More and more well-known celebrities are choosing to be single, focusing on things like their careers, personal development, and family. By openly discussing their decision, they’re helping to change what society considers ‘normal’ when it comes to relationships. This showcases famous people who are truly happy and fulfilled living single lives.

Jennifer Aniston

I’ve always admired Jennifer Aniston’s perspective on life. She often talks about how happy she is being single, and it really resonates with me. She believes – and I agree – that a woman doesn’t need a husband or kids to feel complete. She’s so focused on her career – producing and starring in ‘The Morning Show’ – and it’s clear she finds fulfillment from within, not from being in a relationship. It’s a really empowering message!

Charlize Theron

Charlize Theron says she hasn’t had a significant romantic relationship in more than ten years. She gets a lot of fulfillment from being a mom to her two children and focusing on her acting career. The ‘Monster’ star explains that she’s happy with her busy life and doesn’t feel like she needs a partner to be complete. Theron continues to thrive professionally and remains committed to her charitable work.

Diane Keaton

Diane Keaton is famous for her independent lifestyle and hasn’t been in a romantic relationship for over thirty-five years. The star of ‘Annie Hall’ finds fulfillment through creative outlets like photography and interior design. She’s shared that she never felt a strong need for marriage or a conventional home life. Keaton continues to be a Hollywood icon, demonstrating that a single life can be full and rewarding.

Drew Barrymore

I’ve been following Drew Barrymore, and it’s really inspiring to hear she’s taking a step back from dating for a while. She’s prioritizing herself and really focusing on growing as a person. Being a mom to her daughters is huge for her, and she wants to be fully present for them, as well as give her all to hosting her show. She’s actually said being single has been a really powerful experience, helping her understand herself better than ever before. And I love how openly she shares all of this with her audience – it’s so encouraging to see her inspire others who might be going through something similar.

Emma Watson

Emma Watson popularized the term ‘self-partnered’ to describe being single in her thirties, aiming to reframe singledom in a positive light. She prioritizes her independence and dedicates her time to causes she cares about, as well as her acting career. Watson continues to be a strong advocate for empowerment, living life confidently on her own terms.

Tracee Ellis Ross

I absolutely love how Tracee Ellis Ross owns her single life! She talks about how happy and fulfilled she is, and that everything she has – a great career in TV and fashion, a fantastic social life – is because of the choices she’s made. It’s so inspiring! She really encourages women to embrace being alone and find happiness within themselves, and I think that’s a powerful message. It’s about valuing your own independence and knowing you’re complete just as you are.

Mindy Kaling

Mindy Kaling is a talented actress and writer who intentionally chose to become a single parent. She’s spoken openly about being happy and fulfilled raising her children without a partner, finding joy in both her career and family. Kaling is a role model for those balancing parenthood and professional goals on their own.

January Jones

January Jones has openly discussed her choice to raise her son as a single parent. She enjoys a calm and fulfilling life and doesn’t feel a need for a romantic partner. The actress, known for her role in ‘Mad Men,’ prioritizes her career and maintaining a private life, away from public attention. She appreciates the independence to make choices for her family without needing to compromise.

Susan Sarandon

Susan Sarandon has embraced a very independent lifestyle since her long-term relationships ended. She appreciates the freedom to focus on her passions – both her acting career and her political activism – without limitations. The acclaimed actress has described her life now as liberating and satisfying, proving that moving forward after a significant relationship can be a period of personal growth.

Winona Ryder

Winona Ryder has chosen to remain single, preferring that to the possibility of going through multiple divorces. The ‘Stranger Things’ star values her privacy and has successfully kept her personal life out of the public eye. She finds fulfillment in her work and the close relationships she has with her friends. Ryder is a highly respected actress who prioritizes her well-being and independence.

Martha Stewart

Martha Stewart has worked for years to create a successful brand and has remained unmarried. She’s said that her high expectations and demanding career make finding a partner difficult. She finds happiness in her homes, pets, and hobbies, demonstrating that people can achieve great success and fulfillment in life without being married.

