Now, I’ve seen a good many booms and busts in my time, and I reckon this here market’s got a bit of both in it. Folks are chasing after these “growth stocks” like hound dogs after a rabbit, hoping to turn a few dollars into a fortune. It’s a fine ambition, mind you, but requires a bit more than just wishful thinkin’. A man’s gotta know what he’s buyin’, and why. If you’ve got a thousand dollars burnin’ a hole in your pocket – after lookin’ after the necessities, of course, and avoidin’ any debts that’ll cling to you like a burr – then perhaps I can point you towards a couple of ventures that might just double your money. Not a guarantee, mind you. The market’s a fickle beast, but these two have a bit of a shine to ’em.

Nvidia: The Lightning in the Silicon Bottle

Now, Nvidia. That’s a name you’re hearin’ more and more these days. Some folks wonder why a company already lookin’ like a titan is on a list of “growth” stocks. Well, let me tell you, it’s like askin’ why a Mississippi steamboat keeps addin’ more boilers. It’s about power, pure and simple. This company ain’t just makin’ chips; they’re buildin’ the brains of the future, particularly in this newfangled “artificial intelligence” business. They control a mighty 81% of that market, which is like ownin’ the whole river if everyone else is paddlin’ canoes.

They’re stayin’ ahead of the game, too. They’ve got these new “Vera Rubin” chips comin’ out that promise to make AI calculations ten times cheaper and faster. That’s like tradin’ a mule for a locomotive! And the big boys – these “hyperscalers” like Anthropic and OpenAI – are already linin’ up to get their hands on ’em. These fellas are plannin’ to spend a whopping $700 billion on all this in a couple of years, and Nvidia’s lookin’ to get a hefty slice of that pie.

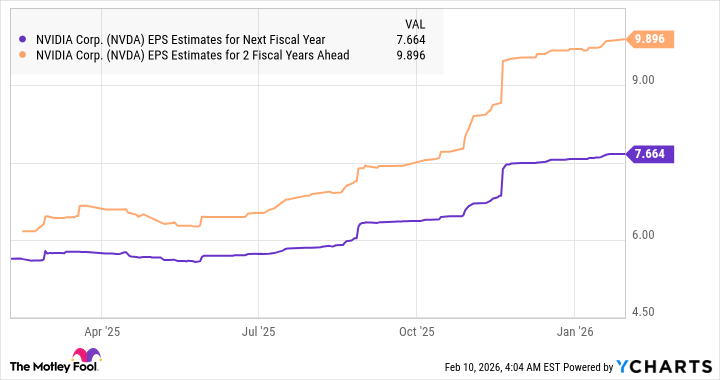

RBC Capital Markets reckons this AI chip market will be worth $550 billion by 2028. That’s a sum that’d make even Croesus blush. If Nvidia keeps hold of its share, it could be lookin’ at over $400 billion in revenue. And their earnings have already jumped 57% to $4.69 a share. They’re tradin’ at a reasonable 24 times earnings, which, in this day and age, is akin to findin’ a gold nugget in your boot heel. Some folks are whisperin’ this company could reach a $10 trillion market cap in five years. Now, that’s a bold claim, but I wouldn’t put it past ’em.

Seagate Technology: Diggin’ for Gold in the Data Stream

Now, let’s talk about Seagate. This company makes hard drives and solid-state drives – the things that store all this digital information. Their stock has jumped a good 183% in the last six months, which is a bit like findin’ a whole gold mine in your backyard. It’s all thanks to this AI boom, which is creatin’ a mighty thirst for storage space. Seems everyone needs a place to put all this data, and Seagate is there to provide it.

They recently reported a 21% jump in revenue and a 53% jump in earnings. That’s a sign that they’re doin’ somethin’ right. The prices of these drives are goin’ up, too. Hard drives are up 46%, and solid-state drives are costin’ sixteen times more than they used to. That’s enough to make a man clutch his wallet!

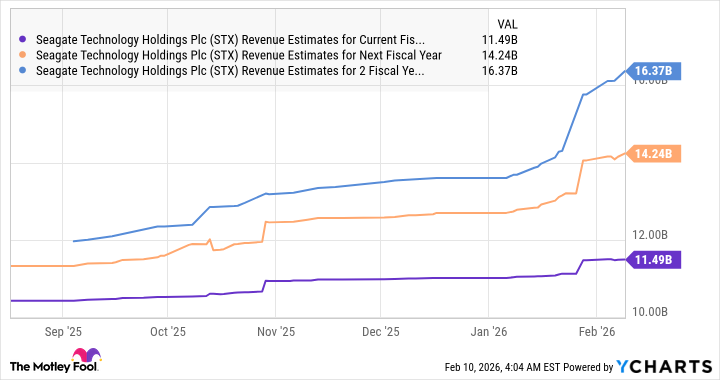

These AI data centers are gobblin’ up storage space like a swarm of locusts. And the demand is only goin’ to grow. Mordor Intelligence reckons this market will be worth $76 billion by 2030. Seagate is well-positioned to take advantage of this growth. They’re tradin’ at 9.5 times sales, which ain’t too shabby. And analysts are expectin’ their revenue to jump to $16.1 billion in a few years. If they can manage that, their market cap could double.

Now, I ain’t sayin’ these stocks are a sure thing. The market’s a wild and unpredictable beast. But if you’re lookin’ for a couple of ventures with a bit of potential, these two might just be worth a look. Just remember, a little caution and a good deal of common sense are always the best investments of all. And don’t go bettin’ the farm on any one thing. A man’s gotta keep a little somethin’ back for a rainy day.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- Anime That Should Definitely be Rebooted

- The 10 Most Underrated Mikey Madison Movies, Ranked (from Least to Most Underrated)

2026-02-13 22:34