The past three years have unfolded with a generosity rarely witnessed in the realm of investment. A veritable spring tide lifted all vessels, particularly those navigating the currents of technological advancement. Artificial intelligence, that elusive phantom of the modern age, has blossomed into a tangible force, enriching not merely the technology sector itself, but spreading its bounty across the fields of energy, industry, and even the most staid of utilities. It has been, one might say, a time when even the most hesitant hand could scarcely avoid grasping a share of the increase.

But the seasons shift, and a certain…restlessness has settled upon the markets. The year has progressed with a measured pace, the S&P 500 advancing with a modesty that feels, after the recent exuberance, almost…provincial. The Nasdaq Composite, once a whirlwind of activity, remains stubbornly still, as if contemplating the weight of its own past glories. A subtle disquiet, a premonition of change, hangs in the air.

Let us, then, examine the source of this hesitation. Let us delve into the currents that now tug at the foundations of prosperity, and consider the strategies by which a discerning investor might navigate these uncertain waters.

Valuation: Echoes of a Distant Past

One often encounters, in the pronouncements of those who claim to read the future of finance, a preoccupation with valuation metrics. The price-to-earnings ratio, a simple enough calculation, is bandied about as if it held the key to all mysteries. Yet, such calculations are prone to distortion, blinded by the transient storms of inflation or the peculiar accounting of a single quarter. They are, one might say, like attempting to chart the ocean by observing only the foam on the waves.

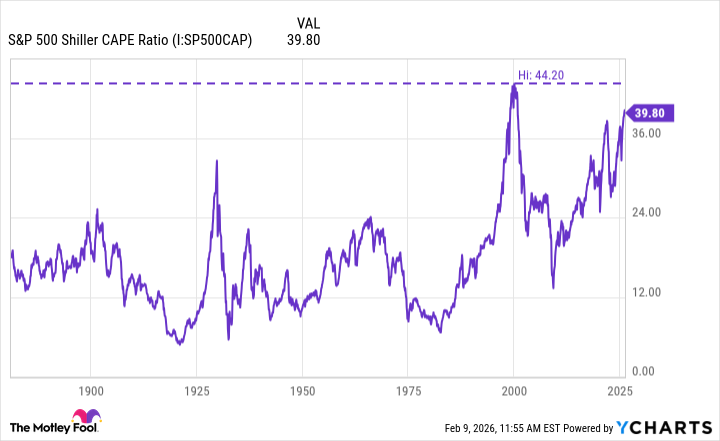

A more considered approach lies in the cyclically adjusted price-to-earnings ratio, a metric favored by the late Robert Shiller. This allows for a smoothing of the inevitable fluctuations, a decade-long view that offers a more normalized perspective. It is akin to observing the landscape from a distant hill, rather than being lost in the thicket of detail. And it is here that a certain disquieting resemblance to the late 1990s begins to emerge.

The current Shiller CAPE ratio for the S&P 500 hovers just below the level that preceded the bursting of the dot-com bubble. A coincidence, perhaps? Or a warning whispered from the past? Some investors, understandably cautious, fear that history is poised to repeat itself, that we are once again on the precipice of a speculative excess.

AI vs. the Dot-Com Era: A Different Bloom?

The comparison to the late 1990s is inevitable. The current fervor surrounding artificial intelligence bears a superficial resemblance to the dot-com boom, with soaring stock prices and a heady sense of limitless potential. But to equate the two is to ignore a crucial distinction. In those bygone days, many companies merely professed belief in the power of the internet, without demonstrating any practical application. They were, in essence, peddling promises, building castles on air.

Today, the situation is markedly different. Companies like Amazon, Alphabet, and Microsoft are not merely investing in AI; they are integrating it into the very fabric of their operations, revolutionizing their business models, and generating substantial earnings. The same holds true for the semiconductor giants – Nvidia, Taiwan Semiconductor Manufacturing, and Micron – who are at the forefront of this technological revolution. This is not a mirage; it is a tangible force reshaping the economic landscape.

A Portfolio for Uncertain Times

When the market feels…overextended, a prudent investor often seeks refuge in stability, shifting capital from the volatile and speculative to the solid and predictable. AI, while offering immense potential, is not a panacea. Some companies, despite embracing the technology, may struggle to adapt, their business models undermined by the very forces they seek to harness. It is a realm where discernment is paramount.

In times of uncertainty, a touch of…boredom can be a virtue. Trimming exposure to speculative stocks, those tantalizing promises of overnight riches, and reallocating capital to blue-chip companies with durable business models is a sound strategy. And maintaining a healthy cash balance, a reserve of dry powder, allows one to capitalize on opportunities during market corrections, doubling down on quality positions at discounted prices. It is a patient approach, perhaps, but one that often yields the most enduring rewards.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

2026-02-13 14:33