In the ever-shifting sands of digital wealth, a new order has emerged among the XRP fraternity. The latest ledger of opulence reveals that a mere 2,200 XRP now suffice to ascend into the top 10% of global wallets-a sum so modest it could buy a peasant a loaf of bread and a wink from fate. One might ponder whether this democratization of riches signals a revolution or merely the market’s way of mocking our collective desperation.

Analysts, those modern-day soothsayers draped in spreadsheets, now squint at their screens with bated breath, wondering if XRP shall break free from Bitcoin’s shadow in the next grand crypto cycle. Perhaps the gods of finance will finally grant it independence-or perhaps they’ll simply laugh louder.

2,200 XRP Now Secures Top 10% Position

Behold the spectacle: 760,000 souls now dwell in the liminal space between 2,200 and 7,700 XRP, their wallets swelling with the thrill of barely scraping into the top decile. To claim this dubious honor, one must hoard 2,232 XRP-a treasure so trivial it could fill a child’s piggy bank, yet so coveted it grants entry into the aristocracy of decentralized finance.

Observe the tiers of this digital aristocracy:

- Top 10%: ~2,232 XRP (a sum that would make a medieval serf weep with envy)

- Top 5%: ~7,700 XRP (down from 8,100, as if the gods of wealth have grown weary of generosity)

- Top 1%: ~46,400 XRP (a figure so grand it could buy a castle-if one still existed)

- Top 0.1%: ~290,000 XRP (down from 360,000, perhaps due to divine budget cuts)

- Top 0.01%: ~3.8 million XRP (a number so vast it defies comprehension, much like the purpose of life itself)

The lowering of thresholds suggests a slow, inexorable redistribution of tokens. Yet, in U.S. dollars, these holdings gleam brighter than ever, thanks to XRP’s long-term price ascent-a golden goose that lays eggs of inflation and hope.

Retail Participation Rises as Larger Holders Consolidate

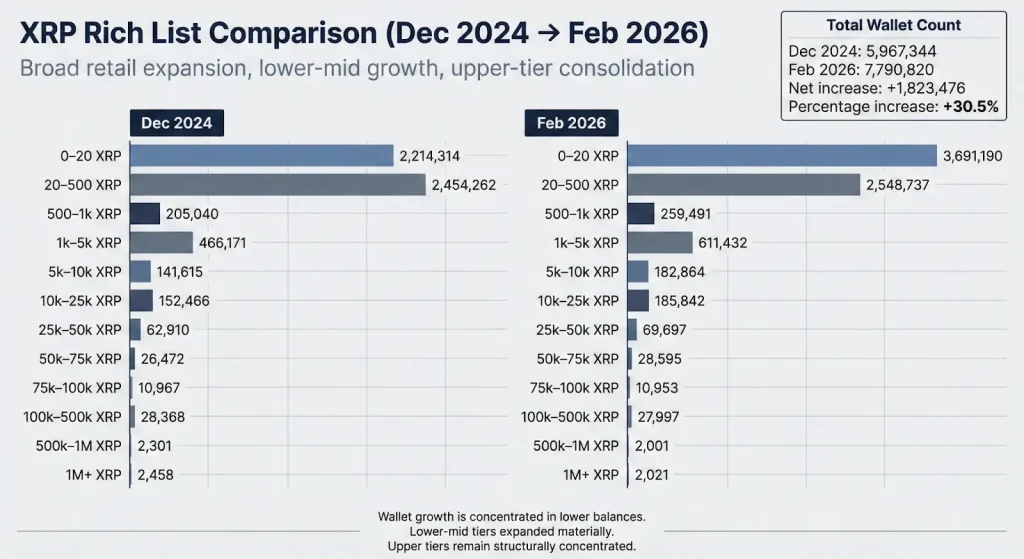

From December 2024 to February 2026, the number of XRP wallets swelled from 5.97 million to 7.79 million-a 30% surge that would make even the most jaded economist raise an eyebrow. What does this mean? Perhaps the masses have finally realized that holding XRP is less risky than investing in a bridge to nowhere.

Examine the wallet structure, a tapestry of human folly:

- Wallets under 500 XRP multiplied like rabbits in a crypto utopia

- Balances between 500 and 10,000 XRP expanded with the grace of a bloated wallet

- The 10,000-50,000 tier grew, as if wealth were a contagious disease

- Wallets holding 50,000 to 1 million XRP remained stable, like a sleeping giant

- Addresses with over 1 million XRP declined slightly, perhaps due to divine retribution

This suggests a curious paradox: while the little people flock to XRP in droves, the titans at the top cling to their hoards like Scrooge McDuck in a blockchain bath. Retail participation is rising, but the supply remains concentrated in the hands of those who probably know someone who knows someone at Ripple.

Wallet growth alone cannot confirm a revolution. It merely proves that more people are playing the game-though whether they’ll win remains a question for the oracle of volatility.

Institutional Positioning vs Retail Uncertainty

The market dances between chaos and calm. Retail investors, trembling at every price swing, clutch their wallets like talismans. Meanwhile, the suits in glass towers sip their artisanal coffee and whisper of ETF inflows and institutional adoption-a game of chess where the pawns are us and the king is an algorithm.

This pattern repeats like a broken clock: retail fear peaks near cycle lows, while the wise (or simply wealthy) accumulate assets with the patience of a tortoise racing a hare in a blockchain marathon. If XRP were to break free from Bitcoin’s chains, analysts claim it would be the accumulation during uncertainty that sets it aloft. Or perhaps they’re just making it up as they go.

Ripple’s Long-Term Infrastructure Strategy

According to Brad Garlinghouse, XRP’s triumph will not arrive in a blaze of glory but rather in the quiet drizzle of infrastructure. Ripple, that noble enterprise, has spent years forging partnerships, engaging regulators, and polishing the XRP Ledger like a miser polishing his gold. Their upgrades-liquidity, cross-border payments, tokenization-sound as thrilling as a spreadsheet audit. Yet, supporters insist this methodical approach will fortify XRP’s foundations against the storms of speculation. One can only hope they’re not building a castle in the sand.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Or don’t-either way, the market won’t care.

FAQs

How much XRP do you need to be in the top 10% of holders?

Approximately 2,232 XRP, a sum that now grants you the dubious privilege of joining the 1%. A small price to pay for the illusion of wealth.

Is XRP distribution becoming more decentralized?

Retail wallets rise like dandelions in a storm, but the titans at the top still hoard the lion’s share. Decentralized? Hardly. Merely less centralized than a central bank.

Is Ripple’s long-term strategy bullish for XRP?

Ripple’s focus on infrastructure and payments may one day matter-or it may join the pantheon of forgotten buzzwords. Only time, that fickle goddess, shall tell.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-02-17 11:03