A year ago, Sandisk, which sounds like a particularly stubborn piece of beach debris, re-emerged as an independent entity. Western Digital, having briefly collected it like a rare seashell, let it go. And since then? Well, the stock has done this thing. It’s…ascended. Over 1,500 percent. My Aunt Carol, who still forwards chain emails about the dangers of 5G, called to ask if she should remortgage. I told her to maybe stick with the lottery.

I spend my days staring at spreadsheets, trying to predict the future based on numbers that are, let’s be honest, largely made up. It’s a bit like trying to assemble IKEA furniture with only the pictures as instructions. But every now and then, something genuinely interesting surfaces. And Sandisk, despite the name conjuring images of forgotten toys, might just be that thing.

Everyone’s talking about Nvidia, of course. The golden child of the AI boom. They make the brains, the GPUs, that allow computers to think, or at least pretend to. Meta, Alphabet, Microsoft, Amazon, even OpenAI – they’re all throwing money at Nvidia like it’s going out of style. Which, given the rate of technological obsolescence, it probably is. But all this processing power requires something to remember things. And that’s where things get interesting. And slightly claustrophobic, if you think about the sheer volume of data we’re all generating.

I was at a conference recently, surrounded by people who use words like “synergy” and “disruptive” with alarming frequency. One presenter, a man whose tie seemed to be actively choking him, was explaining the challenges of scaling AI infrastructure. He kept mentioning “memory bottlenecks.” It reminded me of my own attempts to scale a Thanksgiving turkey – always a bottleneck, and usually involving a lot of frantic basting. But in this case, the bottleneck wasn’t gravy, it was HBM – high-bandwidth memory. Apparently, we’re running out of places to store all this digital stuff.

Big Tech isn’t just hoarding GPUs anymore. They’re starting to realize that all that processing power is useless without a place to put the results. So, they’re shifting their focus – and their budgets – towards DRAM and NAND solutions. Which, as it happens, is exactly what Sandisk does. They make the digital equivalent of filing cabinets, only much, much faster. And infinitely more fragile, if you drop them.

The next generation of AI isn’t just about chatbots. It’s about self-driving cars, robotic surgery, and systems that can process data in real-time. These systems need rapid access to information. They need memory that’s not just big, but also incredibly fast. And that means solid-state drives, DRAM, and NAND flash storage. Precisely what Sandisk offers. It’s not glamorous, but it’s essential. Like plumbing.

How Much Higher Can Sandisk Stock Go?

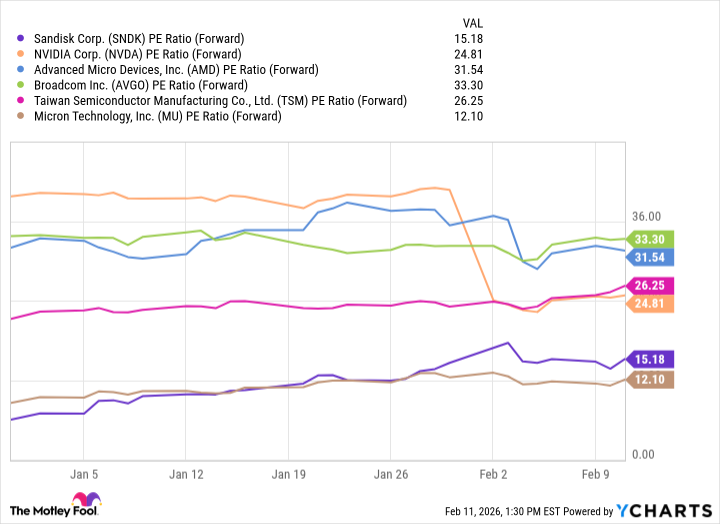

As of today, February 11th, Sandisk stock is hovering around $600 a share. Which sounds…expensive. My broker keeps sending me emails with subject lines like “Don’t Miss Out!” and “Time is Running Out!” It’s very stressful. But share price alone doesn’t tell the whole story. Analysts are predicting earnings per share of $39.45 in 2026 and $76.34 in 2027. And despite this optimistic outlook, it’s currently trading at a relatively modest price-to-earnings multiple of 15.

Other AI chip leaders are trading at much higher multiples – in the mid-20s to low-30s. Micron Technology, another player in the high-bandwidth memory space, is the closest comparable. To me, this suggests that growth investors haven’t fully priced in the potential upside of rising AI infrastructure spending into the shares of memory and storage companies. Sandisk, despite its impressive gains, might still be undervalued.

If Sandisk’s valuation were to align with its peers, the stock could reasonably soar to $1,000 a share or more by the end of the year. It’s a big “if,” of course. But in a world where everything seems to be accelerating towards some unknown destination, it’s not entirely unreasonable. Calling Sandisk the “next Nvidia” might be a bit hyperbolic. But I’m optimistic that the company will continue to rise, mirroring Nvidia’s early trajectory during the AI revolution. Which makes it a compelling buy-and-hold opportunity, at least until the next technological bubble bursts. And it always does.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 17:12