Hollywood stars are known for their glamorous public lives, but many have surprising and engaging hobbies outside of acting. Quite a few are deeply involved in things like tabletop games and competitive video games, revealing a more down-to-earth side to their personalities. This article showcases celebrities who openly embrace their ‘geeky’ passions and interests in technology.

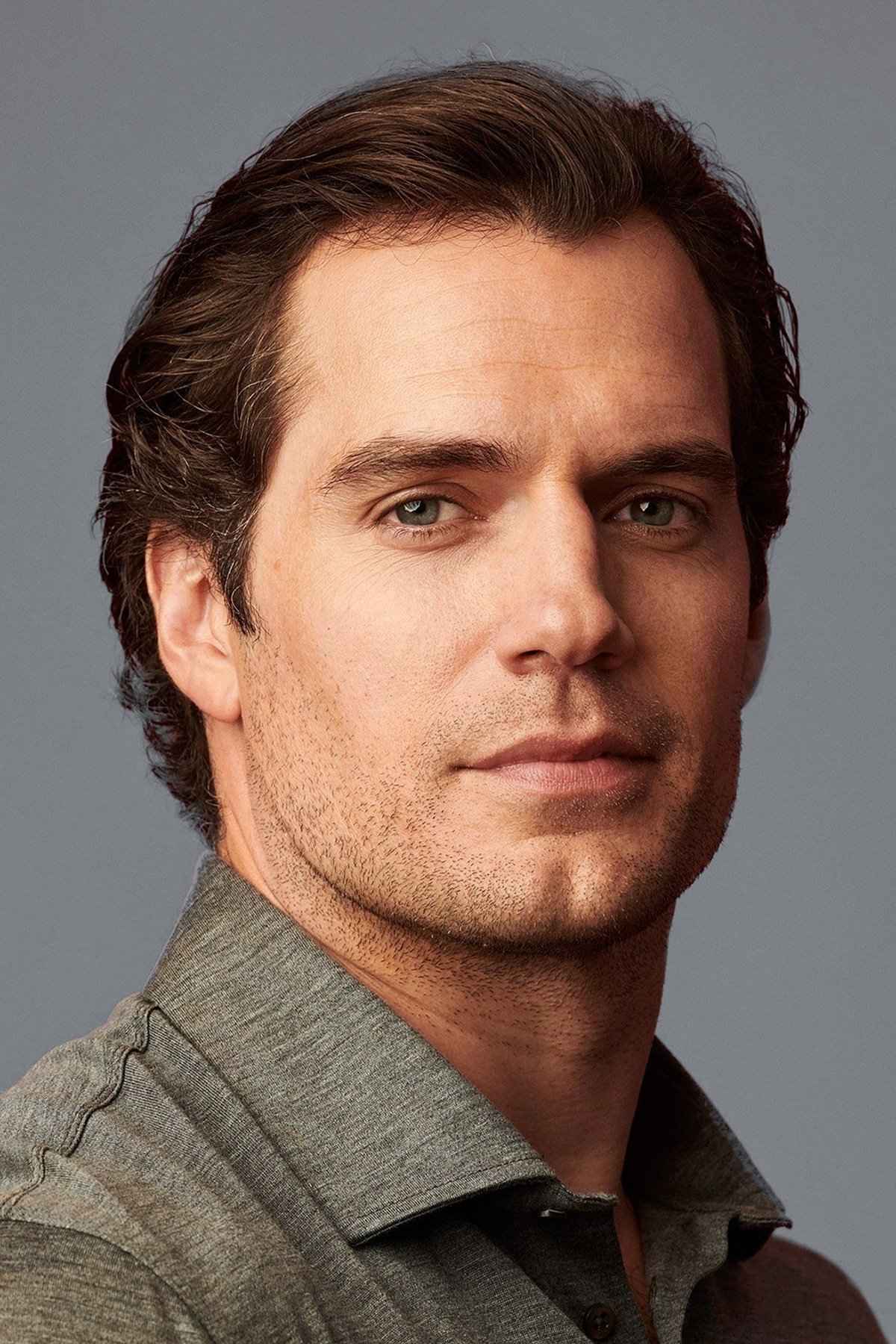

Henry Cavill

Henry Cavill is famous for his acting work in shows like ‘The Witcher’ and movies like ‘Man of Steel’. Beyond acting, he’s a dedicated Warhammer enthusiast who enjoys painting detailed miniatures. He’s also a computer enthusiast, having built a powerful gaming PC and shared the building process with his followers. Interestingly, he almost missed the call offering him the role of ‘Superman’ because he was engrossed in a video game.

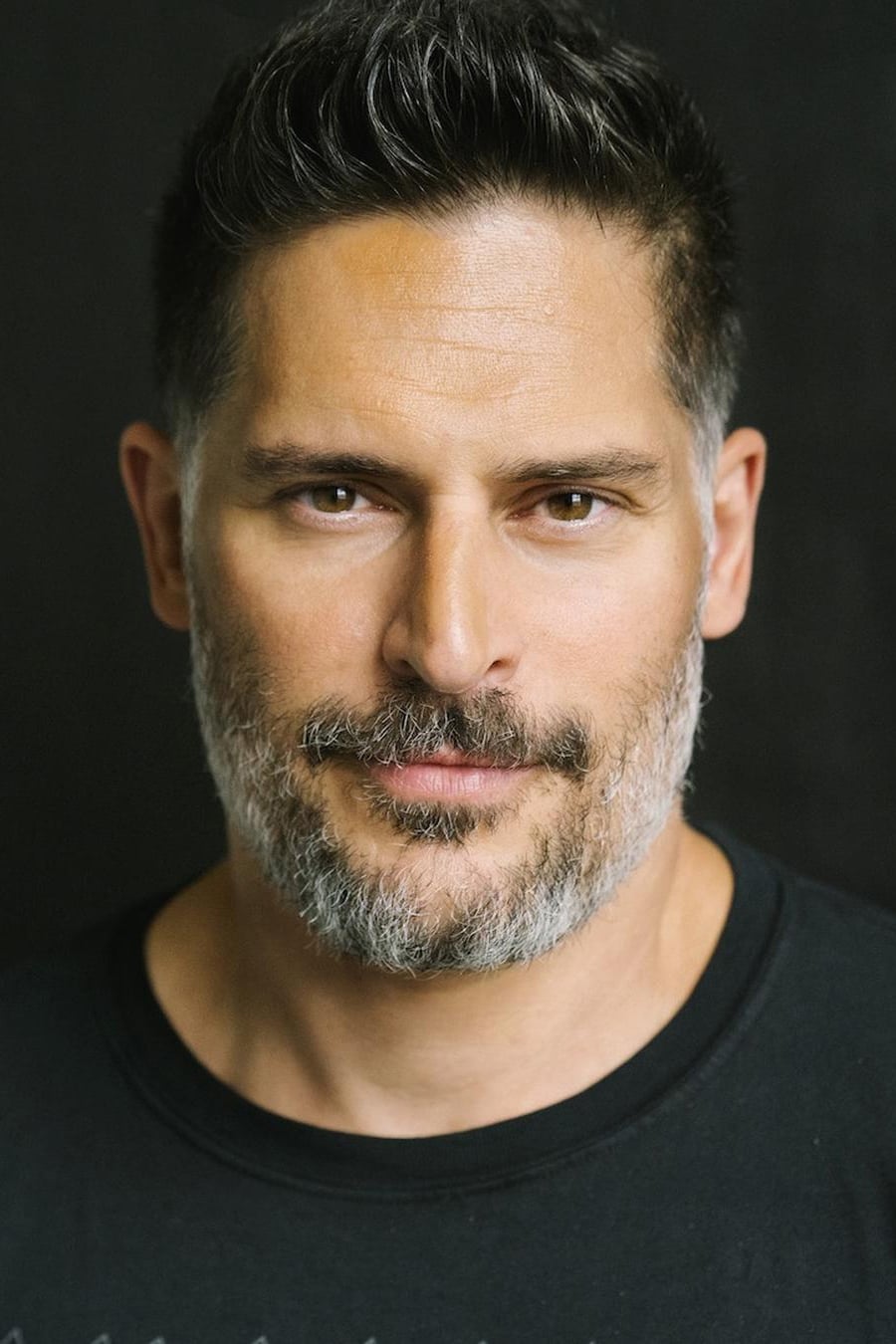

Joe Manganiello

This actor is a huge advocate for Dungeons & Dragons. He’s famously transformed his basement into a dedicated gaming space, which he calls the Gary Gygax Memorial Dungeon. Beyond playing, Manganiello actually creates official content for the game and often hosts gaming sessions for his celebrity friends. His serious dedication to the hobby has helped popularize tabletop gaming and bring it to a wider audience.

