Hollywood frequently favors actors who have a commanding physical presence, especially for strong and powerful roles. Many famous actors are notably tall, which helps them project authority on screen in both action and dramatic films. This highlights a group of prominent African-American men who are at least six feet one inch tall and have built successful acting careers. They’ve used their height and talent to play a wide variety of characters in many different kinds of movies.

Winston Duke

Winston Duke is well-known for playing M’Baku in the ‘Black Panther’ movies. At six feet five inches tall, he often plays strong, intimidating characters, and his height is a noticeable part of his presence. He also starred in the horror film ‘Us’ as a father fighting to protect his family. Duke honed his acting skills at the Yale School of Drama, preparing him for roles in both theater and film. Before becoming an actor, he was an athlete, and his height was an advantage in sports.

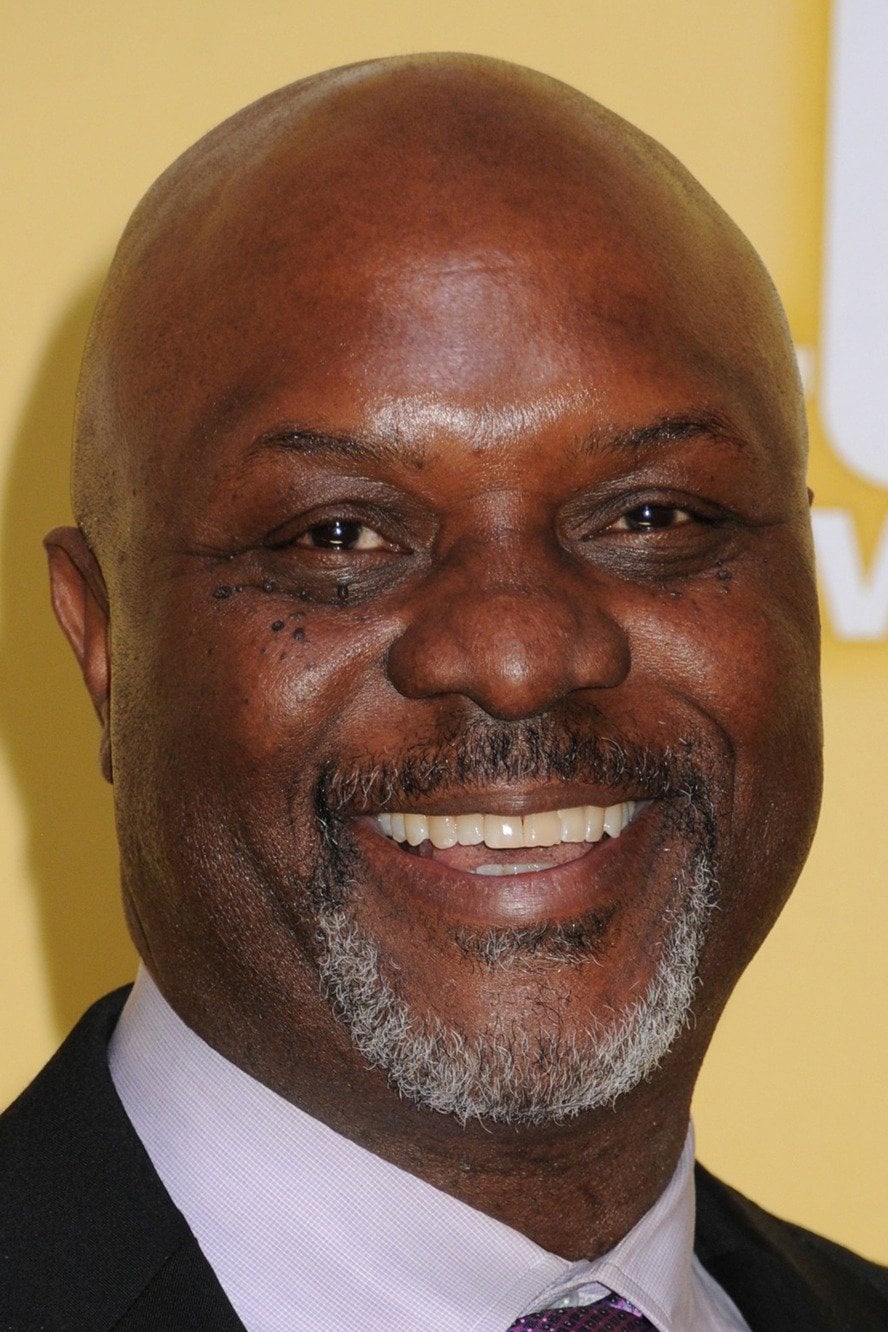

Dennis Haysbert

Dennis Haysbert is best known for his commanding voice and his portrayal of President David Palmer on the popular show ’24’. At six feet five inches tall, he frequently plays characters who project strength and leadership. He’s also the familiar face and voice of Allstate insurance, where his presence conveys trustworthiness. Throughout his long career, he’s delivered memorable performances in films like ‘Major League’ and ‘Far from Heaven’, consistently appearing in both movies and television for decades.

Tyler Perry

Tyler Perry is a highly successful filmmaker and actor, known for his towering height of six feet five inches. He’s best recognized as the creator and performer of the iconic character Madea, featured in numerous popular plays and movies. While famous for comedy, Perry has also demonstrated his acting range in dramatic roles in films like ‘Gone Girl’ and ‘Alex Cross’. He also runs his own large film studio in Atlanta, producing a significant amount of content for both TV and movies. His height often makes him easily noticeable at public events and on the red carpet.

Bill Duke

Bill Duke is a seasoned actor and director, known for his imposing height of six feet four inches. He gained prominence in the 1980s through memorable roles in action classics like ‘Predator’ and ‘Commando’. His powerful physique and intense presence made him a compelling performer alongside many iconic action stars. Beyond acting, Duke has also directed several films, including ‘A Rage in Harlem’ and ‘Sister Act 2: Back in the Habit’. He continues to be a highly regarded figure in the entertainment industry for his work both in front of and behind the camera.

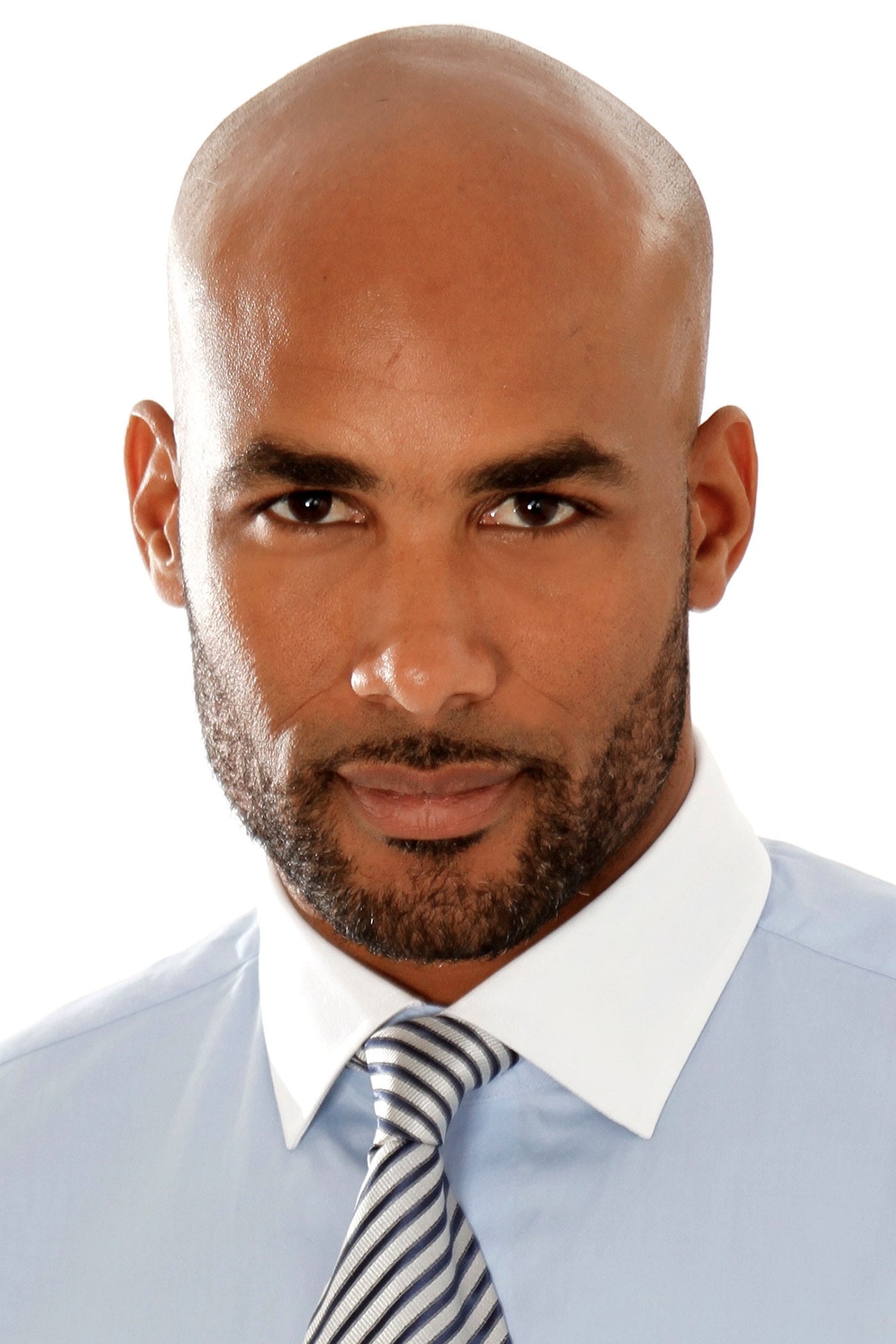

Boris Kodjoe

Boris Kodjoe is a tall actor – standing at six feet four inches – who began his career as a fashion model. He first gained recognition for his role in the TV series ‘Soul Food’ and later starred in ‘Station 19’. His impressive physique and height initially helped him succeed in the fashion world before he became a full-time actor. He’s also appeared in films like ‘Brown Sugar’ and ‘Resident Evil: Afterlife’, and continues to be a popular leading man in both dramatic and romantic roles on television.