Jane Fonda

Jane Fonda has said she’s done with romantic relationships after being married three times. She feels content and fulfilled with her life as it is, focusing on her work as an environmental activist and spending time with her family. Fonda believes she’s enjoying the best and most meaningful period of her life while being single.

Chelsea Handler

Chelsea Handler often talks about her decision to remain single and not have children, sharing her perspective through her comedy. She emphasizes the freedom and career opportunities that come with that choice, and believes society shouldn’t pressure everyone to get married. Despite bucking tradition, she’s thriving professionally, traveling the world, and working on a variety of projects.

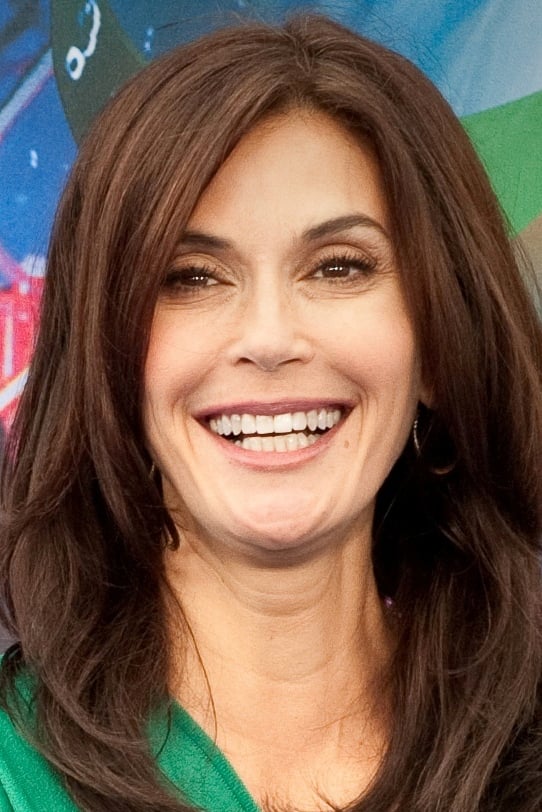

Teri Hatcher

Teri Hatcher has shared how content she is with being single. The ‘Desperate Housewives’ star prioritizes her well-being, staying fit, and her bond with her daughter. She’s realized she doesn’t need a romantic partner to feel complete. Hatcher continues to thrive in her career and appreciates the peace and freedom of living life on her own terms.

Kristin Davis

Kristin Davis chose to become a mother through adoption and is raising two children as a single parent. She’s spoken about how being a mom is the most important thing to her, and she feels fulfilled even without a husband. In addition to motherhood, the ‘Sex and the City’ star is passionate about her work protecting wildlife around the world. Davis shows that women can create happy, complete families in many different ways.

Stevie Nicks

Stevie Nicks prioritized her music career over having a conventional family life. She’s frequently expressed that her purpose was to focus on her art and connect with her fans. The celebrated singer has largely lived a single life and cherishes the freedom that comes with her creativity. Nicks remains a rock icon, consistently staying true to herself and her unique journey.

Lucy Liu

Lucy Liu is raising her son on her own and has always valued her privacy. She feels that family doesn’t need to follow traditional norms and doesn’t require marriage. In addition to her acting work on shows like ‘Elementary,’ Liu also enjoys painting and photography. She demonstrates that it’s possible to thrive as a working single parent.

Kim Cattrall

As a film buff, I’ve always admired Kim Cattrall, and I was really struck by what she said about prioritizing herself. She’s made it clear she doesn’t feel pressured to conform to expectations around marriage, and honestly, that’s inspiring. She genuinely seems to thrive on her career and the independence that comes with being single. It’s clear she deeply values being in control of her own life and making her own choices, and that strength of character really shines through in everything she does. She’s a fantastic actress, and I respect her for living life on her own terms.