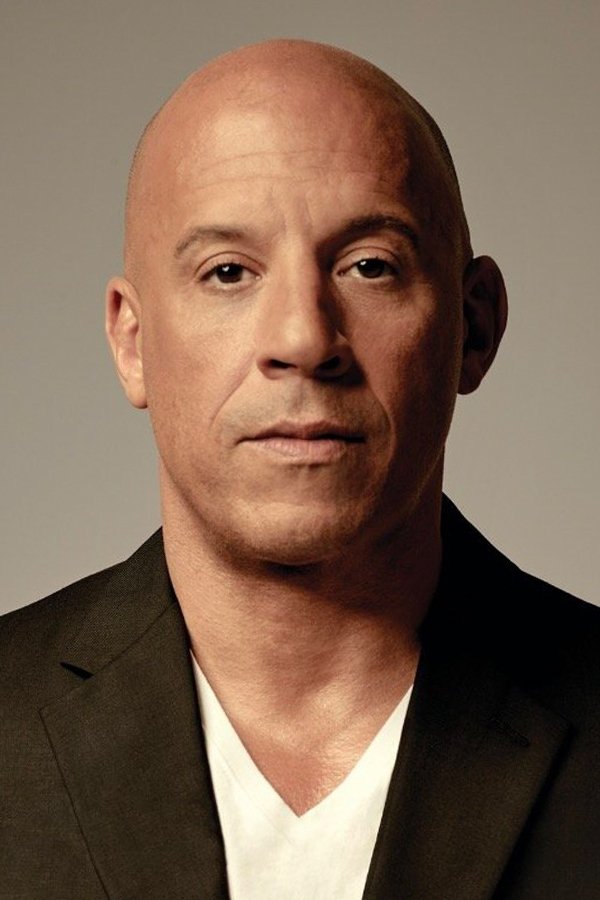

Vin Diesel

Vin Diesel, known for his role in ‘The Fast and the Furious’, has been playing Dungeons & Dragons for many years. He’s such a fan that he wrote the introduction to a book about the game’s history. Diesel credits role-playing games with helping him develop his imagination, and he was so committed to the hobby that he even got a temporary tattoo of his character’s name, Melkor, while filming ‘XXX’.

Mila Kunis

The actress has been candid about her previous addiction to World of Warcraft. To keep her identity secret from other players, she played the game for a long time under a fake name. She became very involved in the game’s community, joining a group and participating in challenging raids. When she first revealed how much she knew about the game, many of her fans were surprised.

Nicolas Cage

The actor took his professional name to honor the Marvel hero Luke Cage. He used to have a huge collection of valuable comic books, including a pristine copy of the first issue of ‘Action Comics’. He sees these comics as modern-day myths and says they inspire his acting. He’s such a fan that he named his son Kal El, Superman’s birth name.

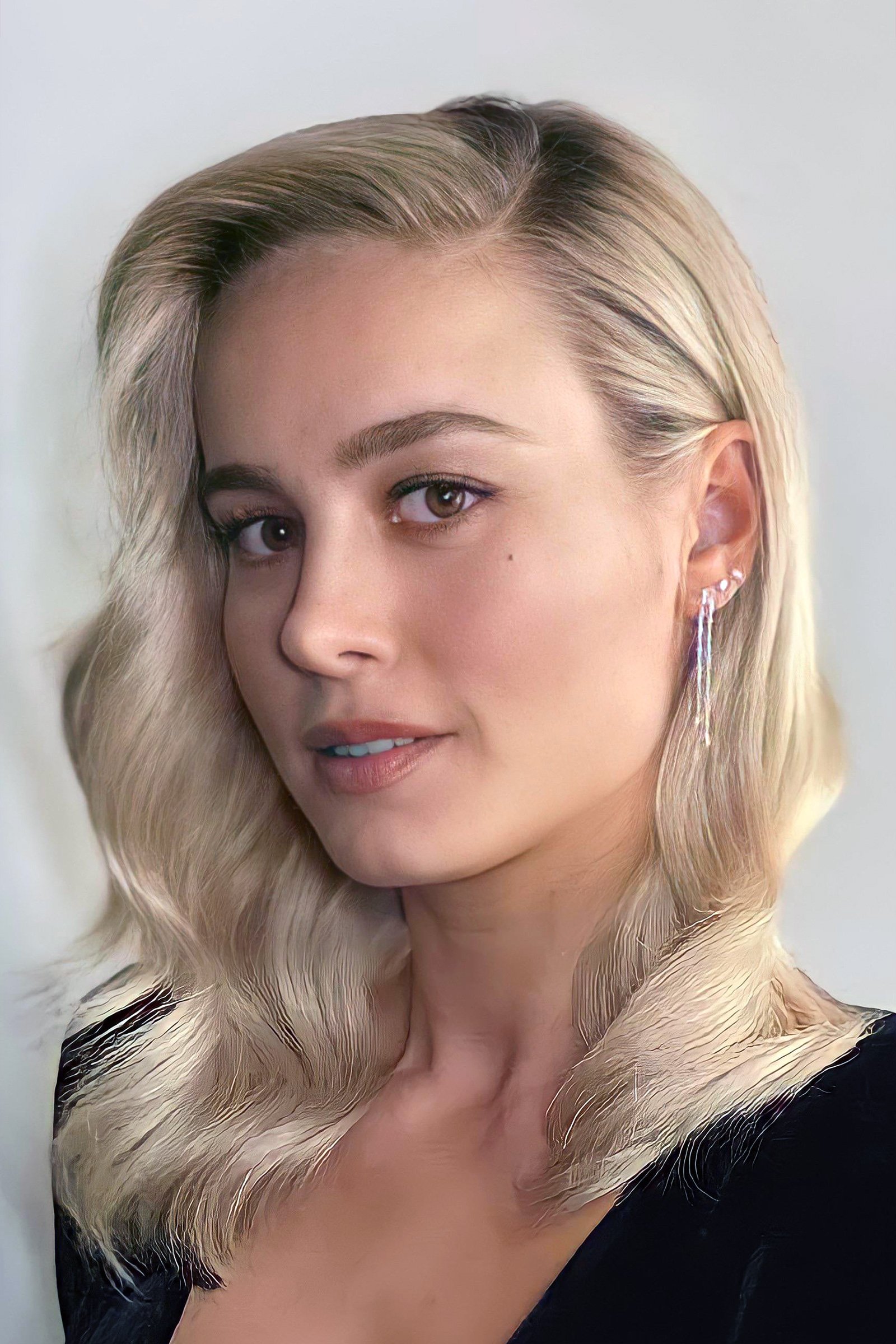

Brie Larson

Brie Larson, known for her role in ‘Captain Marvel,’ is a big fan of Nintendo games like Animal Crossing and Super Smash Bros. She shares her gaming experiences, including tours of her in-game island, on her YouTube channel. Larson has also expressed interest in playing Samus Aran in a potential ‘Metroid’ movie and often connects with gamers online to talk about the latest games.

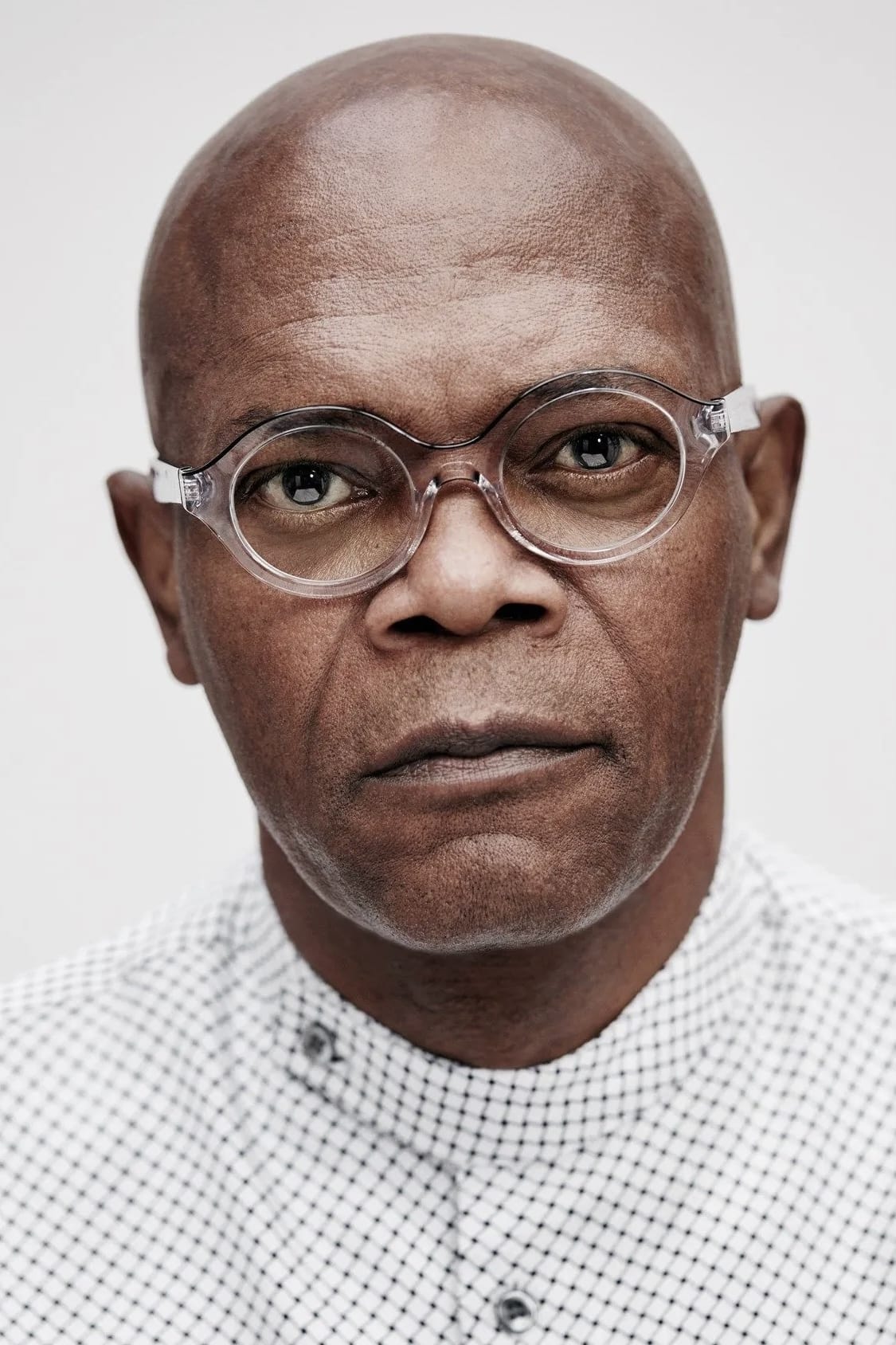

Samuel L. Jackson

Samuel L. Jackson is a well-known anime enthusiast and has even contributed his voice to various animated projects. He went above and beyond as both the lead voice actor and an executive producer for the series ‘Afro Samurai’. He’s spoken about how much he loves classic anime like ‘Ninja Scroll’ and ‘Black Lagoon’, appreciating the creative stories and distinctive visuals that Japanese animation offers.

