Many years later, as the algorithms began to weep digital melancholy into the server farms, old Mateo remembered the whispers. Not of fortunes made, but of a quiet dread that settled over the city like the dust from a forgotten harvest. He’d seen it before, this shimmering mirage of perpetual growth, this belief that the market, unlike men, was immune to the slow rot of time. It was 2026, though the present felt more like a borrowed echo of 1999, and the air smelled of anticipation and something else… a metallic tang, like the taste of rain on old coins.

The Americans, a people perpetually poised between hope and ruin, were, as always, preoccupied with the possibility of loss. Surveys, those pale reflections of collective anxiety, suggested a quiet fear – eighty percent, they said, bracing themselves for the inevitable contraction. But the market, a capricious deity, rarely announces its displeasure in advance. It prefers to descend like a humid night, slowly suffocating the unwary.

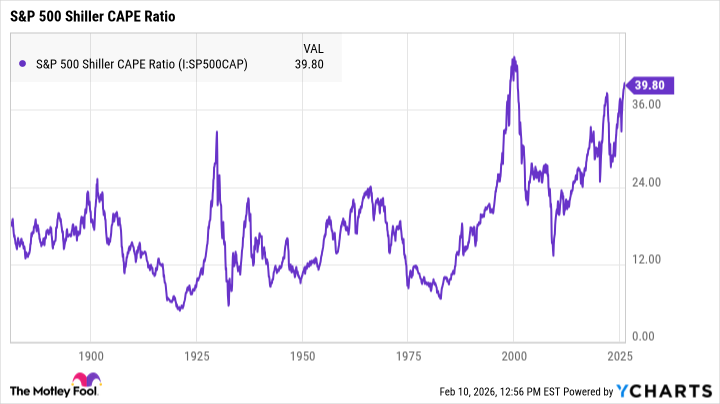

The truth, if one bothered to seek it amidst the noise of speculation, lay in the ghosts of markets past. The elders spoke of a ratio, a strange calculation called CAPE, born from the fevered dreams of an academic. It measured not the immediate bloom of earnings, but the slow, steady pulse of profit over a decade. A high CAPE, they warned, was a flag raised on a crumbling fortress, a promise of leaner years to come.

It wasn’t a prophecy, of course. The market had long since abandoned the pretense of logic, preferring instead to dance to the tune of sentiment and the whispers of unseen forces. But the ratio, stubbornly resistant to the currents of irrationality, offered a glimpse into the underlying fragility. It had peaked before the bursting of the dot-com bubble, a time when fortunes were built on air and dreams were sold by the kilowatt. Now, it hovered near an all-time high, a silent sentinel watching over a landscape of inflated valuations. Around forty, they said, a number that tasted like ash in the mouth of a seasoned investor.

The tech industry, a relentless engine of innovation and excess, had driven this latest surge. It was a world of fleeting loyalties and exponential growth, where companies were valued not on their current earnings, but on the promise of future dominance. This, of course, was perfectly reasonable, or so the optimists claimed. But Mateo, who had seen empires rise and fall on the shifting sands of speculation, knew better. Valuations, like dreams, had a way of dissolving in the harsh light of reality.

A downturn, then, was not a question of if, but when. Not necessarily a catastrophic collapse, but a correction, a gentle reminder that even the most gilded of towers eventually succumb to gravity. And while no indicator could predict the future with certainty, a prudent investor, one who remembered the lessons of the past, would prepare accordingly.

The key, Mateo believed, lay in quality. Not in chasing the latest fads or betting on speculative ventures, but in investing in companies with solid fundamentals, those that could weather the storm and emerge stronger on the other side. These were the companies that built things, that solved problems, that offered genuine value. They were not glamorous, perhaps, but they were resilient. Like the ancient trees that clung to the mountainsides, they had deep roots and a stubborn refusal to be uprooted.

To fill one’s portfolio with such investments was not merely a matter of financial prudence, but of a certain philosophical outlook. It was a recognition that true wealth was not measured in fleeting gains, but in the enduring power of substance. It was a quiet rebellion against the tyranny of the ephemeral, a refusal to be swept away by the currents of irrational exuberance. And in a world increasingly defined by uncertainty, it was, perhaps, the most sensible course of action one could take.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- 50 Serial Killer Movies That Will Keep You Up All Night

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Top gainers and losers

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-14 16:02