Edie Falco

Edie Falco doesn’t feel that marriage was ever for her. As a single mother to two adopted children, she’s built a fulfilling life and enjoys her independence. The ‘Sopranos’ star thrives both on screen and in her personal life, making her children and her own well-being a priority.

Bill Maher

Bill Maher has never been married and often talks about his decision to stay single. He sees marriage as an old-fashioned idea that doesn’t fit his life or what makes him happy. He finds plenty of satisfaction in his career and enjoys the freedom of being single. Maher is a well-known celebrity who proves you can be happy and successful without getting married.

Leonardo DiCaprio

Leonardo DiCaprio, a hugely successful actor for many years, has never tied the knot. He seems to focus more on his busy acting career and his dedication to environmental causes than on finding a life partner. The Oscar winner is well-known for both his important work protecting the environment and his many popular movies. He remains a major star in Hollywood and continues to enjoy being single.

Lenny Kravitz

Lenny Kravitz has enjoyed a largely single life in recent years and often talks about how much he appreciates being alone. He dedicates himself to his passions – music, photography, and design. A devoted father to his daughter, he also prioritizes his personal and spiritual development. Kravitz remains a highly respected artist known for his creative spirit and independent lifestyle.

Whoopi Goldberg

Whoopi Goldberg has openly talked about deciding she prefers to live independently. She enjoys having her own space and doesn’t want a partner sharing her home. The host of ‘The View’ feels fulfilled by her work and family, and believes that marriage isn’t the right path for everyone – choosing to be single is perfectly acceptable.

Emilia Clarke

Emilia Clarke says she’s enjoying being single and prioritizing her health and happiness. After facing some health issues, she’s focused on recovering and her career, finding fulfillment in her work and close friendships. She’s staying positive and embracing where she is in life.

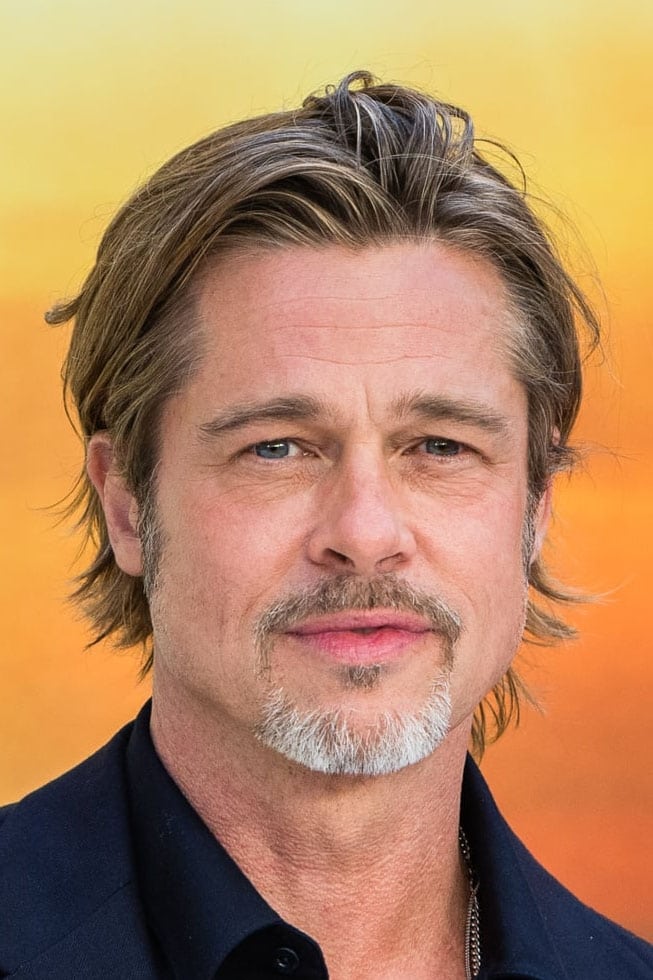

Brad Pitt

Since his public split, Brad Pitt has largely kept to himself and dedicated more time to his passions, like creating art and sculptures. He’s been spending a lot of time in his studio, focusing on personal projects and self-improvement. Despite remaining a famous actor, known for films like ‘Fight Club,’ Pitt seems to be prioritizing reflection and personal growth, while continuing to focus on his work and family.

