Right. So, the universe, as anyone who’s bothered to look at it for more than five minutes will tell you, is a profoundly improbable place. And yet, here we are, discussing quarterly earnings reports. The irony is not lost on me, though it frequently seems lost on the people giving the earnings reports. Recent calculations (involving a lot of abacuses and a slightly disgruntled quantum physicist) suggest that capital expenditure by the top four hyperscalers in the U.S. might, just might, reach a rather staggering $700 billion this year. That’s a number so large, it’s practically a philosophical statement. Last year? A mere $394 billion. Which, in the grand scheme of things, is like the difference between a mildly annoyed amoeba and a fully-fledged existential crisis.

This, naturally, means money will be sloshing around. And where money sloshes, opportunity… well, it usually sloshes along with it. Semiconductor companies, being the chaps who actually make the things that make the AI happen (it’s all terribly complicated, involving silicon and electrons, and a lot of hoping for the best), are poised to benefit. And one company, Lumentum (LITE +1.55%), appears to be rather cleverly positioned to catch a significant portion of that slosh. (Don’t think of it literally, please. The image is unsettling.)

Shares in this purveyor of optical and photonic networking components – which, translated from engineer-speak, means they make the stuff that lets data whizz around at ludicrous speeds in AI data centers – are already up 56% this year. Which, if you consider the general state of things, is frankly astonishing. It wouldn’t be entirely surprising, therefore, to see them continue to climb. Possibly even becoming the best-performing AI chip stock of 2026. (Though, let’s be realistic, predicting the stock market is about as reliable as predicting the weather on Jupiter.)

Let’s explore why this may be the case, shall we?

Lumentum is Clocking Stellar Growth Thanks to AI

Lumentum recently released its fiscal 2026 second-quarter results (for the period ended Dec. 27, 2025). The numbers, while not defying the laws of physics, were decidedly impressive. Revenue increased 66% year-over-year to $666 million. (A curiously symmetrical number, don’t you think? Perhaps a sign of underlying cosmic harmony. Or just accounting.) Wall Street, in its infinite wisdom, had predicted $652 million. Even better, non-GAAP earnings jumped nearly fourfold to $1.67 per share, crushing the consensus expectation of $1.41. (One suspects the consensus expectation was based on wishful thinking and a particularly strong cup of coffee.)

CEO Michael Hurlston, on the latest earnings call, made the rather bold claim that Lumentum is playing a “critical role” in AI data centers. He went on to say:

“We are now recognized as a foundational engine of the AI revolution. Virtually every AI network is powered by Lumentum technology, either through our direct hyperscaler partnerships or as the critical component supplier that enables our network equipment manufacturer customers.”

It’s a grand claim, certainly. Though, in a universe built on improbability, perhaps not entirely unreasonable. Importantly, Lumentum expects this growth to accelerate, driven by a solid backlog, new contracts, and capacity expansion plans. They currently have a backlog of over $400 million for optical circuit switches – the things that allow data to travel at speeds that would make a cheetah blush. They’ve also received a “multi-hundred-million-dollar” contract for co-packaged optics, which are, apparently, more efficient. (The details are best left to the engineers. It involves quantum entanglement and a lot of very small wires, I’m told.)

Lumentum is aggressively expanding capacity to meet demand. They’ve already achieved more than half of their targeted 40% capacity improvement. They also plan to bring new capacity online at plants in the U.K. and Japan later this year. (One hopes they’ve accounted for the logistical challenges of shipping tiny components across vast distances. It’s a surprisingly complex undertaking.)

Accelerating Growth Should Lead to More Upside

Lumentum management anticipates an 85% year-over-year increase in revenue in the current quarter, reaching $805 million at the midpoint of their guidance range. Adjusted earnings are forecast to be $2.25 per share – almost four times what they were in the same period last year. (Which, if you think about it, is a rather significant jump. It suggests they’ve either discovered a new source of energy or are very good at accounting.)

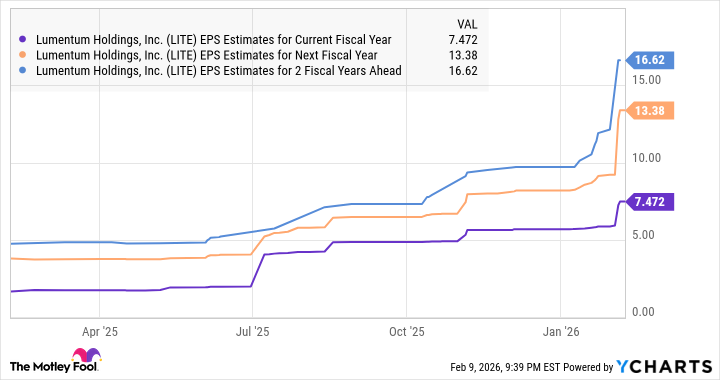

Analysts expect a 263% spike in Lumentum’s earnings in the current fiscal year, followed by impressive jumps over the next couple of years. (These analysts, one assumes, have access to a crystal ball or a very sophisticated algorithm. Or possibly both.)

The company may deliver even stronger growth as it brings more capacity online. That could pave the way for more upside in this technology stock. Which, in the grand scheme of things, is a perfectly reasonable expectation. Though, as always, past performance is not indicative of future results. (A disclaimer that is, ironically, almost entirely useless.) Investors, therefore, might consider buying Lumentum before it jumps higher. (Or, they might not. The choice, as they say, is yours. And, frankly, it’s none of my business.)

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

2026-02-13 13:23