Well, bugger me with a blockchain, Michael Saylor’s at it again. According to the grand wizard of Strategy, even if Bitcoin takes a nosedive to $8,000, his company’s still got enough wizardry to keep the debt collectors at bay. Simple, he says. As simple as explaining the rules of Cripple Mr. Onion to a drunk dwarf. The reality, of course, is about as straightforward as a Lancre tax code.

Debt Cushion: Thicker Than a Troll’s Skull?

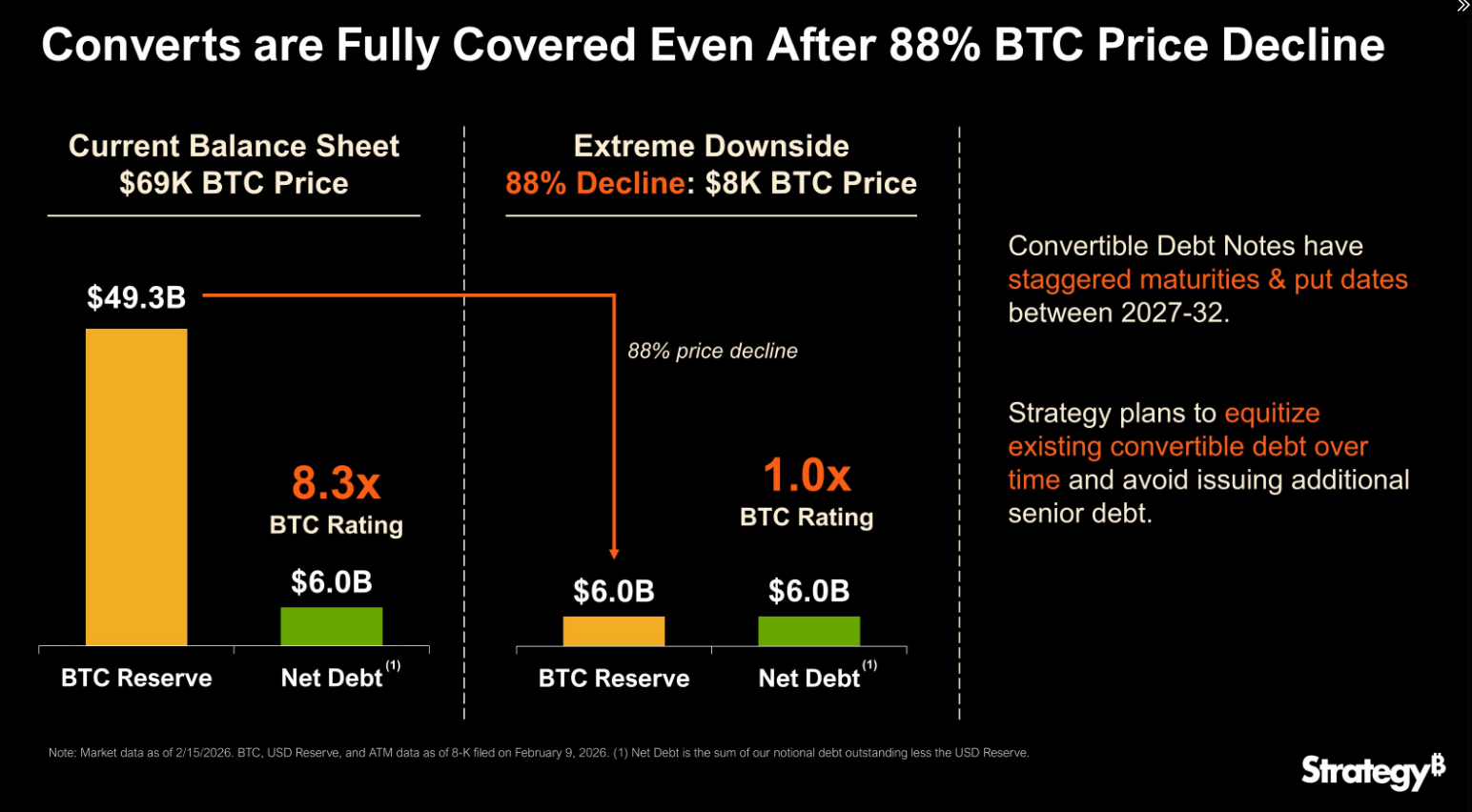

Reports claim Strategy’s got a $6 billion net debt staring at its crypto holdings like a goblin eyeing a gold coin. On paper, a Bitcoin crash might leave them just about even. But paper’s a fickle thing, isn’t it? Timing’s the real trick here. Liquidity windows, market access, and investor panic can turn that “cushion” into a damp tissue in a storm.

“Strategy can withstand a drawdown in $BTC price to $8K and still have sufficient assets to fully cover our debt.”

– Strategy (@Strategy) February 15, 2026

Equitization: Shareholders, Meet the Dilution Dragon

Saylor’s got a plan to turn debt into shares over the next three to six years. Sounds clever, until you realize it’s like swapping a dragon for a swarm of gnats. Shareholders get diluted, deadlines stretch like a rubber band, and interest payments keep ticking like Death’s scythe. If the market sneezes, this plan might just catch a cold.

“Our plan is to equitize our convertible debt over the next 3-6 years.”

– Michael Saylor (@saylor) February 15, 2026

Buying the Dip: Or Diving into the Abyss?

Strategy’s been hoovering up Bitcoin like a wizard collecting rare spells, even as losses pile up like unpaid tavern tabs. Confidence? Or just a fancy way to say “doubling down on madness”? Either way, it’s a wild ride for investors, who’re probably clutching their shares like a dwarf clings to his axe.

CEO’s Crystal Ball: Cloudy with a Chance of Bankruptcy

Phong Le reckons an 80% Bitcoin drop would take years to really hurt the business. Years, mind you, assuming the credit markets don’t slam shut like a trapdoor and cash flow stays as steady as a Ankh-Morpork watchman’s bribe. Assumptions, eh? About as reliable as a witch’s weather forecast.

Saylor’s Political Gambit: Lobbying or Wishful Thinking?

Saylor’s off trying to convince the US to treat Bitcoin like gold. Bold move, considering politicians change their minds more often than a chameleon changes colors. Trump and his lot might have other ideas, and legislation moves slower than a tortoise in a treacle mine.

So, there you have it. Strategy’s got a plan that’s technically sound, provided the markets don’t throw a tantrum, shareholders don’t flee, and the political winds blow just right. Easy peasy, lemon squeezy. Now, if you’ll excuse me, I’m off to invest in a nice, safe swamp dragon.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 11:46