Hulu is adding a lot of new movies and shows this weekend, with something for everyone. You’ll find big-budget action films, critically acclaimed independent movies, and fun options for the whole family. From thrilling sci-fi and intense dramas to animated comedies and scary horror, there’s plenty to choose from. Many of these titles are brand new to Hulu or are already incredibly popular with viewers. So, whether you’re in the mood for a classic favorite or something completely new, you’re sure to find something to enjoy.

‘Kingdom of the Planet of the Apes’ (2024)

Generations after Caesar’s rule, apes now lead the world, and humans are forced to live hidden away. A young ape embarks on a life-changing journey where he begins to doubt everything he knows about history. His decisions will shape the future for both apes and humans. This new film adds depth to the story with fresh characters and detailed settings, and it examines themes of leadership and the challenges of living together in a world that’s constantly evolving.

‘Splitsville’ (2025)

This funny movie centers on a couple going through a very public and complicated divorce. It realistically portrays the challenges of relationships today, and how a high-profile split affects everyone involved. The story follows a group of people as they deal with the emotional and legal difficulties of separating, especially in a world obsessed with social media. While it’s humorous, the film also honestly shows what it’s like to rebuild your life as an adult, and it playfully critiques the pressures and expectations placed on wealthy, modern families.

‘Springsteen: Deliver Me from Nowhere’ (2025)

This film tells the story of a crucial time in Bruce Springsteen’s life and career – the making of his 1982 album, ‘Nebraska.’ It was a period of big changes for him personally and professionally, and the movie offers a rare, personal look at how he wrote and recorded the album. We see how Springsteen tapped into difficult emotions and experiences to create the album’s powerful and memorable songs, ultimately finding his unique voice as a songwriter. The film features intimate footage from the private recording sessions that resulted in one of rock’s most important acoustic albums.

‘The Princess and the Frog’ (2009)

In 1920s New Orleans, Tiana, a determined waitress, is determined to fulfill her dream of owning a restaurant. Her life takes a magical turn when she kisses a prince who’s been transformed into a frog – and she becomes one too! Together, they embark on an adventure through the Louisiana bayou, searching for a way to break the spell. This beloved animated film is known for its lively jazz music and beautiful, classic hand-drawn animation. It’s especially celebrated for its authentic portrayal of the culture and unique American setting, making it a highlight among the studio’s films.

‘Tarot’ (2024)

When a group of friends carelessly breaks the rules of tarot, they accidentally awaken an ancient and terrifying evil. One by one, the cards predict their grim fates, and they’re forced to fight for their lives. The film delves into the idea that some destinies can’t be avoided and that playing with the supernatural can be deadly. Using classic occult symbols, it builds a frightening and suffocating atmosphere, focusing on the characters’ growing horror as they realize they’re trapped in a violent, unavoidable future.

‘Tin Soldier’ (2024)

This thrilling movie centers on a skilled military team whose crucial mission falls apart. As things go wrong, they uncover a dangerous network of deception involving both the government and private companies. To survive and expose the truth, the team must depend on their training and trust in one another. Filled with impressive action sequences, the film explores themes of loyalty, duty, and the difficult moral choices faced in the world of private military work.

‘The Mummy Returns’ (2001)

Years after the first movie, Rick and Evelyn O’Connell are married with a son, Alex, and living in London. They find themselves in a race against time to stop the return of Imhotep and the dangerous Scorpion King, who threaten to unleash an ancient disaster. Their quest takes them from London to Egypt as they try to save the world. This second film built on the original with bigger action scenes and introduced new mythical creatures and storylines. It’s a fun mix of adventure, humor, and thrills that appeals to a wide range of viewers.

‘Clown in a Cornfield’ (2025)

This scary story, inspired by a well-known novel, centers on a group of teenagers terrorized by a killer clown in their small town. The town’s troubled past and disagreements between generations add to the suspense. As the death toll rises, the remaining teens must work together to figure out why they’re being targeted. It’s a fresh take on classic slasher films, exploring important issues relevant to today’s world. The story also asks tough questions about how traditions can be twisted to excuse terrible violence.

‘Summit Fever’ (2022)

A young climber journeys to the Alps to support his friend’s attempt to conquer three of Europe‘s most challenging mountains: the Matterhorn, Eiger, and Mont Blanc. Even after seeing tragic accidents, they continue their risky climb. The film showcases how incredibly difficult and dangerous professional mountaineering is, while also revealing its powerful appeal. Breathtaking visuals capture the stunning, yet frightening, beauty of these iconic mountain ranges.

