It’s becoming increasingly common for famous actors and performers to trade in their glamorous Hollywood lives for the peace and quiet of the countryside. Away from the cameras, they’re often found managing farms, growing food, and caring for animals. This offers them a welcome break from the pressures of fame and lets them focus on things like sustainable living and farming. Whether it’s a small organic garden or a large ranch, these celebrities are happily taking on the role of farmer.

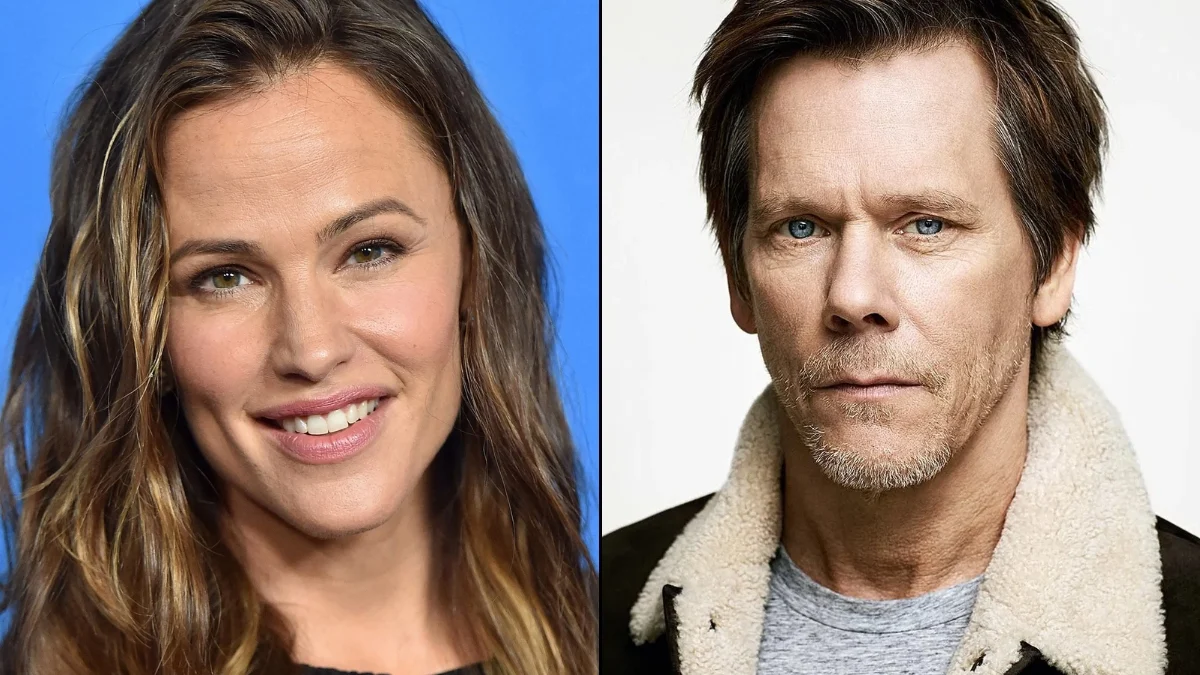

Jennifer Garner

Jennifer Garner runs an organic farm in Oklahoma that’s been in her family for many years. Her grandparents originally bought the land, and now it provides the main ingredients for her organic baby food company, Once Upon a Farm. She grows classic crops like pumpkins, blueberries, and sweet potatoes without using artificial pesticides. Garner often shares photos and stories about farming – like driving tractors and planting – on social media to emphasize the importance of knowing where our food comes from. Through her work, she’s both kept her family’s farming traditions alive and created a successful modern business.

