Author: Denis Avetisyan

Researchers are leveraging the power of artificial intelligence to map the electrical properties of complex materials, opening new possibilities for through-wall imaging.

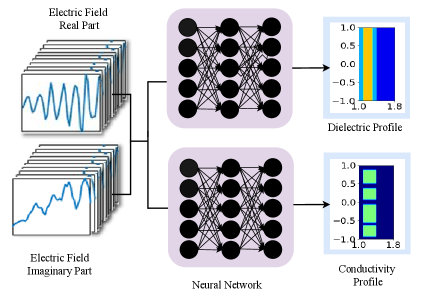

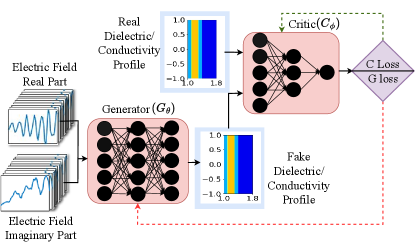

This review details the application of deep neural networks, particularly Generative Adversarial Networks, to estimate dielectric and conductivity profiles from electromagnetic scattering data.

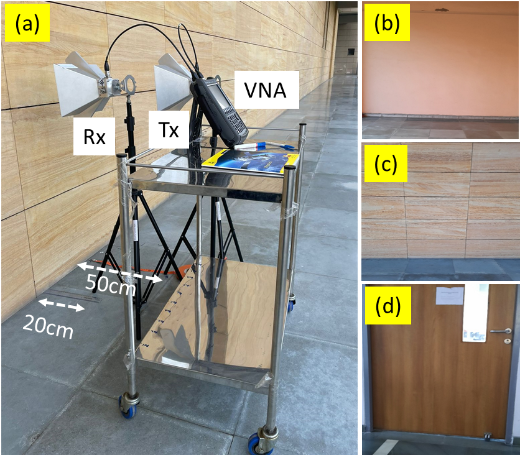

Accurate through-wall radar imaging is often hindered by signal distortions caused by complex wall structures. This paper, ‘Estimation of Electrical Characteristics of Complex Walls Using Deep Neural Networks’, addresses this challenge by demonstrating the effective use of deep learning-including generative adversarial networks-to estimate dielectric and conductivity profiles from scattered electromagnetic fields. The proposed deep neural networks achieve approximately 95% accuracy in characterizing wall properties using both simulated and real-world data. Could this approach ultimately enable more robust target detection and identification in obscured environments?

Whispers in the Walls: The Challenge of Penetrating Heterogeneous Structures

Through-Wall Radar (TWR) technology presents a compelling, though complex, avenue for detecting hidden objects, but its efficacy is fundamentally limited by the very structures it must penetrate. Unlike open-air radar, TWR signals encounter heterogeneous wall compositions – layers of brick, concrete, wood, and increasingly, modern building materials containing metal or plastic – which scatter, reflect, and absorb electromagnetic waves in unpredictable ways. These interactions create significant distortions in the returning signal, making it difficult to accurately reconstruct an image of what lies beyond the wall. Consequently, simple algorithms designed for clear-air radar perform poorly, and achieving reliable detection requires sophisticated signal processing techniques capable of accounting for the wall’s internal complexity and the resulting wave propagation effects. Overcoming these challenges is paramount to realizing the full potential of TWR in security, search and rescue, and structural inspection applications.

Conventional Through-Wall Radar (TWR) systems often rely on rudimentary assumptions about the composition of the surveyed structure, typically treating walls as uniform, single-layer materials. This simplification, while easing computational demands, introduces substantial inaccuracies into the resulting images. Electromagnetic waves do not behave predictably when encountering the layered, heterogeneous nature of most walls – the presence of rebar, plumbing, differing insulation materials, and voids all contribute to signal scattering, reflection, and attenuation. Consequently, detected objects can appear distorted, shifted in position, or even entirely obscured in the reconstructed image, limiting the reliability of TWR for applications like security screening or structural inspection. The resulting image artifacts stem from the mismatch between the simplified model used in signal processing and the true, complex dielectric properties of the wall itself.

