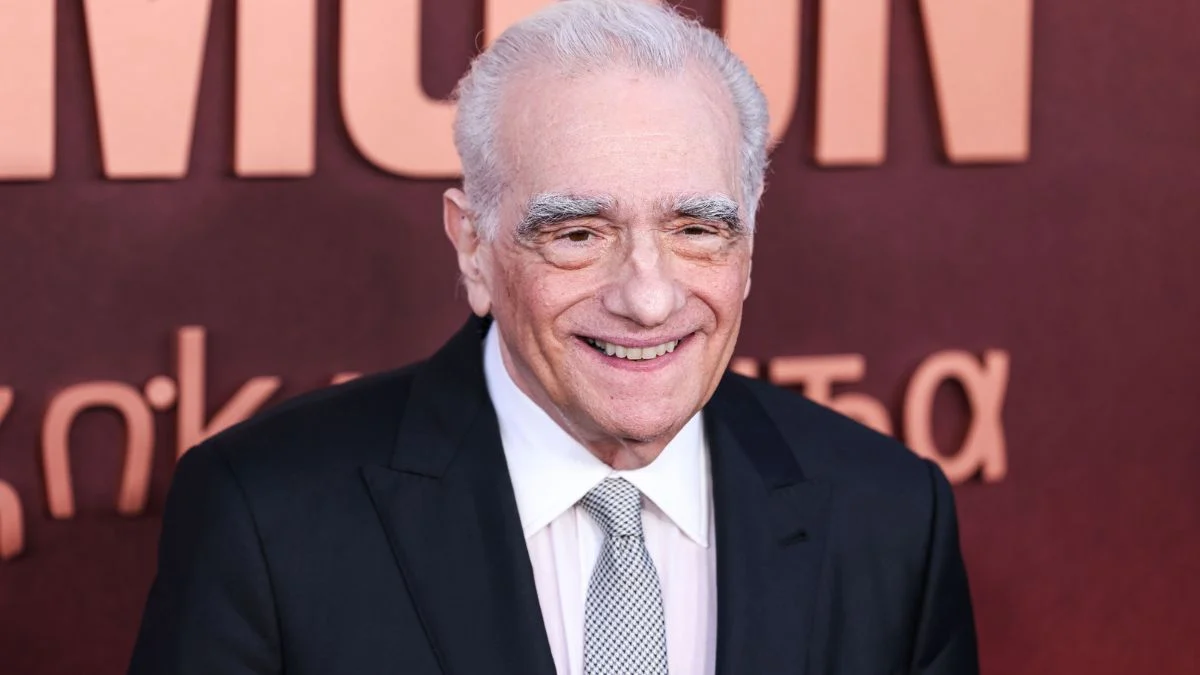

Martin Scorsese is famous for his realistic and intense crime movies, like Taxi Driver and Goodfellas, which are considered classics. But he’s actually made a wide variety of films, including the suspenseful thriller Shutter Island, the family-friendly Hugo, and his recent Western, Killers of the Flower Moon.

Interestingly, many critics believe some of his best work isn’t in his feature films at all, but in his documentaries, especially those focusing on his love of music.

Martin Scorsese has made several documentaries about famous musicians, including Bob Dylan, George Harrison, and The Rolling Stones. However, his 1978 film, The Last Waltz, is still considered his greatest work in this area, capturing The Band’s final concert.

Scorsese didn’t just record the concert; he used a film studio to create close-up performances and interviews with band members like Rick Danko and Robbie Robertson. After spending a week working with these music legends, Scorsese gave Robertson a note saying, this has been the happiest week of my life.

Their working relationship grew into a close, forty-year friendship that continued until Robertson’s death in 2023. Scorsese recently paid tribute to his friend, calling him a trusted confidant, creative partner, and source of guidance. He remembered how Robertson’s music felt rooted in the very soul of America, and expressed his regret that time with loved ones is always too short. Scorsese continues to cherish Robertson’s talent and spirit, and these qualities are central to how he remembers their time together.

Despite being 83 years old, Martin Scorsese is already hard at work on his next film, What Happens at Night, having recently started production in Prague. This supernatural psychological drama is based on a novel by Peter Cameron and will be his seventh movie with Leonardo DiCaprio.

DiCaprio, who will star with Jennifer Lawrence and Patricia Clarkson, has described the film as a suspenseful and unsettling story, reminiscent of Shutter Island. Filmmakers plan to use Prague’s wintry atmosphere to create a haunting and dreamlike environment for the movie.

Beyond the new film, Scorsese is also creating a documentary called Life Is a Carnival to celebrate Robbie Robertson’s life and work. He was recently seen directing a large tribute concert in Los Angeles featuring Eric Clapton, Van Morrison, and Mavis Staples.

This documentary is intended to complement Scorsese’s classic concert film, The Last Waltz, completing a full circle in his exploration of music. He’s also still working on other long-planned projects, including a film about Frank Sinatra and an adaptation of The Wager, meaning he has a busy few years ahead.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- Anime That Should Definitely be Rebooted

- The 10 Most Underrated Mikey Madison Movies, Ranked (from Least to Most Underrated)

2026-02-13 22:15