For years, many male actors of color in Hollywood have had to choose between well-paying jobs and staying true to their backgrounds. Historically, these actors were often limited to roles that relied on harmful stereotypes for laughs. To fight this problem, some have famously refused high-paying parts that would have been disrespectful to their heritage. These brave choices have helped create a more accurate and respectful representation of diverse cultures in film and TV. By prioritizing authentic portrayals, they’re paving the way for future actors to build successful careers without sacrificing their identities.

Riz Ahmed

Riz Ahmed actively avoids roles that rely on harmful stereotypes about Muslims. He made this decision early in his career, choosing not to audition for characters whose entire identity revolved around their religion or extremism. He feels that playing one-dimensional villains simply strengthens negative perceptions. By seeking out complex roles, like those in ‘The Night Of’ and ‘Sound of Metal’, he’s helped create opportunities for more realistic and layered portrayals. His commitment to honest storytelling is now influencing how film studios depict South Asian characters.

Rami Malek

Rami Malek gained attention for requesting changes to his villain role in ‘No Time to Die’ before accepting it. He discussed with the director to make sure the character wasn’t connected to any particular religion or belief system. Malek didn’t want to perpetuate the harmful stereotype of a Middle Eastern terrorist, and he prefers roles with complexity over those based on tired cultural clichés. This allowed him to create a more original and frightening villain for the James Bond series.

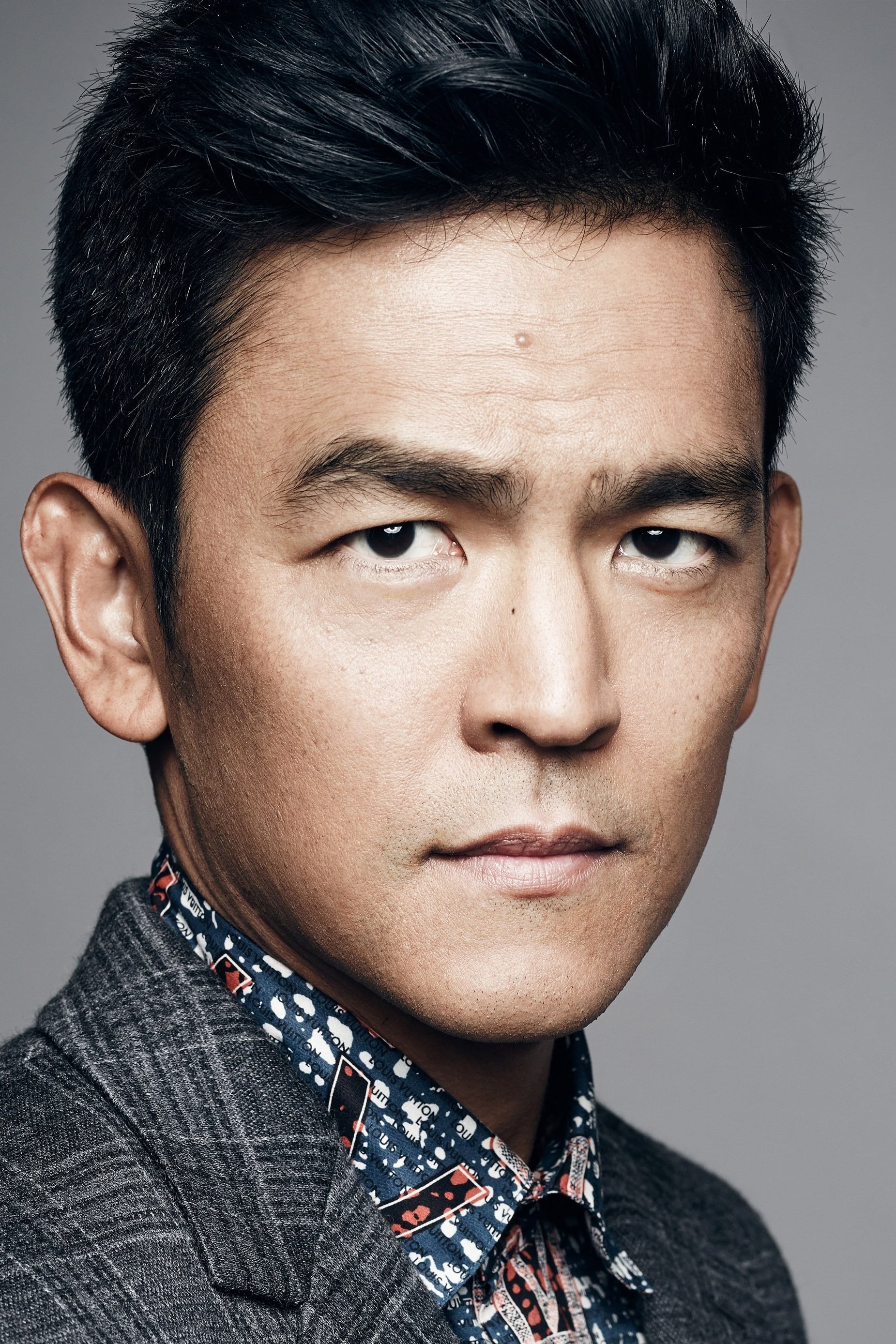

John Cho

John Cho has consistently avoided roles that ask him to use a fake or over-the-top Asian accent. Throughout his career, he’s challenged the common stereotypes of East Asian men as being nerdy or simply ‘foreign.’ He’s well-known for turning down roles that were one-dimensional or used humor based on cultural differences. His work in films like ‘Searching’ and ‘Columbus’ demonstrates that Asian American men can be the main characters in stories where their ethnicity isn’t the central focus. Cho continues to be a leader in Asian representation in Hollywood by insisting on roles that allow for complex emotions and fully developed characters.

Kumail Nanjiani

Kumail Nanjiani deliberately avoided roles that stereotypically portrayed South Asian men, like taxi drivers or shopkeepers. He noticed early in his career that Hollywood often tried to limit him to these kinds of one-dimensional, stereotypical characters for easy laughs. He focused on creating his own opportunities so he could play more complex and fully developed characters. His success with ‘The Big Sick’ proved that he could share his personal stories with both honesty and humor. Now, he continues to choose roles that break away from traditional expectations of what a leading man should be.

