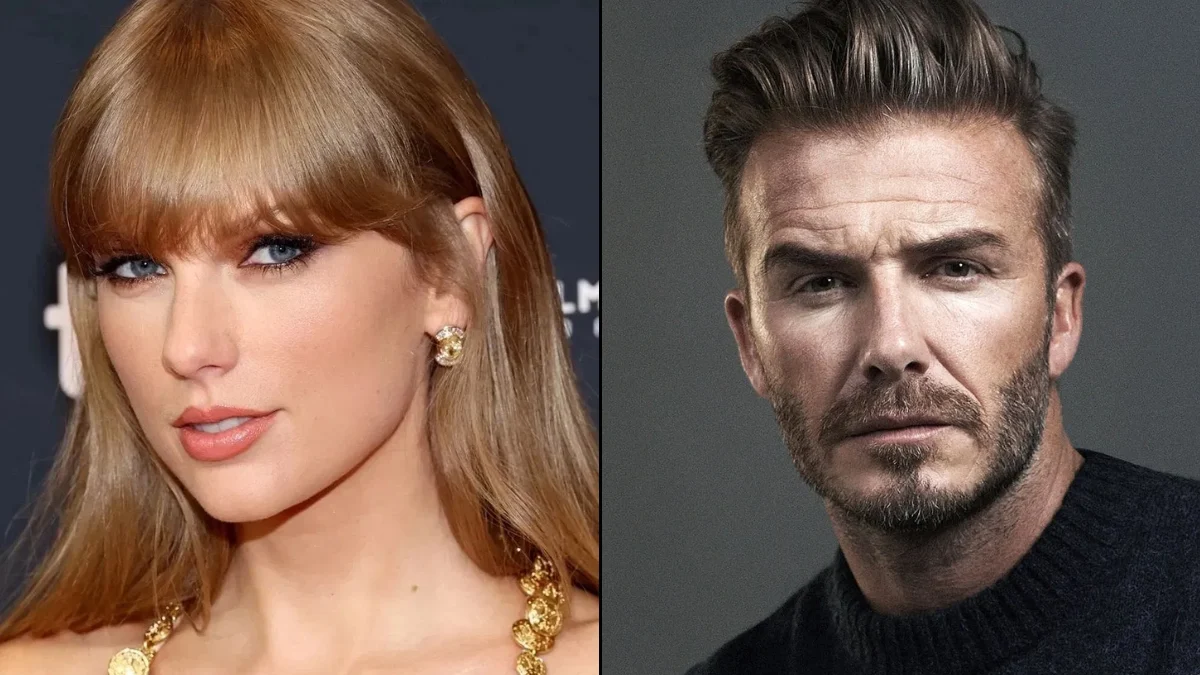

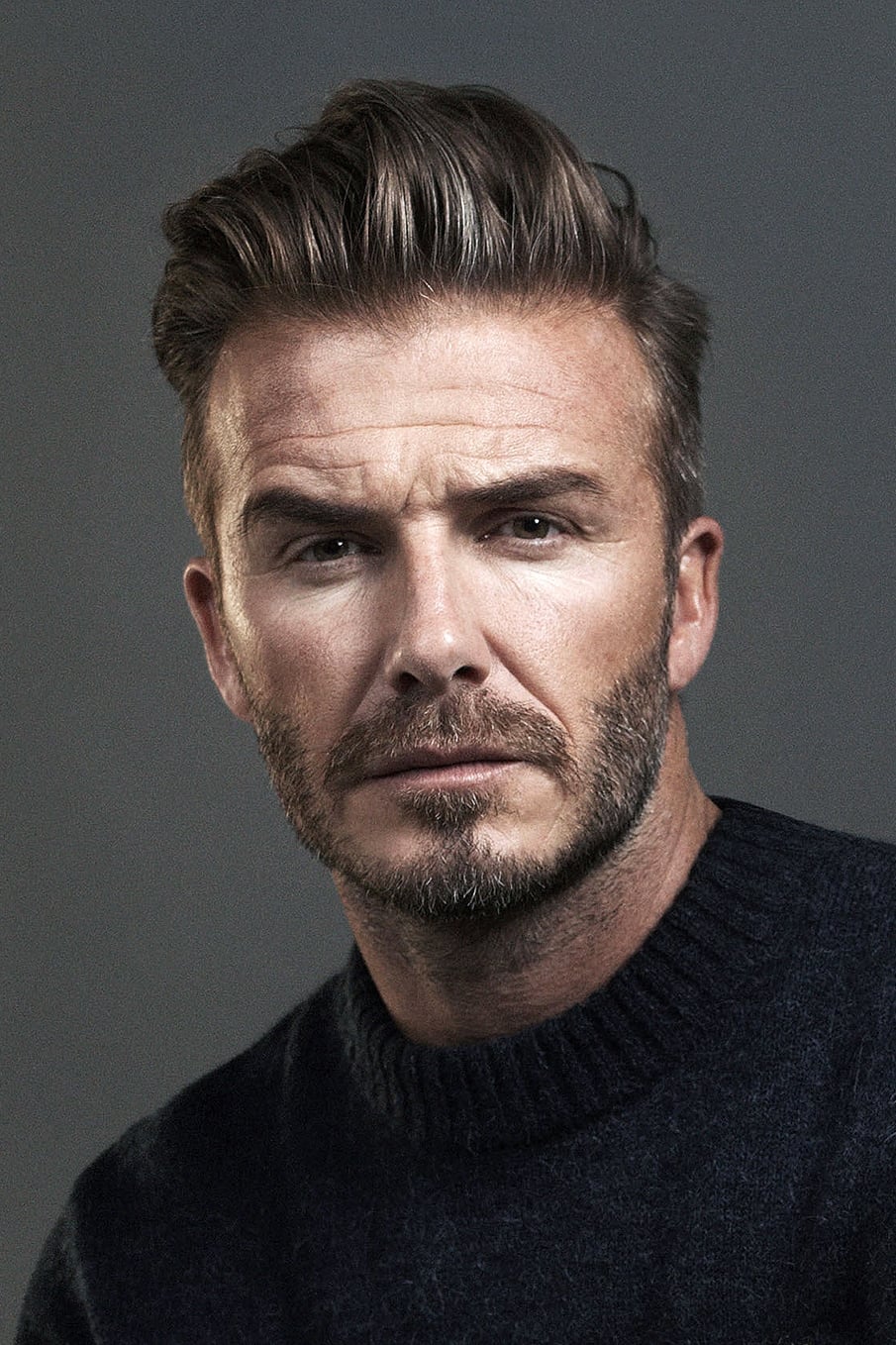

David Beckham

I was always amazed by how much they insured David Beckham’s legs, feet, and face! It was around $195 million – a truly massive deal, and one of the biggest ever for a sports star. It wasn’t just about football, though. Because he was the face of so many brands, any injury that affected his appearance or ability to play could have cost him a fortune in endorsements. Really, it was about protecting everything he’d built – his career, his looks, and his status as a global icon. It was a really smart, comprehensive policy that covered him both on and off the pitch.

Cristiano Ronaldo

When Cristiano Ronaldo played for Real Madrid, the club insured his legs for around $144 million. This huge amount was due to his importance as their main goal scorer and the financial impact if he couldn’t play. The insurance would cover the money Real Madrid spent on signing him and paying his salary if he suffered an injury that ended his career. Because he was one of the most valuable athletes globally, his health was crucial to his team’s success, and this policy remains one of the priciest ever taken out on an athlete.

Taylor Swift

Before her 2015 1989 World Tour, Taylor Swift reportedly took out a $40 million insurance policy on her legs. This was because her performances involve a lot of dancing and energetic movement, and the insurance was meant to protect her income if she were to suffer a leg injury and be unable to perform. Her ability to move and perform is essential to her career, making her legs a valuable asset, and this insurance reflects the large scale of her business.

Julia Roberts

Julia Roberts is famous for her bright smile, and it’s actually insured for around $30 million! This unusual policy protects her most recognizable feature – the smile that helped launch her career with films like ‘Pretty Woman’ (1990). It’s considered a key part of her appeal and earning power, especially in romantic comedies. The insurance acts as a financial safeguard in case of any dental or facial problems that might change her appearance, highlighting how much value Hollywood places on distinctive looks.