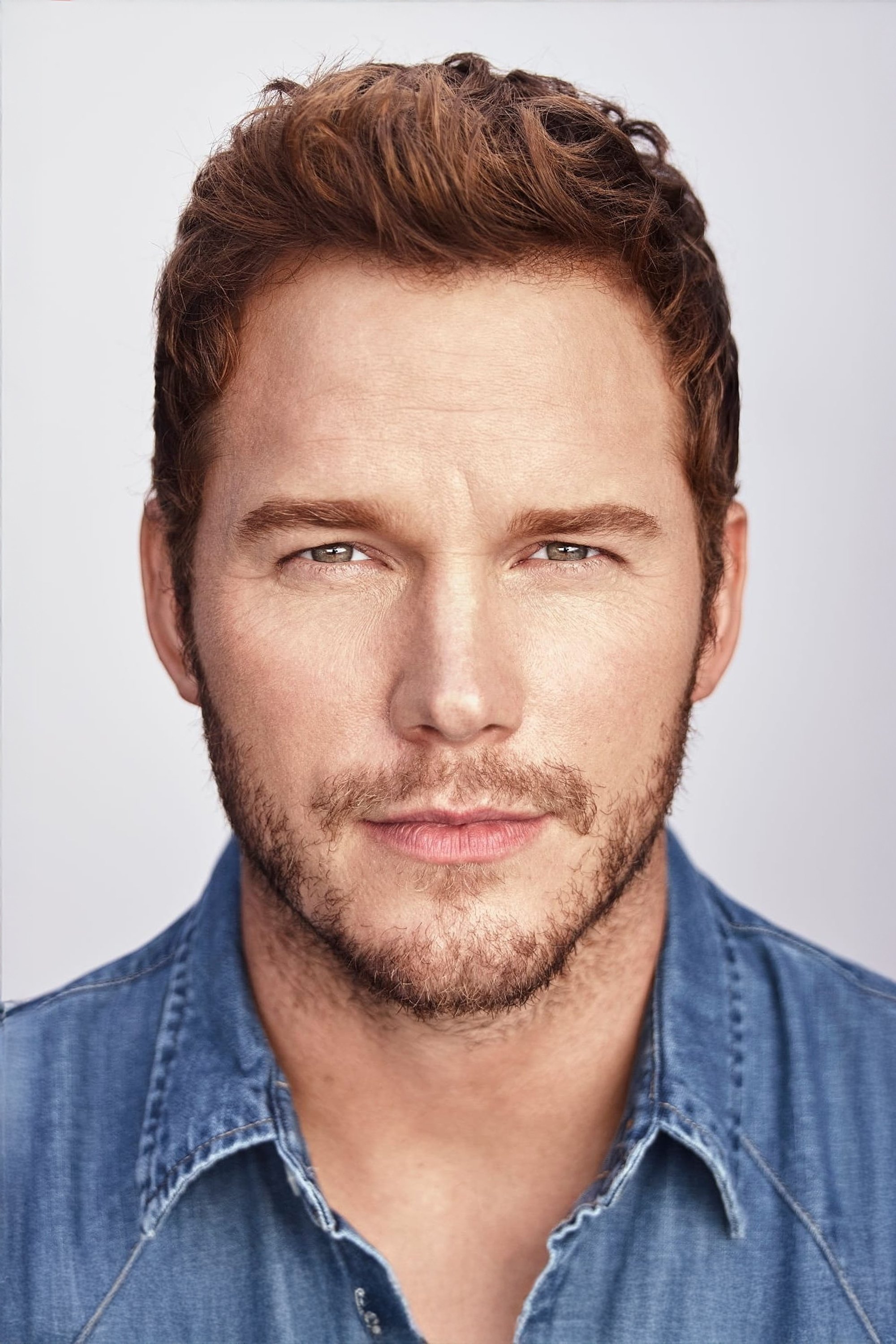

Chris Pratt

Chris Pratt runs Stillwater Ranch on San Juan Island in Washington state, where he raises sheep, pigs, and chickens with a focus on sustainable farming methods. He shares the process of raising animals for food, highlighting the work involved in getting meat from the farm to the table. Pratt finds the physical work of ranching to be a welcome mental escape from his acting career, including films like ‘Guardians of the Galaxy’. He’s dedicated to a self-sufficient lifestyle and caring for his animals.