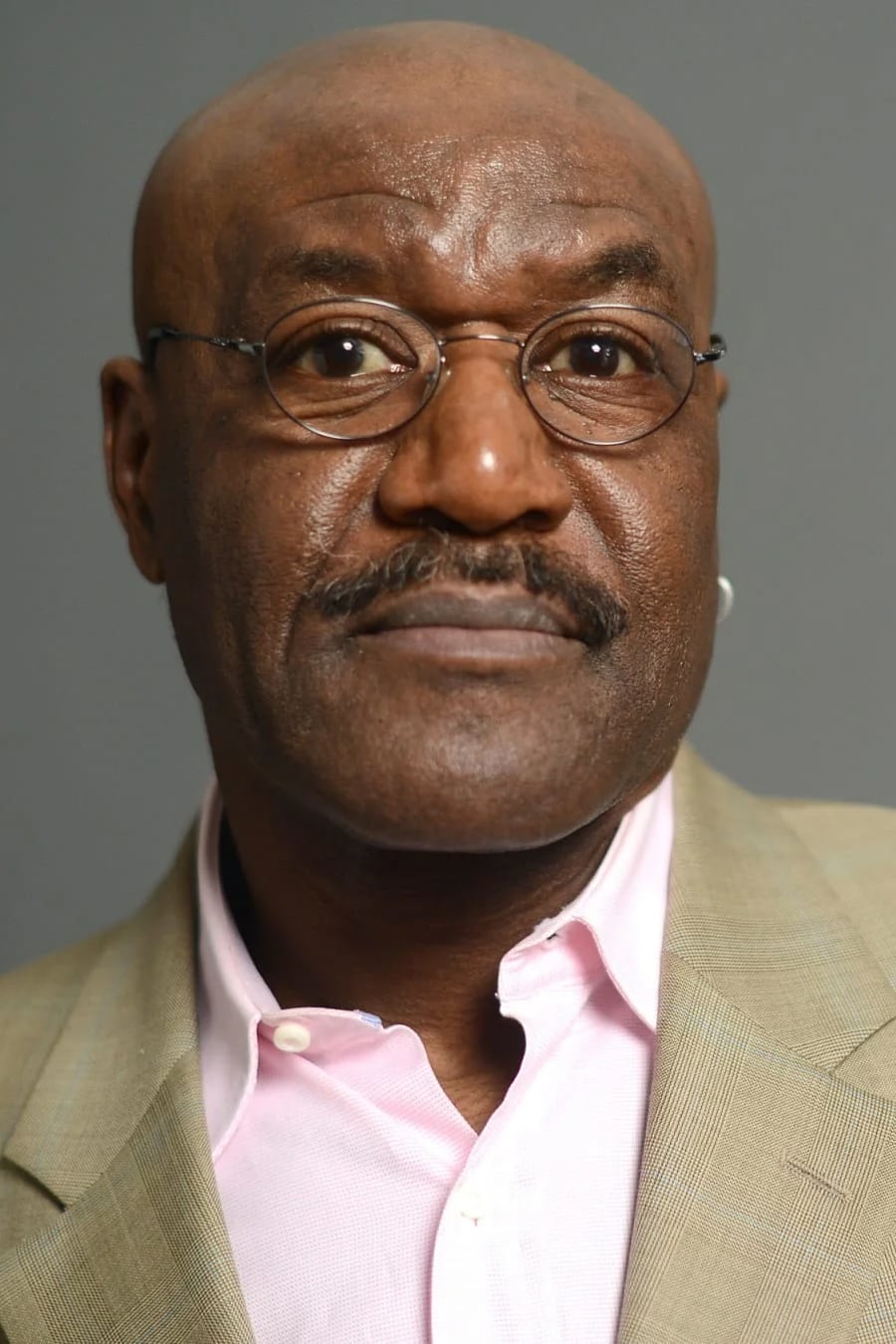

Harry Lennix

Harry Lennix is a well-respected actor known for his height – he’s six feet four inches tall. Many viewers recognize him as Harold Cooper from the popular NBC show ‘The Blacklist’. Throughout his long career, he’s appeared in notable films such as ‘The Five Heartbeats’ and ‘Man of Steel’. Lennix frequently plays powerful or intelligent characters, roles that are enhanced by his impressive stature and resonant voice. He’s also a skilled stage actor with a background in performing Shakespeare.

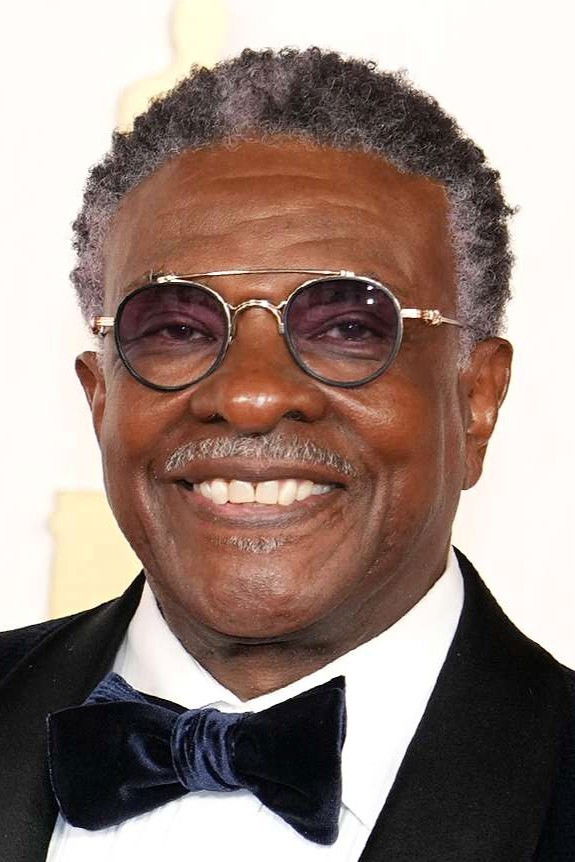

Louis Gossett Jr.

Louis Gossett Jr. was a celebrated actor known for his commanding presence – he was six feet four inches tall. He made history as the first African-American man to win an Oscar for Best Supporting Actor, thanks to his unforgettable performance as a strict drill sergeant in ‘An Officer and a Gentleman’. He also won an Emmy for his role in the influential miniseries ‘Roots’. Throughout his career, Gossett Jr. brought a sense of dignity and weight to every character he played.

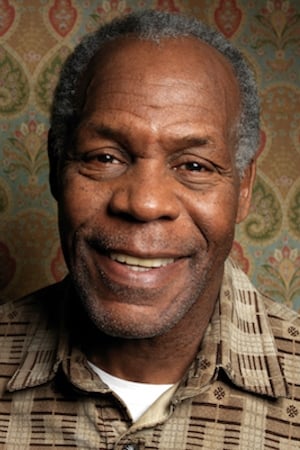

Danny Glover

Danny Glover is a well-known actor and activist who is six feet four inches tall. He’s most famous for playing Roger Murtaugh in the ‘Lethal Weapon’ movies with Mel Gibson, but he’s also appeared in critically acclaimed films like ‘The Color Purple’ and ‘To Sleep with Anger’. For decades, Glover has used his fame to speak out about important social and political issues globally. His height and expressive features have made him a popular and respected figure in film for over forty years.

Henry Simmons

Henry Simmons is a tall actor, standing at six feet four inches. He’s best known for playing Alphonso Mack Mackenzie in the Marvel show ‘Agents of S.H.I.E.L.D.’, but he previously had a regular role on the popular police series ‘NYPD Blue’. Because of his height and fit physique, he’s often cast as police officers or heroes. He continues to work consistently in both television and film and remains a well-known figure in the entertainment industry.

