People often assume celebrities are exempt from the legal problems that affect everyone else. But the truth is, many famous actors, musicians, and other public figures have faced criminal charges and even gone to jail. These offenses vary widely, from drug use and financial wrongdoing to physical fights. Learning about these stars’ legal troubles gives us a more complete understanding of who they are as people and how they’ve overcome challenges in their careers.

Robert Downey Jr.

Between 1996 and 2001, Robert Downey Jr. struggled with legal problems stemming from drug use. He was arrested after police found heroin, cocaine, and a gun in his car while he was speeding. After repeatedly violating his parole, he served three years in a California prison and treatment facility. He eventually got sober and, in 2015, received a pardon from the Governor of California. His career later experienced a major comeback when he starred as ‘Iron Man’.

Mark Wahlberg

When Mark Wahlberg was 16, he was initially charged with attempted murder, but the charge was lowered to felony assault. He admitted guilt after attacking two Vietnamese-American men on the same day and was sentenced to two years in prison. However, he only served 45 days. Wahlberg has spoken about how this experience changed his life. He later tried to get a formal pardon for his actions, but withdrew his request in 2016.

Martha Stewart

In 2004, Martha Stewart, the well-known businesswoman, was found guilty of several crimes related to insider trading. These included conspiring with others, trying to block the investigation, and lying to federal investigators. She served five months in prison and then spent another five months under house arrest. The legal issues caused a lot of attention and financial difficulties for her company. After completing her sentence, Stewart returned to her career in media, even appearing on shows like ‘The Apprentice: Martha Stewart’.

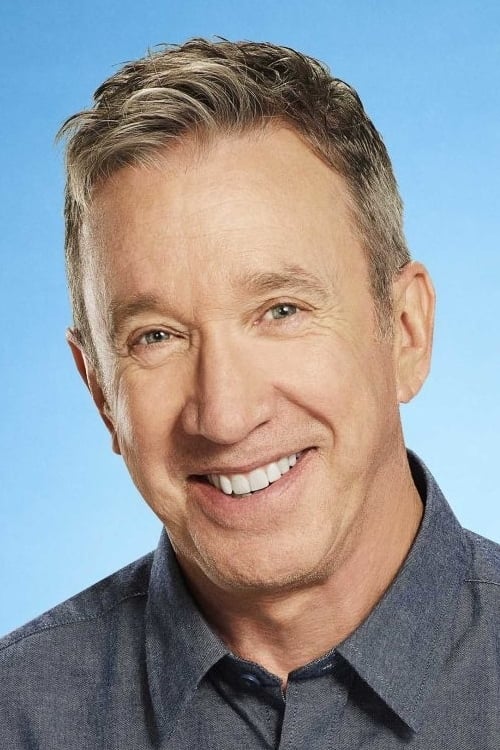

Tim Allen

In 1978, Tim Allen was arrested with over a pound of cocaine at the Kalamazoo/Battle Creek airport. He admitted to drug trafficking and cooperated with authorities by providing information about other drug dealers, which helped him avoid a potentially life-long prison sentence. He ended up serving just over two years in a federal prison in Minnesota. After his release, he moved to Los Angeles and began a career in stand-up comedy, eventually achieving widespread fame as the star of the TV show ‘Home Improvement’.