Kal Penn

Kal Penn has talked about the stereotypical roles he was offered when he first started acting. He often received scripts that asked him to use a strong accent or portray Indian characters as unintelligent or socially inept. Penn turned down many of these parts because he wanted to protect his dignity and represent his culture positively. His roles in films like ‘Harold & Kumar Go to White Castle’ and the TV show ‘House’ were different, showing more realistic and relatable characters. Since then, he’s moved into politics and producing, and continues to speak out against unfair practices in the entertainment industry.

Simu Liu

As a fan, I really admire Simu Liu’s commitment to authentic representation. He’s been so vocal about not wanting to play characters that fall into tired, harmful stereotypes – you know, the weak or desexualized Asian man. He’s talked about how, before ‘Shang-Chi,’ he’d often see auditions that felt like they were asking him to play a cartoon. He’s not afraid to call out projects that use Asian culture as just a pretty background without actually giving Asian characters any real depth or respect. He’s really using his voice to push for better, more powerful portrayals of Asian people in movies and TV, and he believes turning down those stereotypical roles is key to changing how the world sees us. It’s awesome!

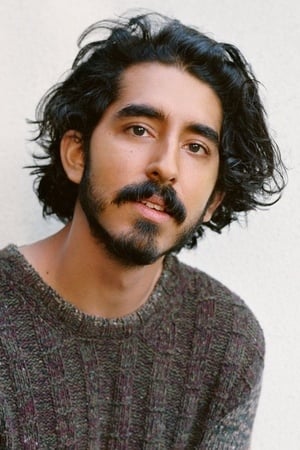

Dev Patel

After ‘Slumdog Millionaire’ blew up, I noticed Dev Patel suddenly getting offered a ton of really predictable roles – you know, the typical tech support guy or just ‘the humble Indian character’. It was frustrating to watch! Thankfully, he made a smart choice and decided to be super picky, holding out for parts that actually meant something to him and felt genuine. That patience really paid off with ‘Lion,’ which was incredible. Now, he consistently picks projects that explore heritage and really dig into complex human emotions – and I really appreciate that about him as an actor.

Hasan Minhaj

I’ve been following Hasan Minhaj’s career for a while now, and it’s really struck me how thoughtfully he’s navigated the challenges facing South Asian actors. He’s talked openly about the constant pressure to either play villains or just be the comic relief, and how early in his career he had to turn down a lot of roles that felt really damaging and stereotypical. Instead of accepting those parts, he brilliantly decided to create his own work, like ‘Homecoming King,’ where he could tell his story, his way. What I admire most is how he sees saying ‘no’ to those harmful roles not as a setback, but as a real source of power. He’s proving that you can achieve mainstream success without sacrificing your cultural identity, and honestly, his career feels like a roadmap for other performers from marginalized communities.

