In the quiet rooms of policy and commerce, U.S. inflation cooled more than anticipated in January, offering a fragile relief to households and stirring a wry debate about when the Federal Reserve might ease its careful march.

January CPI Comes in Light, Core Holds at 2.5%

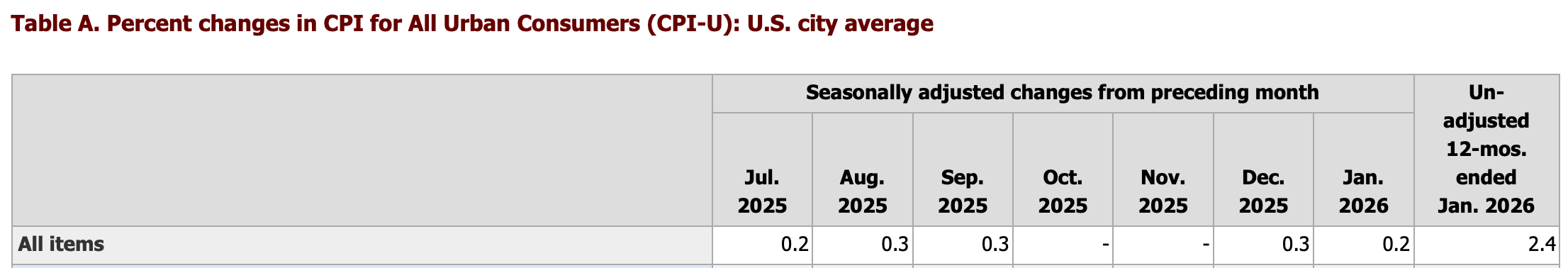

The January 2026 Consumer Price Index (CPI), released Feb. 13 by the U.S. Bureau of Labor Statistics, showed headline inflation rising 0.2% month over month and 2.4% year over year, below economist forecasts. Core inflation, which excludes food and energy, increased 0.3% on the month and 2.5% annually, matching expectations but remaining above the Fed’s 2% target.

The 2.4% annual headline rate marks the lowest reading since May 2025 and reflects declines in energy prices alongside favorable base effects. Energy fell 1.5% in January, driven by a 3.2% drop in gasoline.

Shelter, however, continued to press, rising 0.2% on the month and 3.0% from a year earlier. Food prices increased 0.2% monthly and 2.9% annually, while services categories such as medical care and recreation also posted gains.

Markets delivered a mixed response. Stock futures initially dipped before turning higher, signaling relief rather than exuberance. Equities traded unevenly during Friday’s morning session, with most majors mostly down, while the crypto economy also showed a split performance across major tokens. Meanwhile, gold climbed 1.6% to $4,998.61 an ounce and silver advanced, reflecting continued demand for hard assets.

The report arrives after inflation hovered above target through much of 2025 and follows a brief delay tied to a partial government shutdown. January’s data incorporated updated seasonal factors and revisions to prior years, though no major trend shifts were reported.

