So, the robots are getting smarter. It’s happening. And people, predictably, are getting jittery about stocks. GoDaddy, of all companies, is caught in the downdraft. GoDaddy. The folks who sell you the digital dirt for your website. It’s funny, isn’t it? So it goes.

Why Isn’t Anyone Paying Attention?

They register names, host websites, the usual. They have servers, actual machines humming with electricity, which feels…substantial in a world increasingly made of air. It’s a business, a perfectly ordinary business, which is almost a novelty these days.

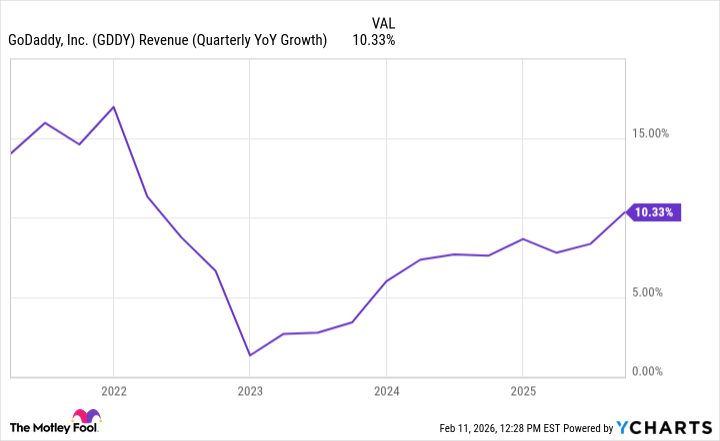

Turns out, this AI business is actually helping GoDaddy. They’ve got these little AI helpers working for them, making things more efficient. Third quarter revenue was up ten percent. Not a revolution, mind you. But operating income jumped seventeen percent. Seventeen. That’s a respectable number, in a world of diminishing returns.

And they’re selling AI tools to you now. Airo, they call it. Helps you build a website, design a logo. Makes it easier to exist in the digital ether. The chart shows a little bump in revenue. A tiny blip. But a blip nonetheless.

They think there’s a new wave of web addresses coming, for all these AI agents. Like they need names. As if giving a robot a name will somehow make it less likely to take over the world. They’re launching “agent name services.” It’s a solution looking for a problem, maybe. But who are we to judge? So it goes.

So, they’re growing, they’re making a little more money, and they’re trying to stay relevant. It’s all very…human. And, from a business perspective, it’s…okay. Not great. Just…okay.

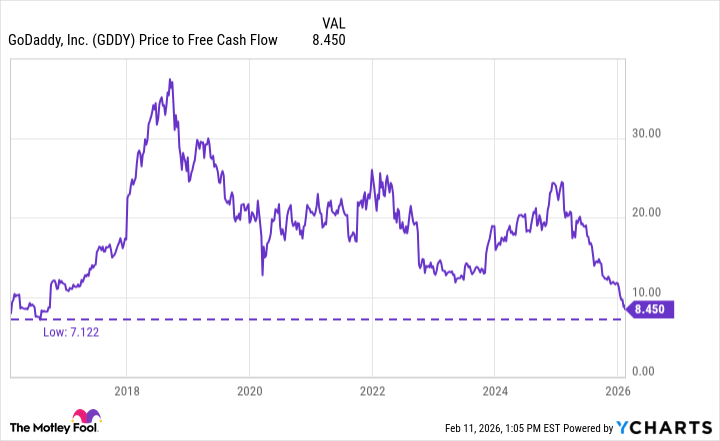

From an investment perspective, it’s…interesting. They’re trading at just over eight times free cash flow. Eight. That’s cheap. The cheapest they’ve been in nearly a decade. Which means either everyone else knows something I don’t, or…well, or nothing at all. It’s often just nothing at all.

They’ve been buying back their own stock. Almost $1.4 billion worth. Which is a way of saying they don’t have a better use for the money. Or maybe they do, and they’re just being polite. They still have another $2.4 billion to spend. A lot of money. Enough to buy a small country, probably. So it goes.

With a market cap of about $12 billion, they can keep returning cash to shareholders. It’s a cycle. Money in, money out. A meaningless ritual, perhaps. But it keeps the gears turning.

I think GoDaddy is a hidden value stock. A small, flickering candle in the vast darkness. The business is…functional. Profits are up a little. The stock is cheap. And they’re buying back shares. For investors looking for something to believe in, GoDaddy checks a few boxes. It’s not a solution to the human condition, of course. But then, what is?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 16:12