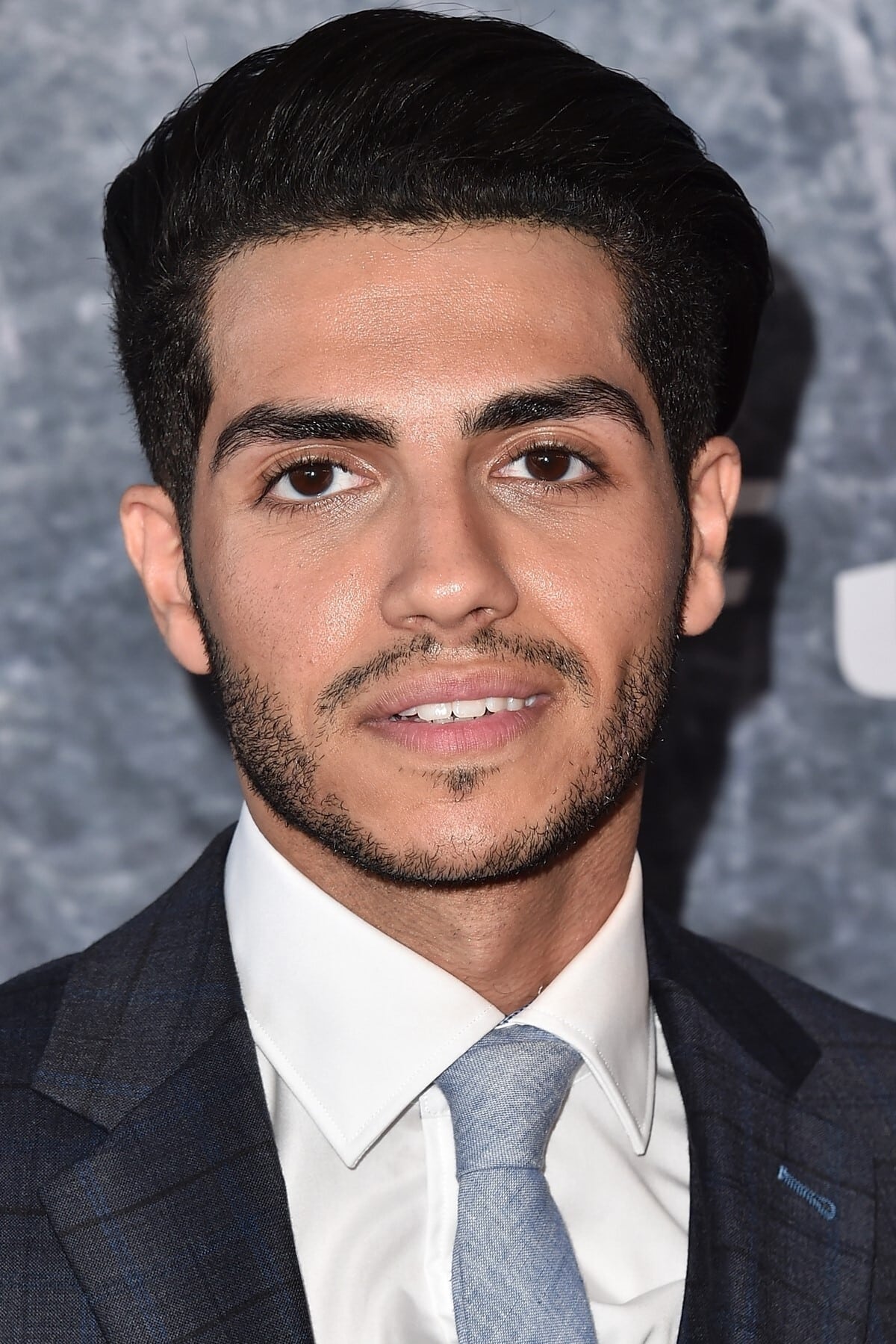

Mena Massoud

As a huge fan of Mena Massoud, I was really disappointed to hear how tough it’s been for him even after ‘Aladdin’! Apparently, a lot of the roles offered to him after the movie were super stereotypical, playing into tired tropes about people from the Middle East. He’s been really brave about speaking out about how few opportunities there are for actors who don’t fit the usual mold – it’s like they’re only offered villain roles or caricatures. He’s refusing to settle for those kinds of parts, and is holding out for roles with the same depth and complexity as everyone else. It just shows how much work still needs to be done to give diverse actors a fair chance, and it’s inspiring to see him stand up for himself and his heritage.

Danny Pudi

Danny Pudi has intentionally chosen roles that avoid relying on stereotypes about his Indian heritage for laughs. Even during his breakout role on ‘Community,’ he made sure his character was complex and not just a collection of familiar tropes. He’s turned down parts that asked him to play into harmful stereotypes about being a foreigner, preferring roles that let him be funny while still respecting his background. This demonstrates his dedication to seeing more authentic and complex portrayals of South Asian actors in comedy.

Mahershala Ali

Mahershala Ali is celebrated for carefully choosing roles that avoid harmful stereotypes. He’s known for turning down parts that go against his values – early in his career, he even declined a role in ‘The Curious Case of Benjamin Button’ due to a scene that conflicted with his faith. Ali consistently looks for complex, human characters, no matter their background. He’s also used his platform to push for more thoughtful and original scripts that steer clear of lazy clichés. His two Oscars demonstrate that he can achieve incredible success while staying true to his principles.

Irrfan Khan

As a film lover, I always admired Irrfan Khan not just for his incredible talent, but also his principles. He was offered a lot of roles in Hollywood, but he wasn’t afraid to say no if he felt a part was stereotypical or just didn’t offer anything meaningful. He really prioritized working in Indian cinema, and honestly, I respect that so much. He didn’t want to play into those tired, old tropes. When he did take on international projects, like ‘Life of Pi,’ it was clear he was looking for stories with real substance and universal themes. To me, his career stands as a testament to artistic integrity and dignity, no matter where in the world he was working.

Aasif Mandvi

Aasif Mandvi has long been a vocal critic of how Hollywood depicts South Asian and Middle Eastern people. He’s often had to refuse roles that relied on harmful stereotypes – either as terrorists or as characters meant to be funny because of their accents. He expressed these concerns in a play and a book, highlighting the limited and stereotypical thinking in casting. Mandvi aims to portray complex, fully developed characters, not just representations of their ethnicity. Through his work on shows like ‘The Daily Show’ and in dramatic roles, he’s pushing the entertainment industry to improve its representation.

Faran Tahir

Faran Tahir is an actor dedicated to ensuring Muslim characters are portrayed accurately and with depth. When he appeared in ‘Iron Man,’ he worked to create a nuanced character, avoiding harmful stereotypes. He often declines roles he finds offensive to his Pakistani background or Muslim faith. Tahir feels actors should speak up against scripts that spread negative and inaccurate ideas, and this commitment has led to a varied career encompassing both science fiction and traditional dramatic roles.

Alexander Siddig

Alexander Siddig is known for speaking out against stereotypical portrayals of Arab characters in film and television. He’s frequently been offered roles focusing on terrorism or conflict, which he feels are overly simplistic. Siddig has rejected several prominent roles because he wants to see more complex and realistic characters. He gained international fame on ‘Star Trek Deep Space Nine’ where his character was defined by his skills and personality, not by his background. He continues to push for scripts that give characters of Middle Eastern descent the same depth and nuance as any other role.

Sayed Badreya

Sayed Badreya is an Egyptian American actor known for challenging how Arab men are portrayed in film and television. For years, he turned down roles in Hollywood that he felt were disrespectful to his culture. He even started his own production company to share more positive and realistic stories about Arab people. Badreya has consistently spoken out against the entertainment industry’s tendency to use harmful stereotypes, and his career has been dedicated to ensuring Middle Eastern actors are represented with respect and dignity.

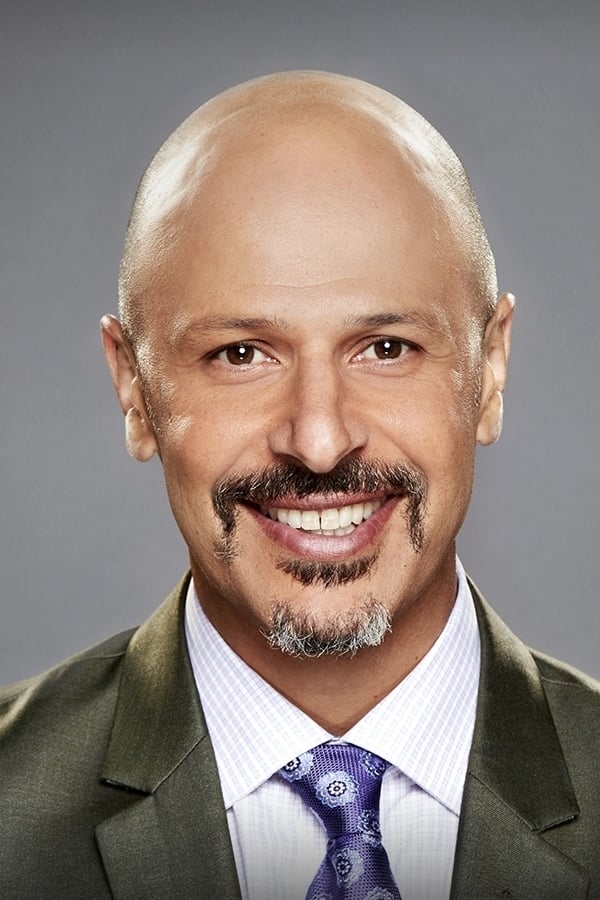

Maz Jobrani

Comedian and actor Maz Jobrani intentionally avoids playing stereotypical roles, specifically those depicting terrorists. He’s passed up well-paying acting opportunities because they asked him to portray Iranians or Middle Easterners negatively. Jobrani believes comedy should help people understand each other, not reinforce harmful stereotypes. He often uses his own experiences with these types of requests in his stand-up routines to highlight bias in the entertainment industry. By consistently choosing roles that positively represent his heritage, he’s built a successful and authentic career.

