I’m really enjoying how HBO Max keeps adding fresh content! They’ve got everything – critically acclaimed dramas, scary international films, and those big, popular sequels. This week, I’ve noticed a bunch of movies from 2025 are already making waves, alongside all the classics we know and love. Whether I’m in the mood for a spooky thriller or a feel-good rom-com, there’s always something new to dive into for a perfect weekend binge. Here’s a look at what everyone’s been watching and what’s just arrived on the platform.

‘If I Had Legs I’d Kick You’ (2025)

Since its debut on HBO Max in late January, ‘If I Had Legs I’d Kick You’ has become a hit, quickly rising to the top of viewership charts. Starring Rose Byrne, the drama has earned widespread praise from critics and is being recognized during awards season for its compelling story. The film delves into difficult emotions as it follows a woman going through a major life change and how it affects her relationships. Many consider it one of the best films of 2025, thanks to its heartfelt performances and strong direction.

‘The Smashing Machine’ (2025)

‘Smashing Machine’ is a biographical drama telling the story of MMA fighter Mark Kerr. Dwayne Johnson powerfully portrays Kerr, showcasing his incredible career alongside his battles with addiction and the physical consequences of being a pioneer in the sport. The film follows his journey to fame during the UFC’s early years and the personal struggles he faced as a top competitor. It’s a notable project, bringing together A24 and HBO Max to offer a raw and realistic look at the world of combat sports.

‘Train to Busan’ (2016)

‘Train to Busan’ is considered one of the best zombie movies ever made and is now available on HBO Max. The film centers on a busy father and his distant daughter who find themselves caught in a terrifying viral outbreak while traveling on a fast train in South Korea. They’re forced to team up with other passengers to fight for survival as the infection rapidly spreads throughout the train and the country. The movie is known for its thrilling action and surprisingly heartfelt moments, even in the midst of the chaos.

‘Urban Myths’ (2022)

‘Urban Myths’ is a South Korean horror series featuring ten standalone stories based on popular modern legends. Each short film explores different kinds of spooky happenings – from haunted buildings to creepy experiences found online – and uses a unique filmmaking style. The series has become popular with viewers for its fresh and frightening twist on classic folktales, reimagined for today’s world and our digital lives.

‘The Ghost Station’ (2023)

I just finished watching ‘The Ghost Station,’ and it’s a really gripping movie! It’s all about these strange and disturbing deaths happening at the Oksu train station. The story follows a journalist trying to get the inside scoop and a station employee, and together they start digging into what’s really going on. What they find is a seriously creepy secret about how the station was built. It’s a cool mix of detective work and classic Asian supernatural horror. I was excited to see it added to the platform in February – it’s a great addition for anyone who loves international thrillers and a good scare.

