The market’s been handing out premiums like confetti at a parade. Everything’s overpriced, polished, and pretending to be something it isn’t. Dig a little, though, and you find a few names that haven’t gotten the memo. Stocks that have stumbled, fallen, and are now lying there, looking…vulnerable. I’ve been looking. It doesn’t mean they’re buys, mind you. Just that they’re interesting. Like a stray dog with a limp.

Sprouts Farmers Market

Sprouts. The name itself is optimistic. The stock hasn’t been. It soared for a while, riding the health kick, then took a tumble. A 60% drop. That’s not a correction; that’s a freefall. Now it’s trading at twelve times this year’s projected earnings. Five dollars and seventy-four cents a share. Plausible, they say. Everything’s plausible until it isn’t. Analysts think it’s worth a hundred and eight bucks. They always do. The chart looks like a broken staircase.

The story is health food, of course. People talk about eating better. They mostly eat what’s cheap and tastes good. But the industry gurus predict growth. Ten percent a year. Numbers. They’re just numbers. The market will believe what it wants to believe.

Progressive

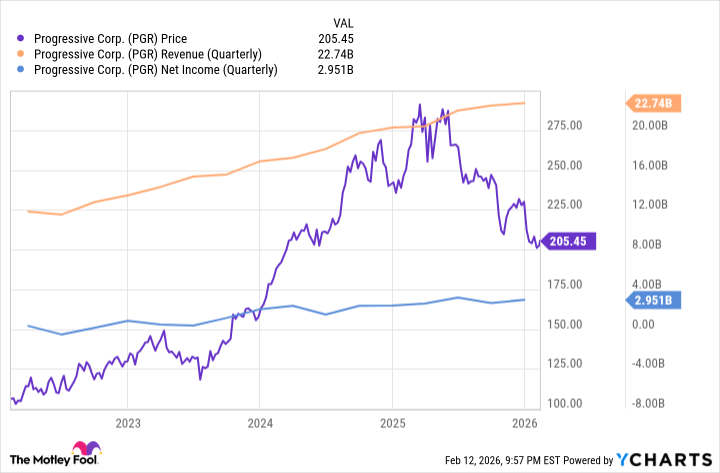

Insurance. A business built on assessing risk. And yet, it’s the riskiest business of all. You’re betting on things not happening. Progressive’s been having a rough patch. Revenue growth slowing. That’s enough to spook the suits. The stock’s been drifting. Like a barge without a rudder.

The bears overreacted, as they usually do. Trading at thirteen times next year’s earnings. A dividend yield pushing seven percent. That gets your attention. The misunderstanding? Revenue growth is slowing, yes. But they’re still bringing in the money. A steady drip, not a gusher. But reliable. Like a leaky faucet in a dark room.

Insurance companies are built on actuarial tables and cold calculations. They’re good at what they do. Over the long haul. If you can stomach the short-term volatility. Which, let’s face it, is considerable.

PayPal

PayPal. Once the king of the hill. Now facing a crowded battlefield. Growth is slowing. That’s the story. The market is pricing in a collapse. Eight times this year’s earnings. That’s… optimistic, considering the competition. Single-digit growth is the new normal. Accept it. Or move on.

They still control forty percent of the online payment market. That’s a moat, of sorts. A shallow one, but a moat nonetheless. A new CEO is coming in, from HP. Enrique Lores. Fresh ideas, they say. It’s a long shot. But a foundation is there. A cracked one, maybe. But a foundation.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Wuchang Fallen Feathers Save File Location on PC

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Best Video Games Based On Tabletop Games

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

2026-02-16 20:24