Naveen Andrews

Naveen Andrews has discussed how hard it is to find acting roles that aren’t based on stereotypes about his Indian background. He became well-known for his role in ‘Lost’ as a soldier with a complicated and sad history. Andrews is careful to avoid roles that are simple or disrespectful to his family’s culture. He looks for characters whose personalities and feelings are more important than their ethnicity. This approach has resulted in a career full of varied and interesting performances.

Utkarsh Ambudkar

Utkarsh Ambudkar is known for his firm stance against using stereotypical Indian accents for laughs. He’s shared experiences of leaving auditions when asked to perform such accents. Ambudkar aims to be recognized as an American actor with South Asian roots, not a caricature. His work in shows like ‘Ghosts’ and ‘Free Guy’ demonstrates his talent for portraying modern characters authentically, avoiding tired ethnic clichés. He continues to be a powerful advocate for accurate and modern representation in the entertainment industry.

Rahul Kohli

Rahul Kohli is an actor who carefully chooses roles to avoid harmful stereotypes of South Asian characters. He refuses to play one-dimensional parts, like the typical tech support worker or nerdy doctor, unless they are well-developed. Kohli often uses social media to advocate for diverse casting that respects cultural backgrounds. He’s achieved success in shows like ‘iZombie’ and ‘Midnight Mass’ by taking on roles that aren’t limited by his ethnicity, and this dedication to good storytelling has gained him a dedicated fanbase.

Randall Park

Randall Park has carefully chosen roles throughout his career, steering clear of projects that rely on harmful stereotypes about Asian Americans. He’s determined not to contribute to a history of mocking Asian culture in movies and TV. From playing a dad on ‘Fresh Off the Boat’ to a government agent in the Marvel films, Park has shown his versatility. He frequently works with other Asian American artists to create genuine and respectful stories. His achievements demonstrate that comedic actors can thrive without resorting to stereotypes.

BD Wong

BD Wong has long been a strong voice for Asian American actors. He famously spoke out against the miscasting of a role on Broadway and continues to champion authentic representation. Wong consistently avoids roles that rely on harmful stereotypes or feel like updated versions of yellowface. Throughout his impressive career in television and film, he’s become known for portraying powerful and nuanced characters. His performances in shows like ‘Law & Order: Special Victims Unit’ and ‘Mr. Robot’ demonstrate his talent and commitment to his work.