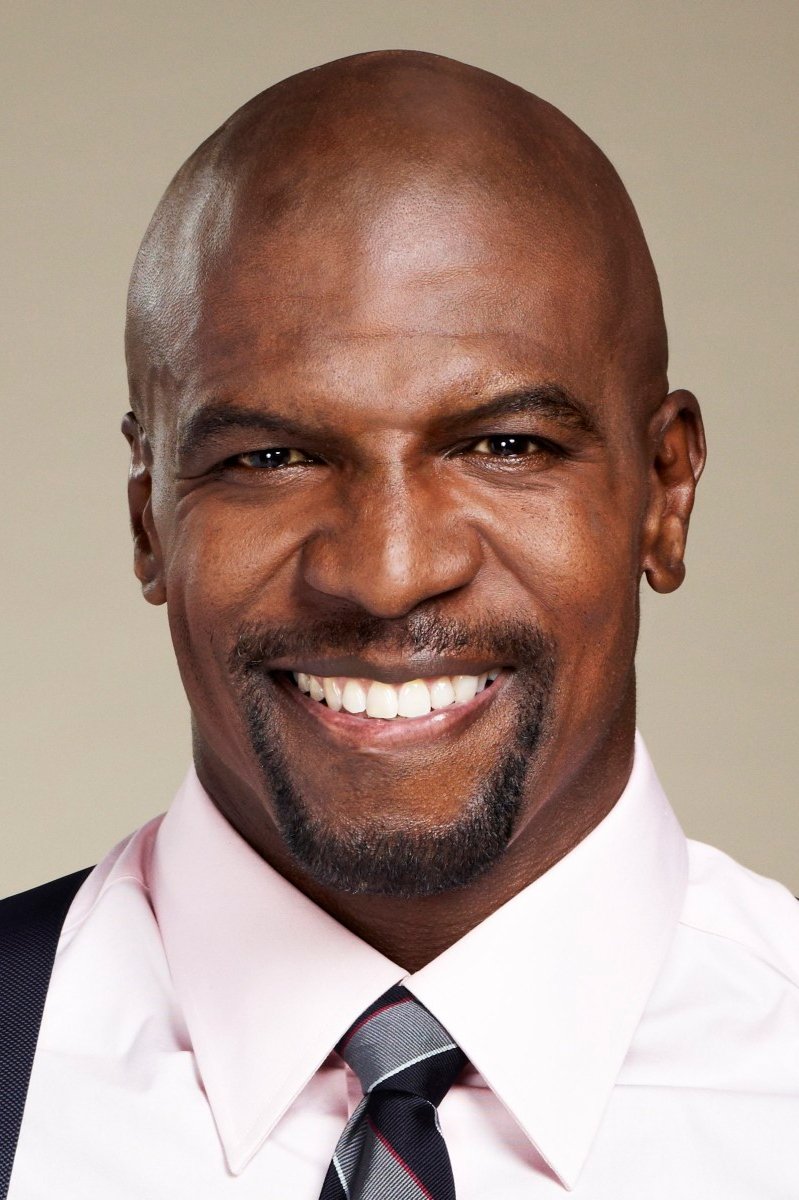

Terry Crews

Terry Crews is a well-known actor and former NFL player who’s six feet three inches tall. He’s popular for his funny roles in shows like ‘Brooklyn Nine-Nine’ and ‘Everybody Hates Chris,’ and his impressive size and build are often featured in both comedies and action movies like ‘The Expendables.’ In addition to acting, Crews has hosted ‘America’s Got Talent’ and shared his life story in several books. His energetic personality and striking presence have made him a familiar face in television, film, and literature.

Mike Colter

Mike Colter is famous for playing the superhero Luke Cage in the Marvel series of the same name. At six feet three inches tall with a strong build, he was a natural fit for the role. He’s also gained recognition for his work in the drama series ‘Evil’, where he plays a priest in training. Beyond television, Colter has appeared in popular films like ‘Million Dollar Baby’ and ‘Zero Dark Thirty’. He’s often cast as characters who are outwardly calm but have a powerful inner strength.

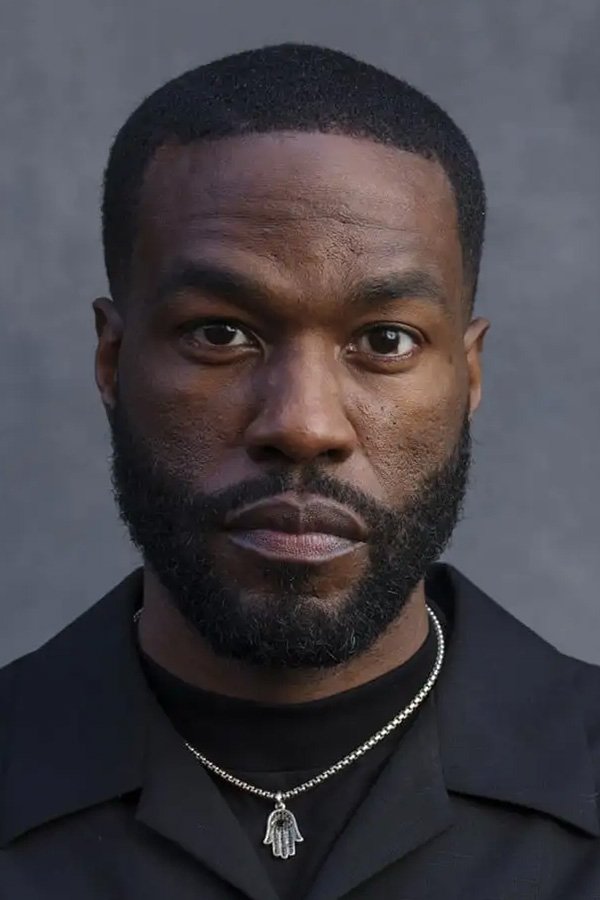

Yahya Abdul-Mateen II

Yahya Abdul-Mateen II is quickly becoming one of Hollywood’s most exciting actors. Standing at 6’3″, he’s already earned an Emmy for his performance as Cal Abar in the series ‘Watchmen’. He’s been in several big movies, including playing the villain Black Manta in ‘Aquaman’, and took on the famous role of Morpheus in ‘The Matrix Resurrections’. He also starred in the horror film ‘Candyman’. His background in architecture, combined with his impressive height, gives him a distinctive and memorable presence on screen.

Wood Harris

Wood Harris is a skilled actor standing at 6’3″. He’s best known for playing the powerful drug lord Avon Barksdale in the acclaimed HBO show ‘The Wire,’ and for his role as Julius Campbell in the popular film ‘Remember the Titans.’ He’s also appeared in the ‘Creed’ movies as a boxing coach and had a part in the musical drama ‘Empire.’ Throughout his career, Harris has gained a dedicated fanbase thanks to his ability to convincingly play both tough and relatable characters.

Keith David

Keith David is a tall actor and voice artist, standing at six feet three inches. He’s known for memorable roles in films like ‘The Thing’ and ‘Platoon,’ where his height and distinctive deep voice made a strong impression. He’s also a popular voice actor in animation and video games, including the ‘Halo’ series. More recently, he starred in ‘Greenleaf’ as a charismatic and influential bishop. Throughout his career, Keith David has consistently delivered performances that are both powerful and refined.

Delroy Lindo

Delroy Lindo is a well-known and admired actor, standing at six feet three inches tall. He’s worked with director Spike Lee on several films, including ‘Malcolm X’ and ‘Da 5 Bloods.’ His performance in ‘Da 5 Bloods’ was highly praised and earned him numerous award nominations. He’s also appeared in the TV series ‘The Good Fight’ and the crime comedy ‘Get Shorty.’ Because of his height and powerful acting style, he often commands attention whenever he’s on screen.

Mustafa Shakir

As a movie and TV fan, I’ve really been noticing Mustafa Shakir lately. The guy is a towering presence – six foot three, to be exact – and he really knows how to use it. Most people probably recognize him as the villain Bushmaster from season two of ‘Luke Cage,’ which was fantastic. He also nailed the role of Jet Black in the live-action ‘Cowboy Bebop’ on Netflix. Beyond those, he’s been great in the drama ‘The Deuce,’ playing a part in that show’s gritty look at the adult film industry. He’s clearly in amazing shape and brings a real authority to every character he plays, which makes him super watchable.

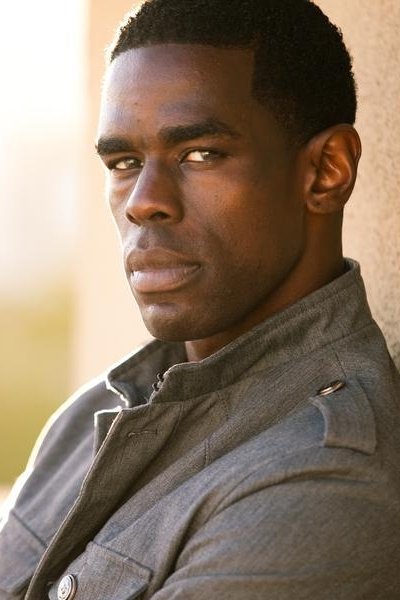

Corey Hawkins

Corey Hawkins is a talented and physically imposing actor, standing at six foot three. He first gained recognition for his portrayal of Dr. Dre in ‘Straight Outta Compton’ and went on to star in the action series ‘24: Legacy’ and the film ‘Kong: Skull Island’. Beyond acting, Hawkins is also a musician, appearing in the movie version of the Broadway show ‘In the Heights’. A Juilliard School graduate, he’s committed to performing both on stage and in front of the camera.

