It is a truth universally acknowledged that a bank in possession of a good reputation must be in want of innovation. For too long, the financial world has been content with the merely adequate, a landscape of grey suits and greyer ideas. One might almost suspect a conspiracy of mediocrity. However, even in this rather dismal realm, a few institutions are beginning to display a certain…flair. They are not merely repositories of wealth, but rather, engines of possibility, and, dare I say, even a touch of style.

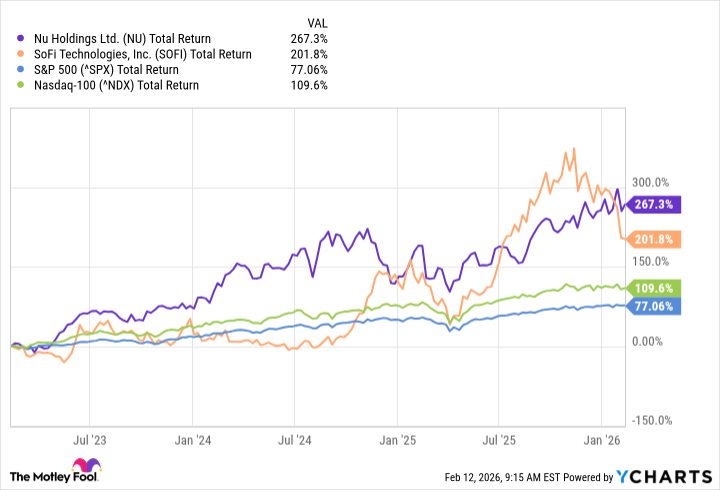

Consider, if you will, Nu Holdings (NU 1.29%) and SoFi Technologies (SOFI +1.55%). These are not your grandfather’s banks – though one suspects a wise grandfather might approve. They have not simply kept pace with the market; they have outstripped it, leaving the lumbering giants in their wake. Over the past three years, they have not merely outperformed the S&P 500 and the Nasdaq 100; they have positively danced around them, a delightful spectacle for the discerning investor.

One should always be wary of excessive optimism, of course. But in these two cases, a degree of confidence appears…justified. Let us examine why they are poised to remain the most captivating of financial institutions through 2030.

1. Nu: A Brazilian Rhapsody

Nu, a purely digital bank originating from Brazil, is not merely disrupting the financial landscape; it is rewriting the rules. Before its arrival, even those with ample fortune faced obstacles, and the less privileged were effectively excluded. It operated, until recently, as a non-bank financial entity, a clever maneuver that allowed it to offer services with a certain…unconventionality. To deny access to financial services is, after all, a rather vulgar display of power.

Its growth has been nothing short of explosive. More than 60% of Brazil’s adult population now utilize the platform, attracting clientele from all walks of life. One might assume saturation is near, but that would be a rather unimaginative conclusion. Nu continues to onboard approximately one million new members each month in Brazil, and, crucially, is beginning to monetize its user base. Many customers currently hold only a NuBank product, suggesting ample opportunity for cross-selling and expansion. It is a simple truth: the more one possesses, the more one desires.

Furthermore, it is making significant inroads in Mexico (14% of the adult population) and Colombia (10%). Management hints at expansion into new markets, and has recently applied for a banking charter in the United States. A bold move, perhaps, but one cannot achieve greatness without a touch of audacity.

Nu is, in essence, just beginning its ascent. It promises to reward investors handsomely, not merely in the next five years, but for decades to come.

2. SoFi: An American Ingenuity

SoFi, while operating within the American framework, shares a similar spirit with Nu. It is focused on lending, yes, but also on embracing the possibilities of blockchain technology. Its ambition? To become a top-10 U.S. financial institution. A rather grand ambition, but one cannot fault a little aspiration.

Like Nu, its success is rooted in a growing membership base. It added a record one million new customers in the fourth quarter of 2025, a 35% year-over-year increase, bringing the total to nearly 13.7 million. A rapid pace, certainly, but SoFi remains a relatively small bank, leaving ample room for expansion. One must remember, size is not always an indicator of quality, but it does provide a certain…stability.

With interest rates easing, SoFi’s lending business, which still accounts for approximately half of its revenue, is experiencing a welcome resurgence. And as the company matures and gains experience navigating various economic climates, it is better positioned to withstand future turbulence. One should always prepare for the unexpected; life, after all, is rarely predictable.

However, the true growth is occurring within its financial services segment, which includes non-lending offerings like bank accounts and investment opportunities. Revenue increased by 78% year-over-year in the fourth quarter, and contribution profit doubled. A most encouraging sign.

Its tech platform, while not growing as rapidly, is now being leveraged to create innovative financial products, such as its new all-in-one Smart Card. A clever innovation, one might say, though whether it will truly revolutionize the industry remains to be seen.

SoFi is brimming with potential, and it is poised to continue outperforming its peers for the foreseeable future. A most agreeable prospect, wouldn’t you agree?

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2026-02-16 15:13