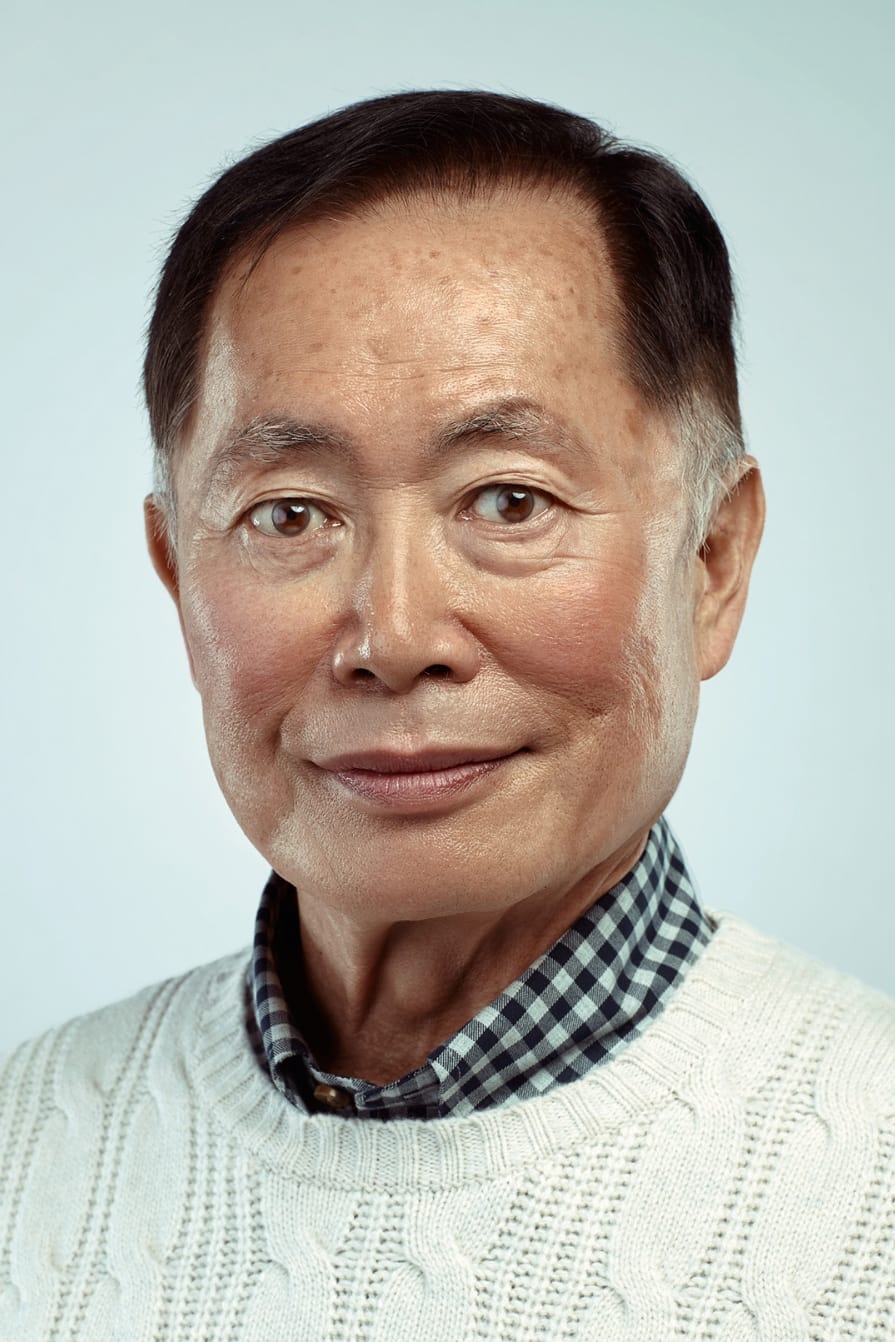

George Takei

Early in his career, George Takei challenged the limited and often stereotypical roles offered to Asian actors. He was particularly proud to play Sulu on ‘Star Trek’ because the character was a respected and authoritative Asian man – a rare portrayal at the time. Takei has always been vocal about opposing projects that disrespect Japanese culture or history. He’s used his platform to raise awareness about the unjust internment of Japanese Americans and the damaging effects of cultural insensitivity. His life and work demonstrate how powerfully someone can advocate for change using their public voice.

Oscar Isaac

As a film lover, I really admire Oscar Isaac’s career choices. He’s been so deliberate about not falling into the typical traps for Latino actors – you know, the same old tired stereotypes. He actively seeks out diverse roles, refusing to be typecast. I’ve heard he’s passed on plenty of scripts that just wanted him to play another criminal or someone with limited intelligence. He’s clearly after roles that really stretch him as an actor, things with real psychological complexity. And it shows – performances in movies like ‘Inside Llewyn Davis’ and ‘Ex Machina’ are why he’s become one of the most respected actors working today, in my opinion.

Edward James Olmos

Edward James Olmos is well-known for refusing a significant part in the movie ‘Scarface’ because he believed it presented a harmful image of Latinos. Throughout his career, he’s championed stories that celebrate the richness and humanity of Chicano culture. Olmos frequently takes on producing roles to guarantee that stories are told with accuracy and respect. He feels actors should carefully consider the effect their choices have on audiences. His performances in ‘Stand and Deliver’ and ‘Battlestar Galactica’ are still celebrated for their honesty and strong values.

John Boyega

John Boyega has openly discussed his time with ‘Star Wars’ and how characters of color were handled. He’s criticized the film industry for showcasing diverse actors in ads but not giving them substantial roles. Boyega now prefers projects with depth and avoids those that rely on stereotypes. He’s committed to supporting independent films, particularly those that authentically portray the lives of Black British people. Because of his outspokenness, he’s become a prominent voice for improved diversity in Hollywood.

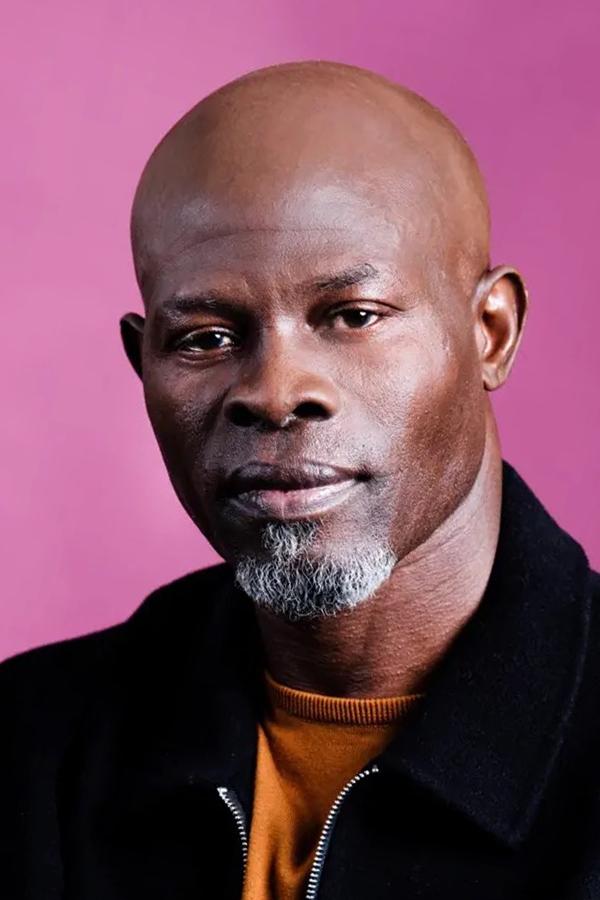

Djimon Hounsou

Djimon Hounsou has frequently discussed the challenges faced by African actors in Hollywood. He’s consistently refused roles that depicted Africans as simplistic or unimportant, preferring projects that showcase the continent’s vibrant history and diverse cultures. His work in films like ‘Amistad’ and ‘Blood Diamond’ successfully brought critical historical and social topics to a global audience. Hounsou continues to prioritize roles that honor his background and portray it with dignity.

Chiwetel Ejiofor

Chiwetel Ejiofor is celebrated for carefully selecting roles that showcase depth and avoid stereotypes. He consistently chooses to portray men of dignity and intelligence, both on stage and in film. His powerful and nuanced performance in ’12 Years a Slave’ earned him an Academy Award nomination and demonstrated his ability to tackle challenging historical stories with sensitivity. He’s become a highly respected figure in the industry, known for his dedication to honest and meaningful representation.

