More and more celebrities are embracing a vegan lifestyle for reasons ranging from animal welfare to environmental concerns and personal health. Several actresses have become passionate advocates for animal rights, using their public influence to encourage cruelty-free products and eco-friendly living. They often report feeling healthier and more in line with their beliefs as a result of their plant-based diets. Here’s a look at some well-known actresses who‘ve publicly adopted veganism.

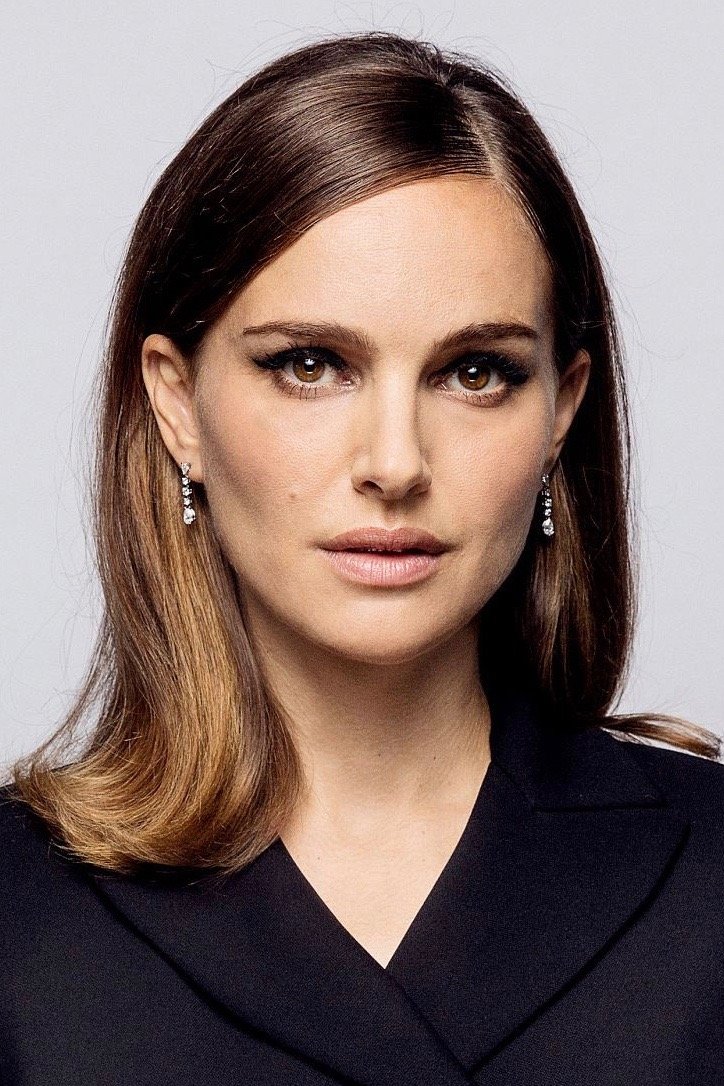

Natalie Portman

Natalie Portman became a vegan in 2011 after learning about the environmental and ethical problems with factory farming. She then produced and narrated the 2018 documentary ‘Eating Animals,’ which examines how our food choices have evolved and where they’re headed. Portman often uses her public voice to support eco-friendly fashion and cruelty-free beauty. This dedication is also reflected in her style choices, as she frequently wears custom vegan shoes and vintage clothing on the red carpet.

Alicia Silverstone

Alicia Silverstone is well-known for promoting a plant-based lifestyle and wrote the popular book, ‘The Kind Diet.’ She became a vegan in 1998, motivated by both wanting to improve her health and her strong belief in animal rights. After becoming famous in the movie ‘Clueless,’ Silverstone has focused much of her work on protecting the environment. She also created a brand of organic, vegan vitamins to help others eat a similar healthy diet.

Jessica Chastain

Jessica Chastain has followed a vegan diet since 2007, after being a vegetarian for more than ten years. She frequently talks about how going vegan boosted her energy and health. The acclaimed actress, known for roles in films like ‘Zero Dark Thirty’ and ‘The Eyes of Tammy Faye,’ is also a dedicated advocate for animal rights and promotes cruelty-free practices in filmmaking.

Rooney Mara

Rooney Mara adopted a vegan lifestyle in 2011 after seeing disturbing footage of farm animals. Passionate about animal welfare, she co-founded ‘Hiraeth Collective’, a high-end fashion brand committed to using only cruelty-free materials like avoiding leather, fur, and silk. Known for her roles in films such as ‘The Girl with the Dragon Tattoo’ and ‘Carol’, Mara also actively supports organizations like Animal Equality to advocate for better treatment of animals.