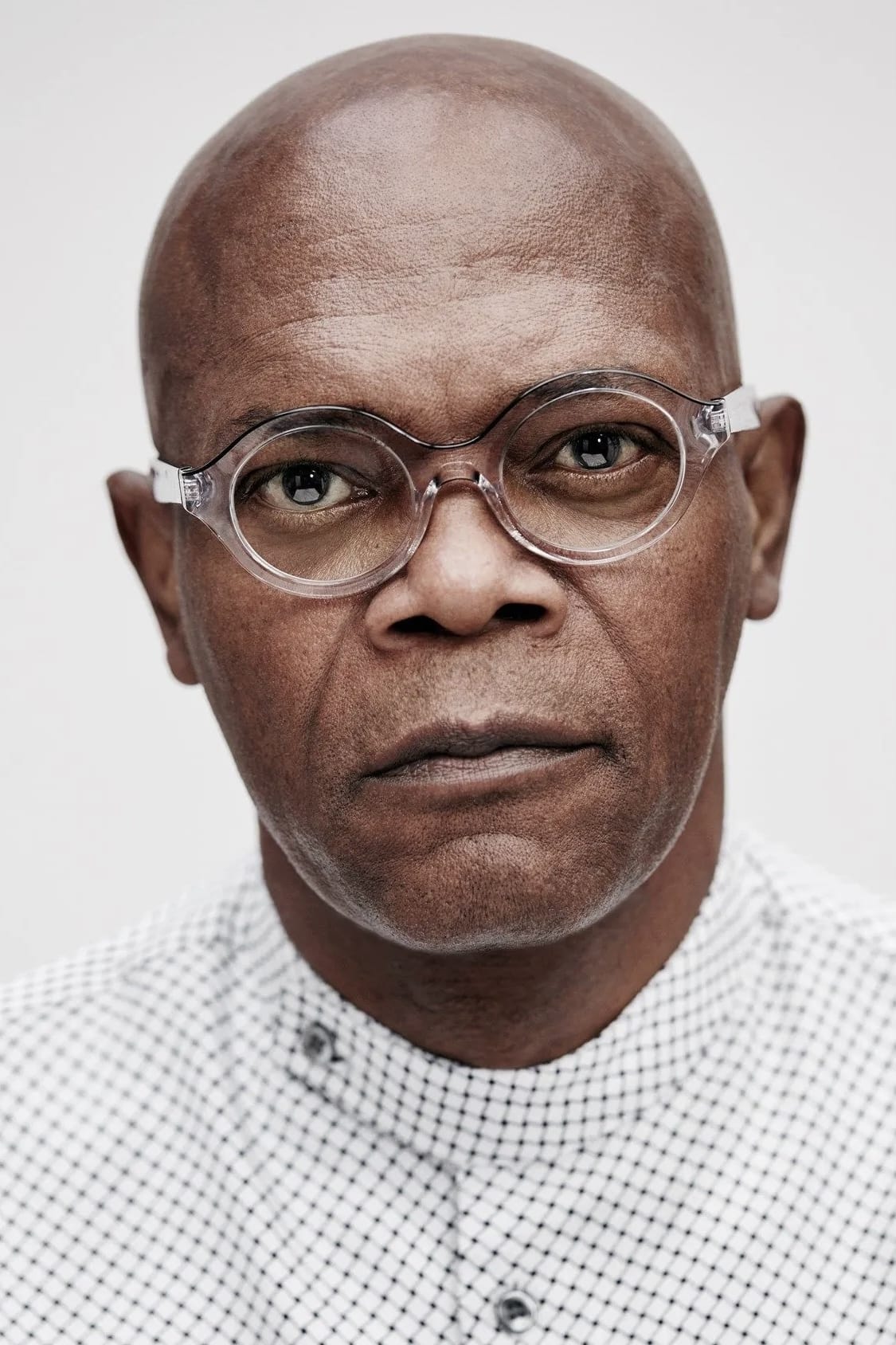

Samuel L. Jackson

Samuel L. Jackson is a hugely successful actor, ranking among the highest-grossing of all time. Standing at six foot two, he’s well-known for his many films with director Quentin Tarantino, including classics like ‘Pulp Fiction’ and ‘The Hateful Eight’. He’s also a key figure in the Marvel Cinematic Universe, playing Nick Fury, the head of S.H.I.E.L.D. Throughout his long and varied career, he’s taken on hundreds of roles in all kinds of movies, from action films to animated features. His unique voice and imposing height have made him instantly recognizable around the globe.

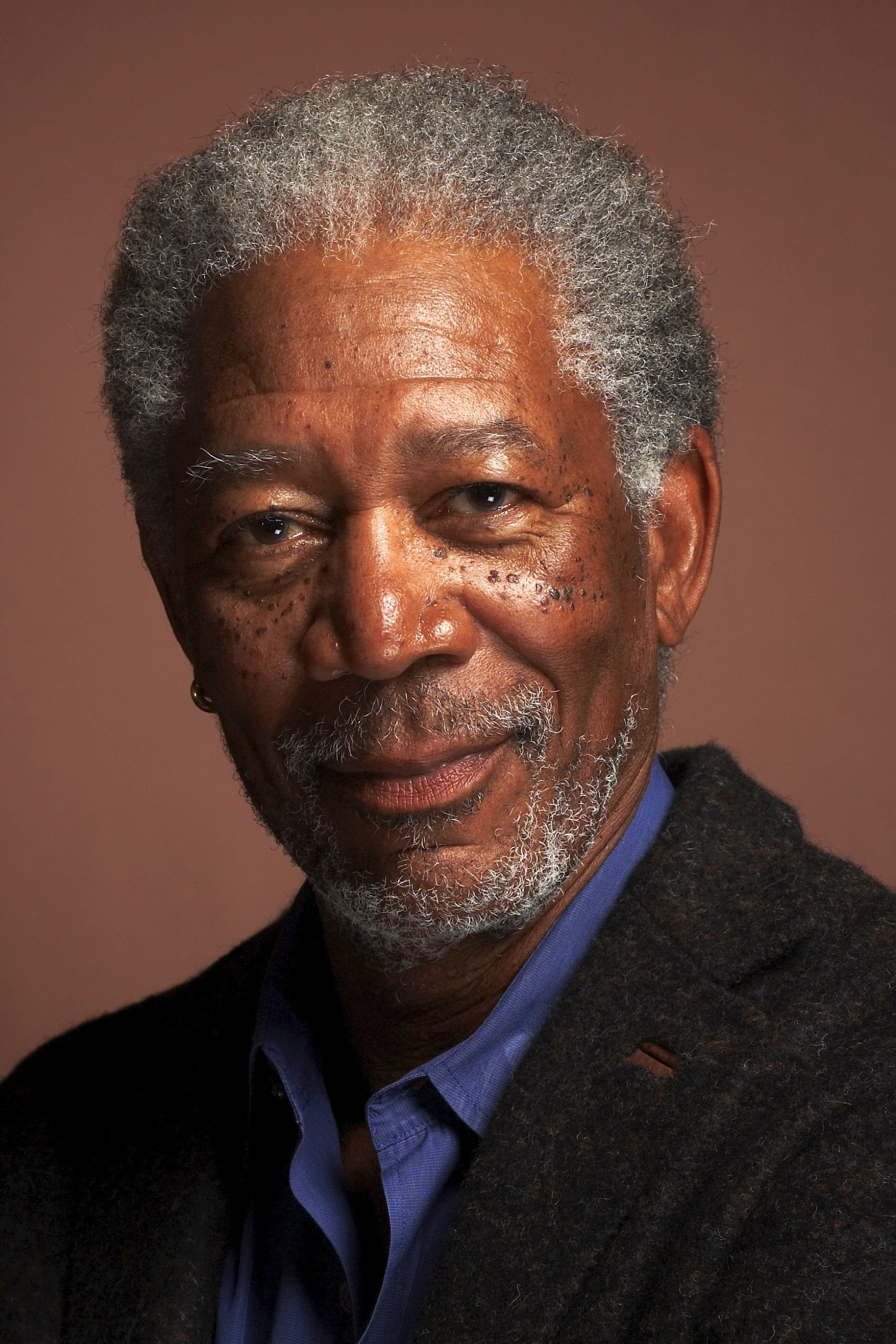

Morgan Freeman

Morgan Freeman is a celebrated actor and voice-over artist, known for his towering height of six feet two inches. He won an Oscar for his performance in ‘Million Dollar Baby’ and received nominations for other famous films like ‘The Shawshank Redemption’. His soothing presence and distinctive deep voice have often led to roles portraying powerful figures, such as God and the President. Freeman started his career on stage and with children’s television on ‘The Electric Company’. Many consider him one of the best actors working in film today.