Angelina Jolie

Angelina Jolie is fully devoted to raising her six children and doing important humanitarian work. As a single mother, she’s made it clear that her family comes first and she isn’t looking for a romantic relationship. Beyond motherhood, Jolie continues to work in film, both producing and directing movies that focus on significant global issues. She lives a purposeful life, prioritizing her children while also making a difference in the world.

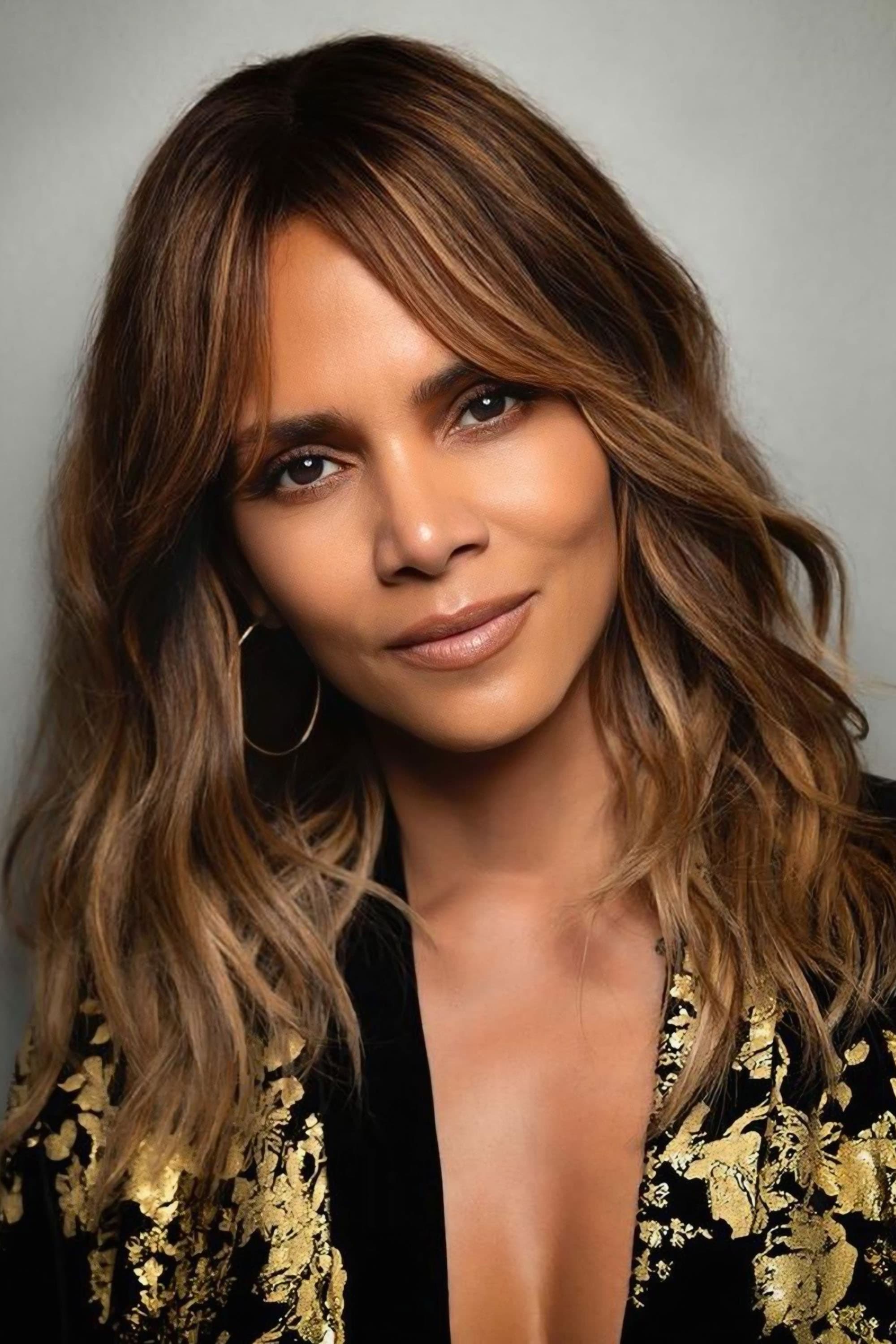

Halle Berry

As a film fan, I’ve always admired Halle Berry, and I’ve been really impressed by her recent focus on herself. She’s intentionally taken time to be single, really prioritizing her own growth and her kids, and she’s said it’s been crucial for figuring out what she truly wants. It’s also great to see how dedicated she is to her health and wellness – she’s really built a brand around that, which is inspiring. She’s always been a strong presence, and I think she’s encouraging a lot of people to embrace their own independence and find strength within themselves.

Julia Fox