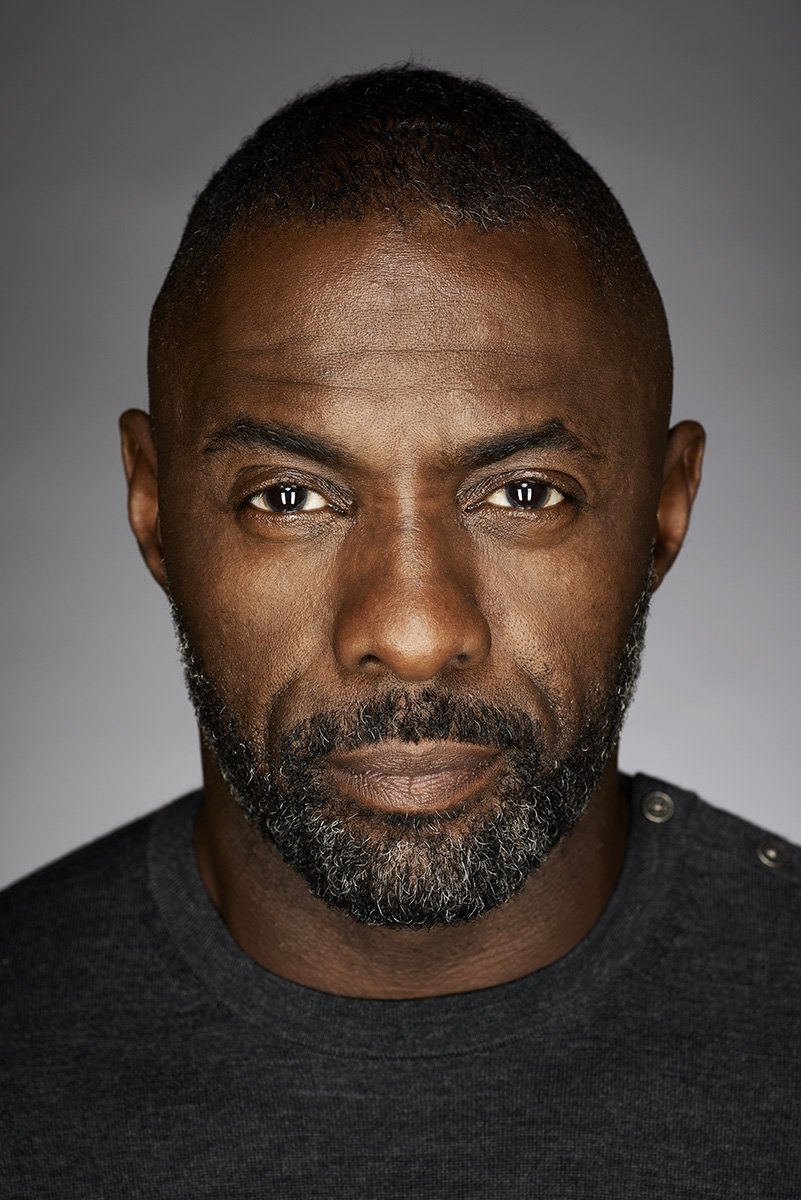

Idris Elba

Idris Elba has always pushed back against being typecast because of his race. He wants to be recognized simply as an actor, not a “Black actor.” This belief has led him to turn down roles that rely on racial stereotypes or disrespect his West African background. Throughout his career, he’s moved seamlessly between serious dramas and big-budget films, staying true to his artistic vision. Elba’s success proves that performers can become global stars without being limited by what the industry expects from them.

David Oyelowo

As a movie fan, I really admire David Oyelowo. He’s a seriously skilled actor, and he’s been really open about how tough it is for Black actors to find good roles in historical films. He’s actually turned down parts he felt didn’t show Black people with the dignity they deserve or didn’t get the full story right. You can tell how passionate he is about getting things right – he fought for years to make ‘Selma’ and tell Martin Luther King Jr.’s story with the respect it deserved. He consistently chooses projects that make you rethink history, and his commitment to representing his heritage shines through in everything he does. It’s inspiring to watch.

Michael B. Jordan

As a moviegoer, I’ve always admired Michael B. Jordan’s career choices, and it’s fascinating to learn the strategy behind them. Early on, he purposefully asked his team to send him scripts for roles not written with Black actors in mind. He wanted a fair shot at the leading man parts traditionally given to white actors – a smart move to challenge the status quo. What’s really impressive is what he doesn’t do. He actively avoids roles that fall into tired urban tropes or poke fun at Black culture. Films like ‘Creed’ and ‘Black Panther’ weren’t just blockbusters; they broadened our idea of who gets to be an action hero. And he’s not stopping there. Through his production company, he’s pushing for real change behind the scenes, making sure diverse voices are not only heard, but actually included.

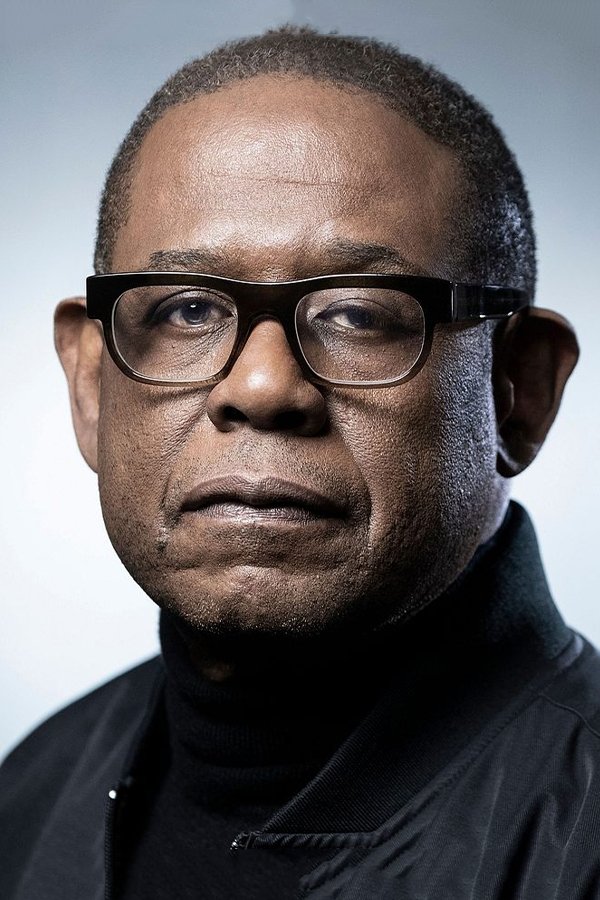

Forest Whitaker

Forest Whitaker is an acclaimed actor and director known for portraying characters with sensitivity and complexity. He consistently avoids roles that might be disrespectful or stereotypical, especially concerning his background. Whitaker often brings a subtle power and rich inner life to his performances, defying typical characterizations. His portrayal of Idi Amin in ‘The Last King of Scotland’ is a prime example of how he can make even controversial historical figures feel human, without minimizing the harm they’ve caused. He’s widely admired in the film industry both for his artistic integrity and his commitment to humanitarian causes.