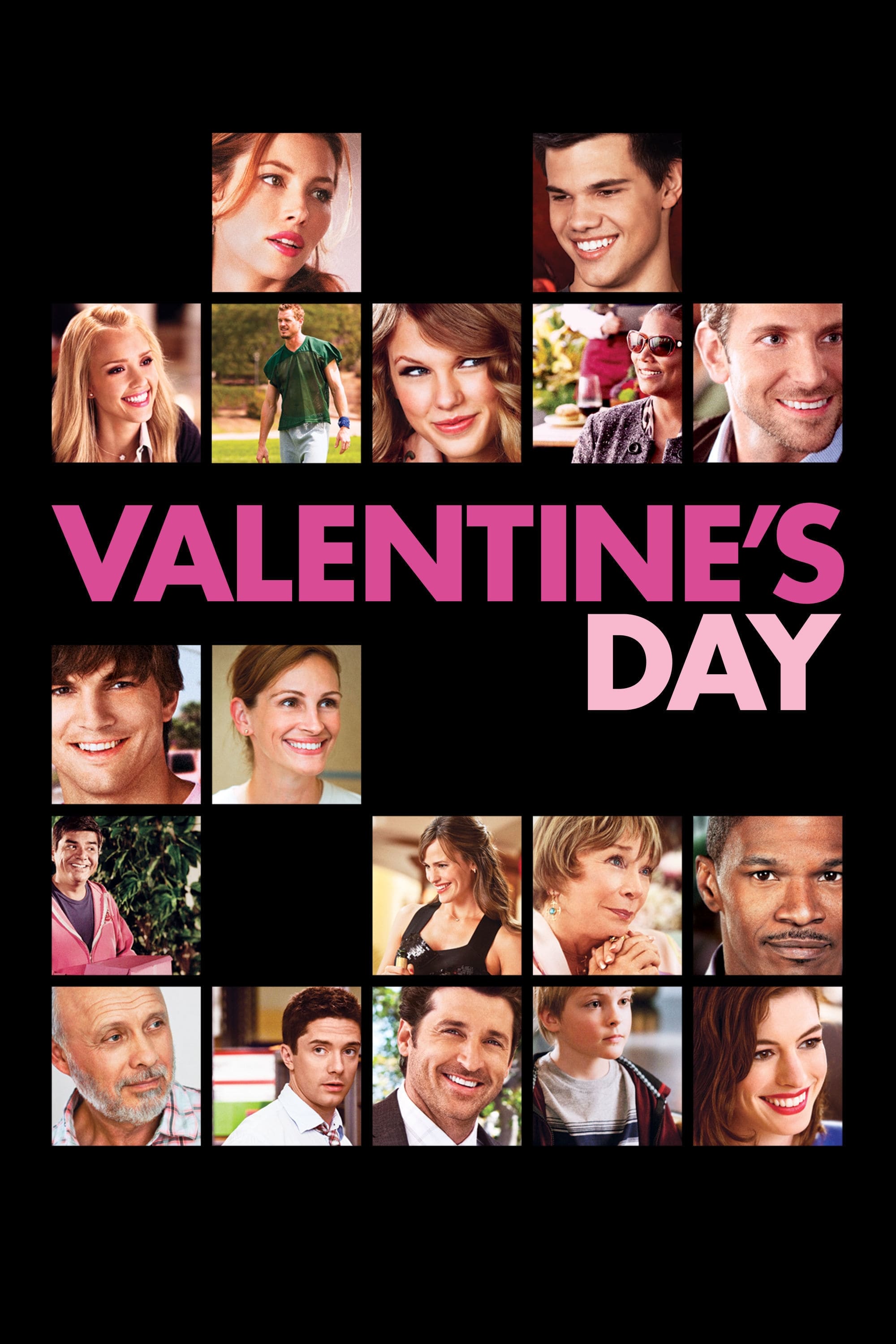

‘Valentine’s Day’ (2010)

‘Valentine’s Day’ is a romantic comedy that follows a large group of people in Los Angeles as they deal with love and relationships on one Valentine’s Day. The movie tells several different stories about characters of all ages, showing them fall in love, experience heartbreak, and find new opportunities. It’s recently become popular again on HBO Max, especially in February, and offers a fun, feel-good look at love and dating today.

‘The Shape of Water’ (2017)

Guillermo del Toro’s ‘The Shape of Water’ is a captivating fantasy drama about a mute woman who cleans a top-secret government lab. She finds an extraordinary creature held prisoner there and forms a special connection with it, communicating without words. Set during the Cold War, the film beautifully explores feelings of loneliness, understanding, and love. It was highly acclaimed, winning multiple Academy Awards, including Best Picture, thanks to its stunning visuals and strong performances.