Julia Fox recently shared that she’s choosing to focus on raising her son and building her career, so she’s currently staying single. She doesn’t enjoy traditional dating and values her independence. Known for her distinctive style and work in fashion and writing, the actress from ‘Uncut Gems’ is dedicated to growing her career and living life on her own terms.

Alexander Skarsgård

Alexander Skarsgard often talks about how much he enjoys being single, particularly the freedom it gives him to travel for work, like with the show ‘Succession’, without needing to consider a partner. He’s dedicated to his career and also highly values keeping his personal life private. Skarsgard demonstrates that you can be a successful and well-known actor and still live a happy life as a bachelor.

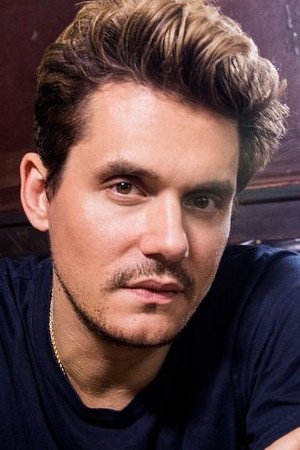

John Mayer

John Mayer has been prioritizing his music and personal well-being over dating and relationships. He’s stated that he’s now focused on finding inner peace and enjoying life as a single person, all while continuing to write hit songs and perform on tour. It seems he’s in a reflective phase, valuing his own growth and experiences.

