The S&P 500, bless its heart, has been doing alright for itself. Three years of gains. Not bad. People piled into these AI things, quantum whatsits, anything that smelled of future money. And for a while, it worked. So it goes.

But things, as they often do, slowed down. The market got a little… thoughtful. Worries started to bloom. Interest rates, AI expectations, the usual suspects. Meta and Taiwan Semiconductor gave us a little cheer, but it wasn’t enough to get the party started again. People stopped throwing money quite so enthusiastically. Understandable, really.

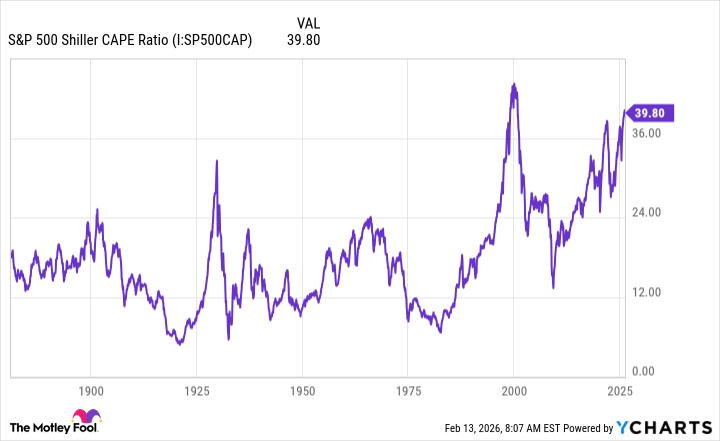

And now this. The S&P 500 is doing something it’s only done twice in 154 years. A peculiar little dance. It involves valuations. And history, well, history isn’t known for its surprises. It mostly just repeats itself, doesn’t it?

What’s Been Weighing on Things

The Fed started fiddling with interest rates, cutting them, then pausing. Markets don’t like uncertainty. It’s like being told a story without an ending. You just want to go home. And these tech companies, Alphabet, Amazon… they’re spending a lot on AI. A lot. Investors noticed. It’s a lot of money to bet on something that might or might not change the world. So it goes.

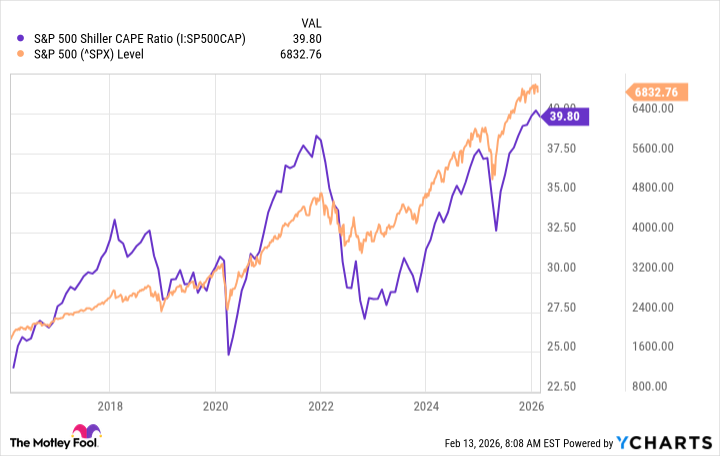

This brings us to the valuation. The Shiller CAPE ratio. It’s gone above 39. Once before, it did that. Right before the dot-com bubble. A coincidence? Maybe. But history tends to rhyme, not repeat exactly. It’s like a slightly altered version of a song you thought you knew.

What History Says

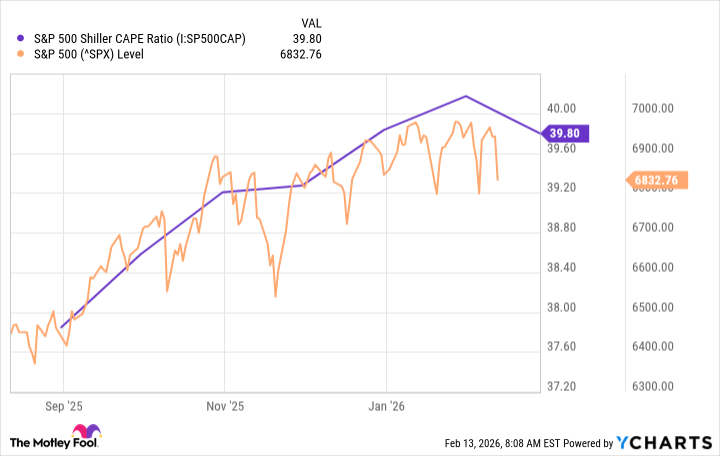

If you look back ten years, you’ll see a pattern. High valuations, then a fall. It’s not a law of nature, of course. Just a tendency. Like gravity, but with more paperwork. And lately, the valuation has started to dip. A tiny little dip. Maybe it means something. Maybe it doesn’t. So it goes.

Another dip, a slight one, over the past month. It’s starting to look like a familiar story.

Does this mean a big crash is coming? Not necessarily. The market might slip a bit, valuations might come down, and then things might recover. It could go either way. It always could. The universe doesn’t owe us a stable stock market. It’s a cold, indifferent place.

But here’s the thing. The S&P 500 has always recovered. From every crash, every disaster. It’s a remarkably resilient beast. So, even if things get rough, remember that. It’s temporary. It always is. Buy good stocks, hold onto them, and try not to worry too much. It’s just money, after all. And we all end up the same way in the end. So it goes.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 12:22