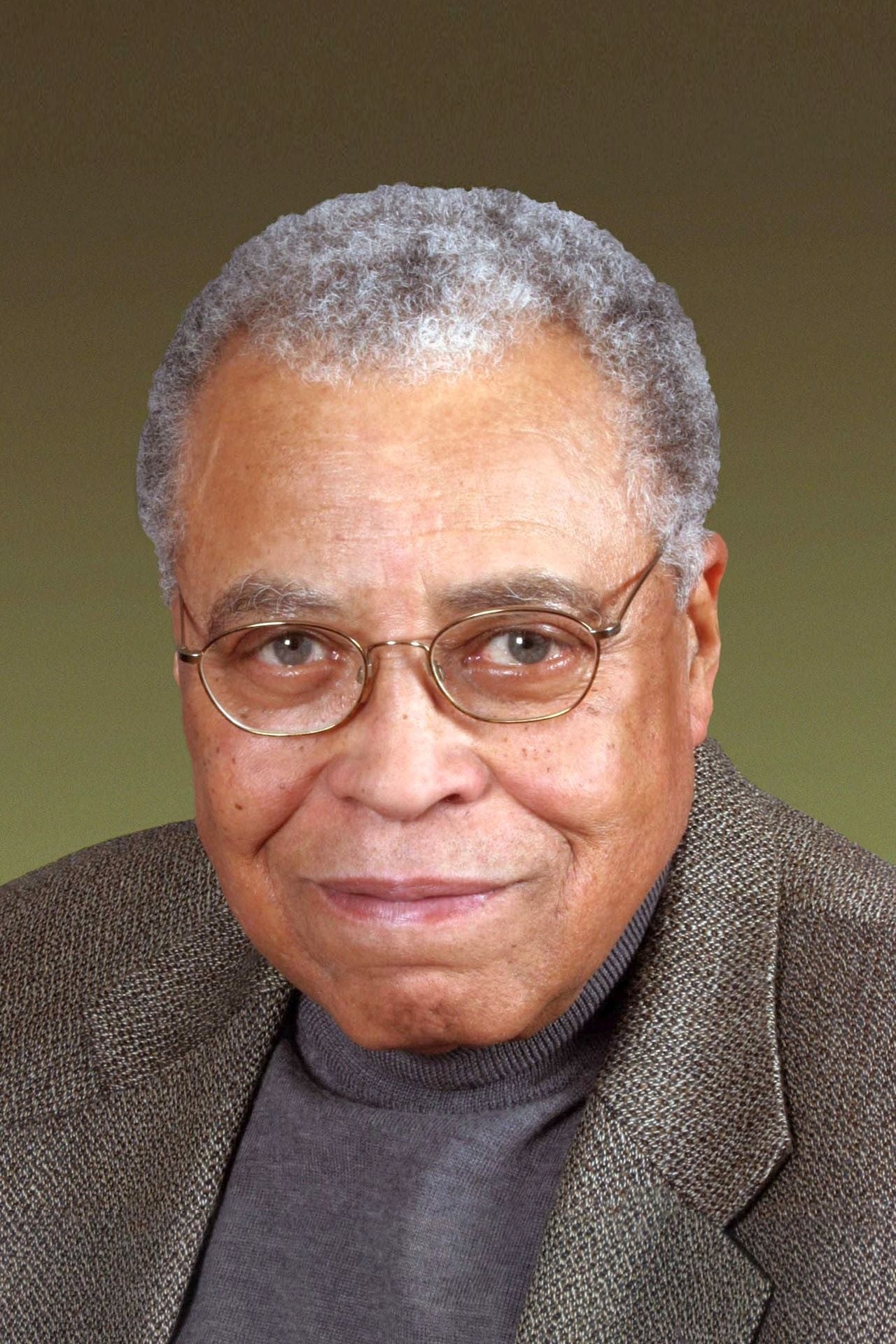

James Earl Jones

James Earl Jones was a towering and iconic actor, standing at six feet two inches tall. He’s best known as the voice of Darth Vader in ‘Star Wars’ and Mufasa in ‘The Lion King,’ but he also had a successful career on stage and screen, including an Academy Award nomination for ‘The Great White Hope’ and a memorable role in ‘Field of Dreams.’ A rare EGOT winner – having received an Emmy, Grammy, Oscar, and Tony Award – Jones captivated audiences with his powerful voice and commanding presence.

Will Smith

Will Smith is a world-famous actor who stands six feet two inches tall. He first became well-known as a rapper and on the TV show ‘The Fresh Prince of Bel-Air’. He then became a major movie star, appearing in huge hits like ‘Independence Day’ and ‘Men in Black’. Smith won an Oscar for his performance as Richard Williams in the film ‘King Richard’. For more than thirty years, he’s remained a leading actor, successfully starring in both action-packed comedies and serious dramas.

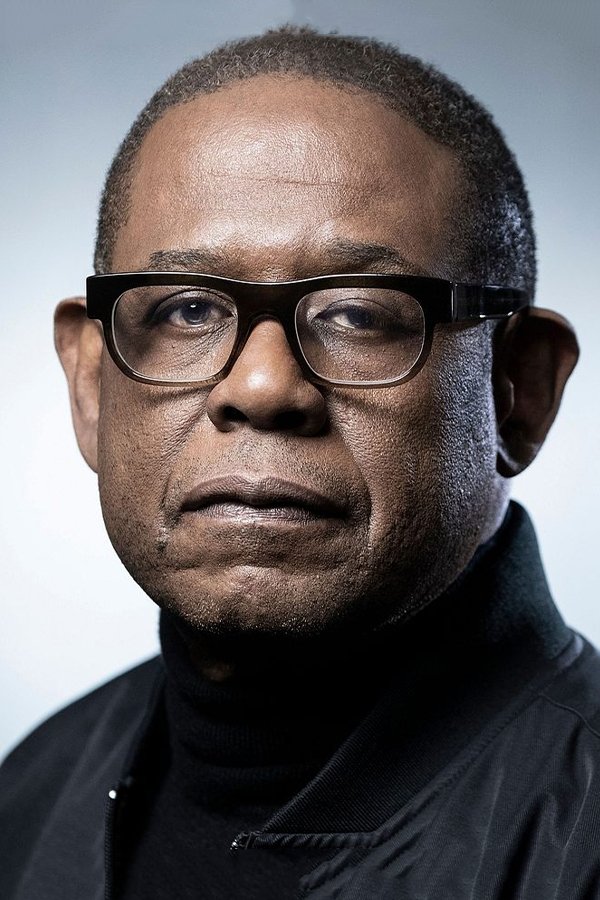

Forest Whitaker

Forest Whitaker is a highly respected actor and director, standing tall at 6’2″. He’s famous for winning an Oscar for his incredible performance as Idi Amin in ‘The Last King of Scotland’. Throughout his career, he’s also appeared in memorable films like ‘Platoon’ and ‘Ghost Dog: The Way of the Samurai’. Currently, he stars as the real-life gangster Bumpy Johnson in the series ‘Godfather of Harlem’. Whitaker is celebrated for fully embodying his characters and delivering lines with a quiet, yet impactful, style.

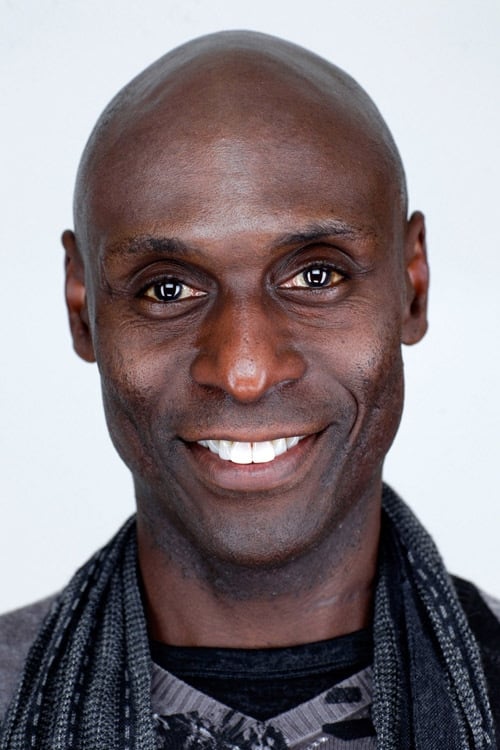

Lance Reddick

As a movie and TV fan, I was really saddened to hear about Lance Reddick’s passing. He was a commanding presence – a really tall guy, over six feet two – and just brought so much to everything he did. Most people probably know him from shows like ‘The Wire’ and ‘Fringe,’ but for me, he was Charon in the ‘John Wick’ movies – that calm, classy concierge. But acting wasn’t all he did! He was a musician too, and even did voice work and character likenesses for games like ‘Destiny’. He always played characters with this amazing air of professionalism and quiet power – it’s a real loss.

Colman Domingo

Colman Domingo is a talented actor and playwright known for his work on stage and screen. Standing at 6’2″, he’s widely recognized for playing Victor Strand in ‘Fear the Walking Dead’ and earned an Academy Award nomination for his powerful portrayal of Bayard Rustin in the film ‘Rustin’. He’s also appeared in popular shows like ‘Euphoria’ and films including ‘Lincoln’. Domingo’s height and refined sense of style contribute to his memorable presence as a performer.