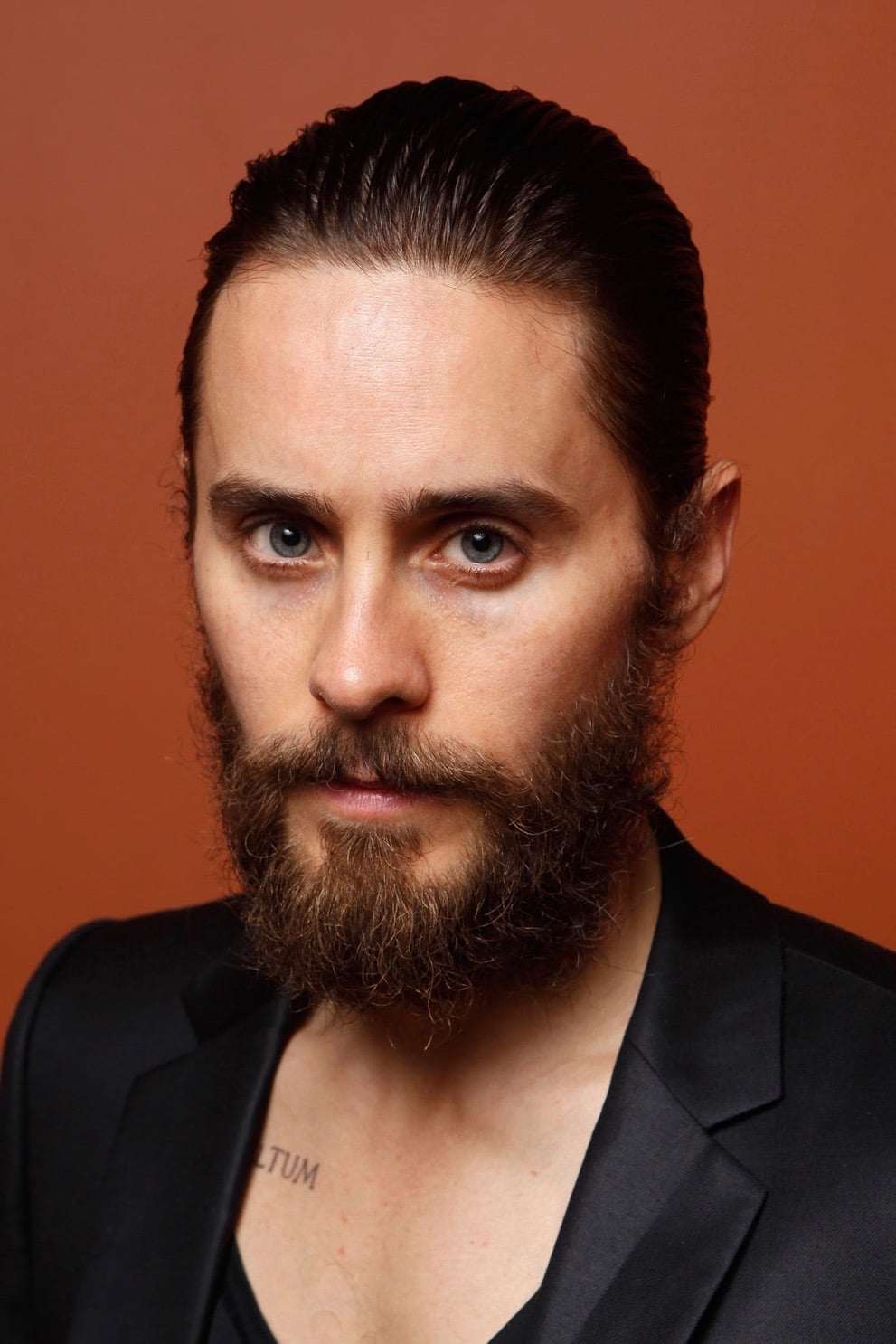

Jared Leto

Jared Leto is a very private person and has largely remained single throughout his career. He focuses most of his energy on his demanding acting work and his music. Known for his role in ‘Dallas Buyers Club,’ Leto also loves spending time outdoors, especially rock climbing and enjoying nature. He seems to find more satisfaction in his creative and active hobbies than in settling down with a partner.

Sharon Stone

Sharon Stone has decided to stop dating and instead focus on her art and family. She’s found that life is calmer and she gets more done without the added complexity of dating. While still acting, the star of ‘Basic Instinct’ is also dedicating time to painting and causes she believes in. Stone shows how fulfilling it can be to confidently embrace being single, especially later in life.

Tyra Banks

Tyra Banks is a successful businesswoman and mother who is happily independent. She’s stated she doesn’t need a romantic partner to feel fulfilled, and instead dedicates herself to her career and teaching. As the creator of ‘America’s Next Top Model,’ Banks continues to be a strong role model, proving that women can thrive on their own.

