Okay, let’s be real. If you’d asked me about the Schwab U.S. Dividend Equity ETF (SCHD 0.95%) back in January, I’d have said, “Pass.” The market was doing that thing where it pretends gravity doesn’t exist, fueled by promises of artificial intelligence and tech bros in hoodies. It was like watching a golden retriever chase its tail – impressive energy, zero actual progress. Everyone was betting on the future, and frankly, the present looked… ignored. Defensive strategies? About as popular as a fax machine at a tech conference.

For three years, it was all about growth, about disruption, about convincing yourself that a company losing money was a “long-term play.” It was exhausting. Like being stuck in a motivational seminar run by a robot. The U.S. economy was stubbornly refusing to collapse, which, admittedly, is nice, but it also meant the “smart money” was throwing itself at anything with a “.com” at the end.

Fast forward to 2026. Suddenly, AI infrastructure spending is the corporate equivalent of admitting you accidentally ordered 500 rubber chickens. Alphabet and Amazon are realizing that building the future is… expensive. And Bitcoin? Let’s just say my nephew’s Dogecoin investment is looking comparatively stable. It’s a mess. A glorious, fundamental-driven mess.

Which, conveniently, is exactly what the Schwab U.S. Dividend Equity ETF is built for. Investors are starting to remember that companies are supposed to, you know, make money. Shocking, I know. They’re looking for value, for actual earnings, for things that aren’t just based on the hope that someone else will pay more for it later. It’s like realizing you should probably own a winter coat before moving to Alaska.

The SCHD Strategy: Surprisingly Sensible

Let’s break it down. This ETF tracks the Dow Jones U.S. Dividend 100 Index. Which, as far as index names go, is refreshingly straightforward. It looks at fundamentals, balance sheet health, dividend history, and yield. Basically, it rewards companies that are actually good at being companies. It’s a radical concept, I realize.

I’ve always thought this fund had a solid strategy. But even the best ideas can get lost in the hype. For a while, it was like bringing a sensible sedan to a monster truck rally. Everyone was obsessed with the flashy, impractical stuff, and this ETF was just… quietly, reliably, working.

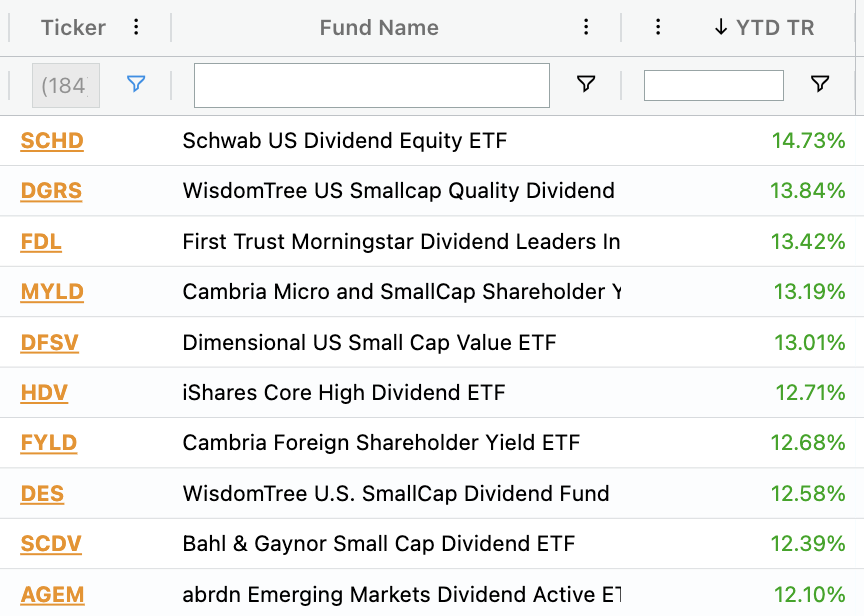

But if this market rotation sticks – and honestly, after the last few years, I’m not betting against anything – the Schwab U.S. Dividend Equity ETF could really lead the charge. It already is! So far in 2026 (as of February 6th), it’s the top-performing dividend ETF. Which, let’s be honest, is a sentence I didn’t think I’d be saying.

The fund’s top holdings are in energy (19.9%), consumer staples (18.5%), healthcare (16.2%), and industrials (12.1%). Healthcare is just keeping pace with the S&P 500, but the other three are beating it by at least 10%. It’s like the ETF saw the writing on the wall and quietly positioned itself in the sectors that were about to benefit. It’s… almost impressive.

Look, any market environment that rewards fundamentals is one where the Schwab U.S. Dividend Equity ETF will thrive. After the “Magnificent Seven” and the AI bubble, it feels like we’re finally getting back to reality. And honestly, after the last few years, that’s a very good thing. It’s not glamorous, it’s not going to make headlines, but it might just make you money. And in this market, that’s a win.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-13 06:03