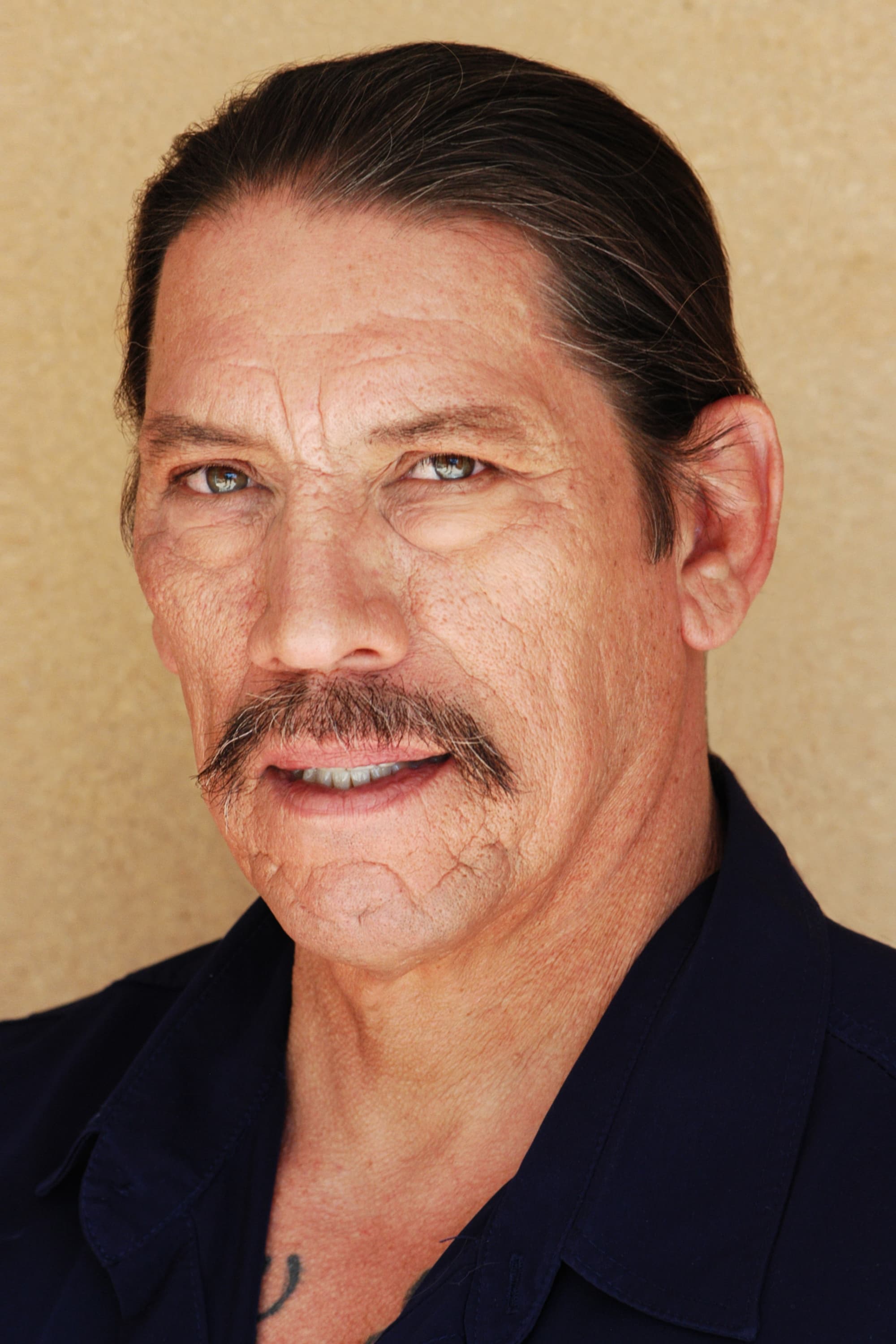

Danny Trejo

Danny Trejo had a difficult youth and spent eleven years in California prisons like San Quentin and Folsom for crimes including armed robbery and drug offenses. While in prison, he became a skilled boxer and completed a program to help him turn his life around. After his release, he worked as a counselor helping young people with drug problems. He stumbled into acting and eventually became a well-known action movie star, famous for his role in ‘Machete’.