Kate Mara

Kate Mara became vegan after discovering how meat production harms the environment and noticing improvements in her own health. A dedicated supporter of the Humane Society of the United States, she often advocates for wildlife protection. The actress, known for her work in shows like ‘House of Cards’ and movies like ‘Fantastic Four’, regularly shares vegan tips and resources with her fans. She says her sister, Rooney, helped her successfully switch to a completely plant-based diet.

Sadie Sink

After working with vegan actor Woody Harrelson on ‘The Glass Castle’, Sadie Sink – best known for ‘Stranger Things’ – decided to try a plant-based diet. She started as a vegetarian and eventually became fully vegan. Sink has said it’s easy to find vegan food and that the lifestyle fits with what she believes in. She also uses her platform to support vegan clothing and cruelty-free cosmetics.

Evanna Lynch

Evanna Lynch, famous for playing Luna Lovegood in the ‘Harry Potter’ movies, is a passionate advocate for animal rights. She hosts ‘The ChickPeeps,’ a podcast focused on vegan living, and helped create ‘Kinder Beauty Box,’ a subscription service offering cruelty-free beauty products. Lynch frequently gives talks around the world about veganism and its ethical implications. She’s also written a memoir detailing her journey of self-discovery and her dedication to a compassionate lifestyle.

Emily Deschanel

I’ve always been fascinated by actors who really live what they believe, and Emily Deschanel is a great example. She’s been vegan for over 20 years – it all started after seeing the documentary ‘Diet for a New America,’ which really impacted her. You probably know her from ‘Bones,’ but she’s also a dedicated animal advocate, working a lot with PETA and other groups. She’s often talked about how great a plant-based diet was for her both when she was pregnant and just in her everyday life. I really admire that she uses her platform to get people thinking about where their food comes from and the ethics behind their choices.

Madelaine Petsch

Madelaine Petsch has followed a vegan lifestyle since childhood, growing up in a plant-based home. The ‘Riverdale’ star frequently shares vegan recipes and wellness advice on platforms like YouTube and social media. She believes her diet gives her the energy needed for demanding workdays and rigorous exercise. Petsch also partners with companies that create eco-friendly and cruelty-free fashion items.

Mayim Bialik

Mayim Bialik is an actress and neuroscientist who has been vegan for a long time. She wrote the cookbook ‘Mayim’s Vegan Table’ to share easy, healthy, plant-based recipes and advice for families. Best known for her roles in shows like ‘The Big Bang Theory’ and ‘Blossom’, she often talks about the science and ethics behind veganism. Bialik promotes kind eating and frequently shares how she’s raised her kids on a vegan diet.

Maggie Q

For more than two decades, Maggie Q has followed a vegan lifestyle and is a prominent voice for animal rights in Hollywood. The actress, known for her role in ‘Nikita,’ believes her plant-based diet helps her perform challenging stunts. She’s actively involved with PETA, leading many campaigns and consistently speaking out against animal exploitation in fashion and entertainment. Showing her dedication to protecting the environment, Maggie Q also created her own line of eco-friendly activewear.

Pamela Anderson

Pamela Anderson has been a dedicated animal rights activist and vegan for over three decades. She’s well-known for her work with PETA, partnering on many campaigns against fur and leather in fashion. In addition to her role on ‘Baywatch,’ Anderson created a plant-based cooking show called ‘Pamela’s Garden of Eden.’ She continues to champion the environmental advantages of a vegan lifestyle through her foundation and public speaking.

Bellamy Young

Bellamy Young, famous for her work on the TV show ‘Scandal’, has been vegan since 1988. She first started eating a plant-based diet after a bad experience with animal products when she was in college. Young often says that her vegan lifestyle is the reason she has great skin and a lot of energy. She’s also a dedicated supporter of animal rescue groups and frequently talks about the positive effects of not eating meat.

Kim Basinger

Kim Basinger has been a committed vegan and animal rights advocate for many years. She’s worked with groups like PETA and Last Chance for Animals to fight against animal cruelty, and frequently uses her platform on social media to speak out for wildlife protection. The actress, famous for roles in films like ‘L.A. Confidential’ and ‘Batman’, believes kindness to all animals is a vital part of how she lives her life.