Megan Fox

The actress has been a fan of comic books and graphic novels for years. She fondly remembers reading ‘Sailor Moon’ as a child and would love to be in a live-action adaptation. Beyond comics, she also enjoys playing video games like ‘Halo’ and ‘Mortal Kombat.’ She’s a big fan of fantasy stories in general, and especially loves the work of J.R.R. Tolkien.

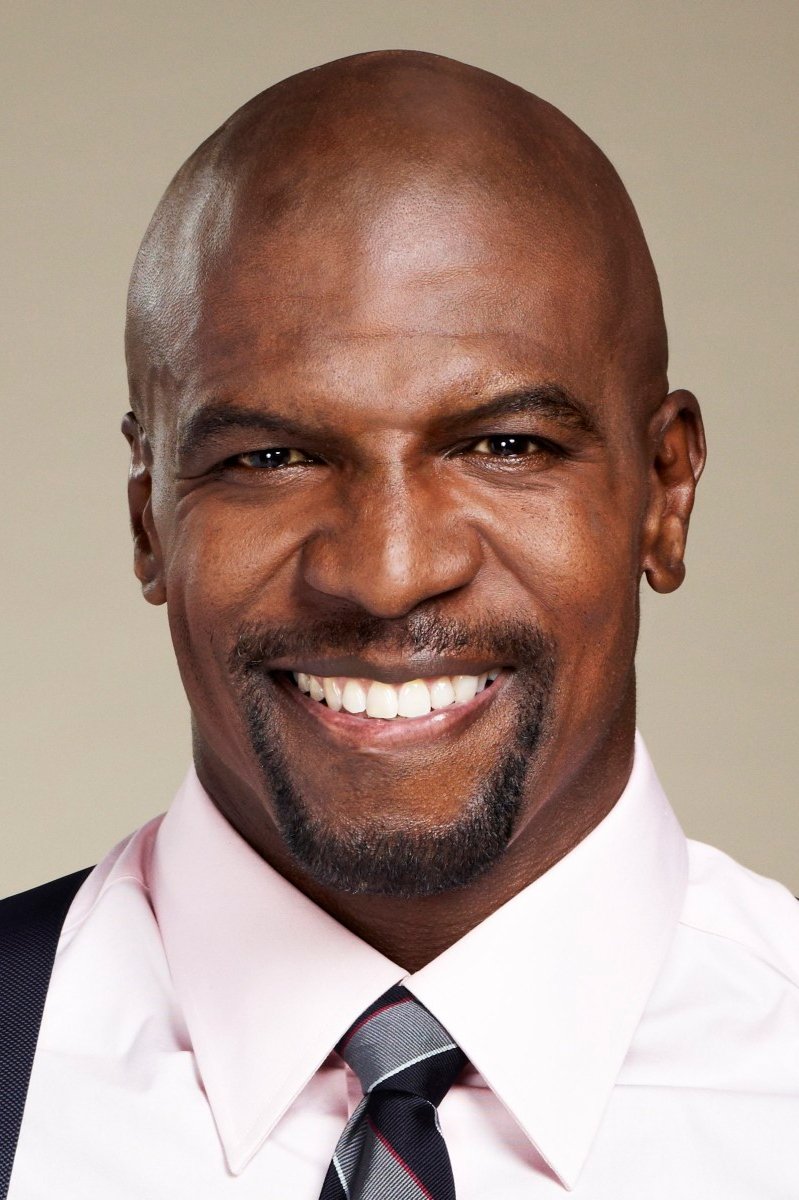

Terry Crews

Once a well-known athlete and actor, he’s now a favorite in the tech world thanks to his open documentation of learning to build computers. He consulted with experts to choose the best parts for a high-performance gaming PC, hoping to connect with his son through their shared interest in gaming. Now, he’s a passionate advocate for the creative and technical skills PC building fosters.

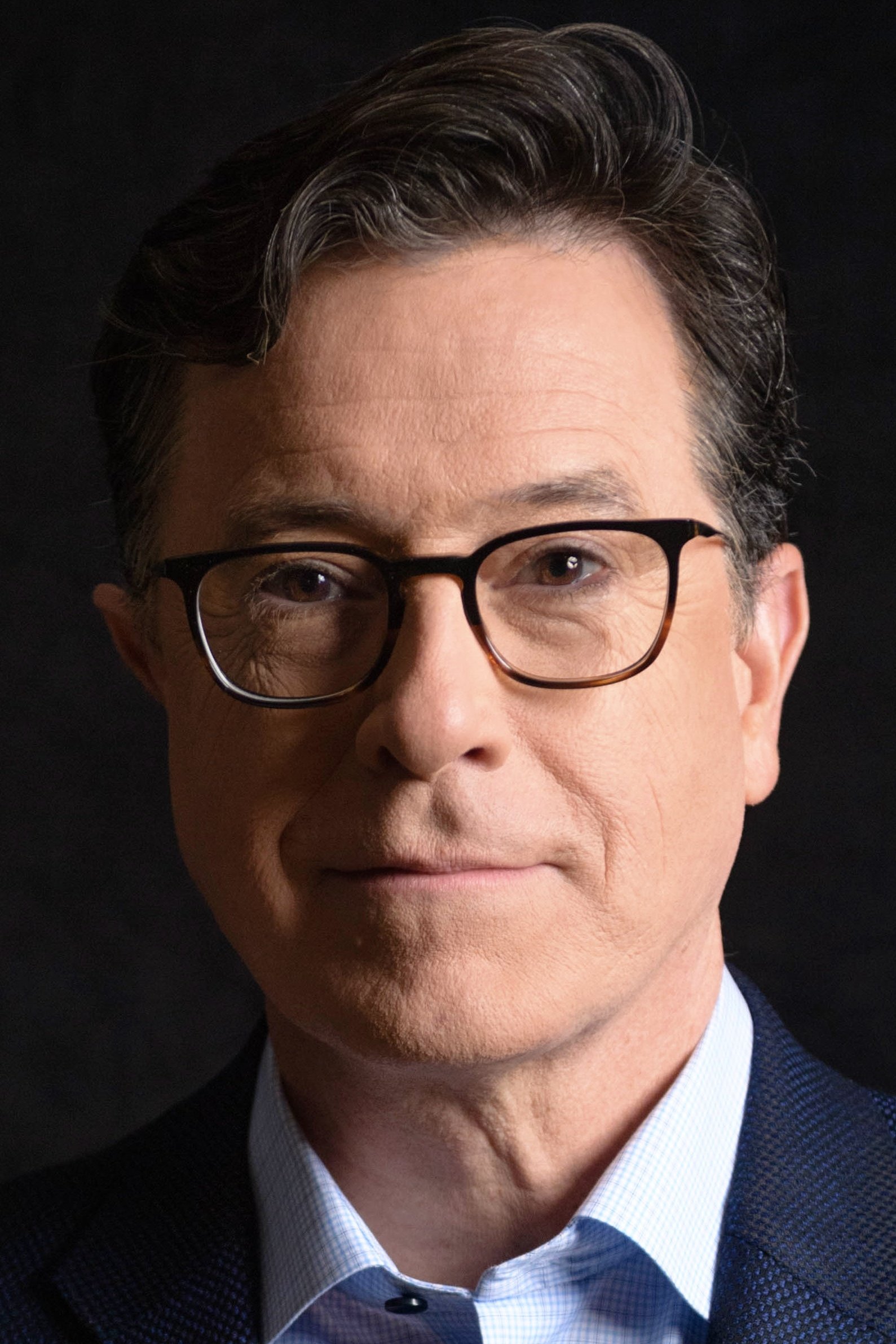

Stephen Colbert

The late-night host is a huge ‘Lord of the Rings’ enthusiast with a deep understanding of the books’ history and details. He’s known for correcting even experts and fellow fans when it comes to Middle-earth lore. His passion for Tolkien’s work is so well-known that he even appeared in ‘The Hobbit: The Desolation of Smaug’ as a fun tribute, and he considers Tolkien’s writings a core part of what he loves.

Margot Robbie

The actress is a huge ‘Harry Potter’ fan and has read the books many times. She even confessed to telling her eye doctor she needed glasses just to get a pair that looked like Harry Potter’s! Robbie loves getting lost in fantasy worlds and being part of the fan community. She’s also fascinated by the detailed work that goes into creating those worlds in books.

Michael B. Jordan

Michael B. Jordan, known for his role in ‘Black Panther,’ is a huge anime enthusiast and often draws inspiration from it in his projects. He even created a clothing line based on the popular series ‘Naruto’ and its characters. Jordan has explained that the strong emotions and character development in anime help shape his acting. He often shares his favorite shows, such as ‘Dragon Ball Z’ and ‘My Hero Academia,’ with his fans.

