![]()

The current enthusiasm for artificial intelligence, a sort of mechanized divination, has become quite the fashionable frenzy on Wall Street. The notion of systems dispensing with the tiresome necessity of human judgment, and presumably, responsibility, is naturally attractive to those engaged in the pursuit of profit. It promises, as all such things do, a fortune. And, of course, a great deal of bother.

Nvidia, a name now uttered with a reverence usually reserved for saints or successful generals, has become the unlikely beneficiary of this technological hysteria. Since late 2022, the company has accrued a market capitalization that would shame a small European principality – a truly remarkable feat, and one that invites a degree of scrutiny often absent in these giddy times.

The quarterly earnings, naturally, are treated as revelations. The company is expected to present its fourth-quarter results on February 25th, and the anticipation is, frankly, absurd. Analysts, ever eager to justify their fees, predict a triumph, and Nvidia will undoubtedly oblige. The question, however, is not whether they will meet expectations, but whether those expectations are, in fact, tethered to reality.

The Insatiable Appetite

The current consensus suggests sales of approximately $65.6 billion, and earnings per share of $1.52. Nvidia has, in recent quarters, demonstrated a knack for exceeding such forecasts, a habit which, while pleasing to shareholders, does little to alter the underlying arithmetic. The demand for their graphics processing units – the very brains of this new digital oracle – remains, shall we say, robust. These chips, powering everything from algorithmic trading to the generation of increasingly vapid content, are in short supply, and command a correspondingly extravagant price.

Their Hopper, Blackwell, and Blackwell Ultra generations, possess a certain technical superiority, a fact readily acknowledged by those who lack the resources to challenge it. Jensen Huang, the company’s chief executive, has been diligent in maintaining this advantage, investing heavily in research and development. One suspects, however, that even the most advanced chip cannot indefinitely defy the laws of supply and demand.

The CUDA software platform, a proprietary ecosystem, deserves mention. It is a clever device, locking customers into the Nvidia fold, and ensuring a steady stream of revenue. It is also, one might observe, a rather blatant exercise in monopolistic practice, but such niceties rarely trouble the truly successful.

The Inevitable Reckoning

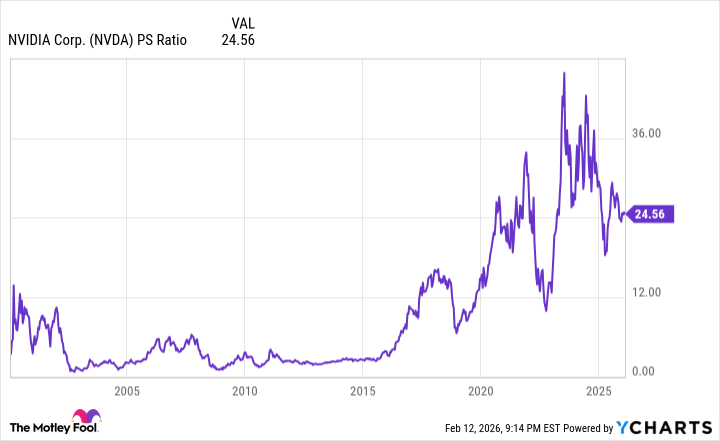

The problem, as is so often the case, is valuation. Nvidia’s current price-to-sales ratio, while somewhat diminished, remains alarmingly high. The market, it seems, is prepared to pay a substantial premium for a company that dominates a nascent industry. Whether that premium is justified remains to be seen. History suggests that such bubbles, while entertaining for those who profit from them, invariably burst.

The outlook for fiscal 2027 is equally troubling. While Nvidia’s guidance is invariably optimistic, two factors threaten to dampen the prevailing enthusiasm. Firstly, internal competition is brewing. The ‘Magnificent Seven’ – those behemoths of the digital age – are increasingly inclined to develop their own in-house solutions, a sensible precaution for those who rely so heavily on technology. While these efforts may not yet match the sophistication of Nvidia’s chips, they are considerably cheaper, and, crucially, available.

Secondly, the aforementioned supply constraints are beginning to ease. Taiwan Semiconductor Manufacturing, the company responsible for producing these chips, has been expanding its capacity at a prodigious rate. As production increases, Nvidia’s pricing power will inevitably diminish. The days of charging exorbitant prices for a scarce commodity are numbered.

A perfect quarter, therefore, is unlikely to sustain the near-parabolic ascent of the past three years. Nvidia remains a formidable company, but even the most advanced technology cannot defy the immutable laws of economics. The gilded cage, one suspects, is beginning to show its age.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 15:12