The year 2025, a curious vintage. For years, the American behemoth, the S&P 500, had gorged itself on returns, leaving its international brethren to scavenge the crumbs. A predictable affair, really. Capital, like a frightened dog, always seeks the loudest bark and the most polished collar. But even dogs tire of the same trick, and the pendulum, that most democratic of instruments, began a hesitant swing. A swing, mind you, that many had declared broken years ago, replaced by a permanently fixed American exceptionalism. How very…convenient.

Now, a faint stirring. The air smells not of revolution, but of…correction. The “Magnificent Seven,” those gilded idols of the American market, cast long shadows, and shadows, as any magician knows, eventually consume the object they conceal. A rotation is underway, a subtle shifting of weight. Investors, those fickle creatures, are beginning to glance beyond the familiar shores, seeking value where it has long been dismissed as quaint or…foreign. It’s a bit like a man, weary of caviar, suddenly craving a simple loaf of rye. Not necessarily a sign of impending doom, but certainly a change in appetite.

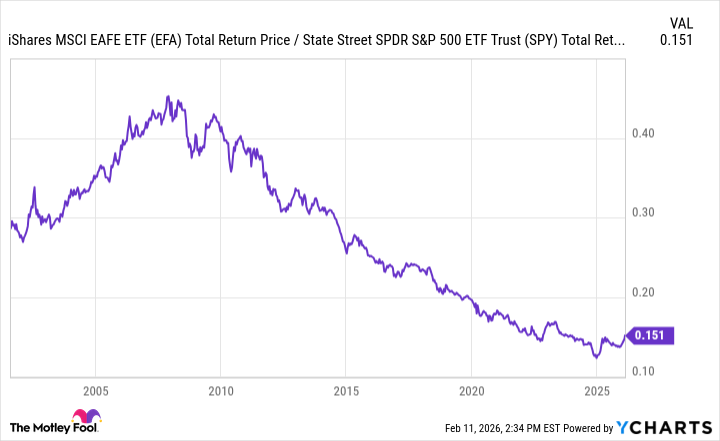

A Comparative Reckoning

In the year just passed, the iShares MSCI EAFE ETF, a modest vessel carrying the hopes of developed foreign markets, managed a respectable 31.6% return, leaving the State Street SPDR S&P 500 ETF trailing at 17.7%. The iShares MSCI Emerging Markets ETF, a more adventurous craft, fared even better at 34%. Not a landslide, certainly, but a crack in the American fortress. It wasn’t merely a rejection of American tech, though that contributed. It was, rather, a rediscovery of the virtues of…moderation. A realization that growth, pursued relentlessly, can become a grotesque parody of itself. And, of course, a weakening dollar always helps lubricate the gears of international finance. A bit like offering a bribe to the market gods.

The ETF crowd, those diligent acolytes of the market, have taken notice. International and emerging market equity ETFs are attracting capital at nearly twice the rate of their American counterparts. A surge of interest, or merely a temporary distraction? Time, that relentless judge, will tell.

Whispers of Opportunity

Several winds fill the sails of foreign equities. Valuations, for one. The S&P 500, currently trading at a forward price-to-earnings ratio of 29, resembles a particularly arrogant nobleman demanding an exorbitant price for his wares. International developed and emerging markets stocks, trading at 19 and 18 times earnings respectively, are…less ostentatious. A simple truth: cheap things are often overlooked until they become expensive.

There’s talk of economic tailwinds, too. Fiscal stimulus in Germany, productivity gains, a weaker dollar. But these are mere promises, whispered in the corridors of power. Earnings growth, stagnant in much of Europe, is expected to accelerate. But expectations, as any seasoned gambler knows, are often crueler than reality. And then there’s diversification. Foreign markets, blessedly, are less reliant on the whims of a single sector. A refreshing change, really. A bit like escaping a crowded ballroom for a quiet garden.

The Shadows Lengthen

But even in this tentative dawn, shadows linger. Geopolitical risk, of course. Global trade tensions, a perpetual source of anxiety. A sustainable rebound in the dollar would act as a headwind, a cold blast of reality. And the cyclical sensitivity of many international economies. A slowdown in manufacturing or trade would be felt acutely, a sharp pain in the side. It is, after all, a world built on fragile foundations, held together by hope and…debt.

The Pendulum’s Arc

Given the American market’s relentless outperformance since the financial crisis, it’s almost…unnatural that international stocks haven’t already staged a more dramatic recovery. They are, to put it mildly, overdue.

International stocks are, on average, more cyclically sensitive and demonstrate better value. But investors, those creatures of habit, have consistently preferred American tech and growth. Sentiment is, however, beginning to shift. Value is back in favor, and the comparatively better growth acceleration expectations of international markets could be the key.

If foreign companies can deliver on those expectations, it could be another good year for international investing. Or it could all be a mirage, a fleeting illusion. The market, after all, is a cruel mistress, and she delights in disappointing those who trust her too much. But even a fool, as they say, can occasionally catch a falling star.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-02-16 22:03