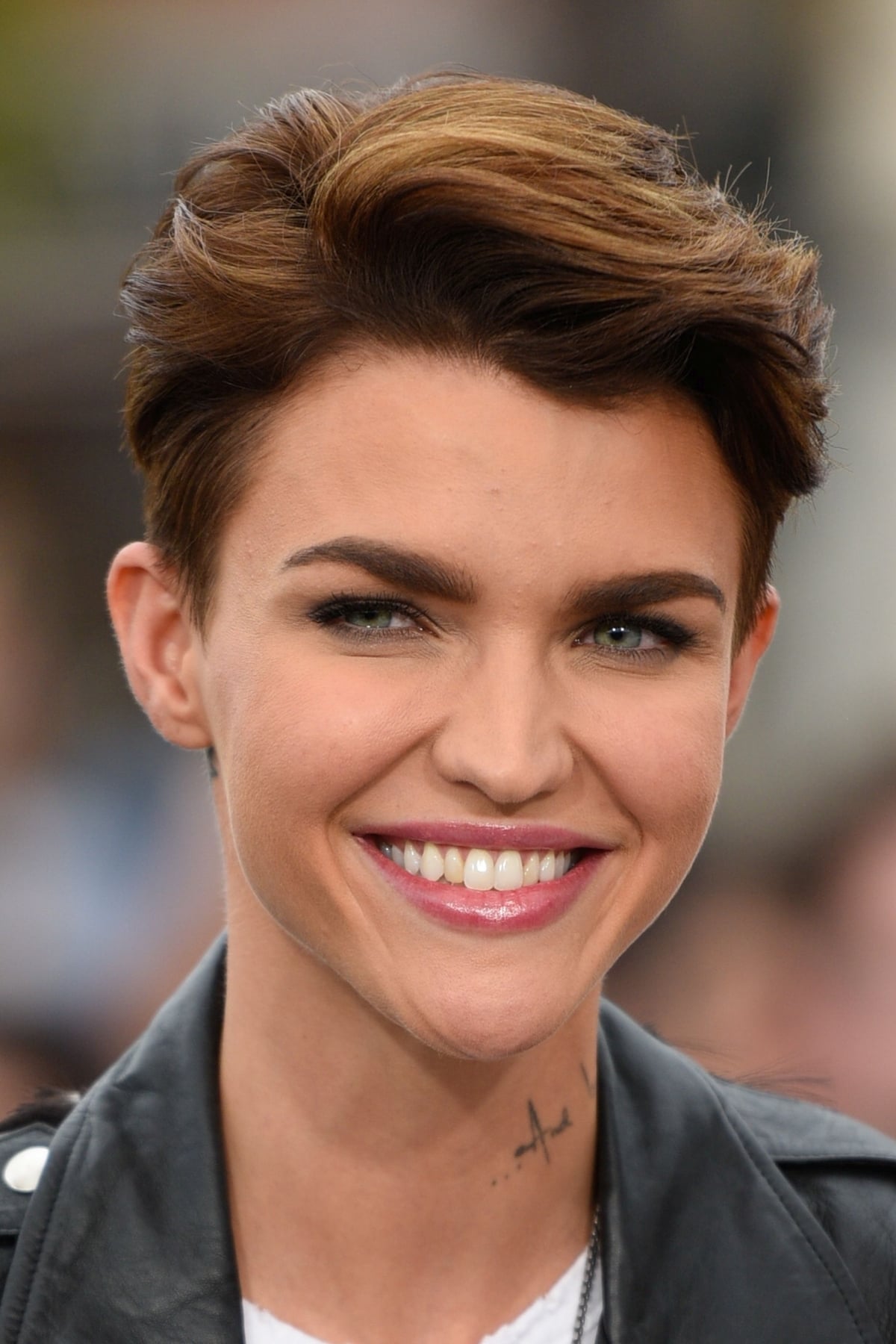

Ruby Rose

Ruby Rose became vegan in 2013 and has passionately advocated for animal rights ever since. The actress and model, famous for her work in shows like ‘Orange Is the New Black’ and ‘Batwoman,’ often points out how a plant-based lifestyle helps the environment. She’s also been involved in efforts to stop animal testing for cosmetics. Ruby Rose regularly shares her favorite vegan foods and recipes with her many followers on social media.

Danielle Macdonald

Danielle Macdonald, known for her roles in ‘Dumplin’’ and ‘Patti Cake$’, is a dedicated vegan and passionate animal rights advocate. She decided to adopt a plant-based diet because she wanted to lessen the harm caused to animals. As a public figure, she regularly shares information about how farming impacts the environment and supports companies that align with vegan and cruelty-free values, encouraging others to make ethical lifestyle choices.

Please share your thoughts on these actresses and their commitment to veganism in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

2026-02-13 05:22