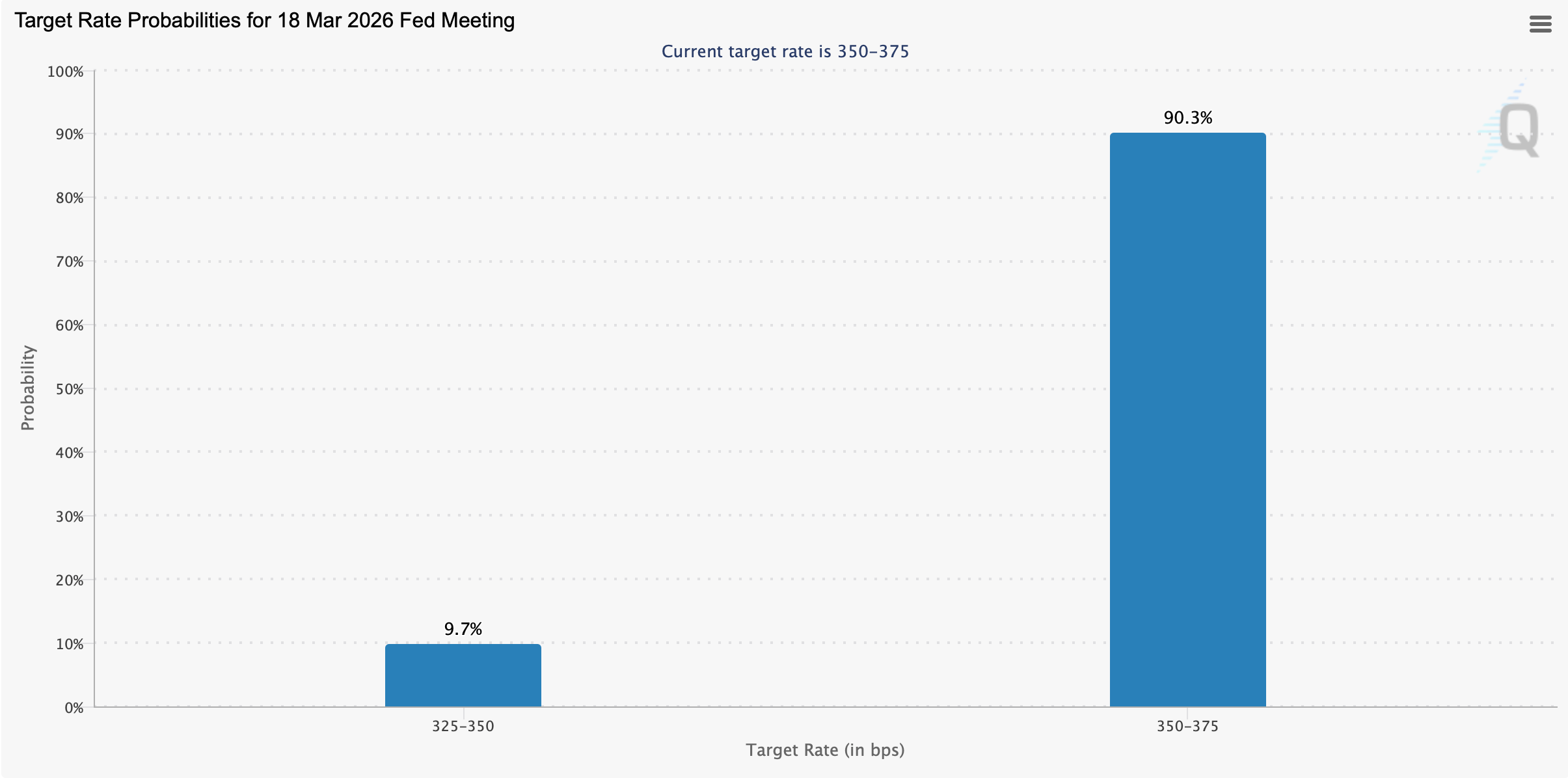

In addition, markets widely anticipate that the Federal Reserve will leave the federal funds rate untouched, as CME’s Fedwatch tool currently places the probability of no change at 90.3%.

For policymakers, the cooler headline reading may reduce immediate pressure. Still, with core inflation at 2.5%, officials have signaled caution, particularly given potential tariff impacts and a stable labor market. Markets have begun pricing in the possibility of rate cuts later in 2026 if the disinflation trend continues.

For consumers, the message is nuanced: gasoline offered relief, but housing and services costs remain elevated. The path back to 2% appears closer than last fall, though not yet complete.

FAQ ❓

- What was the January 2026 headline CPI?

Headline CPI rose 0.2% month over month and 2.4% year over year. - How did core inflation perform?

Core CPI increased 0.3% monthly and 2.5% annually. - What drove the slowdown in inflation?

Energy prices, particularly gasoline, declined and pulled the headline rate lower. - What does this mean for Federal Reserve policy?

The softer reading may support rate-cut expectations later in 2026, though core inflation remains above target.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

2026-02-13 19:27