Constellation Energy (CEG +4.44%) is due to report earnings this week, or thereabouts. These things are never precisely on schedule, you see. It’s a bit like trying to predict the British weather – a best guess, informed by precedent, but ultimately subject to the whims of fate. They’ve historically announced around this time, so let’s say before February 20th, and proceed with cautious optimism.

Now, the question is, should you consider adding this particular power provider to your portfolio? It’s a perfectly reasonable inquiry, and one deserving of a bit of careful examination. The energy sector, as anyone who’s glanced at their electricity bill lately knows, is… complicated. And Constellation, with its rather significant investment in nuclear power, adds another layer of intrigue.

A Brief Look Back

Last we heard, back in November, Constellation was reporting adjusted operating earnings of $3.04 a share, a respectable uptick from $2.74 the year before. The CEO, Joe Dominguez, rather modestly noted they’d had “one of the highest operating quarters for our nuclear fleet.” Which, when you consider the sheer complexity of running a nuclear power plant – and the potential consequences of not running it well – is rather impressive. It’s a bit like successfully baking a soufflé while simultaneously juggling chainsaws. A feat of engineering, really.

They also narrowed their full-year guidance, projecting earnings per share of $9.05 to $9.45 for 2025. Through the third quarter, they’d clocked in at $6.02 a share, suggesting a fourth-quarter haul of around $3.03 to $3.43. Numbers, numbers everywhere. It’s enough to make one long for a simpler life, perhaps involving sheep farming.

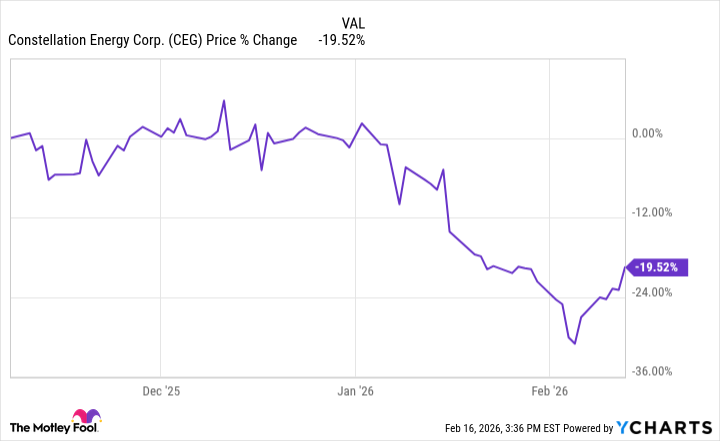

However, and this is where things get a little perplexing, the market hasn’t exactly reacted with unbridled enthusiasm. The share price hasn’t exactly soared since that last earnings report. It’s been doing a bit of a wobble, a sort of hesitant dance that suggests uncertainty. Which, frankly, is often the most interesting part of the stock market. Predictability is terribly dull.

Multiple Catalysts, Murky Results

Despite what appears to be a rather promising trajectory – and the rather significant acquisition of Calpine for $26.6 billion (a sum that feels rather large when written out) – the share price has been stubbornly downbeat. This Calpine deal, you see, has created a much larger, more diversified power producer. It’s like combining a rather efficient bicycle with a rather powerful steam engine. Theoretically, it should go faster.

They’ve also secured a 380-megawatt agreement with CyrusOne, a data center developer. Apparently, data centers require a lot of power. Who knew? It’s the third such agreement, totaling 1.1 gigawatts. That’s enough to power a small city, or a very large collection of computers.

And, just to add another layer of complexity, the U.S. Nuclear Regulatory Commission has approved some license amendments and renewals for their facilities. This unlocks over $500 million in investment for modernization and upgrades. It’s all rather reassuring, really. One hopes they’re using high-quality components.

A Potential Turning Point?

So, here we are. The share price is down, despite all this positive news. It’s a bit like preparing a magnificent feast and then finding out nobody is hungry. Perhaps the market is simply being cautious. Or perhaps it’s simply being… quirky. The stock market, after all, is not known for its unwavering logic.

But, with the Calpine deal closed and these new growth investments secured, the company appears well-positioned to capitalize on the increasing demand for power, particularly from those power-hungry data centers. So, buying before the earnings report might, just might, be a shrewd move. If they unveil strong guidance this week, the share price could well surge. Or it might not. That, ultimately, is the thrilling, frustrating, and endlessly fascinating mystery of the stock market.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-02-17 09:52