The discerning investor, one who doesn’t merely chase quarterly reports but listens to the whispers of capital expenditure, will find a certain, almost decadent pleasure in Alphabet’s recent pronouncements. A projected $175 to $185 billion earmarked for 2026 – a sum so vast it threatens to overwhelm the very digits employed to record it. It is, shall we say, a rather forceful hint that the age of artificial intelligence is not merely upon us, but is actively, and expensively, constructing its own gilded cage.

And within that cage, two particular avian species appear poised to flourish: Nvidia and Broadcom. One might almost suspect a deliberate orchestration, a subtle choreography of silicon and software, designed to funnel capital towards these chosen beneficiaries. Alphabet, you see, is not simply spending money; it is seeding an ecosystem, a complex web of dependencies where its own ambitions intertwine with the fortunes of these two companies. The irony, of course, is that such grand designs are rarely conscious; more often, they are the emergent properties of relentless, data-driven optimization.

Alphabet’s unique position – simultaneously a consumer and a provider of computational power – is key. It’s a peculiar duality, akin to a lepidopterist both collecting and breeding his specimens. Gemini, its generative AI model, demands an insatiable appetite for processing cycles. Google DeepMind, that shadowy laboratory of algorithmic dreams, adds further strain. And, crucially, Alphabet’s Tensor Processing Units (TPUs), those bespoke chips co-created with Broadcom, offer a tantalizing glimpse into a future where hardware is tailored to the specific demands of AI. This internal consumption, naturally, provides a substantial tailwind for Broadcom, a company adept at crafting the very building blocks of this digital revolution.

However, to assume that Alphabet’s largesse will flow exclusively towards Broadcom would be a simplification worthy of a novice. The cloud, that ethereal realm of shared computing resources, introduces a delightful complication. Google Cloud, while eager to entice clients with its own hardware, recognizes the inherent limitations of vendor lock-in. Some users, understandably, prefer the flexibility of Nvidia GPUs, allowing them to migrate their workloads across different cloud providers with relative ease. Thus, Nvidia, too, will partake in this feast, benefiting from Alphabet’s commitment to expanding its cloud infrastructure. It’s a rather elegant demonstration of market forces, isn’t it? A sort of benevolent competition, albeit one fueled by billions of dollars.

Predicting which of these two companies will ultimately benefit the most is a futile exercise, a parlor game for analysts with too much time on their hands. Both are exquisitely positioned to capitalize on Alphabet’s spending spree, their fates inextricably linked to the rise of artificial intelligence. What is noteworthy, however, is the relative valuation of these companies. Despite the undeniable growth prospects, their stock prices remain, dare I say, remarkably reasonable.

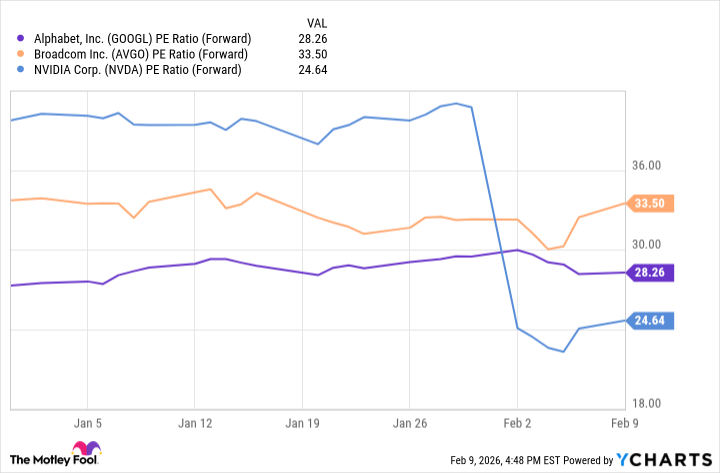

A Comparative Glance at Valuation

Alphabet’s recent quarterly results, while impressive – an 18% year-over-year increase in revenue – pale in comparison to the projected growth rates of Broadcom and Nvidia. Analysts anticipate a 28% surge for Broadcom and a staggering 61% for Nvidia. One might expect their stock prices to reflect this disparity, to trade at a premium commensurate with their superior growth prospects. Yet, the market appears to be exhibiting a curious reluctance.

Broadcom currently trades at 34 times forward earnings, Alphabet at 28 times, and Nvidia, astonishingly, at just 25 times. The discrepancy is almost comical. Investors, it seems, are searching for the next big AI stock elsewhere, overlooking the obvious opportunity right before their eyes. It’s a classic case of misallocation of capital, a testament to the irrationality of the market.

Nvidia, in my estimation, is a clear buy. A no-brainer, as the saying goes. The market’s skepticism is unwarranted, a temporary aberration that will undoubtedly be corrected. Broadcom, too, deserves its premium valuation. The company is on the cusp of introducing several custom AI chips, similar to TPUs, that will cater to a diverse range of clients. This expansion will fuel further growth, as analysts project revenue increases of 52% and 38% for fiscal years 2026 and 2027, respectively. Alphabet, while still an intriguing investment, simply lacks the growth trajectory to compete with these two powerhouses. It’s a solid cornerstone for any portfolio, certainly, but not the most compelling opportunity at present.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 10:52