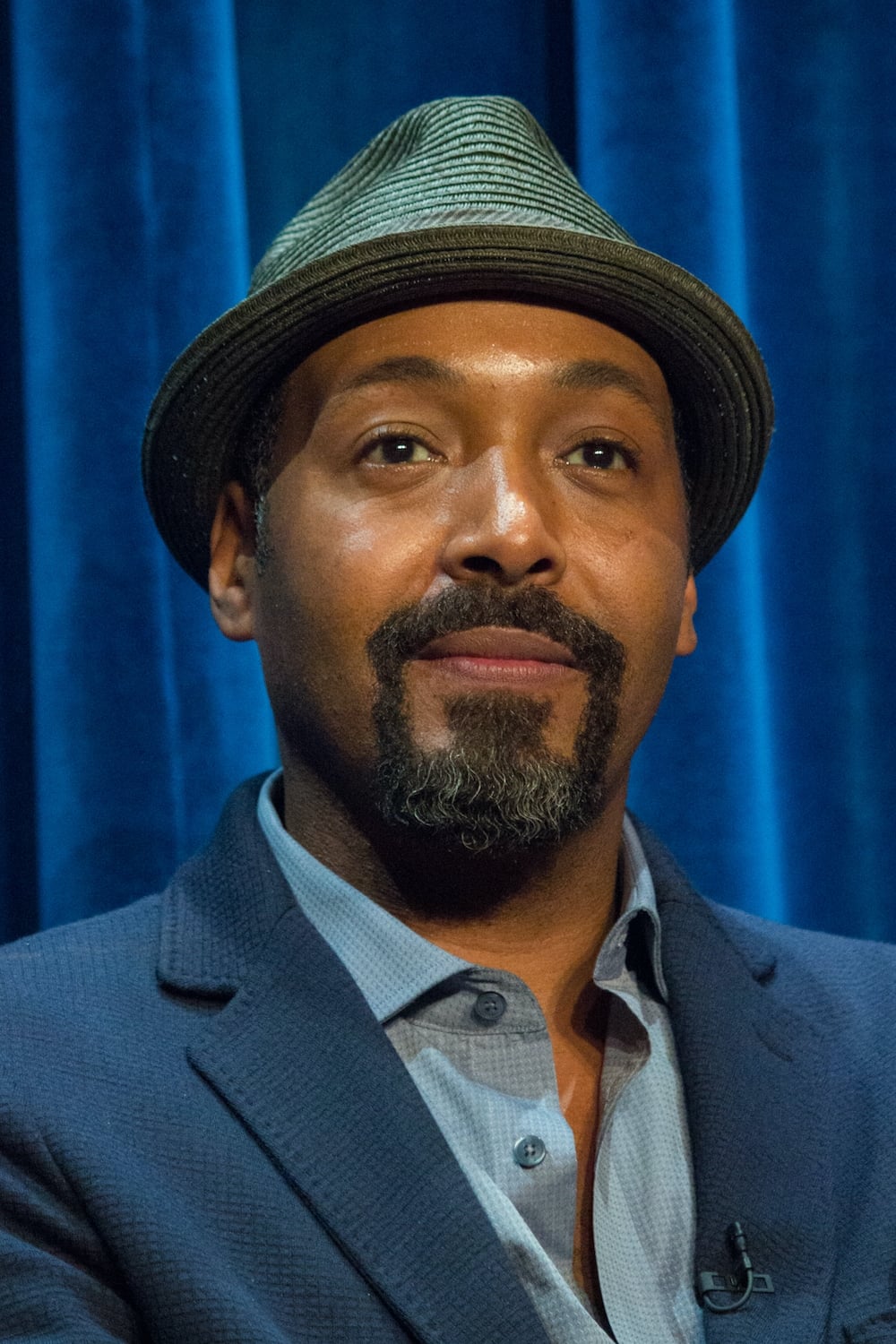

Jesse L. Martin

Jesse L. Martin is a tall actor and singer, standing at 6’2″. He’s best known for playing Detective Ed Green on the TV show ‘Law & Order’. He also first played the role of Tom Collins in the Broadway hit ‘Rent’ and later appeared as Collins in the movie. More recently, he was a regular on ‘The Flash’ as Joe West. His experience in musical theater helps him bring a unique energy and timing to all his roles.

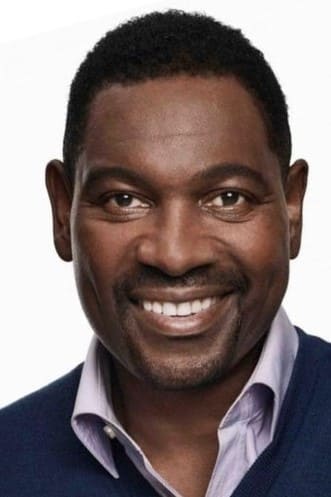

Mykelti Williamson

As a movie fan, I’ve always been impressed with Mykelti Williamson. He’s a commanding presence – a really tall guy, six foot two to be exact! Most people probably recognize him as Bubba from ‘Forrest Gump,’ which is a fantastic role, of course. But he’s been in so much else, like ‘Con Air’ and ‘Heat,’ and he absolutely shines in the ‘Fences’ movie. You might also know him from TV shows like ‘Justified’ and ‘Chicago P.D.’ He consistently plays these really solid, dependable characters, the kind who stick with you long after the credits roll.

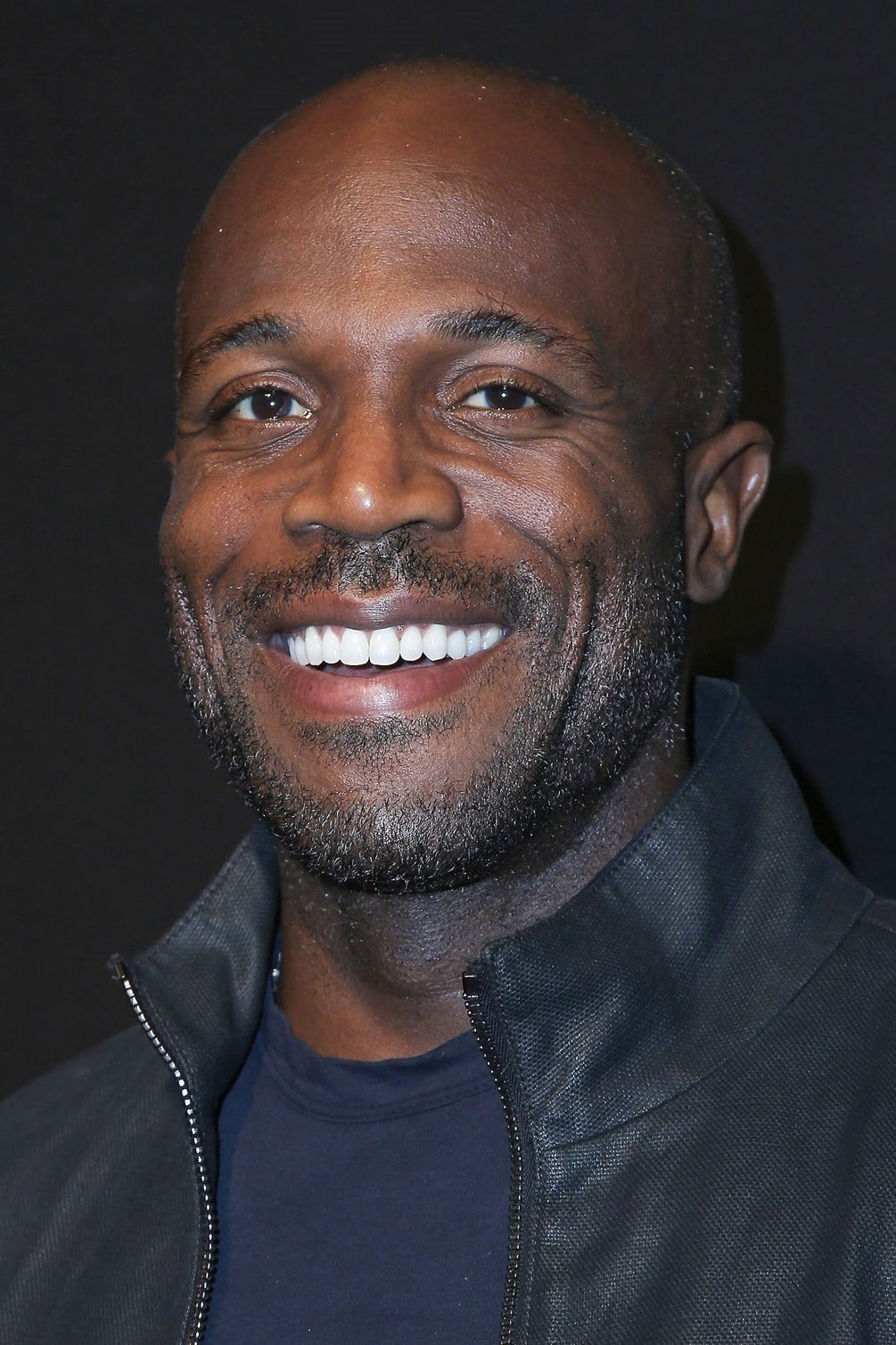

Billy Brown

Billy Brown is a tall actor, standing at 6’2″. He’s widely recognized for playing Nate Lahey in the hit series ‘How to Get Away with Murder’. He’s also appeared in popular shows like ‘Dexter’ and ‘Sons of Anarchy’. Known for his deep voice and fit build, Brown often takes on roles in crime and drama productions. Throughout his career, he’s also done voice-over work for commercials and animated projects.

Nnamdi Asomugha

I’ve been really impressed with Nnamdi Asomugha’s move from the football field to the big screen. Standing at six-foot-two, this former NFL pro has clearly got the discipline to tackle new challenges. He’s not just acting, either – he’s producing too! His work on ‘Crown Heights’ was a standout, earning the film the Audience Award at Sundance. And he’s proven he can hold his own alongside major stars, appearing in films like ‘The Good Nurse’ with Anne Hathaway and the charming romance ‘Sylvie’s Love’. Honestly, he’s quickly become someone to watch in the indie film scene – a genuinely serious talent.

Michael James Shaw

Michael James Shaw is a tall actor, standing at 6’2″. He’s best known for his role as Mercer in the last season of ‘The Walking Dead’, and for playing the villain Corvus Glaive in ‘Avengers: Infinity War’ and ‘Avengers: Endgame’. Because of his height and fitness, he’s well-suited for action-packed roles with challenging stunts. He also appeared in the adventure series ‘Blood and Treasure’ as a recurring character.

