The matter of Amazon—a name that now echoes through the corridors of commerce as persistently as a forgotten theorem—demands a certain circumspection. To speak of its “growth,” as the vulgar market-analysts do, is to misunderstand the nature of the beast. It does not merely grow; it replicates, mirroring itself across the digital landscape, a labyrinth of logistics and algorithms. My investigation, begun some years ago within the dusty archives of the (fictional) Sociedad de Exploraciones Financieras, suggests a pattern of recursive valuation—a stock that seems to contain within itself the seeds of its own future price.

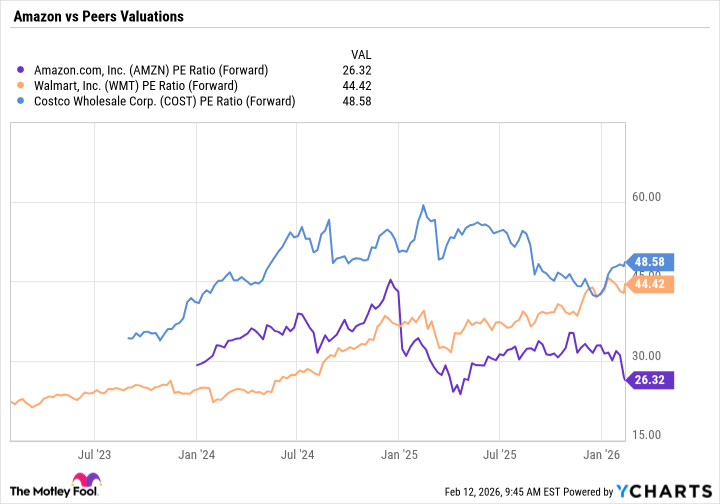

It is a curious anomaly, this recent underperformance. For five years, the stock has lingered, a shadow in the sun, while lesser entities briefly outshone it. Yet, this apparent decline is, I suspect, a necessary illusion—a momentary distortion in the infinite reflection. The current price-to-earnings ratio—approximately 26.5 times the projected earnings of 2026, according to the oracles of Wall Street—is, relatively speaking, quite… reasonable. A disconcerting modesty when compared to the gaudy displays of Walmart and Costco Wholesale, whose valuations seem predicated on the sheer weight of brick and mortar—a decidedly archaic principle.

The Cartography of Commerce

To label Amazon simply an “e-commerce” and “cloud computing” leader is to commit a grievous simplification. It is, rather, a cartographer of commerce, mapping the desires of billions with an accuracy that borders on the preternatural. The company’s early investment in its warehouse network was not merely logistical; it was an attempt to shorten the distance between want and fulfillment—a philosophical undertaking, if you will. The sheer scale of this network—a web of fulfillment centers stretching across continents—is a modern marvel, a testament to the power of organized desire.

More recently, the company has delved into the mysteries of robotics and artificial intelligence, not to replace human labor, but to accelerate the inevitable flow of goods. Over a million robots now roam its distribution centers, coordinated by the DeepFleet AI model—a silent, tireless army dedicated to the efficient distribution of consumer goods. This is not automation for its own sake, but a refinement of the logistical labyrinth, a tightening of the spirals of commerce. The optimization of delivery routes and inventory placement is a subtle art, a form of applied geometry.

The fourth-quarter results confirm this trend. Operating income in North America rose by 24% year-over-year, despite a mere 10% increase in revenue. This suggests a strengthening of operating leverage—a subtle shift in the balance of power between cost and profit. The growth of its sponsored ad business—now one of the largest digital advertising platforms in the world—is another encouraging sign. It is as if the company is not merely selling goods, but capturing a share of the attention itself.

But it is in the realm of cloud computing that Amazon truly transcends the mundane. Holding the No. 1 market share in this nascent industry—an industry it, in effect, created—is no small feat. This is the most profitable segment of the company, and the fastest-growing. Revenue growth in Q4 reached 24%, its highest level in over three years. This acceleration is particularly noteworthy, suggesting that the company is not merely maintaining its dominance, but extending it.

The commitment to invest $200 billion in capital expenditures by 2026 is a bold—perhaps reckless—move. But it is also a testament to the company’s long-term vision. The development of custom AI chips, and the opening of a massive data center dedicated to Anthropic, powered by its Trainium chips, are further indications of its commitment to innovation. It is as if the company is building a new digital infrastructure—a foundation for the future of commerce.

Therefore, considering its attractive valuation, the strengthening of its operating leverage, and the acceleration of its cloud computing revenue, Amazon remains, in my estimation, a stock worthy of serious consideration. It is not merely a growth stock; it is a reflection of the infinite possibilities of commerce—a labyrinthine structure that continues to expand and evolve, defying easy categorization. The investor, like the explorer, must be prepared to lose themselves within its intricate pathways.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- All weapons in Wuchang Fallen Feathers

- Top 15 Celebrities in Music Videos

- Top 15 Movie Cougars

2026-02-16 02:42