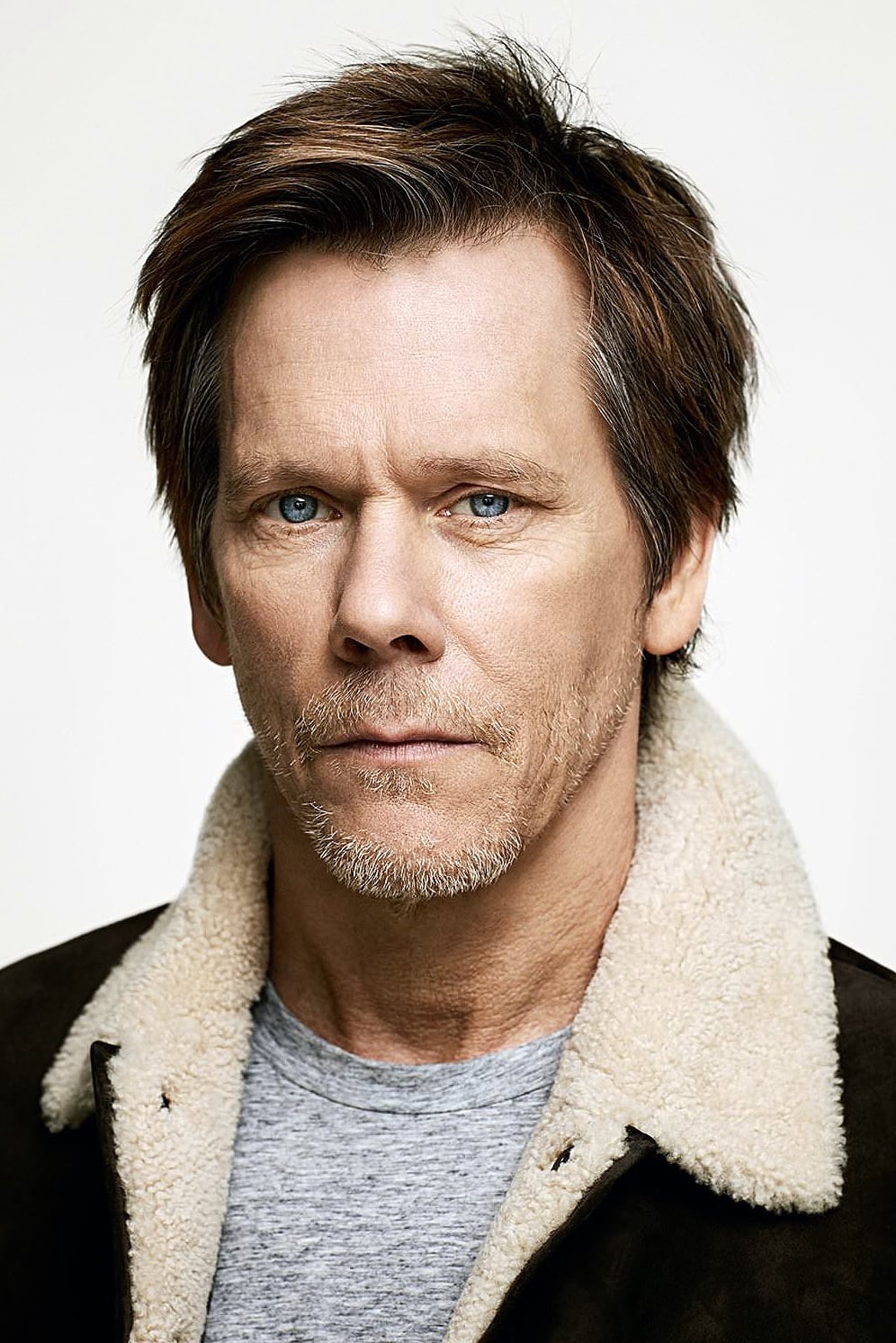

Kevin Bacon

Kevin Bacon and his wife, Kyra Sedgwick, live on a farm in Connecticut, where they care for a variety of animals, including goats, alpacas, horses, and ponies. Bacon often shares glimpses of farm life – and his animals – with his followers online. They intentionally chose a peaceful, country lifestyle that’s a world away from the usual Hollywood scene. Bacon enjoys the hands-on work of running the farm and clearly values the connection he has with his animals. The farm serves as their main home when they aren’t working on film projects.

