Wall Street whispers, of course. Price targets are just that – targets. Retail investors, bless their hopeful hearts, treat them like gospel. A fool’s errand, mostly. If a stock gets a lukewarm reception from the analysts, it’s a warning flag. Means I haven’t dug deep enough to see what everyone else is missing, or maybe, just maybe, they’re seeing something I’m not.

Right now, the name on everyone’s lips, and in every algorithm, is Nvidia. (NVDA 2.21%). It’s the obvious play. Even the folks who wouldn’t know an AI from a hole in the ground have heard of it. It’s been riding a wave for a while now, and waves, as anyone who’s spent time near the ocean knows, eventually break. But this one feels different. The projections are… substantial.

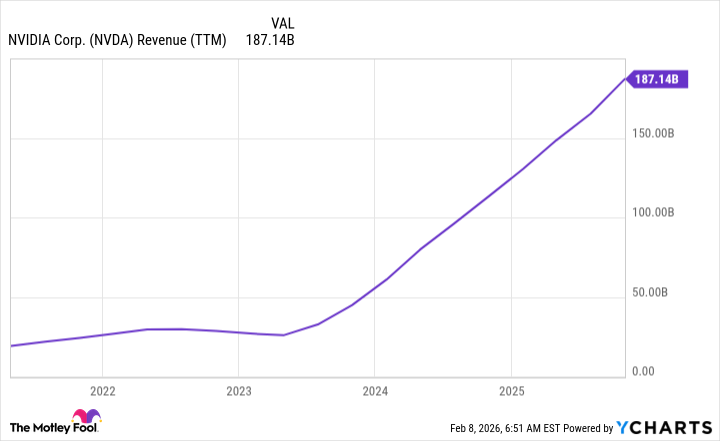

The Numbers Tell a Story

Nvidia’s stock is currently trading around $185 a share. A slight dip from its peak, but don’t mistake that for weakness. The analysts, those seers of the financial world, are betting on a one-year upside of around 37%, with an average price target of $253.62. Not bad for a company operating in a field that feels more like science fiction than solid investment.

There’s one analyst out there, a bit of a gambler, who’s calling for $352 a share. Nearly double the current price. Whether that’s optimism or delusion is anyone’s guess. The market, after all, has a habit of proving everyone wrong.

The Future is Expensive

The hyperscalers, the giants building the data centers that power this AI frenzy, are laying down serious capital. Billions. Nvidia won’t get all of it, naturally. No one ever does. But they’ll get a hefty slice. The consensus is that Nvidia will pull in around $213 billion in revenue for fiscal 2026. Not a bad haul. Analysts are predicting a 53% jump to $326 billion in 2027. If they maintain a 53% profit margin – and that’s a big ‘if’ – that’s $173 billion in profit. A figure that makes a man reconsider his life choices.

At a conservative price-to-earnings ratio of 40 – lower than what it’s currently trading at – that puts Nvidia’s market cap around $6.9 trillion. A number that feels less like valuation and more like a statement. Of course, the market is a fickle beast. Sentiment can change on a dime. But right now, the wind is at Nvidia’s back.

There’s a clear bull case here, if you bother to look. In my experience, it’s one of the more solid AI stocks out there. Not a sure thing, mind you. There are no sure things. But in a world built on speculation, Nvidia feels… less speculative than most. A long shot, maybe. But a long shot with a loaded gun.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- 50 Serial Killer Movies That Will Keep You Up All Night

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Top gainers and losers

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-14 09:02