Behold, gentle investors, a spectacle most diverting! Occidental Petroleum, that purveyor of black gold, doth prepare to unveil its quarterly accounts on the eighteenth of February. A date, they proclaim, ripe with potential! As if a ledger could hold the key to fortune! We shall observe this performance with a discerning eye, for the true drama lies not in the numbers themselves, but in the vanity of those who interpret them.

Let us recall the last act, wherein Occidental presented its bounty. A flourish of production, exceeding even its own inflated expectations! Nearly 1.5 million barrels of oil equivalent per day – a prodigious sum, to be sure, yet it barely stirred the crowd. A mere dip followed, then a belated rally, fueled by the ever-volatile whims of the market and the company’s own pronouncements of “value enhancement.” A curious affair, indeed. Like a player strutting upon the stage, hoping to impress, only to be met with polite indifference.

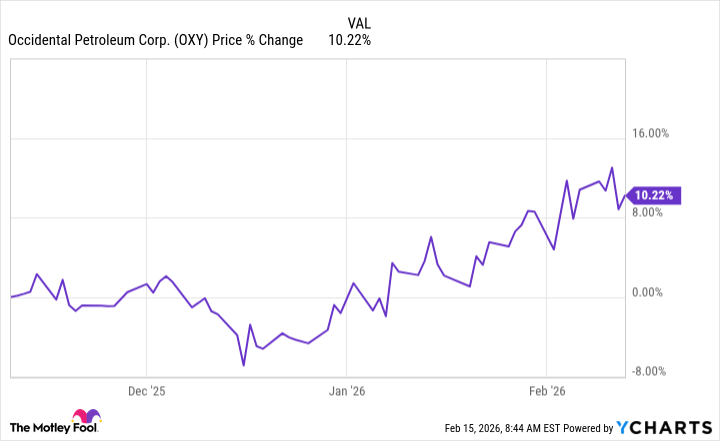

Observe, if you will, this chart, a visual testament to the market’s fickle affections. A momentary plunge, followed by a tepid recovery. The company doth protest its worth, and the crowd, ever susceptible to flattery, offers a grudging acknowledgement. A most predictable dance.

The Approaching Scene

Now, we are told, the fourth quarter presents a less opulent tableau. Oil prices, those tempestuous masters of fate, have deigned to retreat. The analysts, those self-proclaimed prophets, foresee a modest showing – a mere nineteen cents per share. A paltry sum, to be sure, yet they consistently underestimate this company’s knack for exceeding low expectations. It is as if they deliberately set the bar low, merely to appear insightful when it is cleared. A most convenient arrangement.

However, let us not mistake a modest profit for a compelling investment. The true catalyst, as ever, lies not in the company’s internal machinations, but in the external world. Rumors of unrest in the East, whispers of conflict and disruption…these are the forces that truly move the price of oil. Should the drums of war begin to beat, Occidental’s fortunes could soar, not on the strength of its own merits, but on the misfortunes of others. A most unseemly prospect, yet a profitable one, no doubt.

A Word to the Wise

Therefore, gentle investors, heed my counsel. Do not be swayed by the siren song of quarterly earnings. Do not be fooled by the company’s promises of enhanced value. Focus instead on the geopolitical winds, on the potential for chaos and disruption. If you believe that the price of oil is poised to surge, then – and only then – consider a foray into Occidental’s shares. But remember this: you are not investing in a company, but in a gamble. A most theatrical performance, indeed, and one in which the house always wins…eventually.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 11:22