Four months. Four months of watching Solana – that shimmering, unstable beast – get repeatedly kicked in the teeth. Down 65%, they say. A statistic. Just a number, but it feels… visceral. The whole crypto landscape is bleeding, sure, a collective 50% wipeout, but Solana? Solana’s been SPECIAL. A particularly spectacular flameout. And let’s be honest, in this godforsaken market, spectacle is about all we’ve got left.

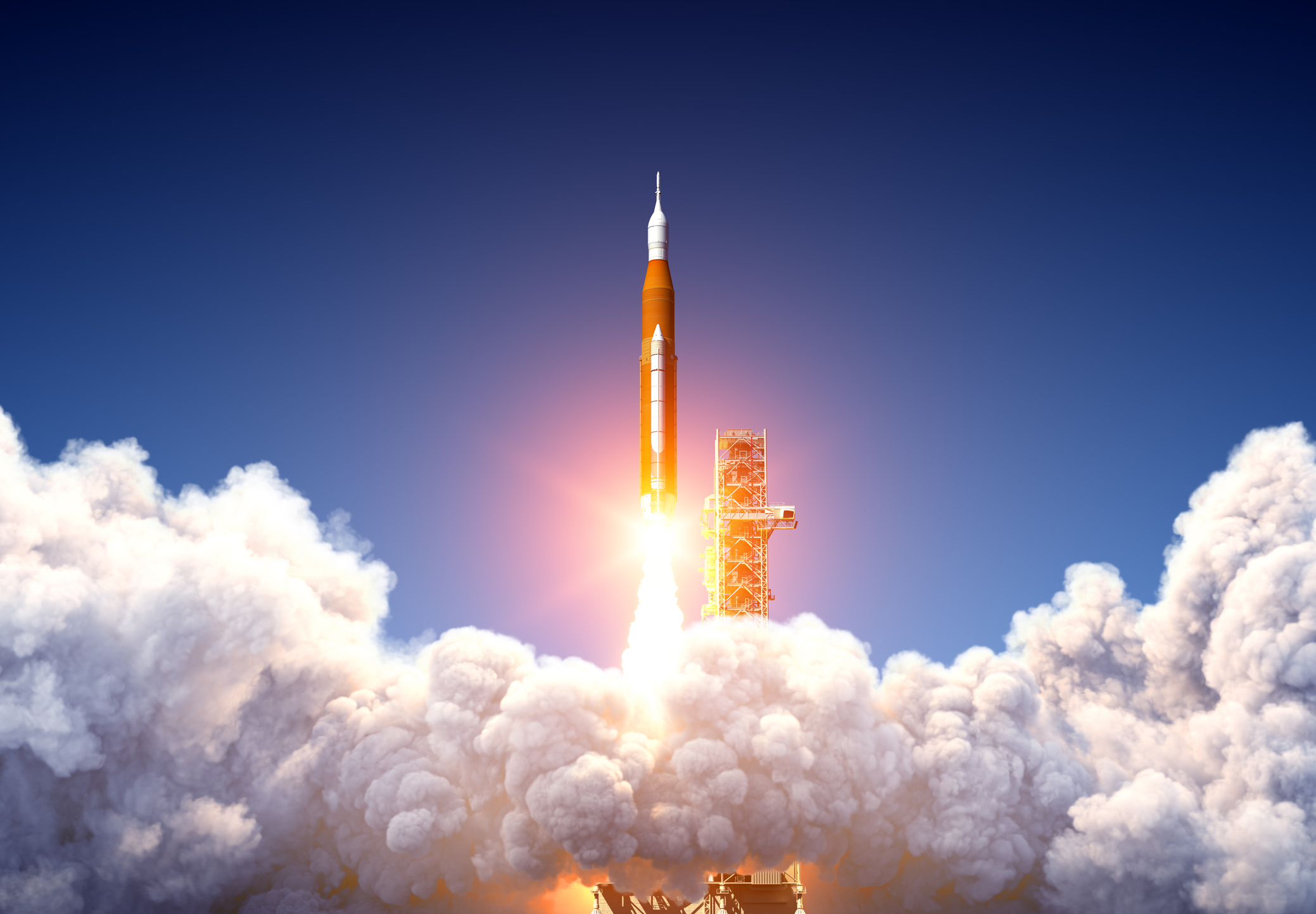

But HOLD THE PHONE. As of 3 PM Eastern, a twitch. A flicker. 9% UP. A reversal? Don’t start polishing the rocket boosters just yet, but… maybe. Just maybe, the vultures are circling a little slower. I’ve seen enough dead cats bounce to know better than to get excited, but I’m also wired on enough lukewarm coffee to chase the phantom of a trend. Let’s dissect this… anomaly.

Is This a Rally, or Just a Temporary Stay of Execution?

It’s not just some technical mumbo jumbo driving this little spike, though the chart-gazers are having a field day, naturally. No, this is about leverage. About the short-squeezed screaming into the void. Nearly $16 million in liquidations – all those smug bastards betting AGAINST Solana getting their faces ripped off. Forced buying, pure and simple. It’s the digital equivalent of a bar fight, and right now, the bears are eating glass. And let’s be clear, that kind of volatility? It’s exhilarating… and terrifying. A razor’s edge, folks. A RAZOR’S EDGE.

But there’s something else bubbling under the surface. Something… institutional. Citigroup. Citigroup, for crying out loud, actually using the Solana blockchain for global trade finance. That’s not noise, that’s a signal. A faint, flickering signal in the digital darkness, but a signal nonetheless. They’re sniffing around, these guys. They see potential. They see… money. Standard Chartered’s been whispering sweet nothings about Solana for weeks, and this tri-party custody model? It’s like building a fortress around the damn thing. They’re trying to legitimize this chaos. And it just might work.

Will these catalysts actually deliver? Who the hell knows? The market is a capricious beast, and logic went out the window months ago. But for one glorious day, good news is… good news. A reprieve from the relentless, soul-crushing pain. A tiny, fragile bubble of hope in the digital wasteland. I’m not saying buy the dip, I’m saying… keep watching. Because in this game, you either adapt, or you get swallowed whole. And I, for one, intend to keep my eyes peeled. And my coffee pot full. ALWAYS full.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- Anime That Should Definitely be Rebooted

- The 10 Most Underrated Mikey Madison Movies, Ranked (from Least to Most Underrated)

2026-02-13 23:42