America Ferrera

In 2007, while starring in the popular TV show ‘Ugly Betty,’ actress America Ferrera had her smile insured for $10 million by Aquafresh. The insurance was part of a campaign to support a charity that provided dental care to communities in need. The high value of the policy reflected Ferrera’s rising fame and the importance of her image for advertising. This deal was a successful combination of celebrity endorsement and corporate social responsibility.

Daniel Craig

During the making of the 2006 film ‘Casino Royale,’ Daniel Craig had a $9.5 million insurance policy to cover any injuries he might sustain. Because Craig did many of his own stunts for the rebooted James Bond series, the risk of him getting hurt was high. The policy was designed to protect the expensive movie from delays or cancellations caused by an accident. The studio considered this insurance essential, as Craig’s physical presence was key to his tough portrayal of James Bond. This highlights just how much money is at risk when making big-budget action films.

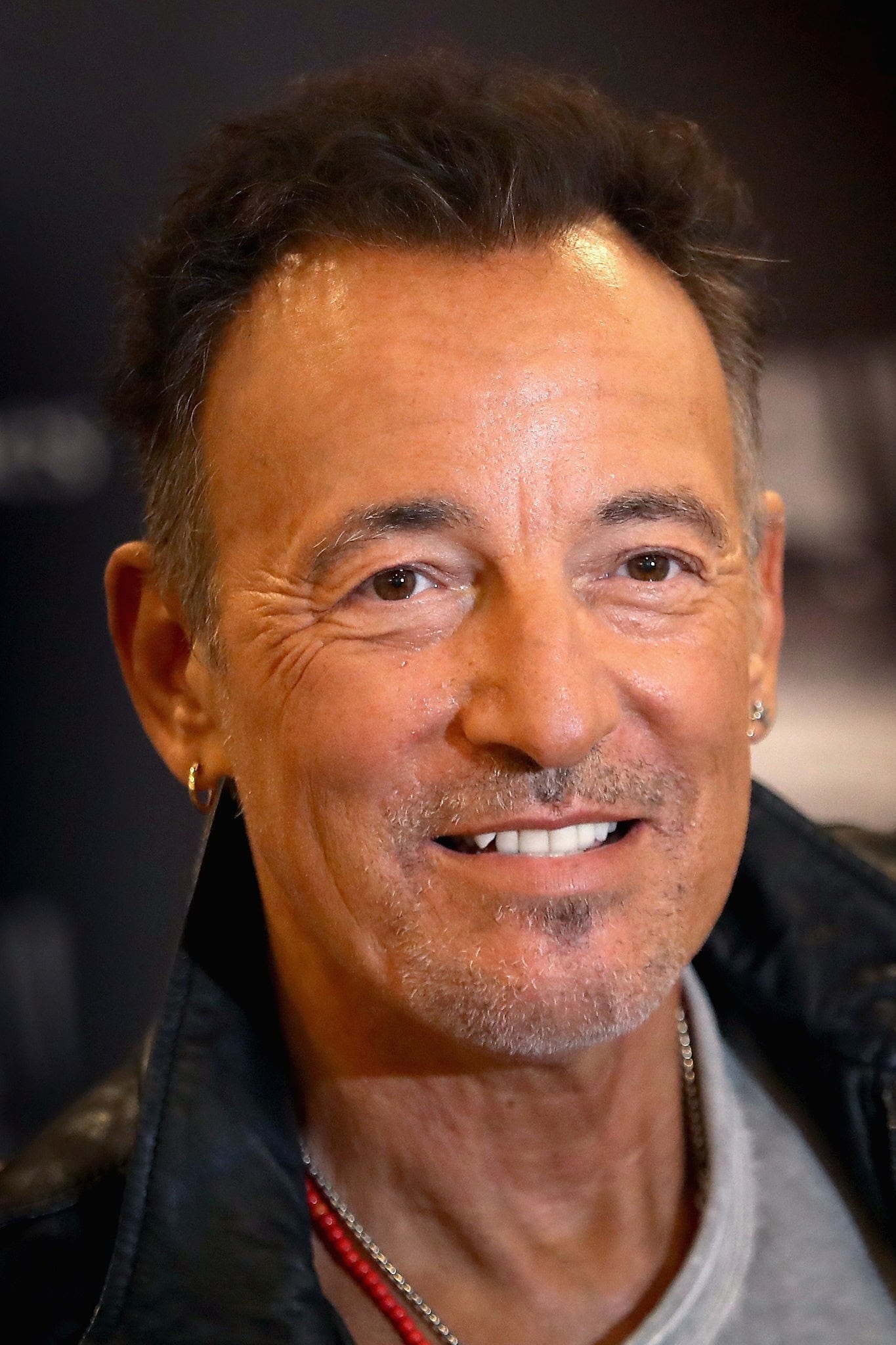

Bruce Springsteen

Bruce Springsteen, the famous musician, has insured his distinctive voice with Lloyd’s of London for $6 million. The policy covers potential damage or illness to his vocal cords that could stop him from performing his energetic, well-known concerts. These live shows are key to both his income and connection with fans. After decades of performing and constant touring, protecting his voice is a smart business move. This insurance demonstrates how important it is for performers to protect their unique talents in the music industry.

Tina Turner

As a huge Tina Turner fan, I always knew she was incredible, but I just learned she actually insured her legs for $3.2 million back when she was at her peak! It makes total sense, though. Her legs were everything – those amazing dance moves in those iconic outfits were such a huge part of her shows. The insurance was basically protecting her ability to keep touring and putting on those legendary performances. Everyone always talked about her legs – they were truly iconic, and she needed to protect them as her livelihood! It just shows how much those performances meant to her and her career.