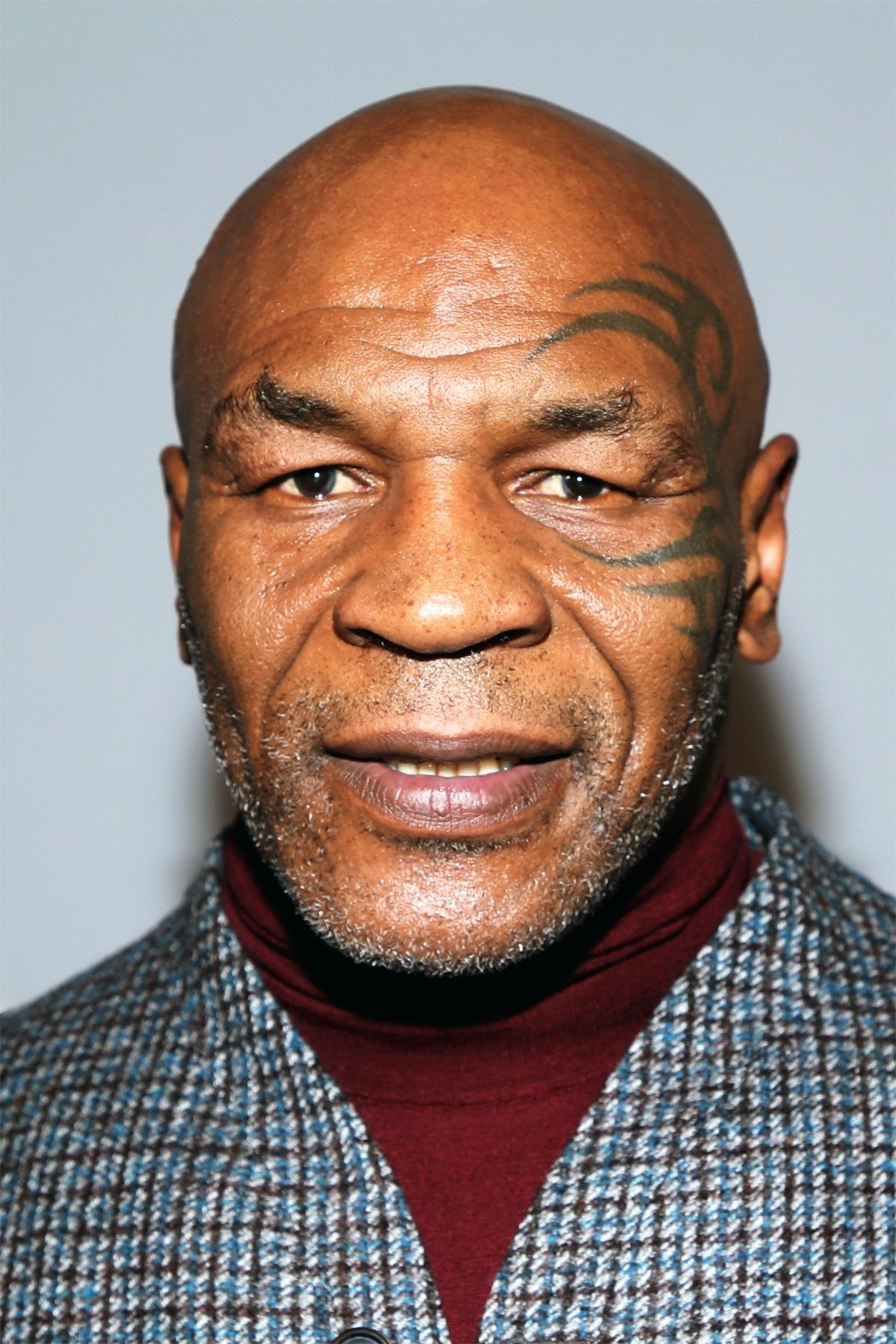

Mike Tyson

In 1992, Mike Tyson, the former boxing champion, was found guilty of rape after an incident in Indianapolis. He received a six-year prison sentence and four years of probation, ultimately serving three years at the Indiana Youth Center before being paroled in 1995. As a result of the conviction, he was required to register as a sex offender. Despite this legal trouble, Tyson continued to be well-known, even appearing in the movie ‘The Hangover’.

Winona Ryder

In 2001, actress Winona Ryder was arrested for shoplifting at a Beverly Hills department store. She was found guilty of stealing expensive designer items, which resulted in a conviction for grand theft and vandalism. As punishment, she received three years of probation, had to pay substantial fines, and complete 480 hours of community service. After the legal issues were resolved, Ryder took a break from acting to focus on her personal life before eventually returning to successful roles, notably in the popular series ‘Stranger Things’.

