Right. So, Nvidia. Everyone’s gone mad for Nvidia. Honestly, it’s a bit… exhausting. Like being at a party where everyone’s talking about the same holiday to Bali. It’s all GPUs and AI and exponential growth. And me? I’m left feeling vaguely inadequate and wondering if I should have invested sooner. Which, naturally, I didn’t. Because that would be too easy.

But then I started looking at… well, the bits that aren’t the glamorous GPUs. The stuff that actually holds all the data. The storage. And that’s where Sandisk comes in. It’s not exactly sexy, is it? Like comparing a supermodel to a sensible pair of shoes. But sensible shoes are often more useful. And, dare I say, potentially more lucrative.

Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24. I’m trying to be rational, honestly. It’s just… the whole market feels a bit frothy. Like a cappuccino that’s about to overflow. So, I’m looking for something… solid. Something that isn’t entirely reliant on the latest AI hype cycle. Something… underappreciated.

From Flash Drives to… Whatever This All Is

Remember Sandisk? They used to be all about those little memory cards for digital cameras. And, yes, I still have a box of them somewhere. Probably next to my Betamax player. It was a good business, back then. Simple. Now, it’s all enterprise solid-state drives and NAND flash memory. Which sounds… complicated. But the principle is the same: storing information. Just… a lot more of it. And for things that are far more demanding than holiday snaps.

It’s a bit like Nvidia’s journey, really. They started with graphics for games (I remember those days, too – hours spent playing Tomb Raider, a truly formative experience). Then someone realised those chips could do other things. Like, you know, power the entire AI revolution. And Sandisk seems to be having a similar moment. Except, instead of flashy graphics, they’re providing the foundation for all that data. Which, let’s be honest, is probably more important.

Can Sandisk Be the Nvidia of… Storage? (Don’t Laugh)

Okay, I know what you’re thinking. This is ridiculous. Comparing Sandisk to Nvidia? It’s like comparing a librarian to a rock star. But hear me out. Nvidia had a first-mover advantage. They were the first to really nail the GPU architecture for AI. Sandisk is in a similar position with high-bandwidth memory. It’s a fragmented market, with Micron, Samsung, and SK Hynix all vying for dominance. But Sandisk seems to be quietly building a strong position.

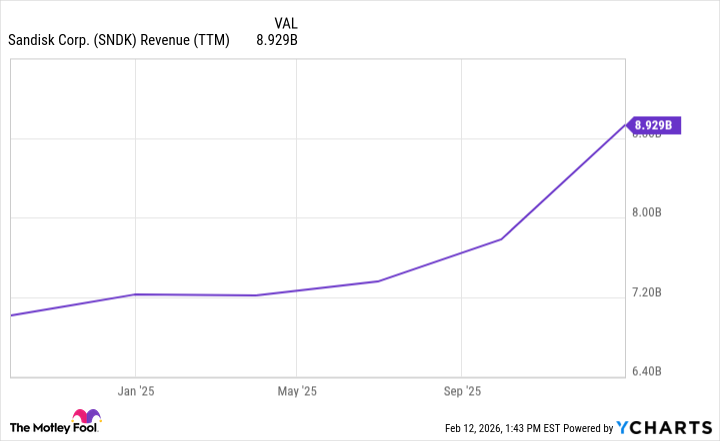

Apparently, the total addressable market for high-bandwidth memory is going to be around $35 billion this year. And it’s expected to grow to $100 billion by 2028. That’s… a lot of storage. Sandisk’s revenue last year was only $9 billion. Which means they have a lot of room to grow. I’m not saying it’s a sure thing. Nothing ever is. But it’s certainly more interesting than another article about Nvidia’s price targets.

The Pick-and-Shovel Play (Or, Why I’m Feeling Slightly Less Panicky)

Everyone’s throwing money at Nvidia and AMD. And Broadcom, with their custom ASICs. Which is fine. But someone has to provide the storage for all that data. It’s like the gold rush. Everyone focuses on the gold miners, but the guys who sold the shovels often did pretty well. And that’s where Sandisk comes in. They’re the shovel sellers.

Apparently, the hyperscalers are moving beyond chatbots and exploring things like robotics, autonomous systems, and… agentic AI. Whatever that is. It sounds terrifying. But it also means they’re going to need a lot more storage. And as AI workloads scale, capacity alone isn’t enough. You need fast, reliable storage. Which, hopefully, Sandisk can provide.

Number of Times I’ve Considered Selling Everything and Becoming a Beekeeper: 3. I’m trying to stay focused. Sandisk isn’t going to make me rich overnight. But it’s a solid company in a growing market. And, frankly, it’s a bit more sensible than most of the other AI investments out there. So, yes, I think Sandisk can be thought of as a “new Nvidia.” Or, at least, a “new shovel seller.” Which, in this market, might be just as good.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-02-16 23:22