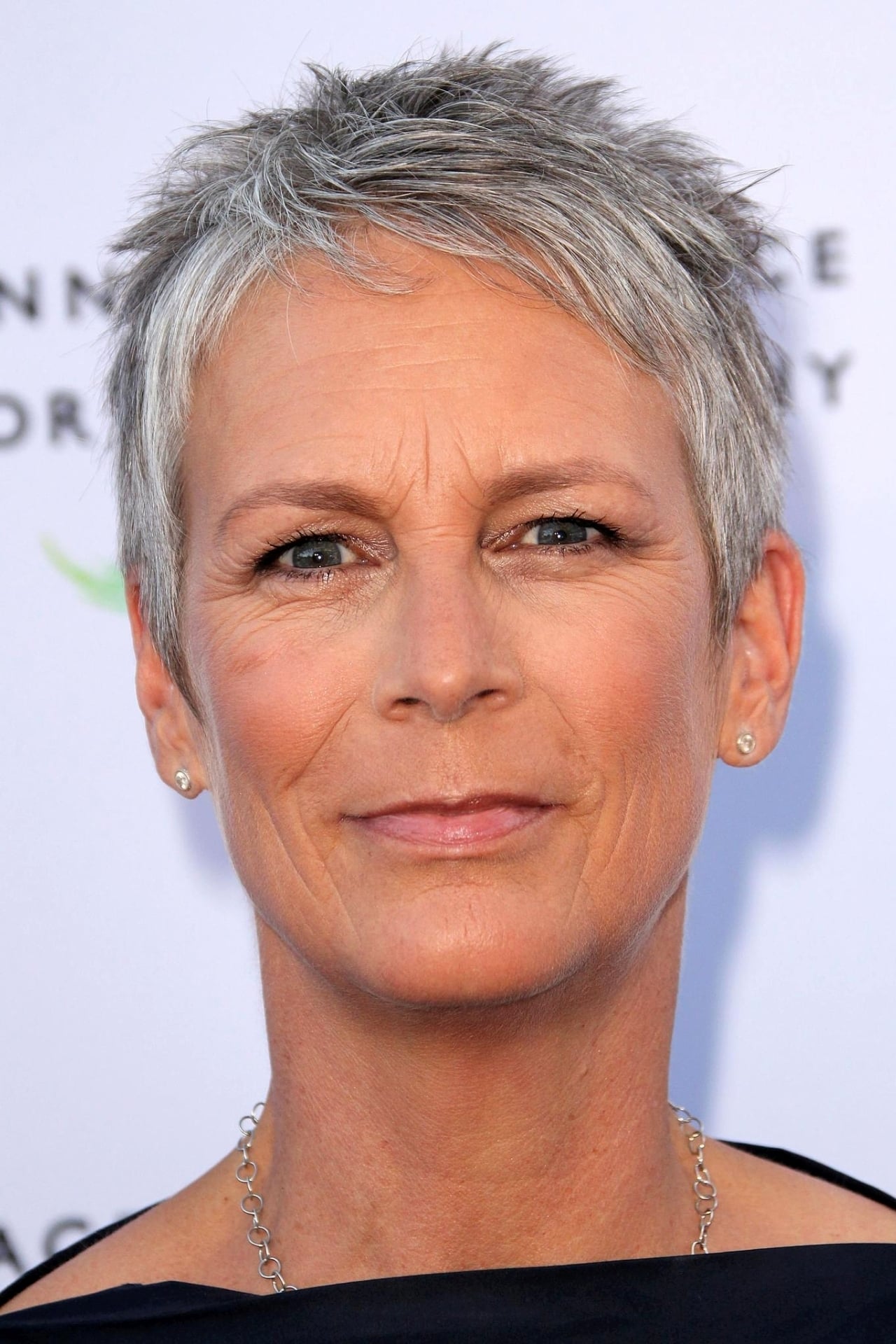

Jamie Lee Curtis

Back in the 1990s, Jamie Lee Curtis, known for her fitness and roles in action films like ‘True Lies,’ reportedly insured her legs for $2.8 million while she was the face of L’eggs pantyhose. This insurance was a way to protect her career and endorsement deals in case she suffered an injury that impacted her ability to work. It’s remembered as one of the most famous examples of a celebrity insuring a body part during that time.

Heidi Klum

Heidi Klum, the famous supermodel and TV host, has insured her legs for $2.2 million. Because of a small scar from a past glass cut, her left leg is insured for $200,000 less than her right. An insurance company in London took out the policy at the request of a client who wanted to safeguard their investment in Klum for a particular project. Klum remains a prominent figure in fashion, known for shows like ‘Project Runway’ (2004–2017), and the insurance helps protect her career if she were to experience a physical injury.