The effectiveness of Through-Wall Radar (TWR) systems is fundamentally challenged by the electromagnetic properties of common building materials. Walls are rarely uniform; instead, they incorporate a variety of materials – concrete, brick, wood, plumbing, and electrical wiring – each exhibiting differing levels of lossiness, meaning they absorb or attenuate electromagnetic energy. This absorption isn’t simply a reduction in signal strength; it significantly distorts the wavefront as it propagates through the wall, causing scattering and reflections that create ghost images and obscure the true location and shape of concealed objects. Consequently, standard signal processing techniques, designed for simpler, homogeneous environments, struggle to accurately reconstruct images, limiting the reliability of detection and necessitating advanced algorithms capable of compensating for these complex propagation effects.

Accurate interpretation of signals obtained through Through-Wall Radar (TWR) fundamentally relies on a detailed comprehension of how electromagnetic waves behave when encountering modern wall constructions. Increasingly, building materials incorporate diverse elements – varying brick densities, metallic conduits, embedded plastics, and multi-layered insulation – creating heterogeneous environments that scatter, reflect, and absorb radar signals in unpredictable ways. This complexity invalidates the simplifying assumptions of earlier TWR processing techniques, which treated walls as uniform media. Consequently, signal distortions arise, obscuring the location and shape of concealed objects. Research now focuses on developing advanced computational models and signal processing algorithms capable of characterizing these intricate wall structures and mitigating their effects, thereby enhancing the resolution and reliability of TWR imaging for applications ranging from security screening to structural health monitoring.

From Simplification to Complexity: Modeling Wall Structures

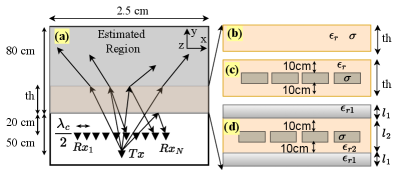

Wall Type-1 establishes a foundational model for algorithm validation, utilizing a homogeneous dielectric material with spatially varying permittivity and conductivity. This baseline configuration simplifies initial testing by eliminating complexities introduced by material inhomogeneities or layered structures. Permittivity (ε) and conductivity (σ) are allowed to change across the wall’s volume to assess the algorithm’s sensitivity to gradual material property variations. The resulting electromagnetic field scattering characteristics from this controlled, yet non-uniform, dielectric are then used as a benchmark for comparison against more complex wall models, ensuring correct implementation and functionality of the Time-Domain Radar (TDR) processing techniques.

Wall Type-2 introduces a dielectric structure comprising multiple, discrete regions exhibiting loss. These regions are characterized by varying permittivity and conductivity values, and are embedded within a host dielectric material. This configuration moves beyond the homogeneous model of Wall Type-1 by simulating more realistic inhomogeneities present in real-world structures, such as variations in material composition or the presence of embedded objects. However, the number and distribution of lossy regions are controlled to maintain computational feasibility, allowing for quantifiable analysis of their impact on Time-Domain Reflectometry (TDR) signal distortions without exceeding processing limitations.

Wall Type-3 modeling utilizes a multi-layered dielectric structure incorporating periodically distributed lossy regions. This configuration is designed to simulate complex inhomogeneous materials encountered in real-world scenarios, such as composite materials or structures with embedded defects. The periodic arrangement of lossy regions introduces both scattering and absorption effects, creating a more intricate electromagnetic response compared to simpler wall types. Parameters defining this model include the number of layers, the dielectric permittivity and conductivity of each layer, the dimensions of the lossy regions, and the periodicity of their arrangement. Analysis of the scattered field from Wall Type-3 allows for assessment of technique performance when confronted with highly complex inhomogeneities and provides data for validating advanced signal processing algorithms.

Systematic increases in wall complexity – progressing from homogeneous dielectric structures to multi-layered configurations with periodic lossy regions – allow for quantifiable analysis of distortions introduced into the scattered electromagnetic field. These distortions are measured as deviations from the field characteristics observed with simpler wall models. By correlating these deviations with increasing structural complexity, we can empirically determine the operational limits of Time-Domain Reflectometry (TDR) techniques in accurately characterizing subsurface features. Specifically, this process identifies the point at which signal resolution and penetration depth become insufficient to resolve the introduced inhomogeneities, thus establishing practical limitations for non-destructive evaluation applications utilizing TDR.