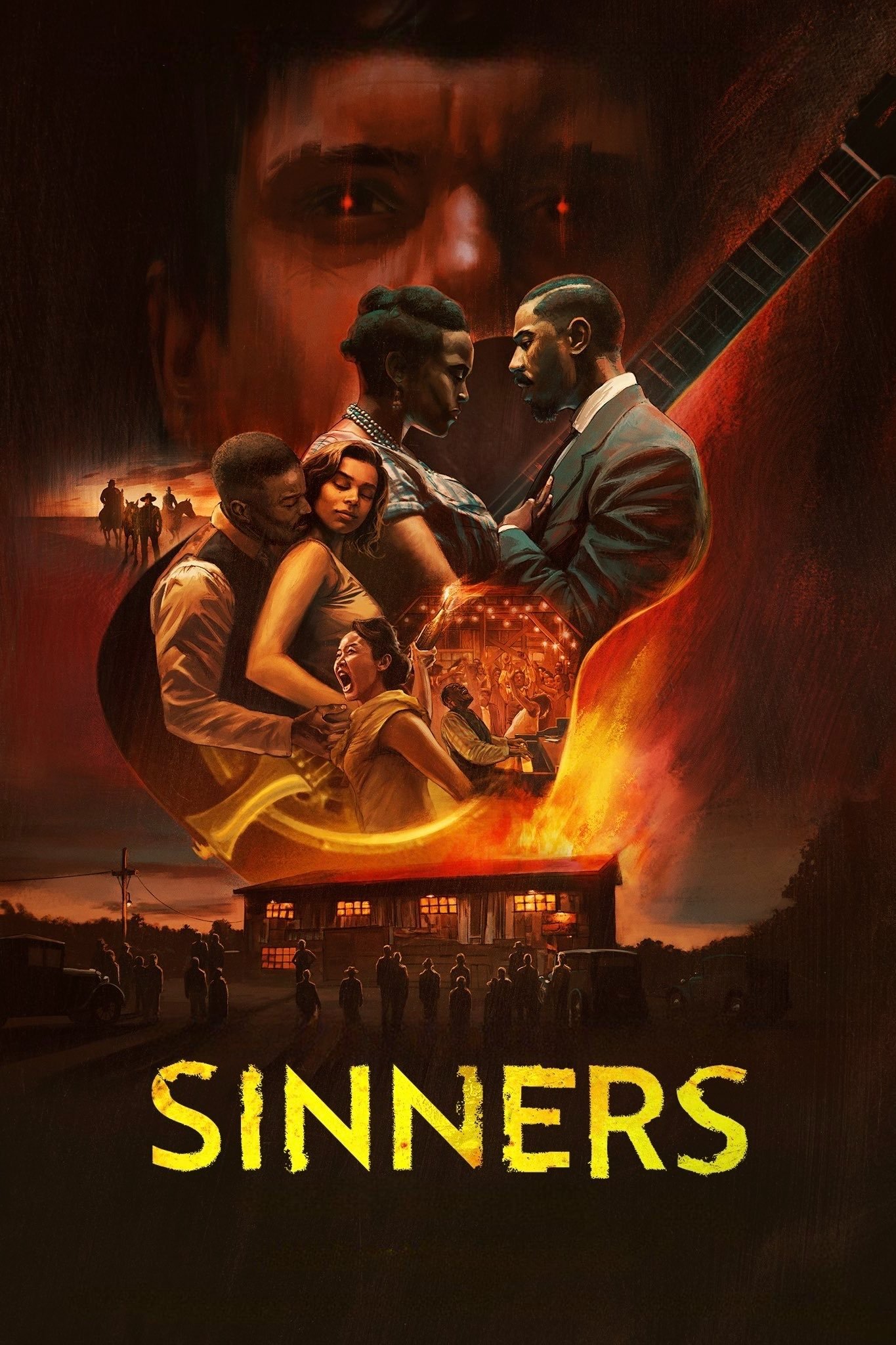

‘Sinners’ (2025)

“Sinners” is a thrilling and spooky movie directed by Ryan Coogler and starring Michael B. Jordan. The story centers on twin brothers who return to their hometown hoping for a fresh start, but instead encounter a terrifying, age-old evil. The film combines history with suspense to create a gripping and immersive experience. It’s quickly become a popular topic of conversation thanks to its impressive quality and the strong connection between the actors.

‘Meg 2: The Trench’ (2023)

‘Meg 2: The Trench’ is an action-packed sequel where Jason Statham returns as Jonas Taylor, leading a team into the deepest parts of the ocean. They face off against multiple giant, prehistoric sharks – Megalodons – and a dangerous mining operation. The film is full of large-scale action and thrilling underwater survival, delivering the excitement of a summer blockbuster and appealing to fans of creature features.

‘Ready Player One’ (2018)

In a bleak future, the film ‘Ready Player One’ depicts people escaping into a vast virtual world called the OASIS. The story follows Wade Watts as he competes in a worldwide hunt for an Easter egg hidden by the OASIS’s creator – a prize that would give the winner complete control of the virtual world. Directed by Steven Spielberg, the movie is packed with nostalgic nods to 1980s pop culture, films, and video games. It blends impressive visual effects with a heartwarming story about friendship and standing up to powerful corporations.

Let us know in the comments which HBO Max show or movie you’re most excited to watch first!

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- Anime That Should Definitely be Rebooted

- The 10 Most Underrated Mikey Madison Movies, Ranked (from Least to Most Underrated)

2026-02-13 22:54