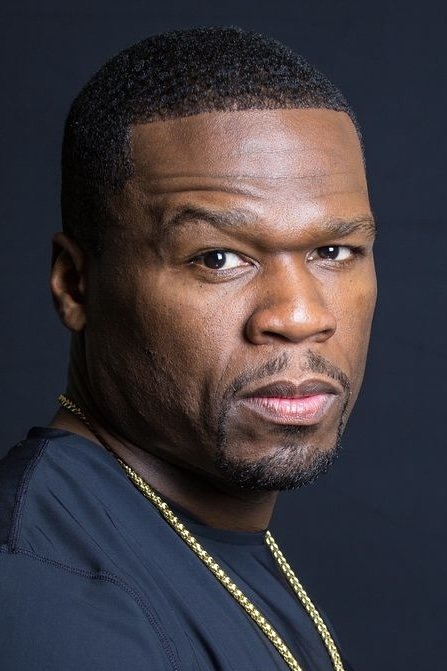

50 Cent

I’ve always been fascinated by 50 Cent’s story. Before he was the superstar we know, his life was incredibly difficult. Back in 1994, he was arrested for selling cocaine, and the police actually found heroin, crack, and even a gun when they searched his home. He ended up with a sentence of three to nine years, but surprisingly, he only served six months in a really tough boot camp program. It’s amazing to me how that whole experience really shaped his music, especially his first album. And look at him now – he’s not just a rapper, he’s a hugely successful businessman and the creative force behind the hit TV show ‘Power’. It’s a real testament to how far he’s come.

Felicity Huffman

In 2019, actress Felicity Huffman, known for her work on ‘Desperate Housewives’, was arrested due to a college admissions scandal. She admitted to paying to have her daughter’s SAT scores illegally boosted and pleaded guilty to conspiracy and mail fraud. As a result, she was sentenced to 14 days in prison (she served 11), a $30,000 fine, and 250 hours of community service.

Snoop Dogg

Snoop Dogg has faced legal challenges throughout his life. In 1990, he was convicted of possessing cocaine and spent time in county jails. Later, in 1993, he was charged with illegally possessing a gun after a traffic stop. While recording his first album, he was also connected to a deadly shooting, but he was ultimately found not guilty of murder. Snoop Dogg has publicly discussed his past difficulties with the law and his early involvement with gangs in Long Beach. He’s also had a successful career in entertainment, appearing in films like ‘Training Day’.

Khloé Kardashian

I remember when the news broke about Khloé Kardashian’s DUI back in 2007 – it was wild, especially since her family was already filming ‘Keeping Up with the Kardashians’. She ended up pleading no contest, and got probation plus had to do an alcohol education program. Unfortunately, she messed up and didn’t finish the program, which led to a 30-day jail sentence. It was a huge deal at the time, but honestly, she only served a few hours because the jail was too crowded! The whole thing played out on the very first season of the show, making it a pretty memorable – and controversial – storyline.

Justin Bieber

In 2014, Justin Bieber was arrested in Miami Beach for drunk driving and resisting police. He later pleaded guilty to lesser charges of reckless driving and resisting arrest, and was required to complete an anger management course and donate to charity. This followed another incident where he was accused of vandalizing a neighbor’s house by throwing eggs. These events happened while he was filming and promoting his documentary, ‘Justin Bieber’s Believe’.

Michelle Rodriguez

In 2003, Michelle Rodriguez had legal trouble after a hit-and-run accident and a DUI. She received probation and a short jail sentence, but didn’t fully follow the rules of her release. This led to another jail order in 2007 – 180 days – because she didn’t complete her community service or alcohol monitoring. She was let out early, though, because the Los Angeles County jail was too crowded. Despite these issues, she continued to star in popular film series like ‘The Fast and the Furious’.

Wesley Snipes

In 2008, actor Wesley Snipes was found guilty of three minor offenses related to not filing his federal income taxes. Although he wasn’t convicted of more serious charges like conspiracy and fraud, the tax convictions resulted in a three-year prison sentence, which he began serving in December 2010. After being released from prison in 2013, he finished his sentence under house arrest. He continued to act, appearing in films like ‘The Expendables 3’.

Let us know what you think about these legal issues involving celebrities and how they affected their careers. Share your thoughts in the comments below!

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-18 05:23