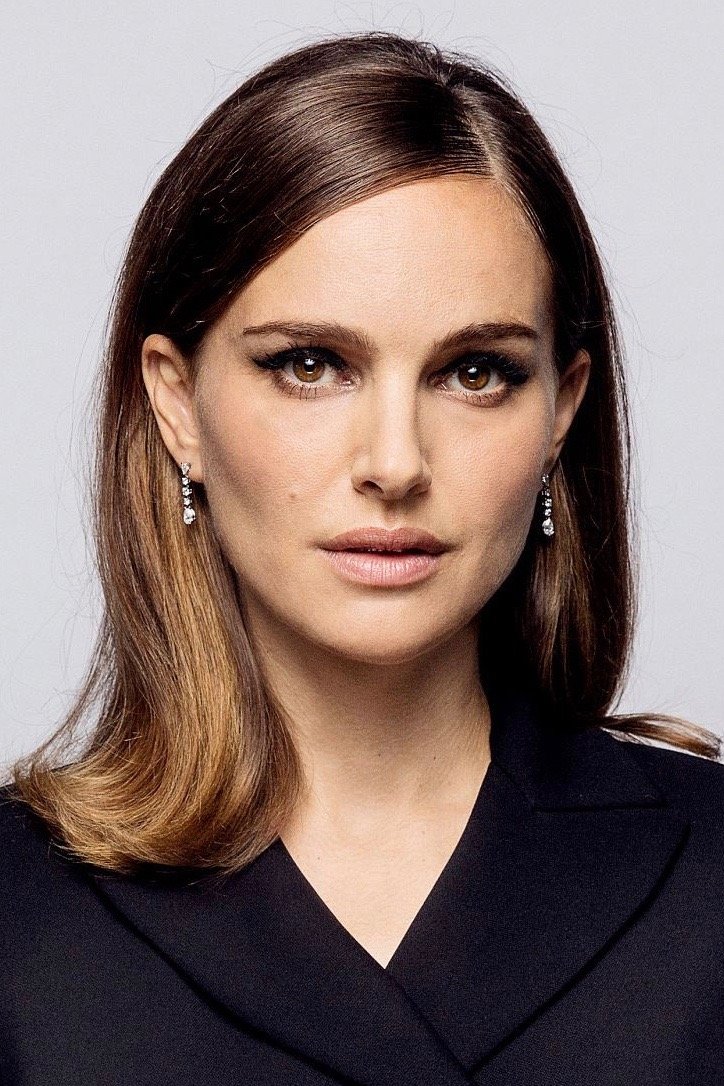

Natalie Portman

Natalie Portman is well-known not only for her acting, but also for her strong academic credentials. While successfully building her acting career, she earned a psychology degree from Harvard University. Beyond her studies, she’s even co-authored and published research papers in scientific journals, demonstrating her ongoing passion for learning and exploring challenging subjects.

Post Malone

The musician is a well-known collector and player of the card game Magic: The Gathering. He famously spent over $2 million to buy a rare, one-of-a-kind card called ‘The One Ring’. Malone often streams matches on gaming channels, playing against both fans and professional players. He loves the game’s challenging strategy and the friendly community around it.

T-Pain

T-Pain is a popular streamer on Twitch, regularly playing video games in front of a live audience. He’s particularly good at games like ‘Forza’ and ‘Call of Duty,’ and also enjoys cosplay, having dressed up as characters from ‘Tekken’ and ‘South Park.’ Through his streaming, he connects the worlds of music and gaming.

Rosario Dawson

The actress is a big ‘Star Trek’ fan and even knows a little Klingon! She’s also creatively involved, having co-created her own comic book series called ‘Occult Crimes Taskforce’. She loves connecting with fans at science fiction and fantasy conventions, and she’s inspired by the forward-thinking ideas often found in those communities.

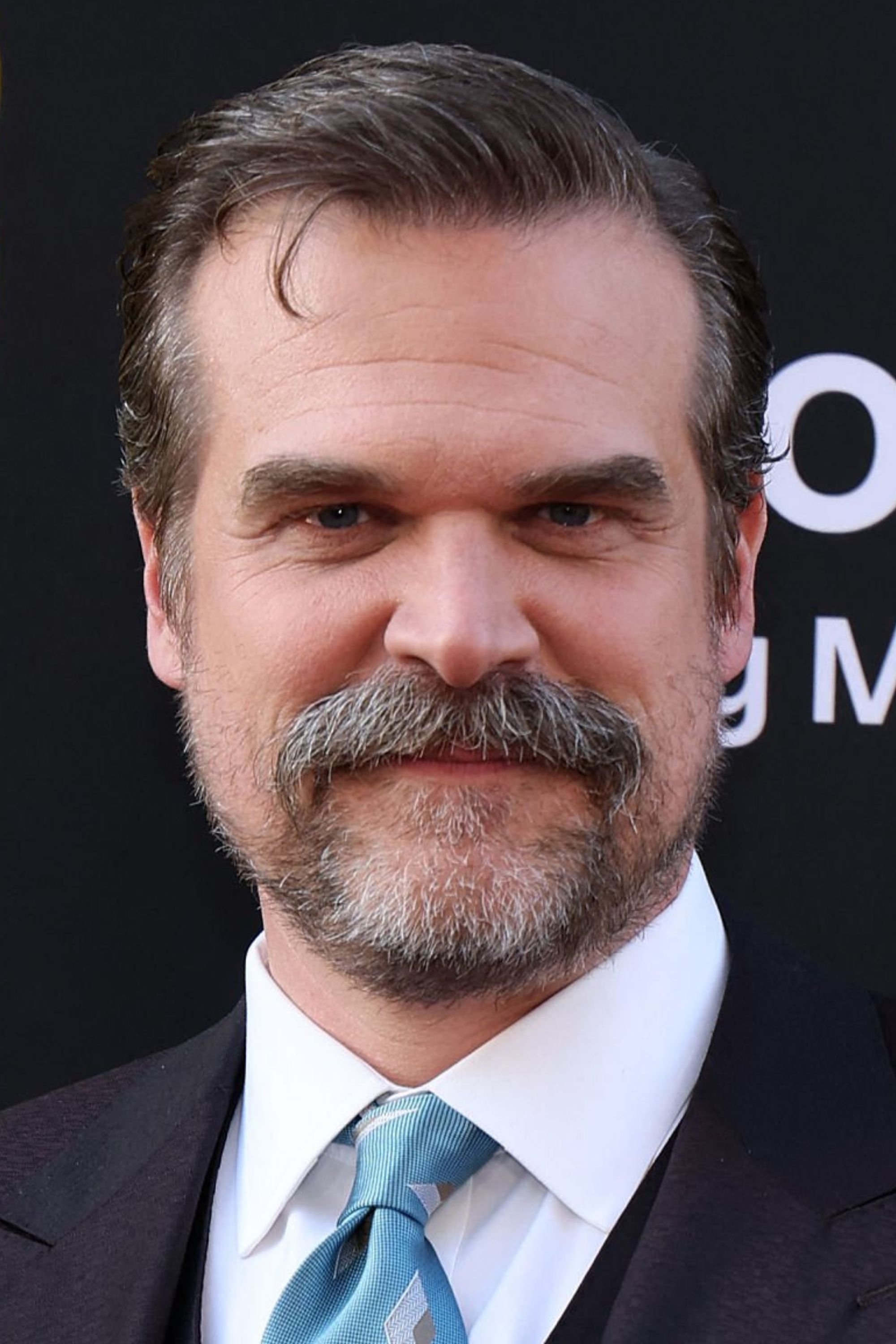

David Harbour

David Harbour, known for his role in ‘Stranger Things,’ used to be deeply involved in playing World of Warcraft when he was starting out as an actor. He became quite skilled at the game, spending a lot of time working with his fellow players. Harbour also loves traditional board games and role-playing games, finding that they offer a fun way to escape into imaginative worlds.

Rahul Kohli

This actor is a passionate gamer, especially a big fan of the Warhammer 40000 world. He loves sharing pictures of his hand-painted miniatures and talking about the rich backstory of the game. He also frequently posts about computer parts and new video games on social media, and is an active, inclusive member of the online gaming community.

Maisie Williams

The actress, famous for her work on ‘Game of Thrones,’ is a dedicated video game player. She especially loves the Animal Crossing series, appreciating how much creativity it lets you express. Beyond gaming, she’s involved in the tech world and has even created her own social media app designed for content creators. She’s fascinated by the ways technology and art can come together.

