As a lifelong Transformers fan, I have to admit, the 1986 Transformers: The Movie actually played a big role in why I started this site! I remember being absolutely devastated when Optimus Prime died, and honestly, I didn’t think Rodimus Prime was a worthy successor. It turns out a lot of other kids felt the same way, which is why they eventually brought Optimus back in the later cartoon series.

I started Cosmic Book News after Marvel killed off the character Quasar during the Annihilation event and introduced a weaker replacement. My goal was to help bring Quasar back and champion Marvel’s cosmic-focused stories. Honestly, I still don’t like Rodimus, and that experience is a big reason why I really dislike it when original characters are replaced with new ones.

Hasbro is celebrating the 40th anniversary of Transformers: The Movie and has issued an apology to fans, acknowledging that Optimus Prime didn’t get the ending he deserved.

Hasbro is kicking off a year-long celebration to mark the 40th anniversary of The Transformers: The Movie, the beloved 1986 animated film. It famously shocked audiences when the heroic Optimus Prime died on screen, and Hasbro is playfully calling the anniversary events the “1986 Apology Tour.”

The 1986 Animated Classic That Shocked Fans

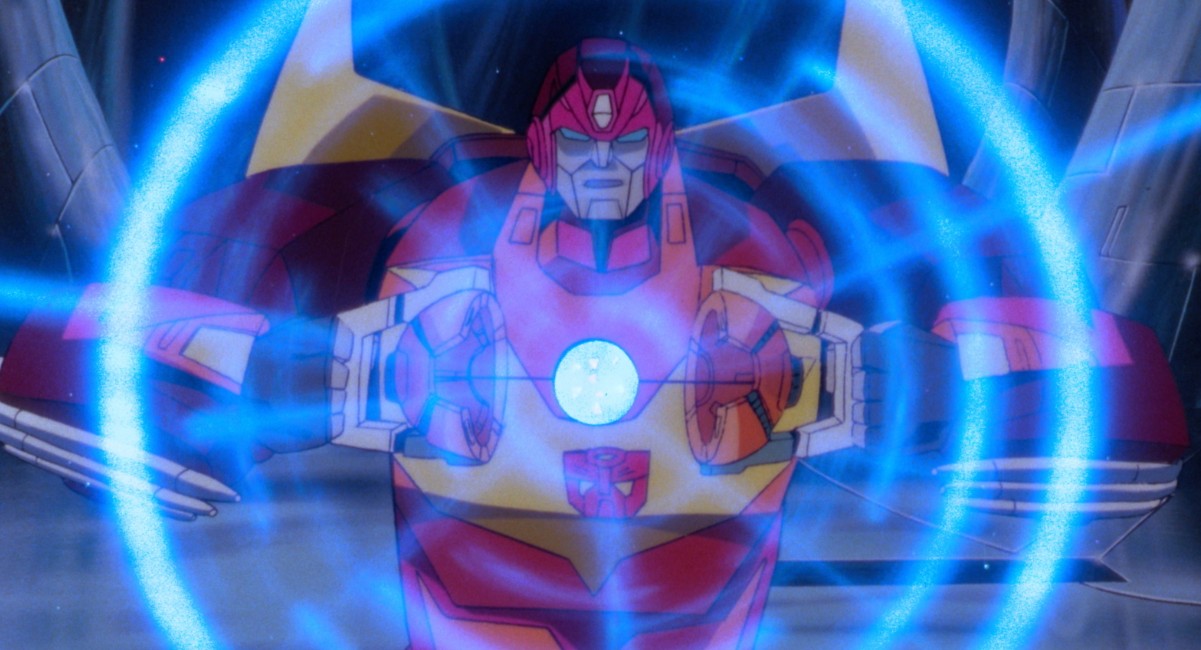

The 1986 movie brought the Autobots and Decepticons to the big screen with a bold and action-packed story.

The death of Optimus Prime in a fight with Megatron was a shocking moment for many viewers and is still remembered as a landmark event in animated storytelling. Originally intended to boost toy sales, the scene unexpectedly had a powerful emotional impact on audiences.

As a lifelong movie fan, I’ve seen this film’s reputation steadily grow over the years. It’s amazing how it’s continued to reach new audiences – through VHS, DVD, and now streaming, plus special screenings and, best of all, word-of-mouth. People always tell newcomers to be prepared – it’s a film that gets passed down with a little warning, and for good reason!

Legendary Voice Cast Still Resonates

The movie boasted a fantastic voice cast, with Peter Cullen voicing Optimus Prime, Frank Welker as Megatron, and iconic performances by Orson Welles, Judd Nelson, Leonard Nimoy, Eric Idle, and Robert Stack. It’s still considered a remarkably ambitious animated film for its time.

Alyse D’Antuono, a Vice President at Hasbro, explained that The Transformers: The Movie was a pivotal moment for the franchise. She noted the powerful emotional effect of Optimus Prime’s death and stated that the anniversary celebration is about recognizing the franchise’s history and showing appreciation to fans for their 40 years of dedication. She also hinted at more exciting announcements regarding entertainment, toys, and other surprises coming soon.

According to D’Antuono, The Transformers: The Movie was a turning point for the entire franchise. The film’s emotional weight – particularly Optimus Prime’s death – and the exciting stories that followed have had a lasting impact. This anniversary is a celebration of the franchise’s history, and a thank you to fans for their 40 years of dedication. Hasbro and its partners are marking this special occasion with events across entertainment, toys, and exciting new surprises – with more announcements coming soon.

Hasbro Launches the 1986 Apology Tour

Hasbro is leaning into the shared trauma with a playful “1986 Apology Tour.”

Even after four decades, the death of Optimus Prime still deeply impacts fans. It’s one of the most memorable scenes in the entire series, and the company is hosting events and screenings all year long to give fans a chance to remember him, share their feelings, and celebrate his legacy.

More details will be announced soon.

40th Anniversary Toys and Collectibles Revealed

Hasbro is releasing a new line of toys and collectibles to celebrate the film’s big anniversary as a thank you to its fans.

Fans can now collect a high-quality, movie-accurate Matrix of Leadership replica for the very first time! Plus, the Studio Series line is expanding with new figures of Shockwave, Skywarp, Wheeljack, Kranix, Sunstreaker, Astrotrain, and Snarl. The collection also includes previously announced figures based on Optimus Prime, Megatron, Hot Rod, Hound, and Scourge, and even more reveals are coming later this year.

Join Hasbro Pulse’s livestream on February 15th to see what they have planned for the anniversary celebration. You’ll be able to pre-order items starting February 16th and 17th.

Publishing and Licensing Expand the Celebration

The 40th anniversary celebration includes new products and stories thanks to partnerships with companies like Culture Fly, Jada Toys, and Super7, who will create special collectibles and merchandise.

Even after forty years, The Transformers: The Movie remains a powerful and memorable film. A daring choice made during its creation turned into an iconic scene in animation history, and Hasbro is now offering an apology for what happened.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- Anime That Should Definitely be Rebooted

- The 10 Most Underrated Mikey Madison Movies, Ranked (from Least to Most Underrated)

2026-02-14 02:32