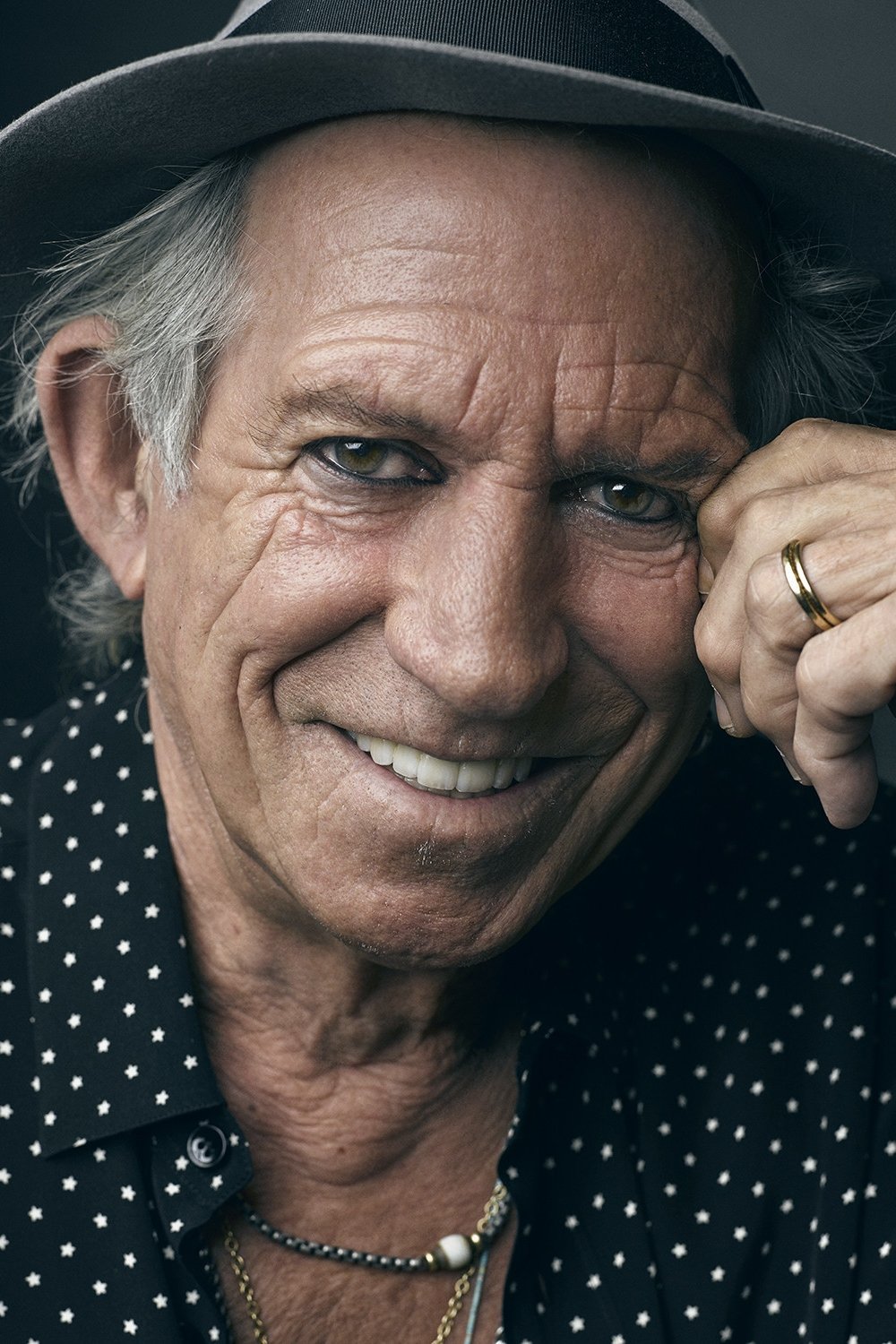

Keith Richards

Keith Richards, the guitarist for the Rolling Stones, has insured his hands for $1.6 million. The policy protects his ability to play, covering the health and skillful movement of his hands – which are crucial for both performing and writing songs. Considering the band’s long career and constant touring, any injury to his hands would be a major financial setback. Richards has been a key figure in rock music for over 50 years, making his guitar playing incredibly valuable. This insurance acknowledges the physical strain that a lifetime of playing music can cause.

Rihanna

After Rihanna was dubbed “Celebrity Legs of a Goddess” by Venus Breeze in 2007, her legs were insured for $1 million. This insurance was connected to her endorsement deal and growing fame, protecting her income if she were to injure her legs. Even as she began acting in films like ‘Battleship’ (2012), her appearance remained central to her brand. This situation demonstrated a growing practice of companies insuring the valuable assets – and appearances – of their celebrity representatives.

Gene Simmons

Gene Simmons, the bassist and singer for the rock band KISS, famously took out a $1 million insurance policy on his tongue. His long tongue became a key part of KISS’s image and branding after the band became popular in the 1970s. Simmons cleverly used this unique feature to create a huge line of KISS merchandise. The insurance protects him financially if he ever suffers an injury that stops him from performing his signature stage moves, which is fitting for someone known as a smart businessperson in the music world.

Miley Cyrus

After gaining attention for her performances in 2013, Miley Cyrus reportedly took out a $1 million insurance policy on her tongue. This was when she was known for frequently sticking it out as part of her image and brand. The policy would cover any injury that stopped her from being able to continue this signature gesture. At the time, Cyrus was moving away from her Disney role in ‘Hannah Montana’ and embracing a more daring music career. This unusual insurance policy highlights how valuable unique physical attributes can be for celebrities.

Holly Madison

Holly Madison, known for her role on the reality show ‘The Girls Next Door,’ took out a $1 million insurance policy on her breasts in 2011. At the time, she was the star of the Las Vegas show ‘Peepshow,’ which involved performing topless. Madison explained she needed the insurance because an injury to her chest could have prevented her from working for months. The policy was essentially protecting her income and career as a performer, highlighting the unique risks faced by entertainers in demanding shows.

Share your thoughts on these massive insurance policies in the comments.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-18 06:46