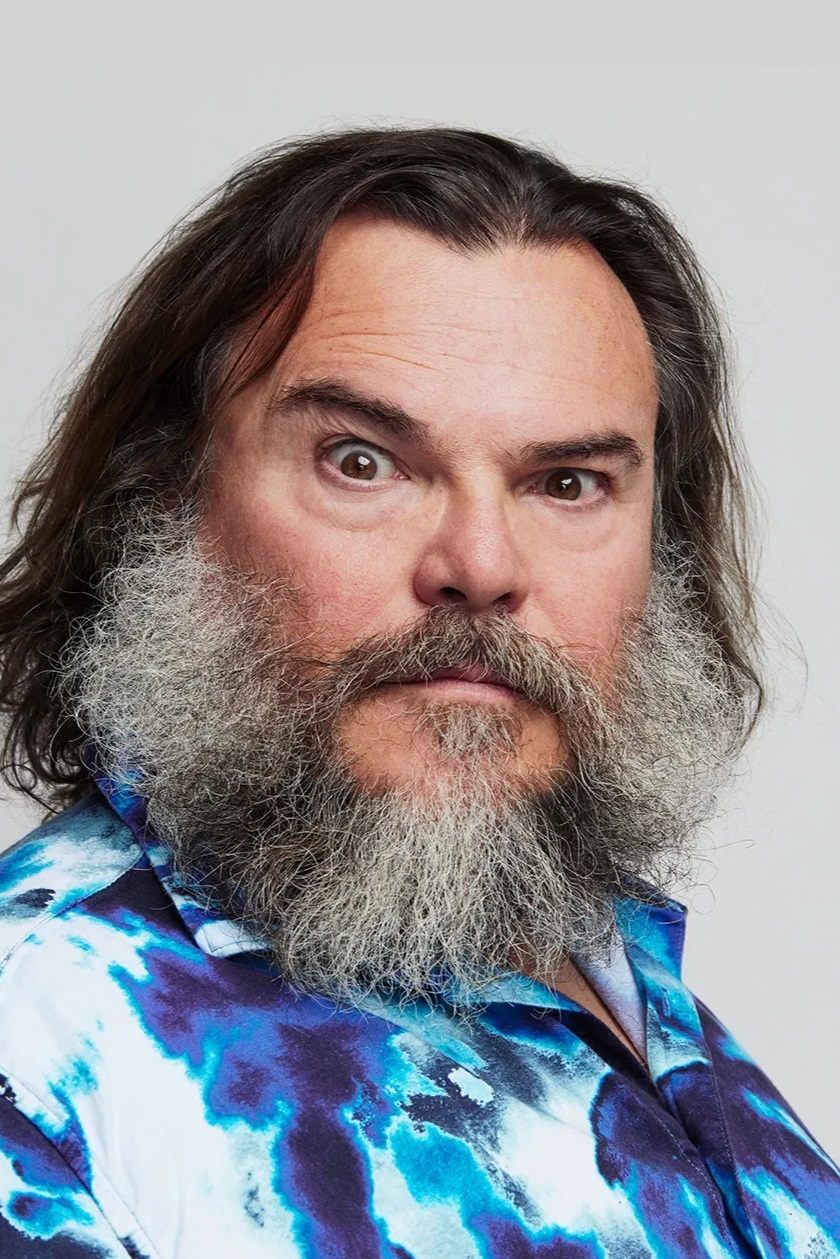

Jack Black

Jablinski Games is a popular YouTube channel run by an actor and musician who loves video games. He shares his thoughts on both old-school arcade games and newer titles, and is passionate about the history and community surrounding gaming. He also frequently teams up with other gaming creators to make fun videos for his audience.

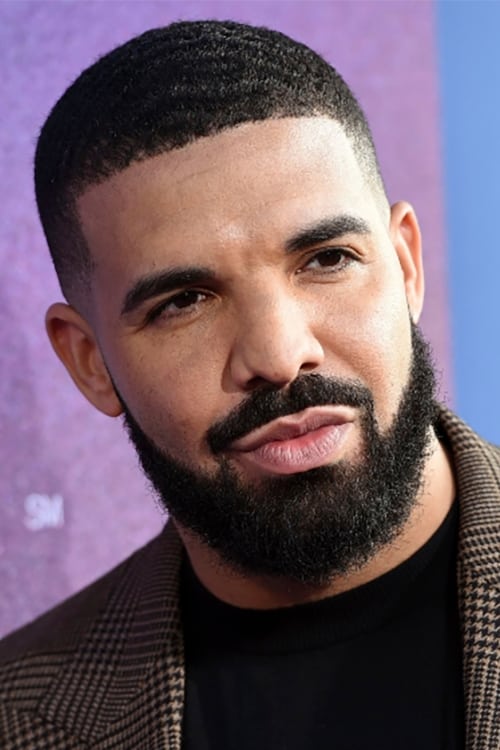

Drake

The rapper recently shocked fans by appearing on a live stream to play ‘Fortnite’ with well-known gamers. He’s since put money into the esports team 100 Thieves and has also become a collector of rare trading cards, even publicly opening packs of ‘Magic The Gathering’. His participation has brought competitive gaming to the attention of a much larger audience.

Henry Golding

Henry Golding, known for his role in ‘Crazy Rich Asians,’ is a big ‘Star Wars’ enthusiast. He has an extensive collection of ‘Star Wars’ items and even had the chance to visit the movie set as a fan. Golding is fascinated by how the films are made and appreciates the imaginative design of the franchise, frequently discussing science fiction’s influence on his life.

Chloë Grace Moretz

As a film buff, I’ve always been fascinated by actors’ lives outside of movies, and Chloe Moretz is a great example. I learned she’s a seriously skilled PC gamer, especially into competitive first-person shooters! She’s always sharing what she’s using – her favorite gaming setups and how different parts perform. She’s said gaming is actually how she unwinds and recharges between films, which I totally get. Plus, she’s a really active supporter of the gaming community online, which is awesome to see.

John Boyega

The actor is a big anime enthusiast and frequently talks about the shows he loves in interviews. He’s particularly passionate about ‘Attack on Titan’ and ‘Naruto’, and even collects detailed figurines and merchandise. He appreciates the intricate stories and distinctive animation that Japanese anime offers.

Anya Taylor-Joy

You know, getting ready to play Beth Harmon in ‘The Queen’s Gambit’ really got me into chess. I actually learned how to play, and I started enjoying it whenever I had some downtime. I’ve always been a bit of a gamer, and I’m a huge fan of fantasy worlds, but both chess and video games really appeal to that part of me that loves a good mental workout and a bit of strategy. It’s just really satisfying to have to think things through!

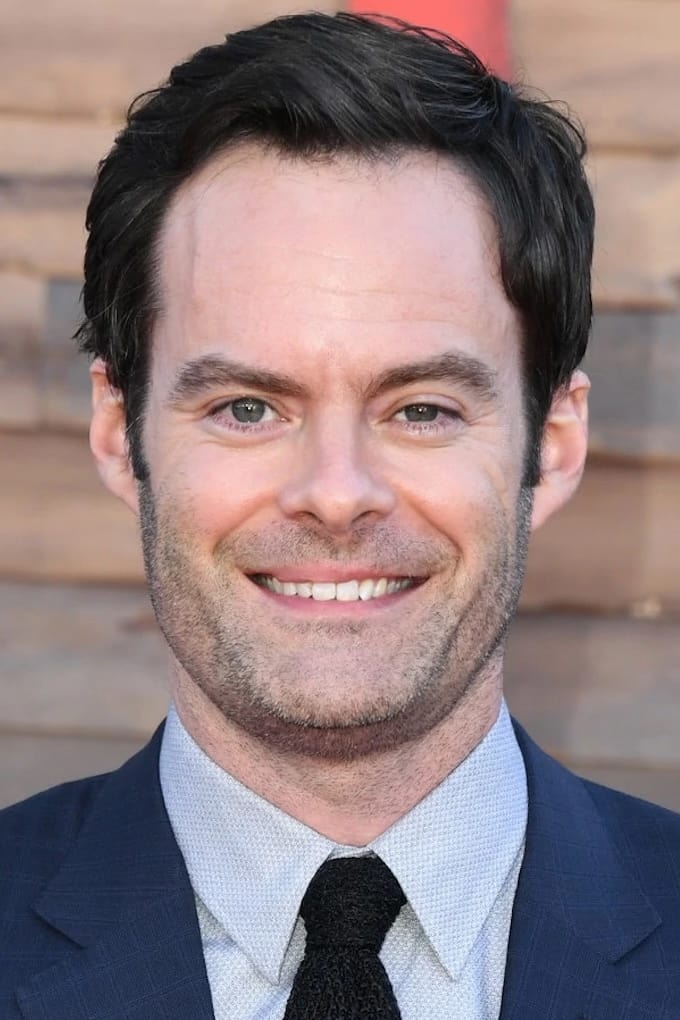

Bill Hader

This comedian and actor is a huge movie buff, especially when it comes to older films and the history of cinema. He loves sharing what he knows about lesser-known movies and directors with his fans. He’s even curated selections of his favorite films for TV channels. He’s fascinated by how filmmaking has developed as both a technical craft and an art form.

Rashida Jones

The actress is also a skilled writer and recently co-created her own comic book series, ‘Frenemy of the State.’ The series received a lot of positive feedback from readers. Having always loved graphic novels and their ability to tell stories, she remains a strong supporter of the comic book world and its creators.

Seth Rogen

Seth Rogen has been a comic book and animation enthusiast his entire life. He’s produced several TV and film adaptations of darker graphic novels, including ‘Preacher’ and ‘The Boys’. Beyond that, he’s a collector of classic toys and items from the franchises he loves, and he often draws inspiration from these stories for his own projects.

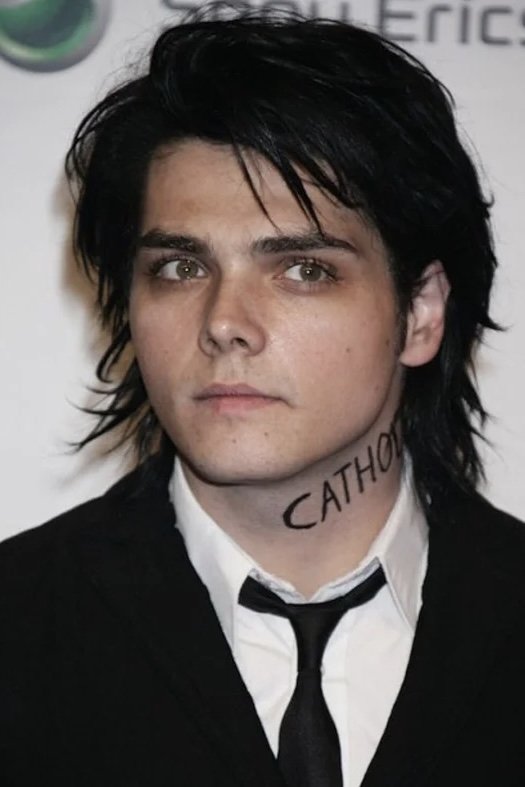

Gerard Way

Gerard Way, the frontman of the band My Chemical Romance, is also a successful comic book author. He’s best known for creating ‘The Umbrella Academy,’ which has since become a popular TV show. With a background in professional illustration from the School of Visual Arts, Way is still a well-respected and active creator in the comic book world, consistently releasing new work.