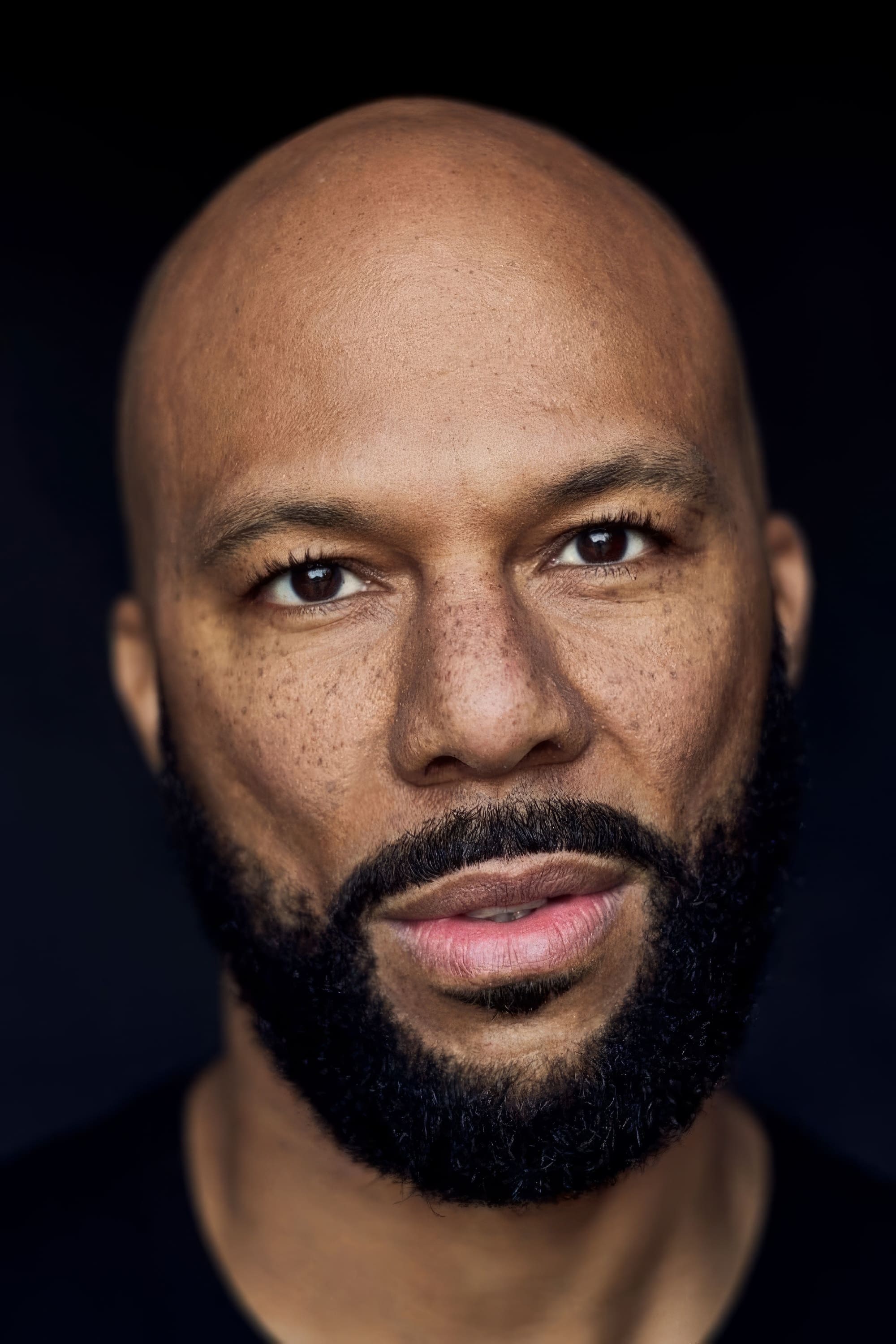

Common

Common frequently discusses his journey to self-love and how being single has helped him grow as a person. He’s shared details about past relationships and now prioritizes his music and spiritual life. The actor and rapper continues to create impactful work while enjoying being single. Overall, Common is known for emphasizing inner peace and personal development over seeking approval from others.

Ricki Lake

Ricki Lake is enjoying life as a single woman after going through several public relationships and big changes. She’s finding fulfillment in raising her children and working as a documentary filmmaker and advocate. The former talk show host has said she feels stronger and happier being on her own. Lake continues to encourage others to live genuine and independent lives.