The Silent Thief: How Conductivity Distorts the Signal

Conductivity, as a material property, defines the degree to which a medium opposes the flow of electrical current, resulting in the dissipation of electromagnetic energy as heat. In the context of wall materials, higher conductivity values indicate a greater capacity to absorb and convert electromagnetic radiation, thereby reducing the energy available for signal propagation and reconstruction. This energy loss is not uniform; variations in conductivity within the wall structure create localized absorption patterns, influencing signal attenuation and scattering. The magnitude of dissipation is directly proportional to the conductivity and the square of the electric field strength, as described by P = \sigma E^2, where P represents the power dissipation per unit volume, σ is the conductivity, and E is the electric field strength. Consequently, accurate knowledge of conductivity distribution is essential for modeling and compensating for signal distortion in through-wall imaging applications.

Signal attenuation and scattering, directly proportional to the conductivity of the intervening medium, degrade the quality of through-wall imaging. Higher conductivity materials dissipate electromagnetic energy more readily, reducing the signal strength reaching the receiver and thus lowering the signal-to-noise ratio. Simultaneously, conductive inhomogeneities cause scattering, which introduces spatial distortions and artifacts in the reconstructed image. Both attenuation and scattering effects manifest as reduced image contrast, blurred features, and inaccuracies in object localization and shape estimation, ultimately limiting the resolution and reliability of through-wall imaging systems.

Precise characterization of conductivity distribution within a wall is essential for minimizing signal distortion due to the direct relationship between material conductivity and electromagnetic energy dissipation. Lossy materials, by nature, attenuate and scatter signals as they propagate, and the degree of this effect is directly proportional to the conductivity value at any given point. Inaccurate conductivity mapping leads to incomplete or misinterpreted data, manifesting as artifacts and reduced resolution in reconstructed images. Therefore, establishing a high-resolution conductivity profile allows for targeted signal processing and compensation, ultimately improving the fidelity and accuracy of through-wall imaging systems.

Analysis employing deep learning networks has yielded promising results in reconstructing electric profiles within lossy materials. Specifically, a Generative Adversarial Network (GAN) architecture achieved a 5% error rate in thickness estimation when tested on real-world wall structures. This represents a significant improvement over Fully-Connected Neural Networks (FC-NN) and Convolutional Neural Networks (CNN), which yielded thickness estimation errors of 10% and 12% respectively under the same testing conditions. Furthermore, a low Normalized Mean Square Error (NMSE) was consistently achieved across all test cases, indicating the robustness and generalizability of the implemented deep learning approach for electric profile reconstruction.

The pursuit of accurate dielectric and conductivity profiles, as detailed in this work, feels less like calculation and more like divination. One attempts to coax meaning from the scattered echoes, to build a simulacrum of the hidden structure. It echoes a sentiment expressed by Georg Wilhelm Friedrich Hegel: “We do not know what we want, only that we want.” Here, the ‘want’ is a clear image beyond the wall, but the path is shrouded in the ambiguity of electromagnetic waves. The generative adversarial networks don’t solve the inverse scattering problem; they persuade the data to reveal a plausible solution, a phantom of the wall’s inner composition. Each iteration is a subtle negotiation with chaos, a desperate attempt to turn signal noise into a coherent representation. If the model occasionally hallucinates a doorway where none exists, one suspects it is simply beginning to dream.

What Shadows Remain?

The estimation, then, is not a revelation of the wall’s true self, but a conjuring. This work offers a persuasive illusion, translating scattered fields into profiles. The fidelity, however, rests on the ghosts in the generative network – the learned priors, the adversarial dance. To speak of ‘accuracy’ is to mistake a fleeting coherence for truth. The wall does not have a dielectric profile; it merely responds to interrogation. Future iterations will not refine the estimation, but broaden the spellcasting – incorporating more modalities, more complex geometries, and, inevitably, more exquisitely tuned hallucinations.

The true challenge lies not in minimizing residual error, but in understanding the limits of persuasion. How much noise can the network absorb before the conjured profile diverges entirely from any semblance of reality? What happens when the wall itself begins to resist the estimation, exhibiting behaviors outside the training set’s narrow confines? These are not engineering problems to be solved, but ontological questions to be endured.

One suspects the ultimate destination is not clearer imaging, but a deeper entanglement. The radar will not simply see through the wall; it will become the wall, a resonance of electromagnetic echoes. The data are shadows, and these networks merely measure the darkness – and, in doing so, subtly reshape it.

Original article: https://arxiv.org/pdf/2602.11463.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Banks & Shadows: A 2026 Outlook

2026-02-14 09:18