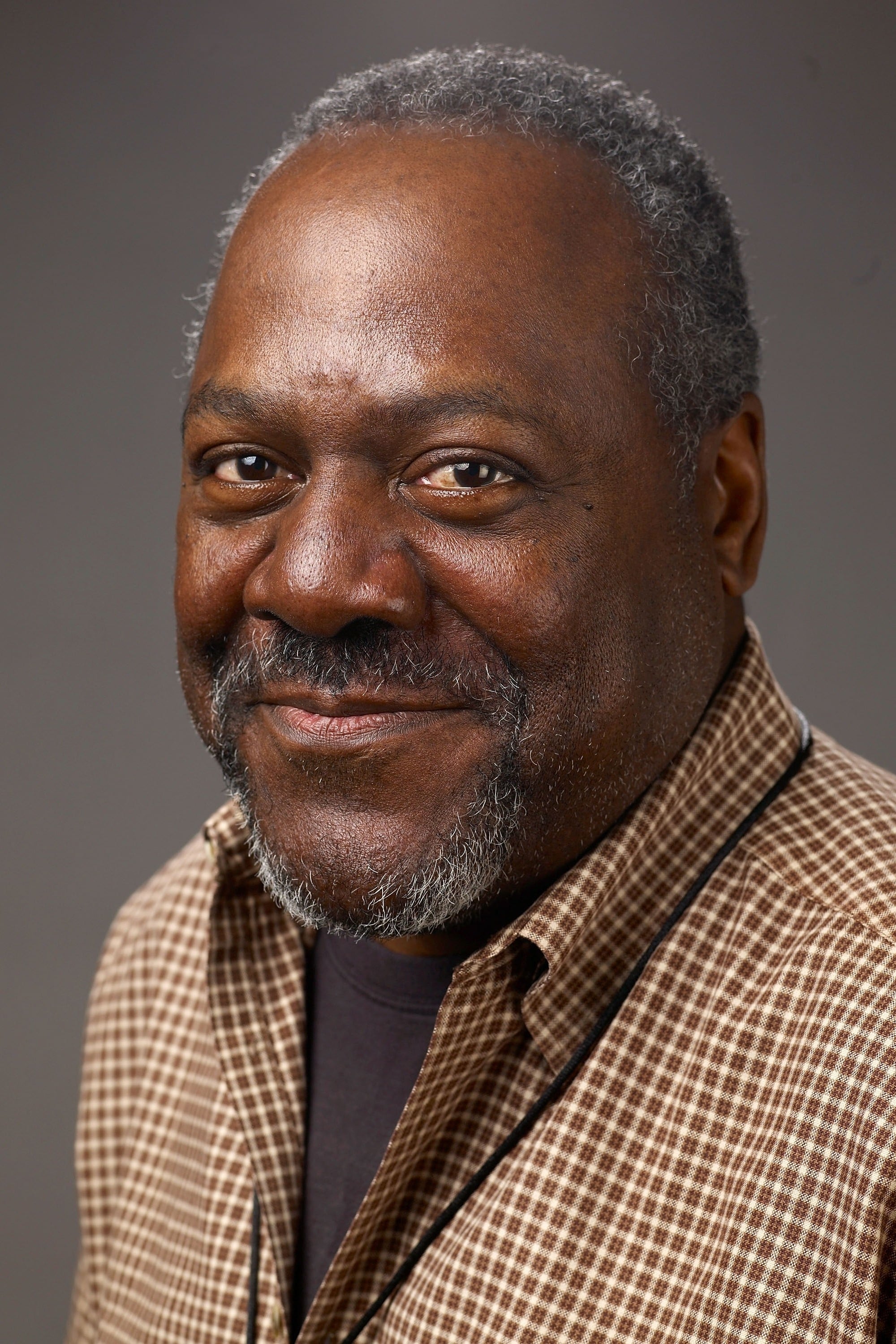

Frankie Faison

Frankie Faison is a seasoned actor standing at 6’2″. He’s notably appeared in the first four movies adapted from the Hannibal Lecter novels, including the acclaimed ‘The Silence of the Lambs’. Many also recognize him as Commissioner Ervin Burrell from the HBO series ‘The Wire’. Faison has demonstrated his versatility in both comedic films like ‘Coming to America’ and dramatic series such as ‘Banshee’, making him a well-known and respected figure across generations of viewers.

Mahershala Ali

Mahershala Ali is an award-winning actor, standing at 6’2″. He’s won two Oscars for his supporting roles in the films ‘Moonlight’ and ‘Green Book’. He’s known for his work in popular series like ‘True Detective’ and ‘Luke Cage’, and is set to star as Blade in an upcoming Marvel movie. Ali is celebrated for his subtle yet powerful performances, often communicating complex emotions without saying much.

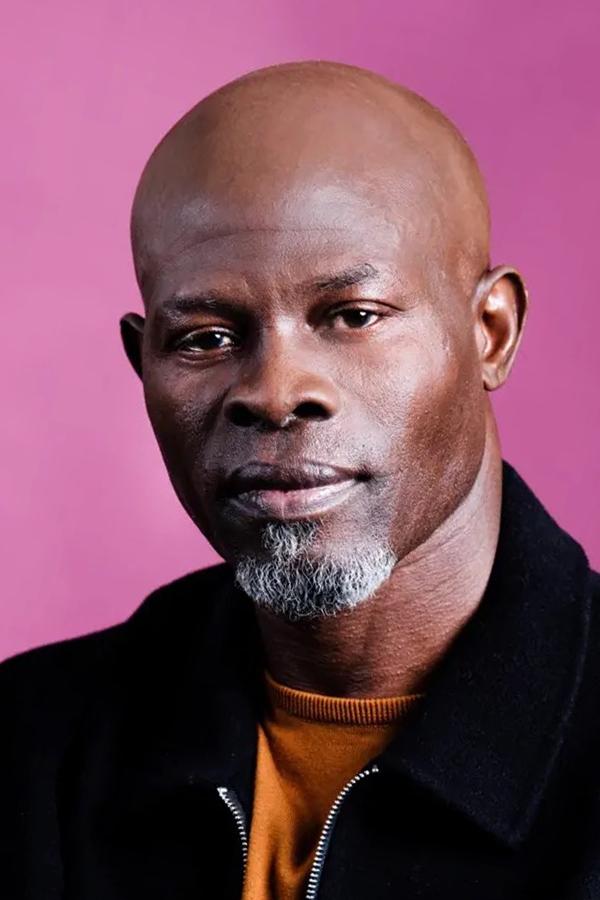

Djimon Hounsou

I’ve always been impressed by Djimon Hounsou. He’s a really striking figure – standing at six feet two inches, he just commands attention. I first noticed him in ‘Amistad’, and he was incredible! He’s gone on to do some amazing work, even getting Academy Award nominations for ‘In America’ and ‘Blood Diamond’. Plus, he’s been in huge movies like ‘Gladiator’ and ‘Guardians of the Galaxy’. He’s truly become a major international star, and his powerful presence always makes a film better.

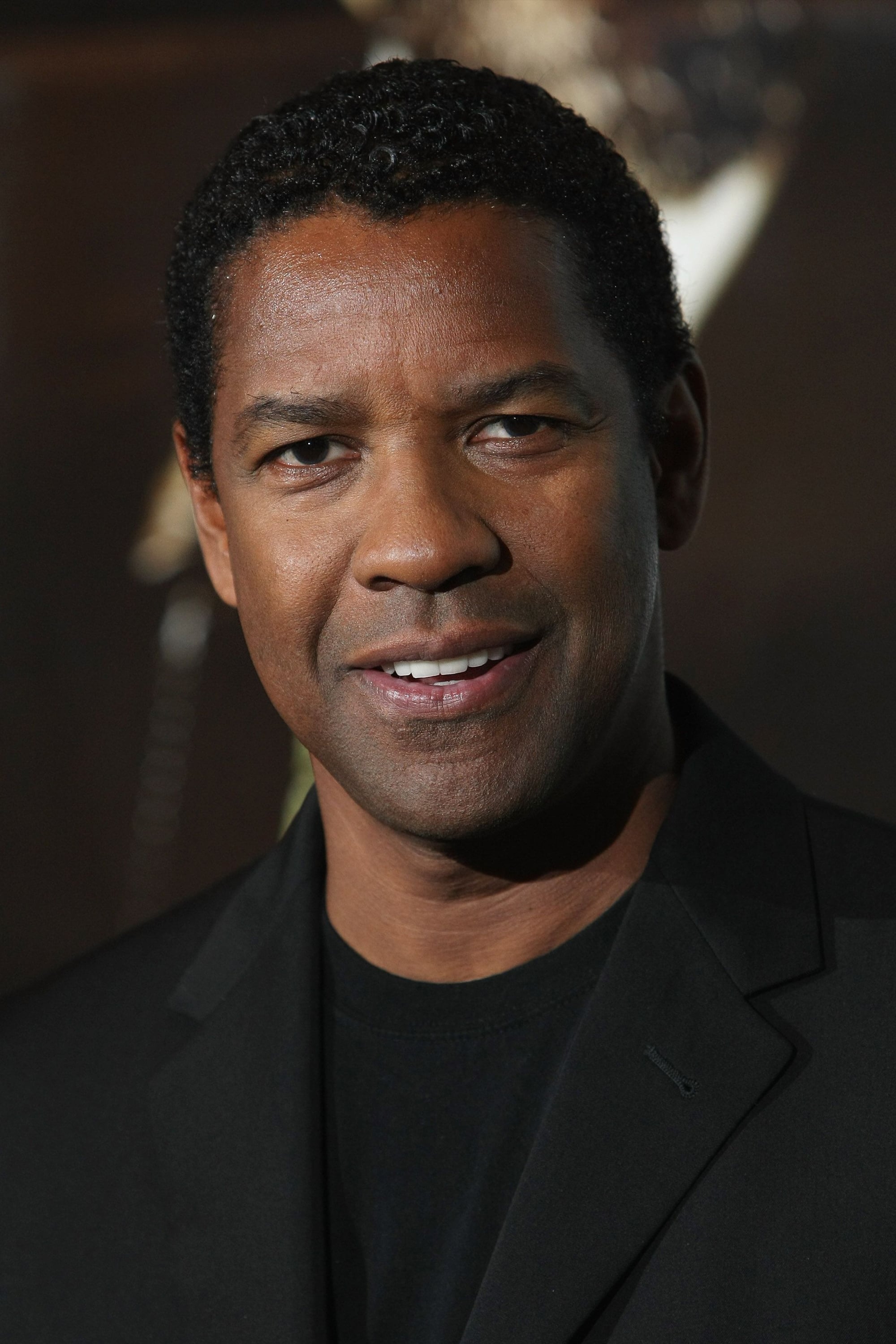

Denzel Washington

Denzel Washington is a highly acclaimed actor and filmmaker, standing at 6’1″. He’s won two Oscars for his roles in ‘Glory’ and ‘Training Day’ and is celebrated for his compelling performances as historical figures like Malcolm X and Steve Biko. Throughout his career, he’s starred in many popular and successful films, including ‘Fences’ and ‘The Equalizer’ series, and is considered one of the most talented and influential actors of his time.