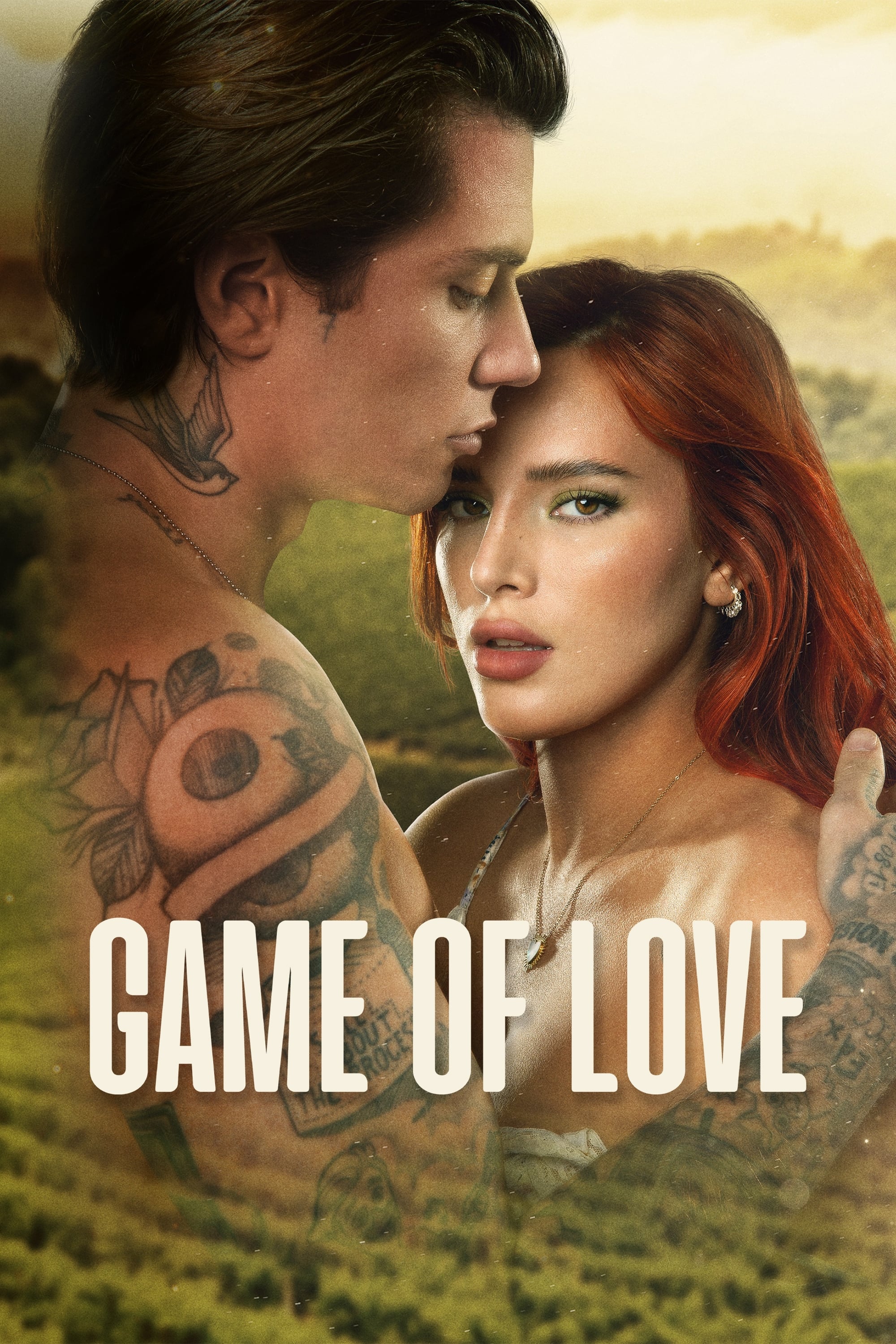

‘Game of Love’ (2022)

This heartfelt drama follows Vivien and Roy on a trip to Sicily, Roy’s childhood home. Their relationship hits a rough patch when someone from Roy’s past shows up, throwing their future into question. Amidst the beautiful Italian scenery, the couple has to confront secrets and grow as individuals while learning if they can truly trust each other and build a lasting connection. The film highlights how important open communication and trust are for any relationship to thrive.

Please share which of these movies you are planning to stream first in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- Anime That Should Definitely be Rebooted

- The 10 Most Underrated Mikey Madison Movies, Ranked (from Least to Most Underrated)

2026-02-14 01:15