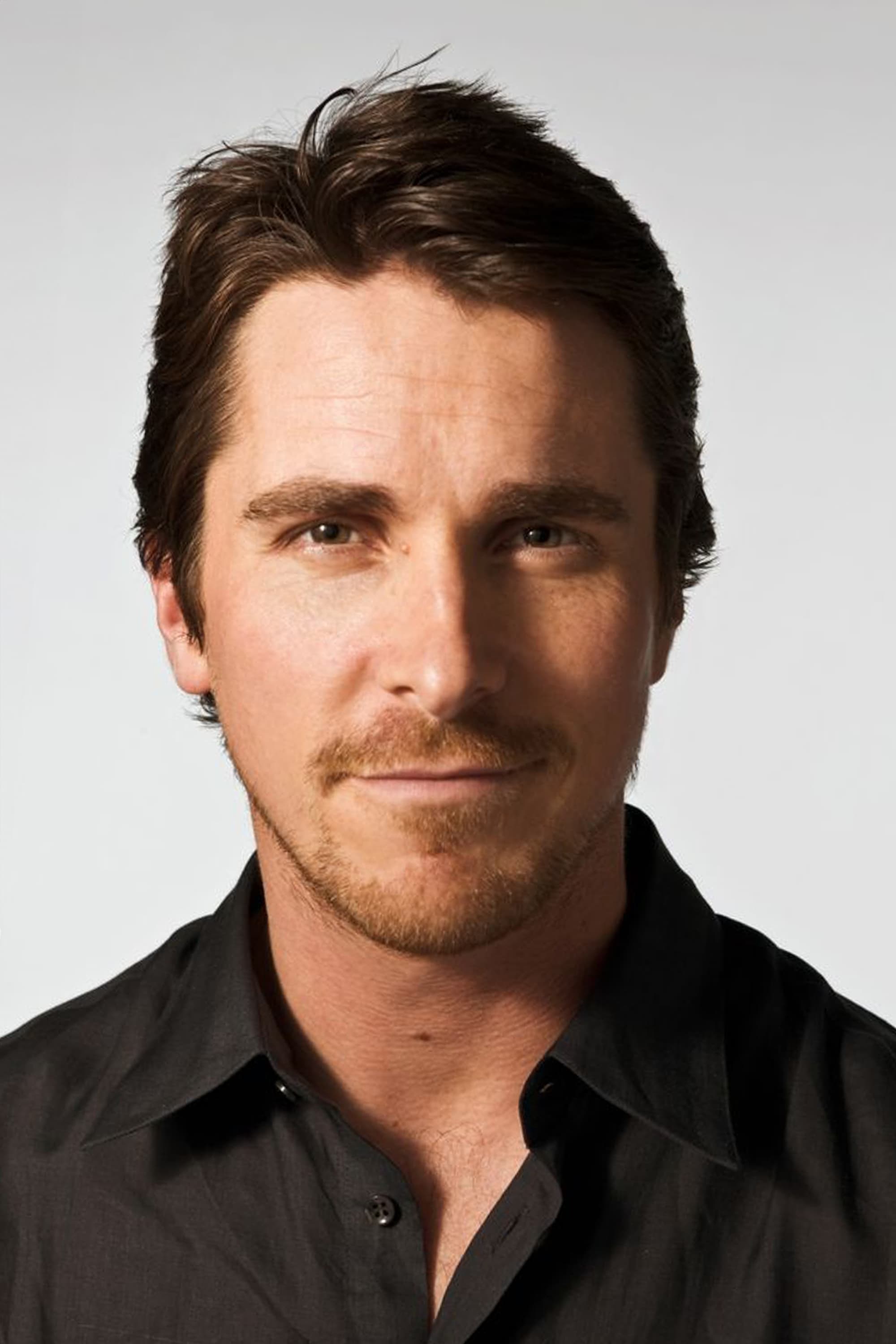

Christian Bale

The actor is famous for playing demanding characters, but he also has a passion for the realistic world of racing simulators. He uses top-of-the-line equipment to make the experience as close as possible to driving a real race car. Beyond acting, Bale is fascinated by the history of film and how movies are made. While he generally keeps his personal life private, he’s spoken about how much he enjoys playing simulation games.

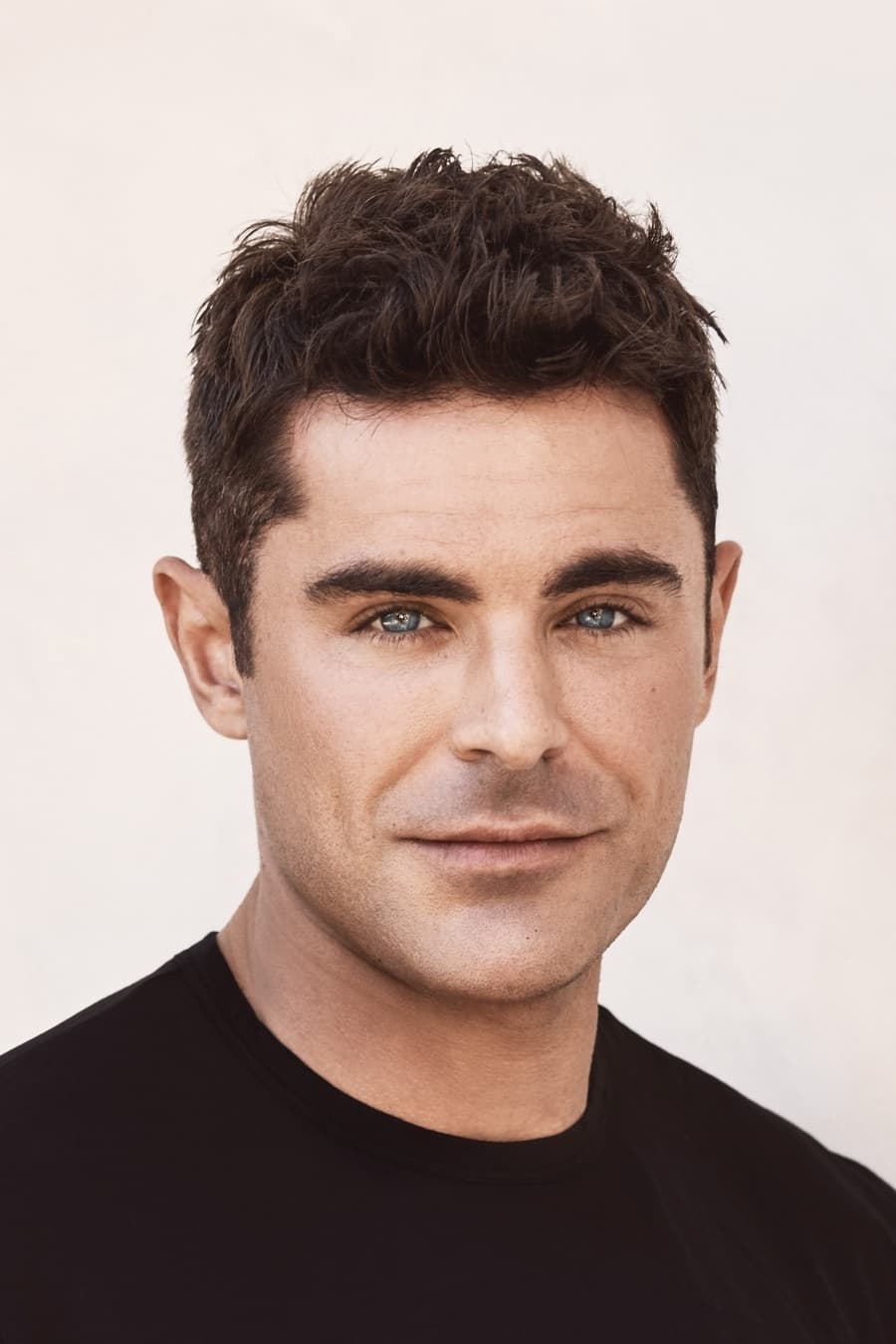

Zac Efron

As a kid, the actor was a big fan of the ‘Halo’ video games and spent a lot of time playing with his friends. He loved the series so much he even hosted an event when a new game came out! Even now, Zac Efron still enjoys gaming, finding it’s a great way to connect with friends when he’s on the road. He values the friendships that can be built through playing games online.

Snoop Dogg

The famous rapper is a dedicated gamer who regularly streams his gameplay online. He’s also created his own esports league to help other gamers compete. You can often find Snoop Dogg playing sports and action games on his Twitch channel, and he’s even been included as a character in some popular video games.