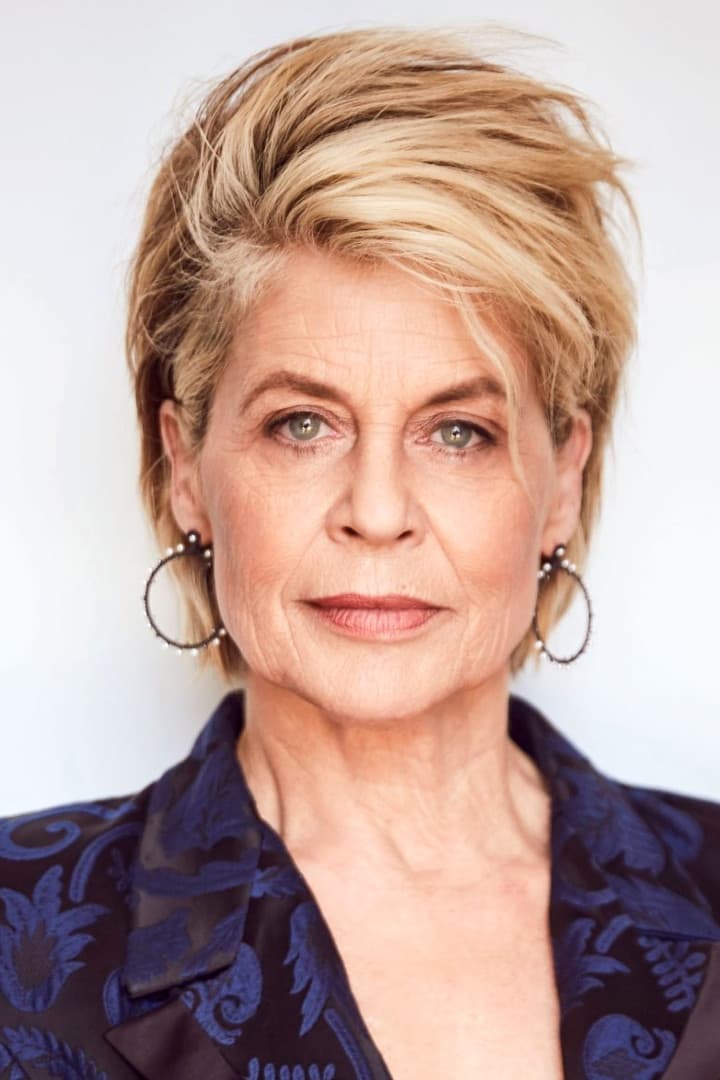

Linda Hamilton

Linda Hamilton has openly talked about enjoying two decades of being single, describing it as a fulfilling time in her life. The ‘Terminator’ star says she doesn’t feel she’s missing out on anything by not being in a relationship, and finds happiness through her work and a peaceful, private life. She’s a great example of someone who genuinely cherishes being alone and the tranquility it offers.

Fran Drescher

Fran Drescher says she’s happily in a relationship with herself, and it’s incredibly fulfilling. She values her independence and is using her time to focus on her well-being and her work as a cancer advocate. The ‘Nanny’ star is thriving while single, and continues to inspire as a woman who proves you can be happy and successful on your own.

Marisa Tomei

Marisa Tomei doesn’t believe marriage is necessary for a fulfilling life. She’s happy and successful thanks to her work as an actress and her passions for things like wellness and the arts. The Oscar winner has often wondered why society expects women to get married. She continues to be a well-respected actress who cherishes her independence and freedom.

Al Pacino

Despite several well-known relationships and having children, Al Pacino has never tied the knot. He’s dedicated his life to his acclaimed acting career and family, maintaining a very private personal life. The star of ‘The Godfather’ remains committed to his craft and continues to appear in major films, all while being one of Hollywood’s most famous lifelong bachelors.

Share your thoughts on these independent stars in the comments.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-18 01:49