SL Green Realty, that venerable purveyor of Manhattan office space, has suffered a decline in recent years, a tumble of some 35% in the last annum and a more protracted malaise over five. The reasons are, of course, painfully obvious: interest rates, those implacable arbiters of financial fate, and a general reluctance amongst the commercial classes to commit to premises when the future appears, shall we say, fluid. One might almost suspect a lack of confidence in the long-term viability of the modern office, but that would be unduly pessimistic.

However, even a distressed asset presents opportunities, and SL Green, should fortune favour it, could yet mount a recovery. Two conditions, rather elementary, really, would be required.

The Ten-Year Yield: A Matter of Expectation

The impact of interest rates on commercial property is, naturally, considerable. Elevated rates, beyond the obvious increase in borrowing costs, tend to divert capital towards less speculative ventures – government bonds, for instance, which offer a reassuringly dull return. This leaves those of us with a taste for risk – and a belief in the eventual resurgence of the skyscraper – rather less well-supplied with funds.

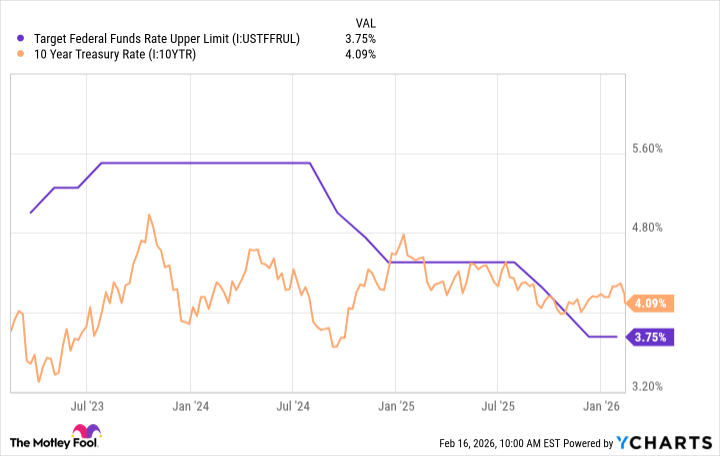

The Federal Reserve, in its benevolent attempts to soothe the financial markets, has lowered short-term rates. The long-term rates, however, remain stubbornly high. As the chart demonstrates:

The ten-year Treasury, that bellwether of investor sentiment, has resisted the downward trend. This is hardly surprising, given the persistent inflation and the nation’s, shall we say, enthusiastic fiscal policy. Should inflation finally succumb to the pressures applied by the Federal Reserve – a fall to around 2% being the target – then a descent in the ten-year yield would be likely, and a corresponding boost to the value of commercial property, and by extension, SL Green, would follow. It is a simple equation, really, though simplicity is often the most elusive of qualities in financial affairs.

The Office: A Return to Purpose?

The office, that once unquestioned symbol of corporate ambition, has fallen on hard times. Companies, understandably hesitant to commit to long-term leases in an era of remote work and uncertain futures, have left vacancies yawning. Rental rates have stagnated, and investors have, with some justification, regarded office buildings with a degree of suspicion.

Yet, even in this landscape of despondency, there are glimmers of hope. JLL’s latest report indicates a surge in leasing activity during the fourth quarter, and an overall annual growth of 5.2%. Large-scale transactions are on the rise, and office sales volume has increased for seven consecutive quarters, a most encouraging statistic. Furthermore, distress in the sector is declining, and new construction is, thankfully, limited. These factors suggest that the office market may be entering a new, albeit tentative, growth cycle. If these trends persist, SL Green’s stock, predictably, should benefit.

From Headwinds to a Breeze, Perhaps

Elevated interest rates and a sluggish office market have, quite understandably, exerted downward pressure on SL Green’s share price. However, should these headwinds abate, and a more favourable wind begin to fill the sails, then a recovery is not merely possible, but perhaps, even probable. One must, of course, retain a degree of skepticism. But even a cynic can occasionally indulge in a flicker of optimism.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Best Video Games Based On Tabletop Games

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

2026-02-17 15:52