The tech scene, you see, has been having a bit of a wobble of late. The Nasdaq Composite, bless its heart, hasn’t exactly been setting the world on fire, and a spot of bother regarding the expenses of building all this artificial intelligence infrastructure has caused a few palpitations amongst the more excitable investors. A trillion dollars vanished last week, a sum that would give even a stout-hearted banker the jitters. However, Morgan Stanley, a firm not entirely devoid of sense, believes a rally is on the cards, driven by this very same AI. They point out that revenue expectations for some of the leading lights are at levels not seen for decades, and a temporary dip in price presents a rather attractive opportunity for those with a bit of capital to put to work.

Thus, we find ourselves contemplating two companies – IonQ and Celestica – which, if one might be so bold, possess the potential for a rather spirited ascent. A parabolic trajectory, if you will. They’re growing at a rate that would make a beanstalk blush, and a shrewd investor might do well to give them a closer look.

IonQ: Quantum Leaps and a Spot of Ingenuity

IonQ, you see, has had a bit of a setback recently, its stock dipping 21% in the early months of 2026. But don’t let that ruffle your feathers. A gaggle of analysts – fourteen, to be precise – predict a jump of no less than 105% from its current level, suggesting a price of $73. They’re rather keen on the company, and with good reason. IonQ is pushing the boundaries of quantum computing, a field that sounds frightfully complicated, but promises to solve problems at a speed that would leave traditional computers gasping for air.

Quantum computers, you understand, possess a rather remarkable ability to handle multiple calculations simultaneously, which is dashedly clever, what! Currently, they’re a bit pricey and prone to errors, but the experts foresee a considerable expansion in their adoption. McKinsey estimates a revenue of $97 billion by 2035, a considerable leap from the $4 billion of 2024. IonQ, with a touch of ingenuity, claims to have achieved 2-qubit gate fidelities of 99.99% – a technical detail, perhaps, but one that suggests they’re on the right track to making this technology a practical reality.

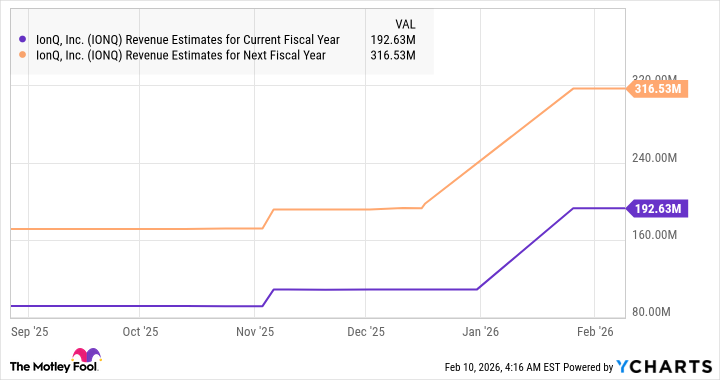

Furthermore, IonQ is democratizing access to this technology, offering it through cloud computing platforms. This allows customers to harness the power of quantum computing without the expense of acquiring the hardware themselves. A most sensible arrangement, wouldn’t you agree? All of which suggests that IonQ’s revenue, currently at $108 million, is poised for a healthy increase in the coming years. The stock trades at a rather lofty 109 times sales, but it’s a shade lower than last year’s 140, and with the exponential growth anticipated, it might just be worth the splurge.

Celestica: A Solid Foundation for Future Growth

Now, let’s turn our attention to Celestica, an electronics manufacturing services provider. They’ve been given a rather substantial boost by the buildout of AI data centers, with their stock soaring 54% in the last six months. And the good news is, this rally isn’t likely to falter. The demand for data centers is booming, and Celestica is right in the thick of it.

They design networking switches used in these AI data centers, enabling fast connectivity. Large hyperscalers, those who spend vast sums of money building these facilities, are their clients. They’re even manufacturing custom AI processors for companies like Google. A most advantageous position, wouldn’t you say? This explains why they anticipate a 50% jump in their connectivity and cloud solutions business in 2026, which currently accounts for 78% of their revenue, generating $2.86 billion in the fourth quarter of 2025.

One wouldn’t be surprised to see this growth accelerate, as they’ve secured new contracts with a new hyperscaler, adding to their existing three clients. AI spending by the top four U.S. hyperscalers is expected to jump to $700 billion in 2026, up from $394 billion in 2025. Celestica anticipates $17 billion in revenue for 2026, a 37% increase from last year. Their growth is poised to accelerate nicely. The stock trades at a mere 3 times sales, a discount to the Nasdaq Composite’s 5.4. Should Celestica trade in line with the index, its market value could jump to $92 billion, more than doubling its current $37 billion. A parabolic run, indeed.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

2026-02-13 19:22