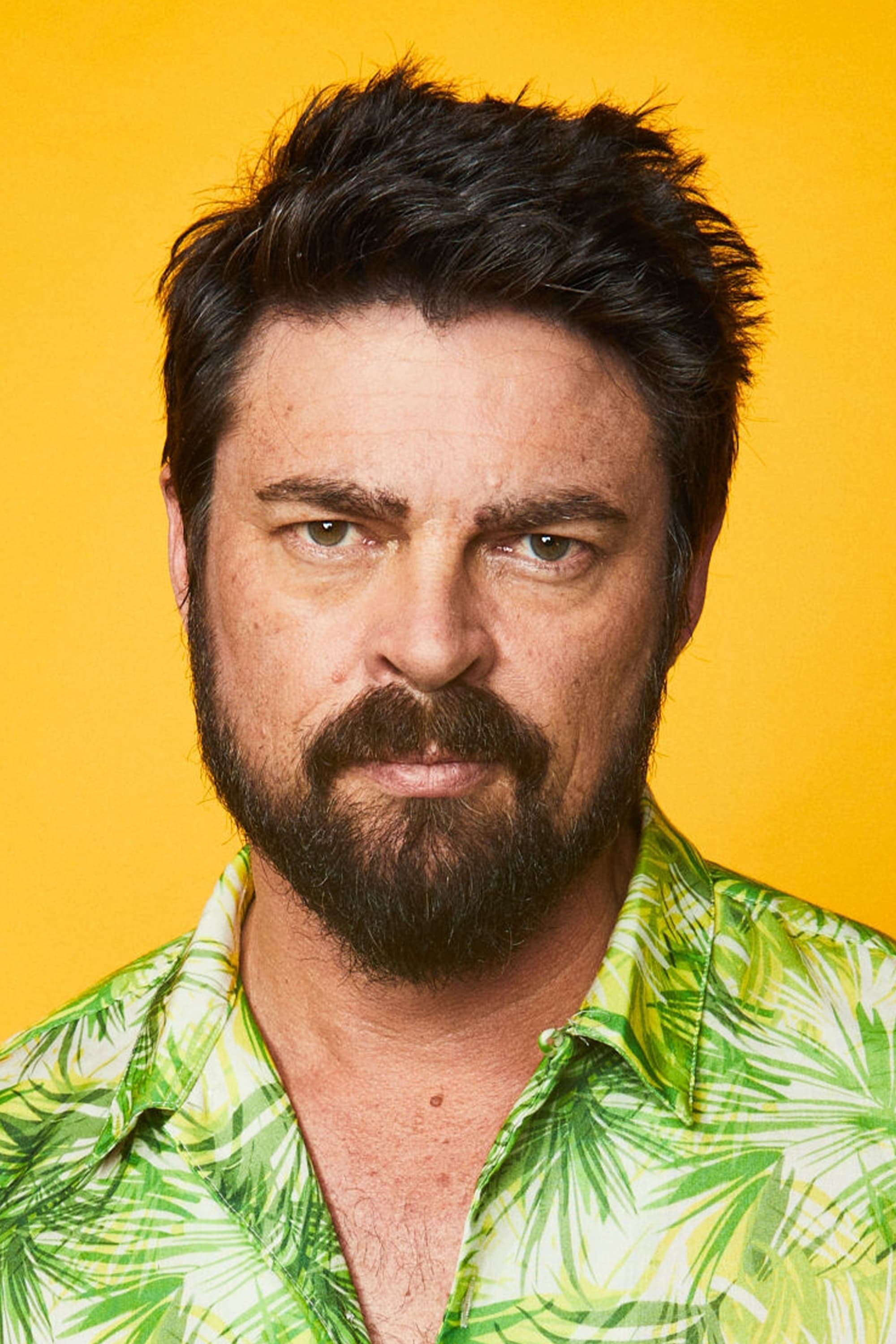

Karl Urban

Karl Urban, known for playing Bones in ‘Star Trek,’ is a big fan of both science fiction and video games. He regularly attends fan conventions to talk about the stories and details of the shows and movies he’s been a part of. He also loves playing video games, especially those related to ‘Star Wars,’ and really appreciates how friendly and enthusiastic the fan communities are.

Simon Pegg

This actor and writer openly embraces his ‘nerd’ status and has written books celebrating pop culture. He’s best known for co-writing and starring in ‘Shaun of the Dead,’ a film packed with nods to classic horror and science fiction. A huge fan of ‘Star Wars’ and ‘Doctor Who,’ he’s even appeared in both series, viewing himself as someone who deeply studies the genres he loved as a child.

Nick Frost

I’m a big fan of Nick Frost, and like his friend Simon Pegg, he’s really into gaming and tech. Whenever he has some downtime, he’s usually playing the latest games and chatting about them with his friends. What I really appreciate is how much he seems to respect the work that goes into making these games – building entire digital worlds is amazing! He really gets lost in the stories modern games tell, and I can see why he loves them.

Ben Affleck

The actor has been a comic book enthusiast since he was a kid and is a serious collector. He’s always loved Batman, even publicly sharing his enthusiasm for the character long before he was chosen to play him. He used to have an entire room in his house filled with his collection and Batman memorabilia, and he especially admires the detailed artwork of classic comic book artists.

Patton Oswalt

This comedian is known as a major Hollywood nerd, with an incredible knowledge of movies, comics, and sci-fi books. He’s written for several comic book companies and often talks about pop culture online. You can also find him at fan conventions, where he loves connecting with other enthusiasts.

Felicia Day

Felicia Day is known for being a trailblazer for people interested in technology and gaming. She created the popular web series ‘The Guild,’ which humorously depicted the lives of online gamers, drawing from her own experiences. Beyond the show, Day has also written books about her life as a geek and her career in the tech world, and continues to advocate for diversity and innovation in gaming.

Wil Wheaton

Wil Wheaton, known for his role in ‘Star Trek: The Next Generation,’ is a prominent figure in the world of tabletop games. He gained popularity hosting the web series ‘TableTop,’ where he played board games with celebrities. Wheaton often writes about his passion for games and how important play is, and he’s a strong voice for the many positive benefits gaming can offer.

Mayim Bialik

The actress has a PhD in neuroscience from UCLA and is a trained scientist. She frequently uses her public profile to inspire young people to consider careers in science and technology. She’s also written books exploring how science connects to our daily lives, and her scientific training gives her a special way of looking at things.

Kristen Bell

The actress loves video games and has even lent her voice to the ‘Assassin’s Creed’ games. She’s said that she likes to unwind by playing games like ‘Mario Kart,’ and she particularly enjoys how fun and competitive those family-friendly games can be. Beyond gaming, she’s also a fan of the imaginative stories told in animated movies and TV shows.

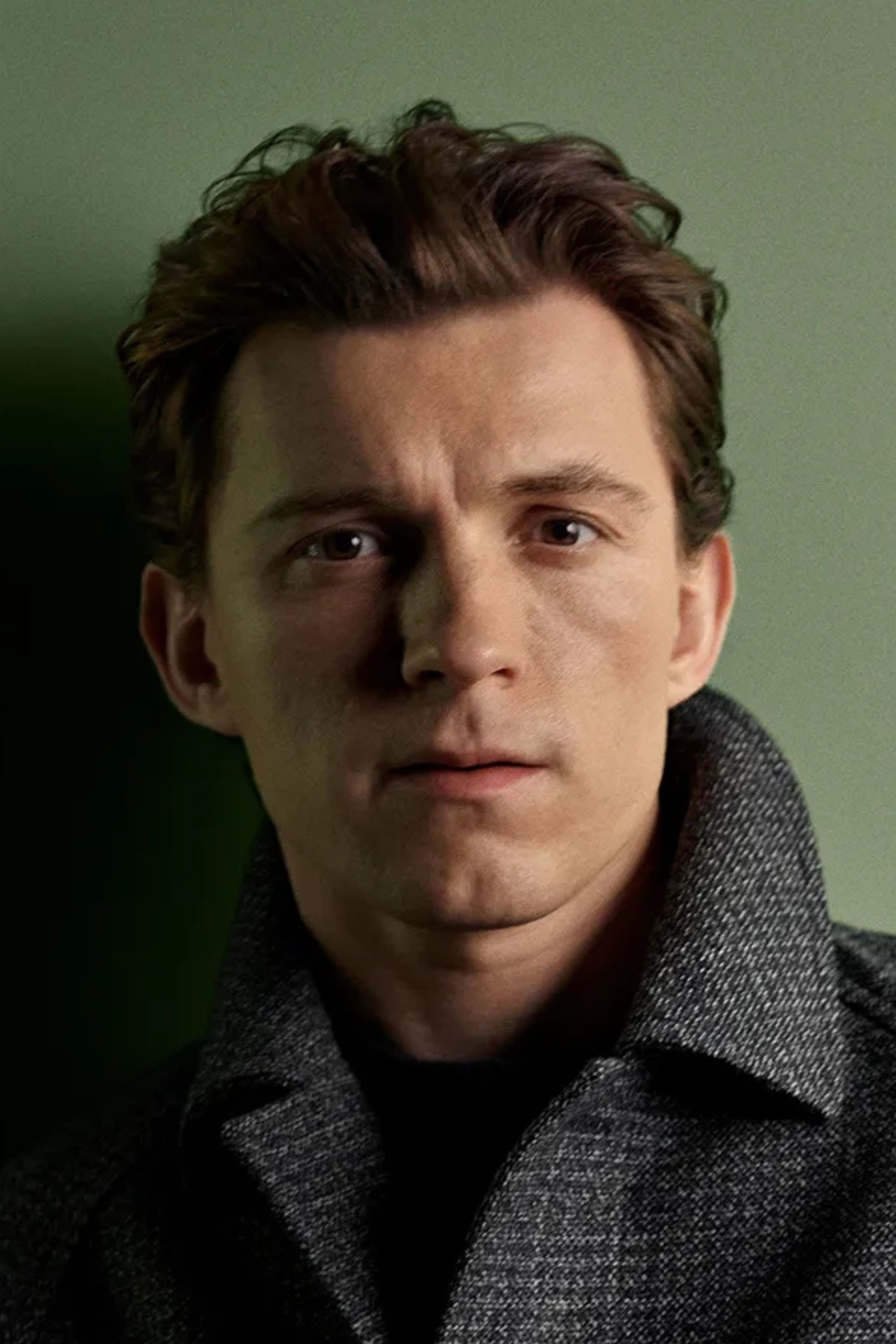

Tom Holland

Tom Holland, the actor famous for playing Spider-Man, is a big fan of the Warhammer hobby. He’s interested in learning to paint the small figures and play the tabletop game. He also loves video games – he even went on to star in a movie based on ‘Uncharted,’ a game he enjoyed playing. Holland often shares his passion for the latest tech and gaming accessories.