Jackie Chan

Early in his Hollywood career, Jackie Chan refused roles that asked him to play typical villainous stereotypes. He didn’t want to be the nameless martial arts expert simply meant to be beaten by the main, Western character. Chan was determined to showcase his own style – a mix of action and humor – and create characters on his own terms. This eventually led to huge success, as he became known for playing heroes who were also funny, rather than one-dimensional caricatures. His impact on action movies worldwide is significant, and he’s always stayed true to his Chinese heritage.

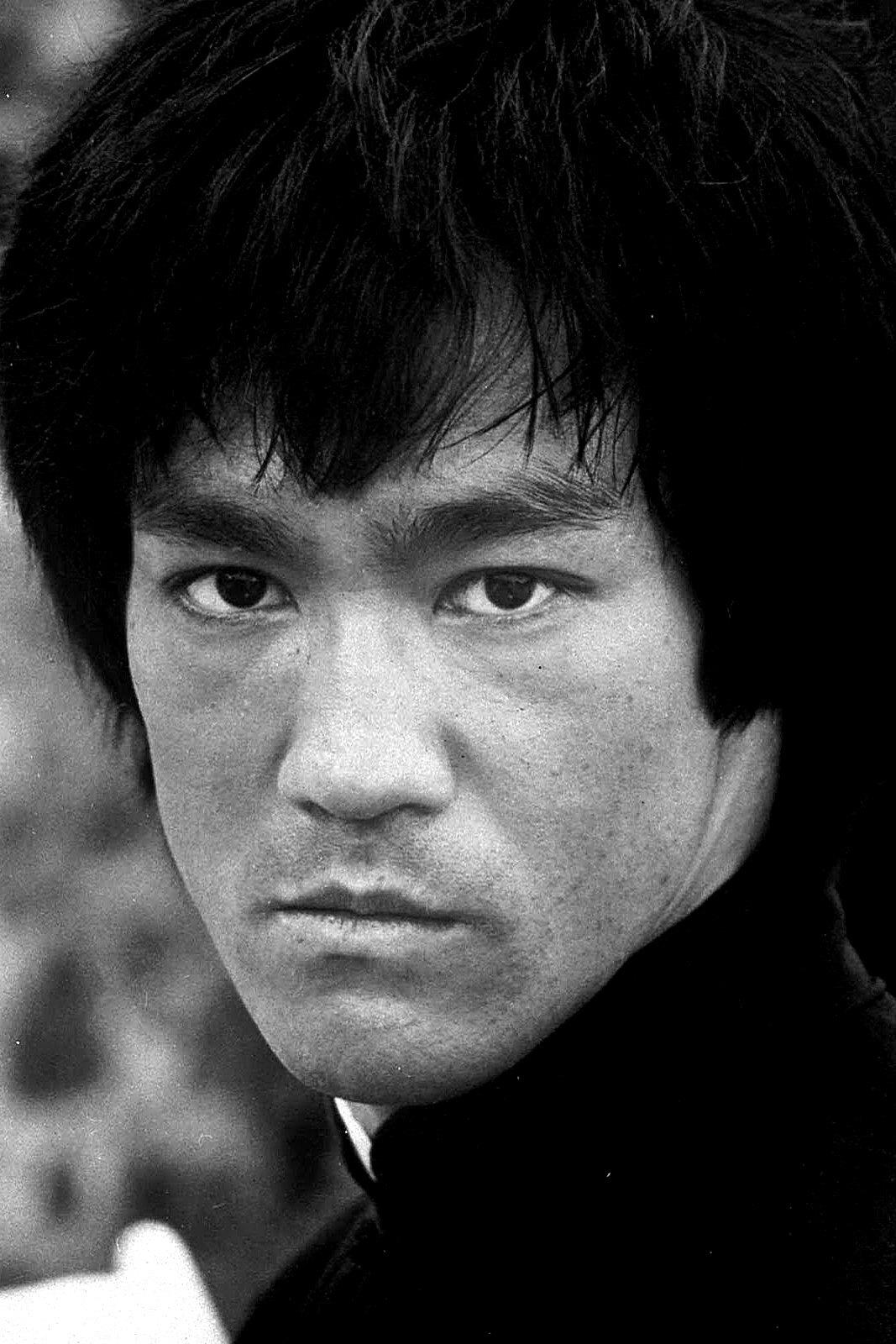

Bruce Lee

Bruce Lee famously left Hollywood because he was frustrated with always being offered roles as stereotypical servants. He rejected the typical portrayal of quiet, submissive Asian characters common in American TV and film. Lee wanted to showcase the strength and artistry of Chinese martial arts and culture through a powerful leading role. His films, like ‘Enter the Dragon,’ fundamentally changed how Asian men were seen in Western media. He continues to be a symbol for those who prioritize their self-respect over financial gain.

