Banking folks at Standard Chartered have taken a good hard look at their shiny cryptocurrency forecasts and have gone on a loping trip downwards, hinting that Bitcoin might plummet toward the mighty $50,000 mark while Ethereum could tumble near $1,400 before a fanciful rebound. They say it looks like a storm is brewing, even though the long‑term future still looks brighter than a Sunday smile.

Standard Chartered Cuts Crypto Targets Amid Market Weakness

Our dear Standard Chartered, in their infinite wisdom, have pulled back their lofty dog‑bane prices for the big digital hats: Bitcoin, Ethereum, XRP, and Solana. After all, nothing says ta‑ta to optimism like tripping over the next few months, right? They published this gloomy piece on February 12, slapping lower numbers onto those tokens and letting us know that near‑term capitulation appears to loom over the entire market.

“I reckon we’re in for more pain and a final capitulation phase in the months to come,” said Geoffrey Kendrick, the global head of Digital Assets Research. “The macro backdrop won’t give us any support until the Warsh thingy takes the Fed wheel.” As if a federal hand‑shake could herd digital gold.

“On the downside, I think Bitcoin will be nudged toward $50,000, and Ethereum to $1,400.”

Kendrick called those numbers “buy levels” for the year‑end-$100,000 for Bitcoin and $4,000 for Ethereum. He also mentioned “further declines near‑term” and that those figures might gaze down the mark toward the future. Which, in typical moose‑in‑the‑miracle‑land style, still comes with a big splash of ambivalence.

And then there’s the whole Warsh thing. Donald Trump’s fished‑out nomination for him to be Fed chair has folks gasping in disbelief. Warsh-who once ran the Fed from 2006 to 2011-promises a leaner central bank, a dash of AI productivity, and “fancy” restructuring. All the while the world waits to see if he can pull a rabbit out of a hat and silence the itch for interest‑rate slurries.

Speaking of low‑brow speculation, Warsh repeated that ETF holders will likely sell rather than buy the dip-so Bitcoin could still fall to a tidy, modest $50,000 in the next few months. And Ethereum, being the “stoplight” of the bunch, might bottom out near $1,400. A fact that’s a lot like a poodle being trained to wheeze: possible, but unlikely to turn your stomach.

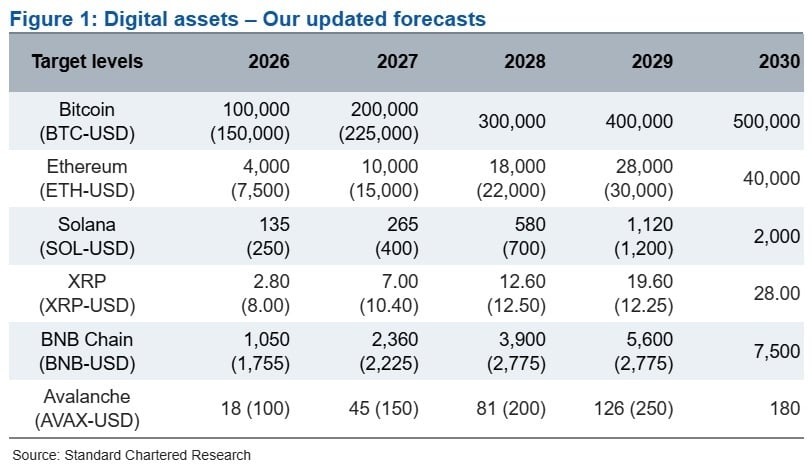

Our field notes of revised projections detail a mess of numbers: 2026 and 2027 targets for BTC, ETH, XRP, and Solana are all drollingly trimmed. Whether that’s a sign of prudence or pretentious pessimism, leave that to the historians.

Kendrick again assured us that “once the lows have been reached… the mount would climb again for the rest of 2026.” Senior pundits call that “recovery.” And that, apparently, will brush the BTC forecast back up to $100,000 and ETH to $4,000 at the year‑end hoop.

He added: “Other digital assets will probably follow the major ones, so we’re adjusting their forecasts accordingly.” Maybe he’s orchestrating a grand choir of falling things? Don’t know, we’re reading between the headlines.

FAQ ⏰

- What is Standard Chartered’s new Bitcoin price forecast?

The freshly shaved figure is a year‑end $100,000, with a near‑term dip expected somewhere down at roughly $50,000. - How low could Ethereum fall according to the revised outlook?

It might slide toward $1,400 before saying “sally forth!” again in the later part of the year. - Why does Geoffrey Kendrick expect further digital asset downside?

Macro weakness and a possible wave of ETF selling are the suspect characters in this drama. - What are Standard Chartered’s long-term Bitcoin and Ethereum targets for 2030?

They’ve kept the large‑scale dreams alive: $500,000 for Bitcoin and $40,000 for Ethereum.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- All weapons in Wuchang Fallen Feathers

2026-02-16 07:07