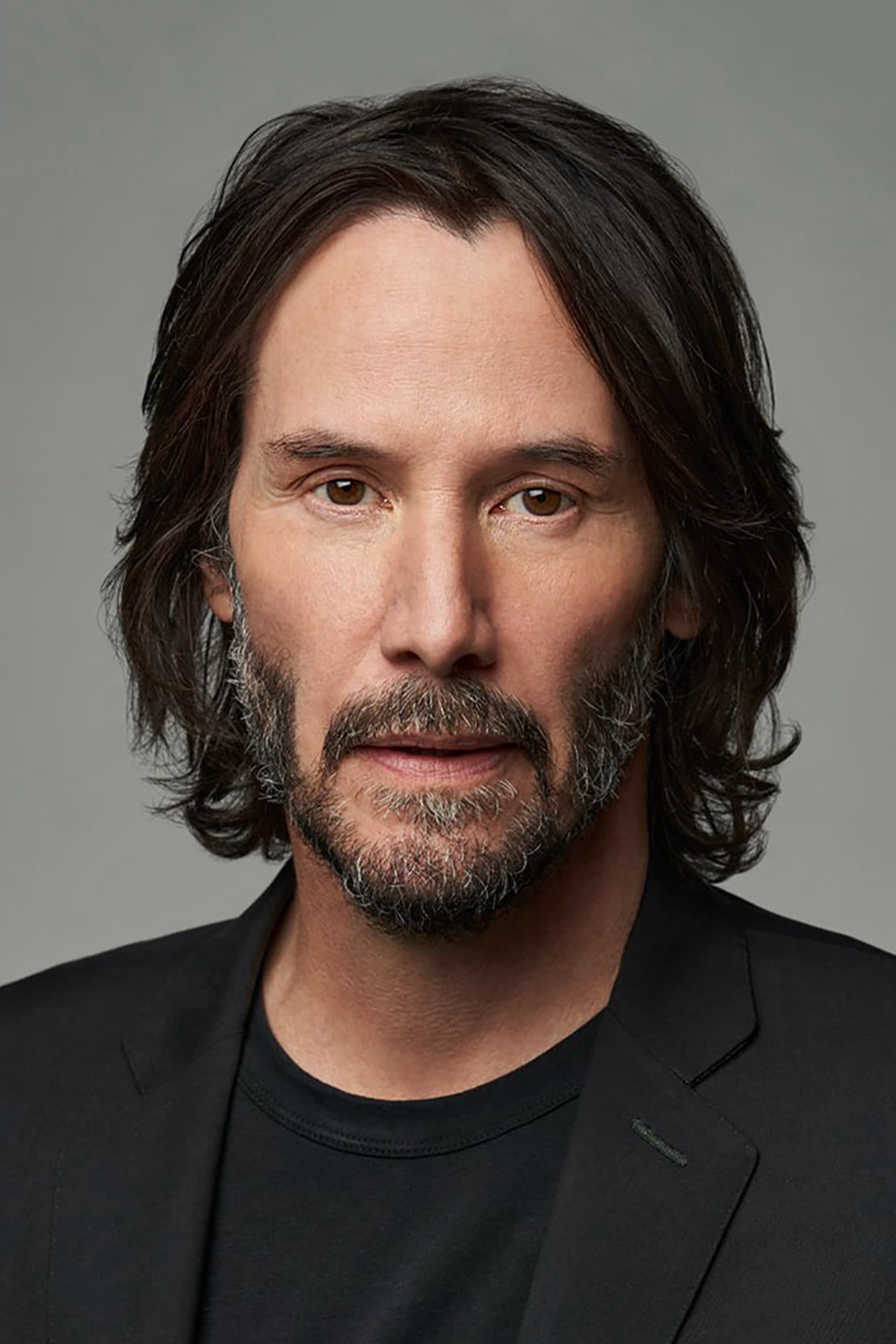

Keanu Reeves

Keanu Reeves is a big fan of comic books and even co-created his own series, ‘BRZRKR’. He also loves science fiction, which is clear in the movies he chooses. Reeves worked closely with the team making the ‘Cyberpunk 2077’ video game, showing he’s genuinely interested in digital technology. He really enjoys the collaborative creative process in all these different areas – comics, film, and gaming.

Mercedes Varnado

I’m a huge fan of this wrestler and actress – she’s seriously into anime and everything about Japanese culture! It’s so cool to see her incorporate ‘Sailor Moon’ into her wrestling outfits during big matches. She’s often at anime conventions, and I love how she always shares her passion with all of us fans. She’s even said that the brave characters in anime give her strength and inspire her – it’s really awesome to see!

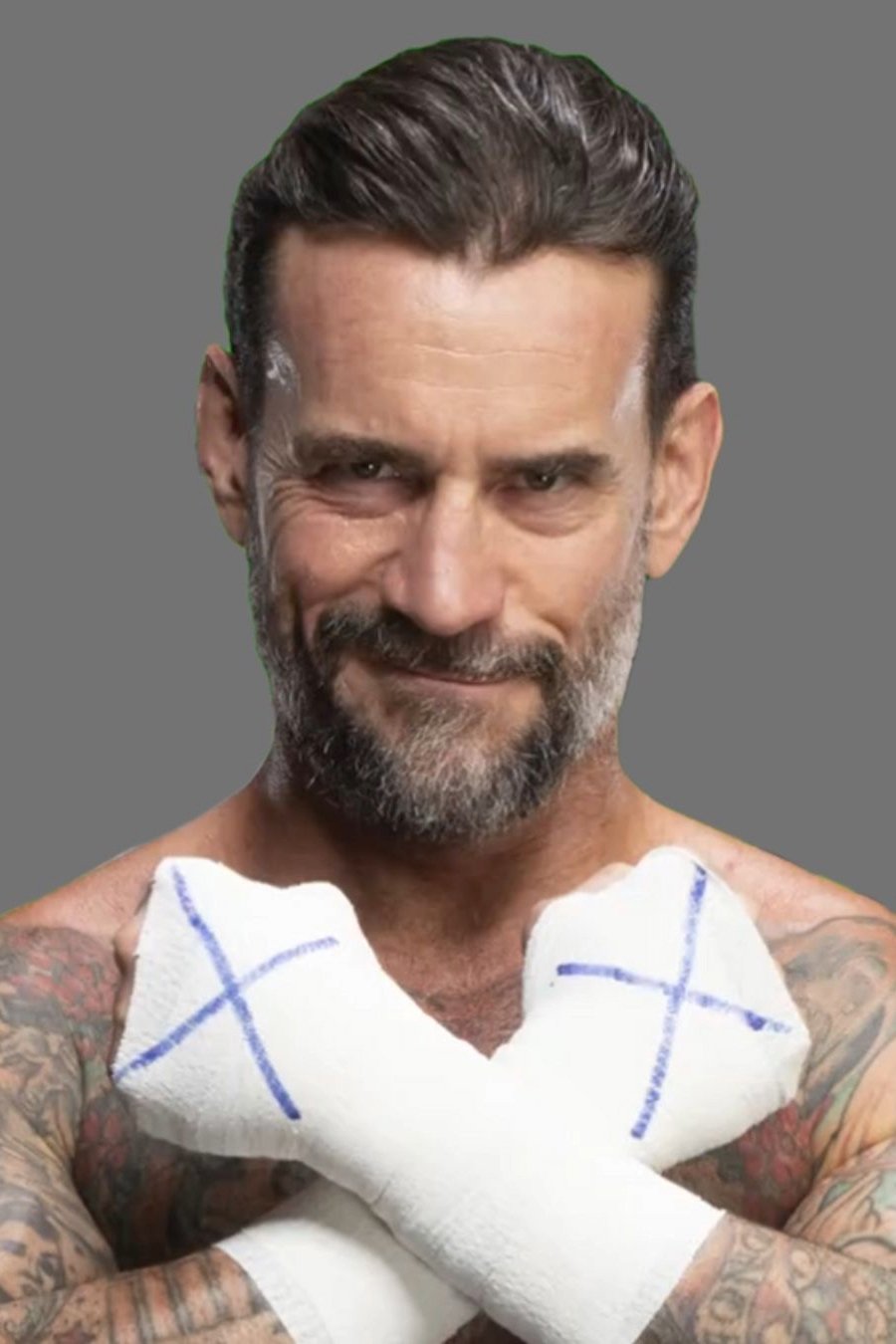

Phil Brooks

This athlete and actor has been a comic book enthusiast his entire life, even writing stories for some of the biggest publishers. He’s contributed to popular series like ‘Guardians of the Galaxy’ and ‘Iron Fist.’ A true expert, he’s known for his deep understanding of comic book history and owns a valuable collection of rare comics. He frequently uses his fame to champion the comic book world.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- Anime That Should Definitely be Rebooted

- The 10 Most Underrated Mikey Madison Movies, Ranked (from Least to Most Underrated)

2026-02-14 00:19