One gathers the S&P 500 is experiencing a touch of… indecision. How tiresome. Naturally, the perpetually anxious are turning their attention to dividend stocks. The theory, as I understand it, is that one receives a small, regular payment simply for allowing a company to utilize one’s capital. A rather quaint notion, really. But, if one must dabble, it’s marginally less ghastly than most pursuits. Provided, of course, one isn’t expecting miracles.

These payments, while hardly a fortune, can at least provide a temporary distraction from the general unpleasantness of the market. And, during periods of stagnation – or, as some optimists call them, “opportunities” – they offer a smidgen of momentum. One shouldn’t rely on it, naturally. But a little extra income never ruined anyone. Let’s examine two companies that, shall we say, have a history of not entirely collapsing.

1. Target

Target is, apparently, a ‘Dividend King’. One assumes they wear crowns of some sort. More to the point, they’ve been distributing a portion of their earnings for half a century. An impressive feat, if one considers the number of companies that have vanished in that time. They currently offer a dividend of $4.56, yielding 4%. A trifle more generous than the S&P 500’s offering, though one shouldn’t mistake it for a windfall.

Recent years haven’t been particularly dazzling for Target, revenue-wise. But a new chief executive, Michael Fiddelke, has taken the reins. One hopes he possesses a modicum of competence. The stock is currently valued at 14 times forward earnings – a slight improvement over last year. A potential recovery story, perhaps? One shouldn’t hold one’s breath. Still, a bit of passive income while one waits for the inevitable… it’s a small consolation.

2. Coca-Cola

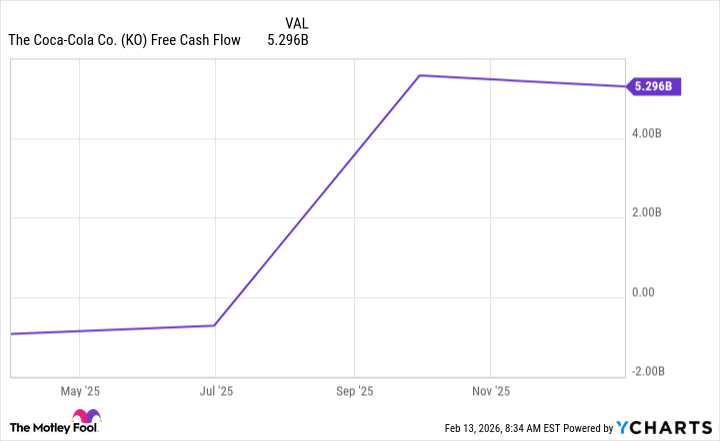

Coca-Cola, like Target, is a ‘Dividend King’. One pictures a rather sticky monarchy. They, too, have a long history of dividend payments. And a considerable amount of cash flow, which is, admittedly, rather useful. They currently offer $2.04 in dividends, yielding 2.5%. Again, hardly a fortune, but a respectable effort.

Coca-Cola’s enduring success is, apparently, due to a ‘moat’. A rather charming metaphor, though one suspects it’s simply a matter of clever marketing and ubiquitous distribution. Consumers, it seems, are rather fond of their fizzy beverages. Sprite and Minute Maid also enjoy a certain… popularity. The stock trades at 24 times forward earnings – a steady valuation, if somewhat uninspired. One pays a premium for stability, of course. Though whether it’s worth it is, as always, debatable.

Ultimately, these dividends are merely a palliative. A small distraction from the inherent uncertainties of the market. One shouldn’t mistake them for a solution. But then, one rarely finds solutions in this particular arena, does one?

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2026-02-16 16:22