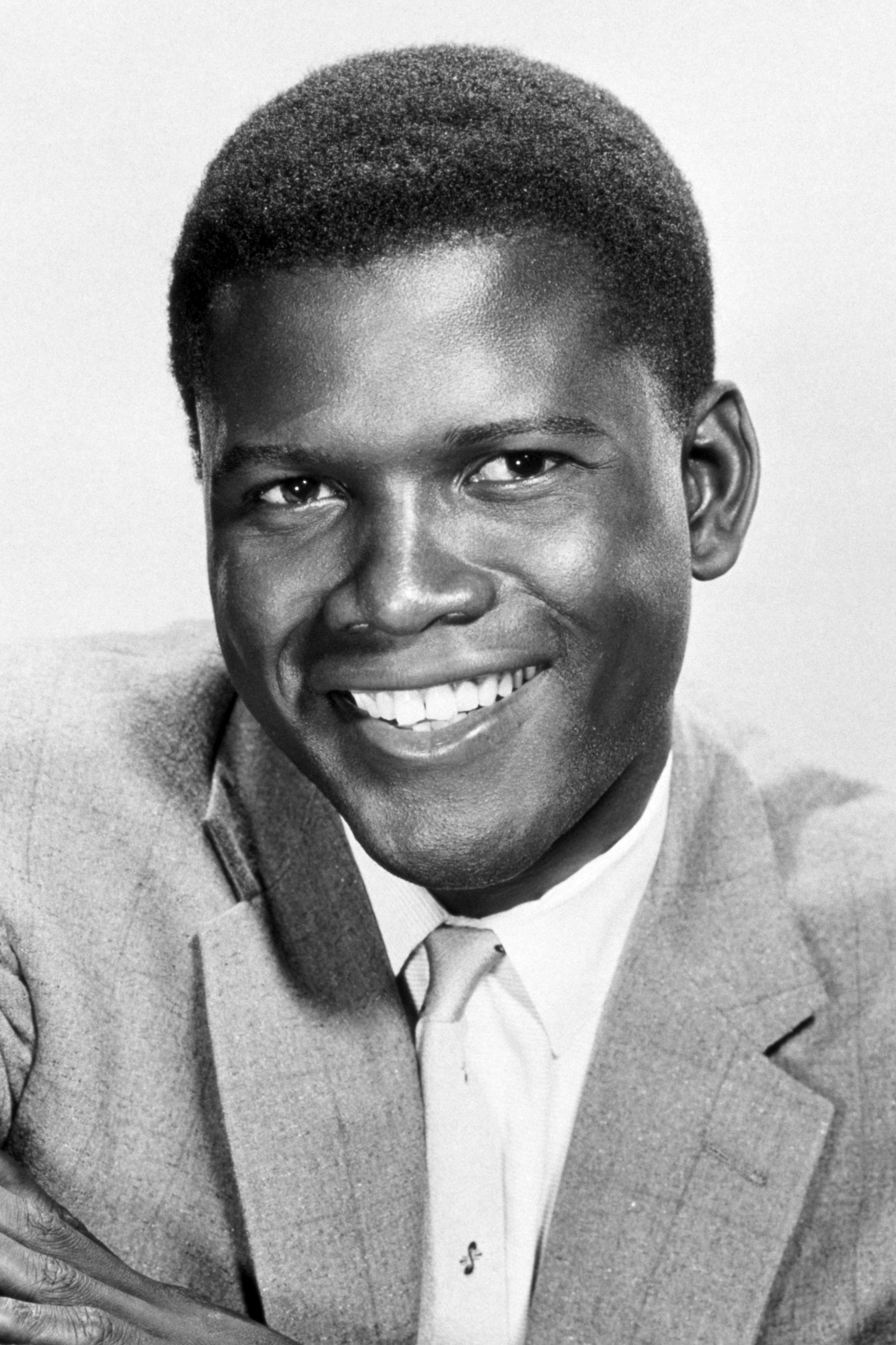

Sidney Poitier

Sidney Poitier broke barriers as the first Black actor to win an Academy Award for Best Actor, a feat he achieved by consistently choosing roles that portrayed dignity and respect. During the 1950s and 60s, he famously turned down scripts that were demeaning or depicted Black men in subordinate positions. Instead, Poitier became known for playing intelligent and capable characters, becoming a symbol of grace and paving the way for future generations of Black actors. He remained steadfast in his values throughout his career and is rightfully remembered as a cinematic icon.

Harry Belafonte

Harry Belafonte was a celebrated singer and actor known for carefully choosing the films he appeared in. He often refused roles in Hollywood that he felt disrespected his Caribbean and African roots. A prominent activist in the Civil Rights Movement, Belafonte’s work always reflected his beliefs, and he prioritized projects with a social message that portrayed people of color respectfully. He’s remembered for his commitment to both activism and artistic principles, which continues to be inspiring.

James Hong

James Hong is a Hollywood legend with a career spanning seven decades. He’s witnessed huge changes in the industry and overcame early limitations by co-founding the East West Players, creating more opportunities for Asian American actors. He bravely challenged stereotypical roles, always striving to portray characters with depth and humanity. Eventually, he achieved a level of success that allowed him to embrace his heritage, as seen in films like ‘Everything Everywhere All at Once.’ Hong is a true pioneer who has dedicated his life to increasing Asian American representation in Hollywood.

Ken Jeong

Ken Jeong has talked about how his acting roles have changed over time, moving from over-the-top comedy to more complex characters. He’s now very careful about the parts he takes, and has rejected scripts that he felt unfairly stereotyped his Korean background. Jeong draws on his medical training and personal experiences to make his comedy feel real. He’s become an important voice for Asian Americans, often speaking out about the need for more genuine and respectful stories in comedy. His career demonstrates how important it is to grow as an artist and to refuse roles that rely on harmful clichés.

Sendhil Ramamurthy

Sendhil Ramamurthy is an American actor known for intentionally avoiding stereotypical Indian accents in his work. He feels South Asian actors should have the freedom to play diverse roles, not be limited by their heritage. He’s turned down parts that relied on clichés like the ‘nerdy scientist’ stereotype. His role in ‘Heroes’ was significant because it showed a South Asian character as a leading figure with depth. He remains committed to seeing more authentic and varied representations of the South Asian community in media.

Haaz Sleiman

Haaz Sleiman is a Lebanese American actor who thoughtfully considers how his roles reflect his background and identity. He often declines parts portraying terrorists or extremists, believing these roles negatively impact how the Middle Eastern community is perceived. Sleiman prefers characters defined by their individual experiences and emotions, not just their ethnicity. He’s also a strong voice for greater LGBTQ+ representation within the Middle Eastern community, and his work consistently focuses on telling genuine and inclusive stories.

Let us know in the comments which actor you think has done the most to improve representation.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Here Are All the Movies & TV Shows Coming to Paramount+ and Apple TV+ This Week, Including ‘The Family Plan 2’

- Top 15 Insanely Popular Android Games

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-15 07:20