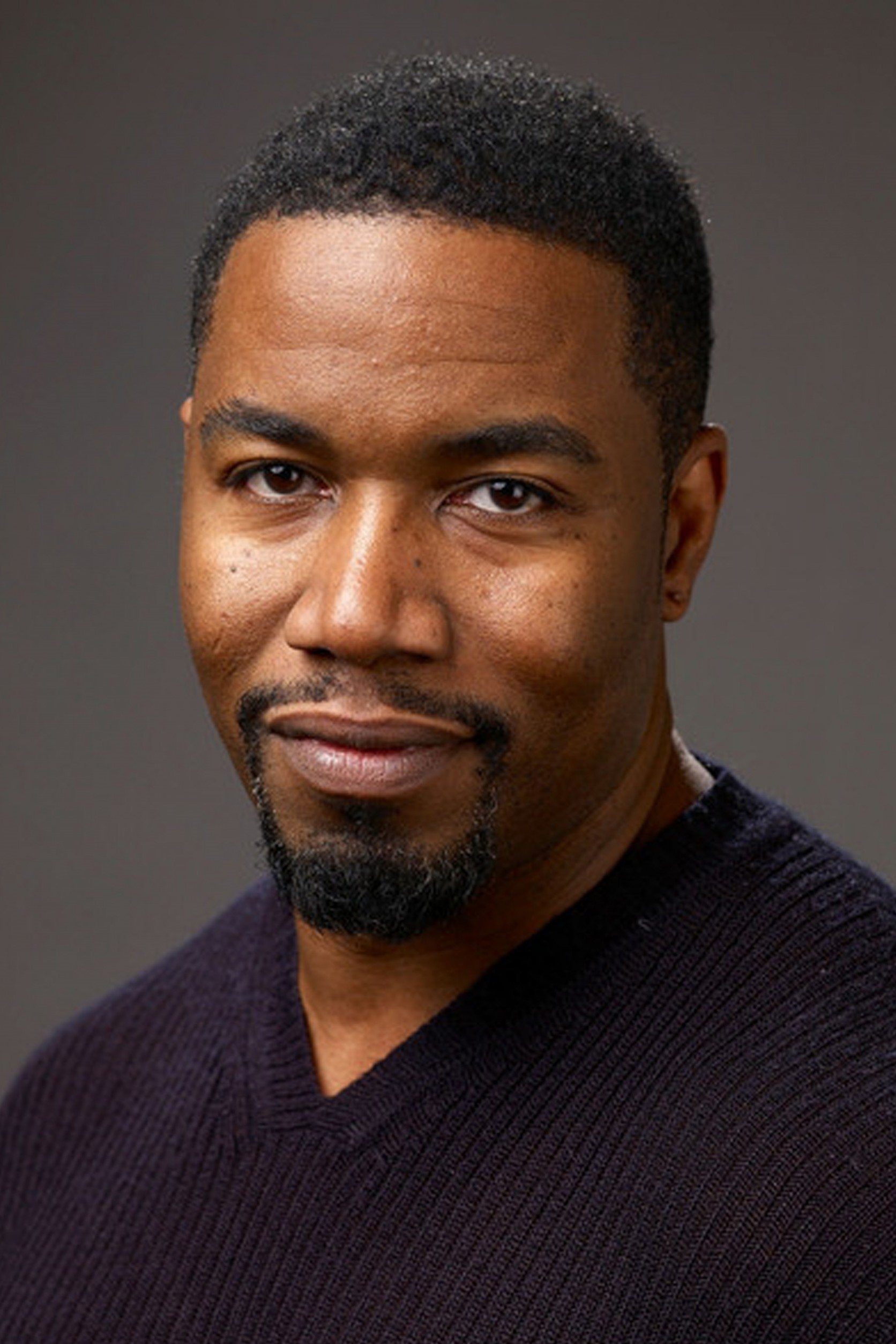

Michael Jai White

Michael Jai White is a talented actor and skilled martial artist, standing six feet one inch tall. He made history as the first African-American actor to play a leading comic book superhero on film, taking on the role in ‘Spawn’. He’s also known for creating and starring in the popular action comedy ‘Black Dynamite’. You might recognize him from ‘The Dark Knight’ and numerous martial arts movies, where he impressively does all his own stunts. His height and athleticism make him a powerful figure in action films.

Blair Underwood

Blair Underwood is a tall actor, standing at six feet one inch, who first became well-known for his role in the TV drama ‘L.A. Law’. He’s continued to work steadily in television, appearing in shows like ‘Agents of S.H.I.E.L.D.’ and ‘Dear White People’. Underwood has also acted on Broadway, earning a Tony Award nomination. Known for his sophisticated style and height, he often plays professionals or romantic leads.

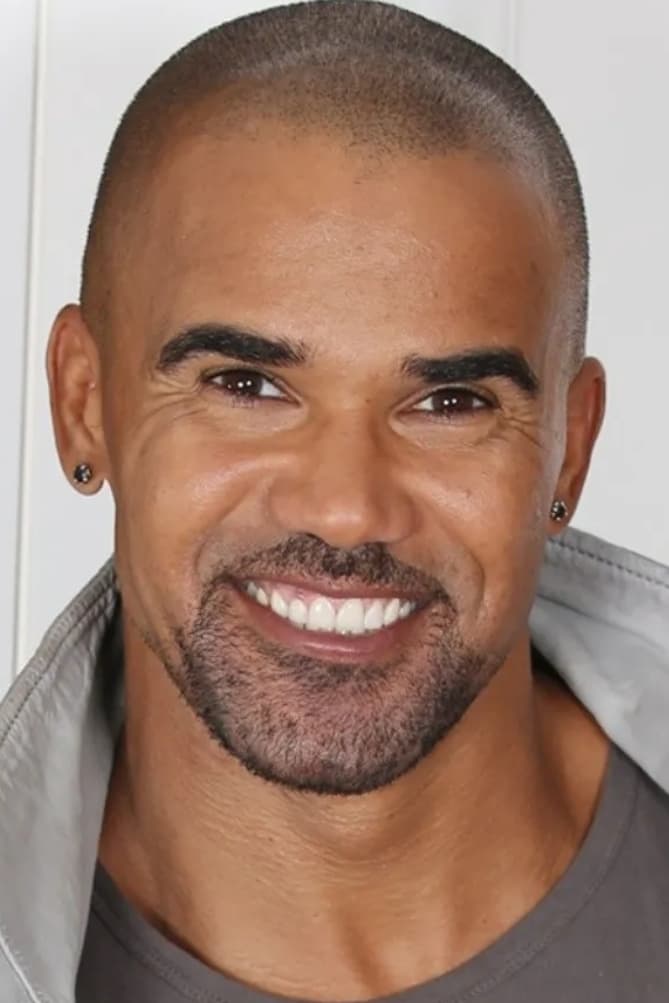

Shemar Moore

Shemar Moore is a popular actor and former model who’s six feet one inch tall. He’s widely recognized for his roles in the TV shows ‘Criminal Minds’ and ‘S.W.A.T.’, and he was also a long-time star on the soap opera ‘The Young and the Restless.’ Moore is known for being in great shape, his charming personality, and remains a prominent figure in television dramas and crime shows.

Charles Michael Davis

Charles Michael Davis is an actor and director who stands at 6’1″. He’s best known for playing Marcel Gerard on the TV show ‘The Originals’, but he’s also had regular roles on ‘Younger’ and ‘Grey’s Anatomy’. Before becoming an actor, Davis worked as a model for well-known brands, which helped launch his career in entertainment. He’s also directed some of the episodes of the shows he’s appeared in.

Aldis Hodge

Aldis Hodge is a gifted actor known for his impressive height of six feet one inch. He’s popular for playing Alec Hardison in the TV show ‘Leverage’ and its reboot, and he also appeared as Hawkman in the superhero movie ‘Black Adam’ and had a role in the film ‘Straight Outta Compton’. Beyond acting, Hodge is a talented watchmaker and designer. His athletic physique and height have been key to his successful career, allowing him to move from acting as a child to playing leading roles as an adult.

Robert Wisdom

As a huge film and TV fan, I’ve always been impressed with Robert Wisdom. He’s a commanding presence – standing at six foot one – and you probably recognize him as the unforgettable Howard ‘Bunny’ Colvin from ‘The Wire’, which is a show everyone needs to watch! He’s been in so much else too, like ‘Prison Break’ and the brilliantly dark ‘Barry’. Plus, he’s had roles in films like ‘Ray’ and even ‘The Dark Knight Rises’. I’ve noticed he often plays characters who are either really good people or incredibly skilled at what they do – it’s a pattern I enjoy seeing in his work.

Share your favorite performances from these actors in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- Anime That Should Definitely be Rebooted

- The 10 Most Underrated Mikey Madison Movies, Ranked (from Least to Most Underrated)

2026-02-13 21:50