Nicole Kidman

Nicole Kidman has a large, 111-acre farm in the Australian countryside of New South Wales, called Bunya Hill. She grows organic vegetables and fruit on the property to feed her family. She also raises Black Angus cattle and alpacas on the land. Kidman enjoys the peaceful, private lifestyle the farm offers her and her children, and she’s deeply involved in caring for her animals and the land throughout the seasons.

Zayn Malik

Zayn Malik now lives much of his time on a private farm in rural Pennsylvania. He chose this quiet life to get away from the spotlight and connect with a simpler, more hands-on way of living. He enjoys raising horses and growing crops like cucumbers, tomatoes, and cherries. Malik has said that the routine of farm work helps him with his anxiety and creates a calm space for writing music. This dedication to farming shows he’s prioritizing a life close to nature over the demands of being a celebrity.

Martha Stewart

Martha Stewart owns Cantitoe Corners, a 153-acre farm in Bedford, New York, where she focuses on efficient and high-quality agriculture. The farm includes excellent stables, greenhouses, and carefully designed vegetable gardens. She raises a variety of traditional animal breeds, like Friesian horses and different kinds of poultry. Many of the fruits, vegetables, and other products grown on the farm are used to create recipes for her TV shows, cookbooks, and other projects. Martha is very involved in the day-to-day running of the farm and personally oversees its operations.

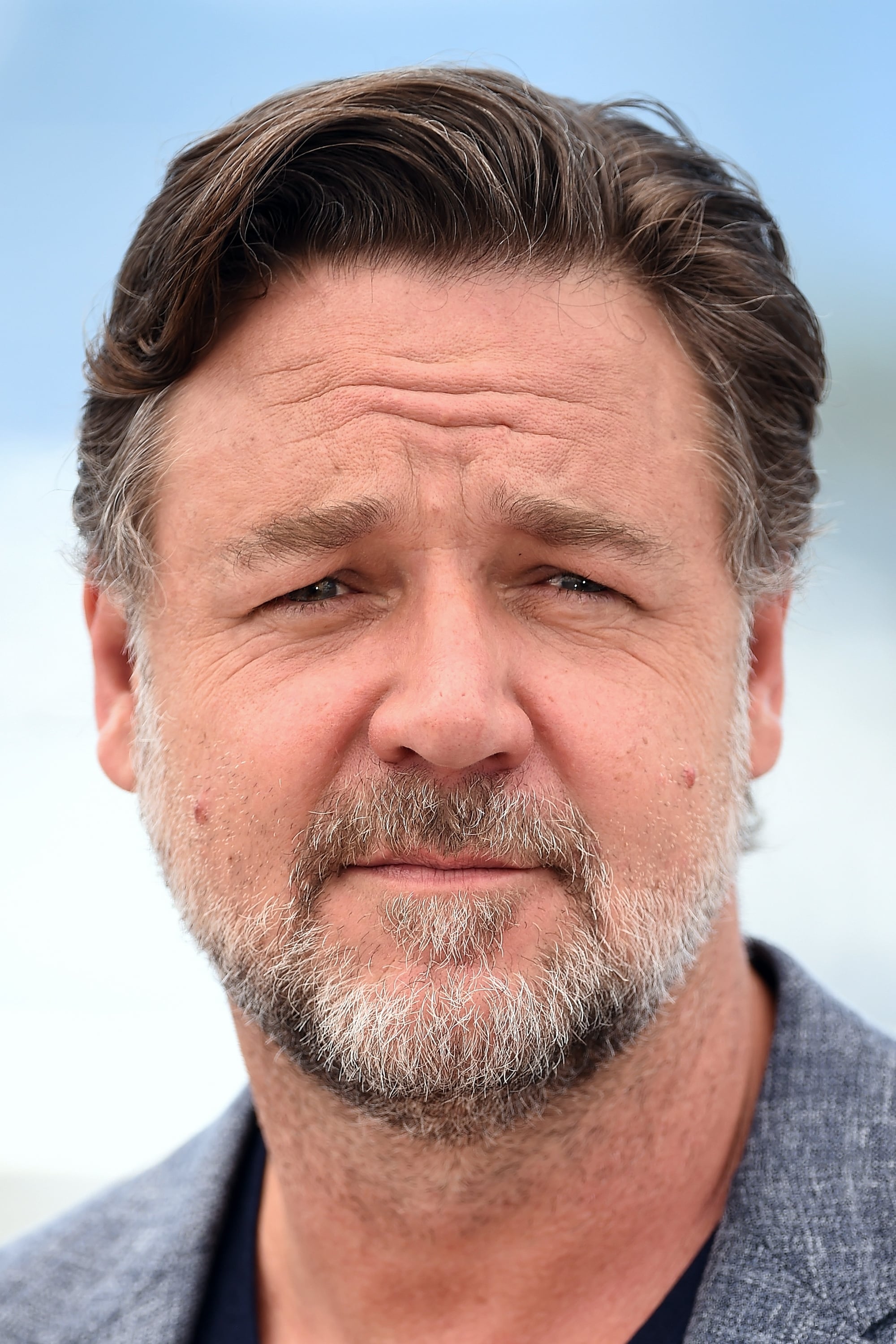

Russell Crowe

Russell Crowe owns a 400-hectare cattle ranch in Nana Glen, New South Wales, where he cares for over 700 cattle. He’s dedicated significant resources to restoring the land after it was damaged by bushfires. Crowe often says he’s more comfortable working on his farm than attending glamorous events. The ranch provides a private retreat for his family and allows him to focus on protecting the environment. He continues to be a strong voice supporting farmers and rural communities in Australia.

Kelvin Fletcher

After leaving his long-running role on the soap opera ‘Emmerdale’, Kelvin Fletcher traded city life for a 120-acre farm in the Peak District. Though he had no farming background, he quickly took on the responsibility of running a farm complete with sheep, pigs, and goats. His journey from actor to farmer was captured in the TV series ‘Kelvin’s Big Farming Adventure’. Fletcher has enthusiastically accepted the demands of farm life – including long hours and hard work – while still occasionally taking on acting projects.

Oprah Winfrey

Oprah Winfrey owns a large organic farm on the slopes of Mount Haleakala in Maui. The farm grows many different crops, like avocados, kale, radishes, and citrus fruits. She started the farm to help Hawaii grow more of its own food and often donates extra produce to local food banks. Winfrey actively helps plan the farm’s operations and believes in the benefits of eating fresh, locally grown, organic food. The farm also provides her with a relaxing place to connect with nature.

Elizabeth Hurley

For over ten years, Elizabeth Hurley ran a 400-acre organic farm in the Cotswolds. She raised organic beef, pork, and lamb, selling it to nearby shops, and even created her own line of healthy snack bars using ingredients grown right on the farm. Elizabeth was actively involved in all aspects of the farm, from herding sheep to helping with the harvest. She still enjoys a country lifestyle and is dedicated to protecting the rural environment.

Jeremy Clarkson

Jeremy Clarkson owns and runs Diddly Squat Farm, a large 1,000-acre property in the Cotswolds. The documentary series ‘Clarkson’s Farm’ follows his experiences learning to be a farmer. He grows crops like barley and wheat, and has added sheep to his farm. Clarkson has often spoken about the difficulties farmers face with money and paperwork. He also has a popular farm shop on the property, selling fresh produce grown right there.

Tell us which of these celebrity farmers surprised you the most in the comments.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-16 03:21